LIONIND (4235) - (richDad) - LIONIND - 3 reasons why it is a PRIVATISATION CANDIDATE

1. Even at RM1.00, the stock price is at 60% discount to its Book Value. The book value is RM2.42 based on latest quarterly announcement. Simple math will show it for you ... (RM1.00 / RM2.42 - 100% ) = 58% discount (round up to 60%).

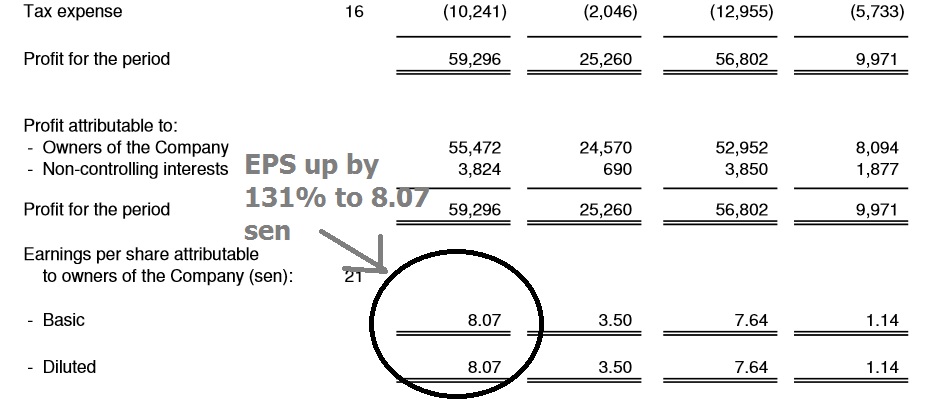

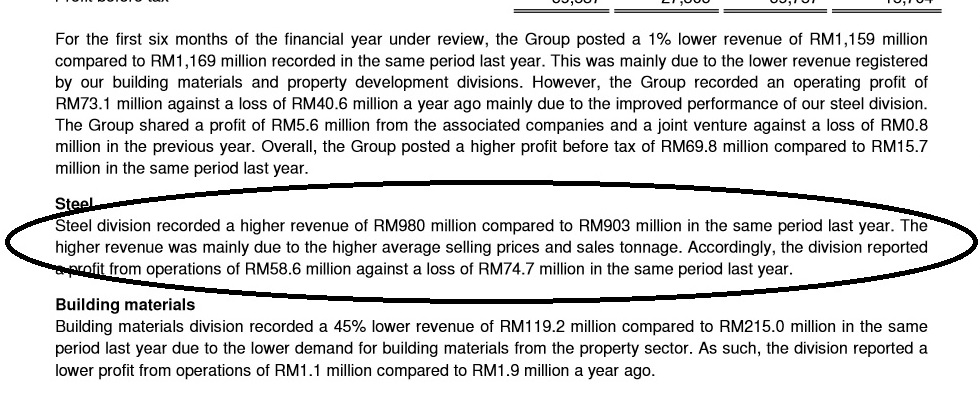

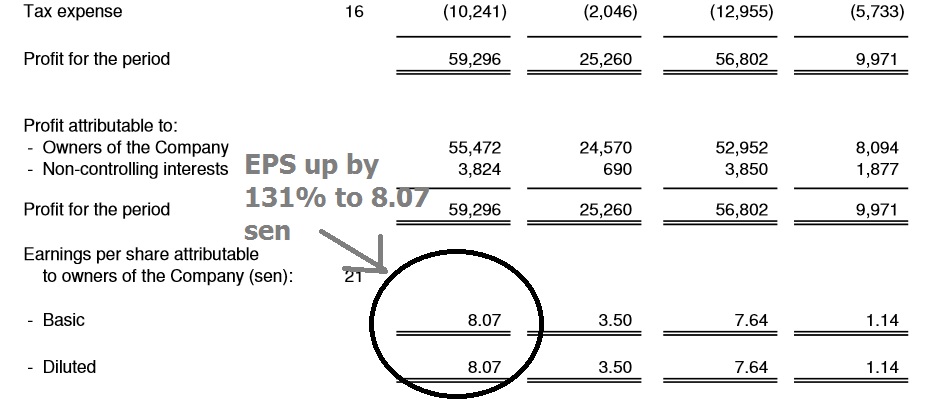

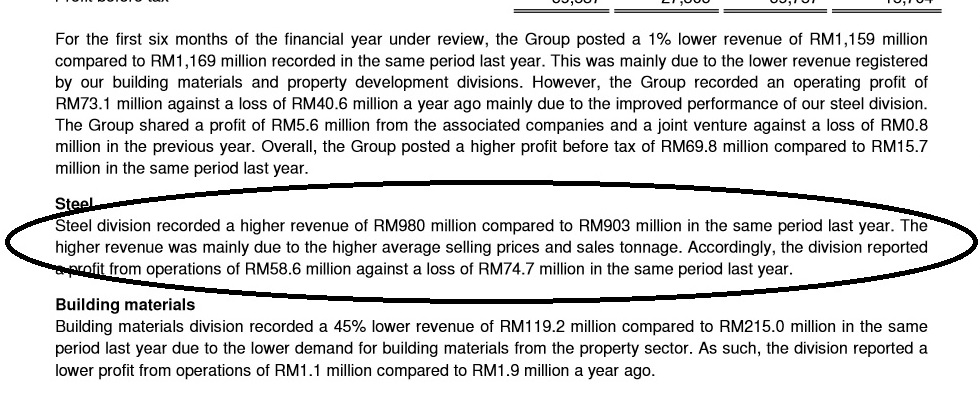

2. Improved earnings prospect for steel industry. The company's latest quarter EPS is 8.07 sen (double last year same period EPS of 3.50 sen). The earnings is pure earnings as I can't find one off items in the latest quarter earnings announcement. In the explanation on the earnings improvement, the Company mention that "Steel division higher revenue was mainly due to higher average selling prices and sales tonnage". These are pure profit.

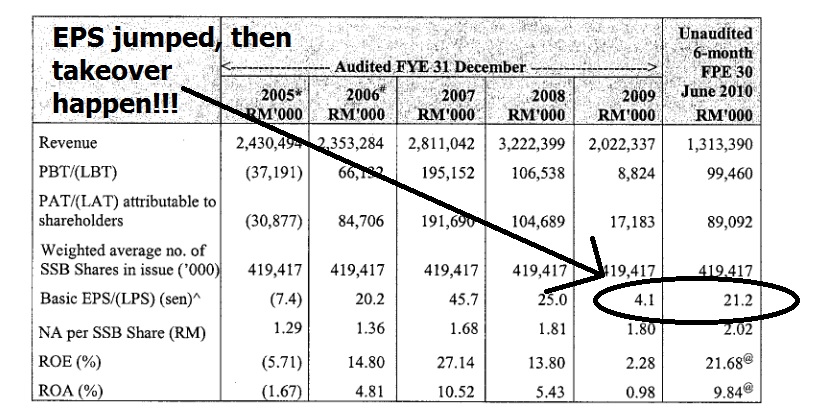

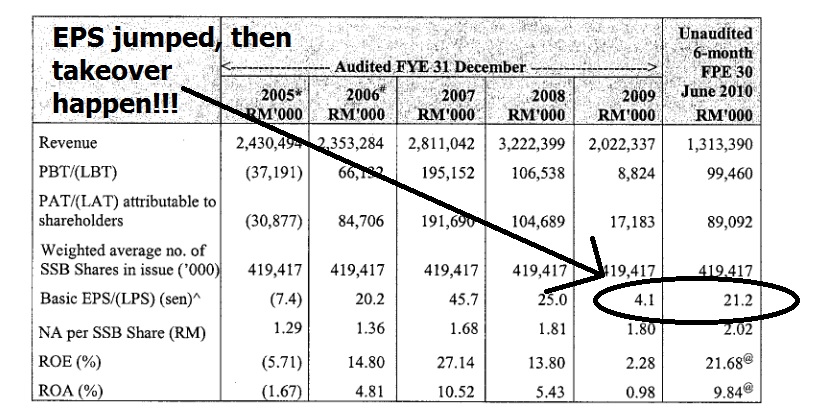

3. Do you know that there was attempt to Takeover Southern Steel in August 2010?

Historically, there was an attempt to takeover Southern Steel in 2010. The offer was made by Tan Sri Quek Leng Chan at that time at RM2.05 per share. While the deal didn't go through, we can see that improved EPS and low share price at deep discount to Book Value triggers this kind of similar corporate actions...

4. Steel stock is a HIGH BETA stock ... avoid it if you can't stand the volatility...

2. Improved earnings prospect for steel industry. The company's latest quarter EPS is 8.07 sen (double last year same period EPS of 3.50 sen). The earnings is pure earnings as I can't find one off items in the latest quarter earnings announcement. In the explanation on the earnings improvement, the Company mention that "Steel division higher revenue was mainly due to higher average selling prices and sales tonnage". These are pure profit.

3. Do you know that there was attempt to Takeover Southern Steel in August 2010?

Historically, there was an attempt to takeover Southern Steel in 2010. The offer was made by Tan Sri Quek Leng Chan at that time at RM2.05 per share. While the deal didn't go through, we can see that improved EPS and low share price at deep discount to Book Value triggers this kind of similar corporate actions...

4. Steel stock is a HIGH BETA stock ... avoid it if you can't stand the volatility...

LIONIND (4235) - (richDad) - LIONIND - 3 reasons why it is a PRIVATISATION CANDIDATE

http://klse.i3investor.com/blogs/richDad/117737.jsp