LNGRES (0025) - LNG RESOURCES BHD: The Pheonix Arising

LNGRES - The Pheonix Arising

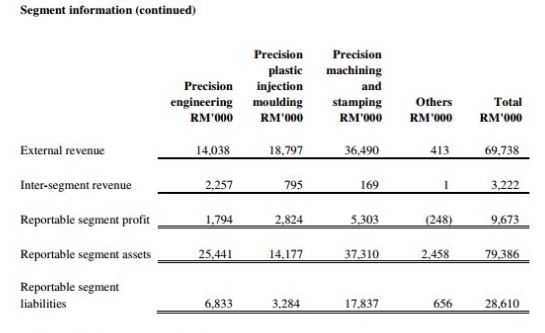

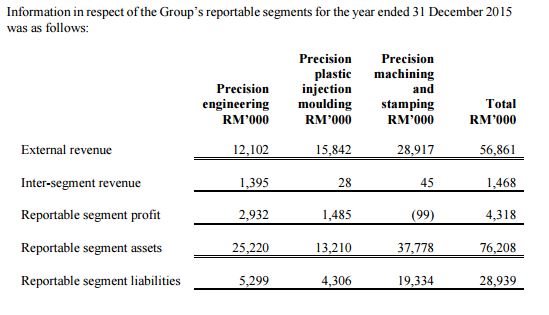

LNGRES is organised and managed into business units based on its products and services. During the financial period, segment information has been changed from three reportable segments to as follows:

i. Precision engineering - Involved in the design and manufacture of high precision moulds, tools and dies.

ii. Precision plastic injection moulding - Engaged in the precision engineering plastic injection moulding and sub-assembly.

iii. Precision machining and stamping - Involved in the manufacture and sale of precision machining and stamping components for the telecommunication, industrial sensors, switches, electronic equipment and other industries and the provision of related specialised engineering services.

iv. Others – Involved in the manufacture and assembly of electronic components and manufacture of paper products.

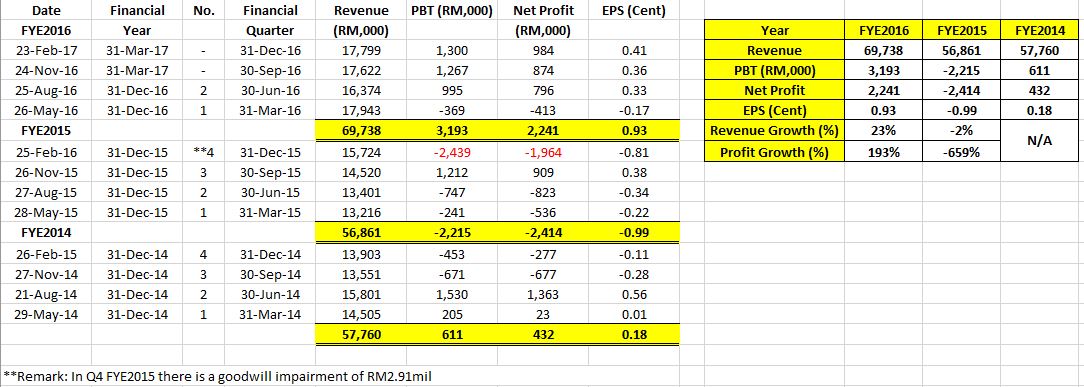

Result Analysis

Overall FYE2016 (disregard change of financial year end) LNGRES generated higher revenue than in FYE2015. The profit also improved tremendously from loss making RM2.41mil to profit making RM2.24mil (EPS growth of 193%!!!!!). The business has turnaround. BUT WHY?

In an article dated 29-May-2015 published by TheStar, "LNGRES registered a net loss of RM241,000 on the back of RM13mil in revenue, the loss was due to the substantial investment of RM20mil we injected last year to expand the operations in Vietnam and India. It will take at least another year for these operations to generate returns. We expect improvement in the group’s performance in the second half of 2015,” said by Group chairman Datuk Pahamin A. Rajab

With the Vietnam and India venture matured, that explains why started Q2 FYE2016 the group is generating positive.

Link attached: http://www.thestar.com.my/business/business-news/2015/05/29/lng-resources-to-spend-rm25mil/#2b6w1QBTFJr6YHXM.99

Segmental Analysis

(Source: Q4 FYE2016)

(Source: Q4 FYE2015)

By comparison of each business segment between FYE2016 and FYE2015, the decrease in profits in FYE2015 was mainly due to increased losses from the precision machining and stamping segment. However in FYE2016, the precision machining and stamping segment has turnaround from loss RM99k to profit RM5.3mil. Again thanks to substantial investment of RM20mil we injected last year to expand the operations in Vietnam and India. In addition if you noticed, each of the segment generate 12-15% profit margin which is very high in current economic condition. Why they can have such a high margin? Please refer below point.

Export Play

Actually LNGRES is an export play counter but not being noticed due to loss reported in FYE2014 and FYE2015. "About 90% of the group’s revenue comes from export sales. LNG Resources currently has manufacturing facilities in Bukit Minyak, Penang, Johor, Vietnam and India." said by Group managing director Jackie Yong Chan Cheah.

Imagine your manufacturing plant is from local assembly and South East Asia (SEA), all your operation cost is derived at MYR, Vietnamese Dong, and Indian Rupee which depreciated against USD, BUT your revenue is all transacted in USD. Do the maths.

Dividend policy

In 2006 LNGRES has set a group dividend policies of distributing 50% of its profit to shareholders. Hence we shall see more dividends in the upcoming financial years with business turnaround

The Group has distributed Interim Single-Tier Dividend of 0.25 sen per Share for the year ending March 31, 2017.

NTA

LNGRES has a high value NTA valued at RM0.23 which is 12% discounted from the closing price dated 16 March 2017.

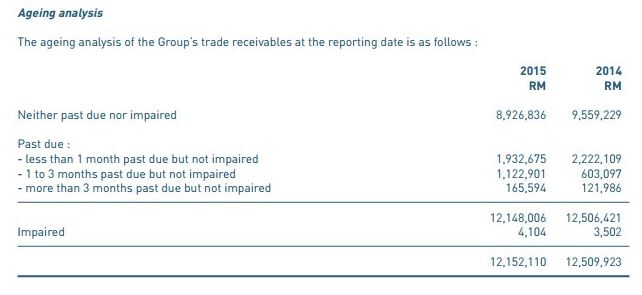

Managing Debts

LNGRES manages their receivable very well as seen above. You can hardly expect shocks from impairment of receivable.

Management Capable

Decisions that affects the Group's prospect are always derived from the Group Management team. I can emphasise here LNGRES management made their decision based on their foresight. WHY?

First of all, Talent Search. Presently LNGRES headquartered in Muar, Johor, LNGRES is looking at shifting its head office to Penang. “It is easier to recruit talents in Penang, where there is also an established electronic and electrical eco-system to support the manufacturing sector,” said by Group managing director Jackie Yong Chan Cheah.

Secondly, High-precision engineering group LNGRES is allocating RM50mil for a merger and acquisition (M&A) exercise this year to expand its presence in the aerospace industry which will grow the revenue to RM200mil. Seeing the earilier venture in aerospace industry turning the business around, LNGRES is aggresively expanding their operations including M&A exercise to grow the business.

(Source: The Star, dated 27 February 2017)

Technical Analysis

With the sudden surge of share price at 16 March 2017, the price has broken the resistance of RM0.19 and closed above RM0.20 at RM0.205 which is favourable. We shall see higher prices ahead (DO YOU SEE SIMILARITIES BETWEEN PTB CHART AND LNGRES CHART? HEHEHEHHEHHE)

In conclusion, do you see the similarities between KGB and LNGRES in term of FA? Do you see the similarities between PTB and LNGRES in term of TA? With the above points we listed out, hardly it can go wrong with the management high integrity on aggresively expanding the business. The business has turnaround with three straight consecutives profit reported. High chances you will see another profit reported in upcoming quarters which turn the EPS to over 15 cents, with standard PE of 20 you shall see the share price hit RM0.30 at first TP.

Stock Alliance

The information contained in this channel is for general information purposes only. Any reliance you place on such information is therefore strictly at your own risk.

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

LNGRES (0025) - LNG RESOURCES BHD: The Pheonix Arising

http://klse.i3investor.com/blogs/stockalliance/118478.jsp