TECGUAN (7439) - Another Limit Up share - TECK GUAN PERDANA BHD

2月刚过了,大多数公司都在2月发布了业绩,有人喜有人忧,业绩好的如 PETRONM 在还没公布业绩之前股价都一片红,公布后,股价从RM4+ 飞到了 RM6+, 幸运买到的人肯定笑到睡不着,资本在2天内增加了50%,这些好康都是留给那些敢搏的人,恭喜恭喜!好了,废话不多说,今天重点是讲解一个冷门股,相信很多人都没听过它,它就是 TECGUAN, 他有可能成为第2个 PETRONM,股票随业绩公布后涨

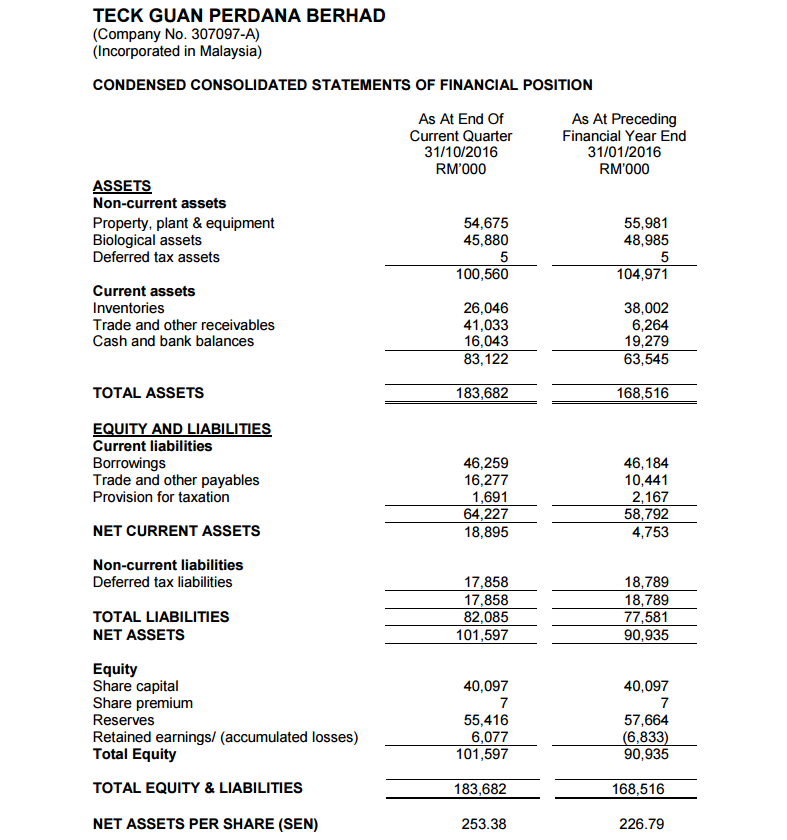

1)Strong Balance Sheets & Maintaining profitable

In 2016, TECGUAN Succesfully turn its Accumulated Loss into Retained Earnings and its Net Assets (83mil) > Total Liabilities (82mil). We do believe Management of TECGUAN might giving out dividend to reward its shareholders in the coming quarters.

From The Picture above, We can see that TECGUAN has been profit for 8 cumulative quarters, it turns to be a very stable company. With such stable profit, its NTA has climbed to rm2.53 as shown in latest QR.

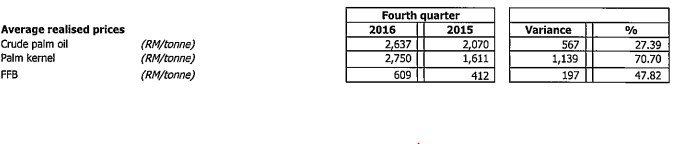

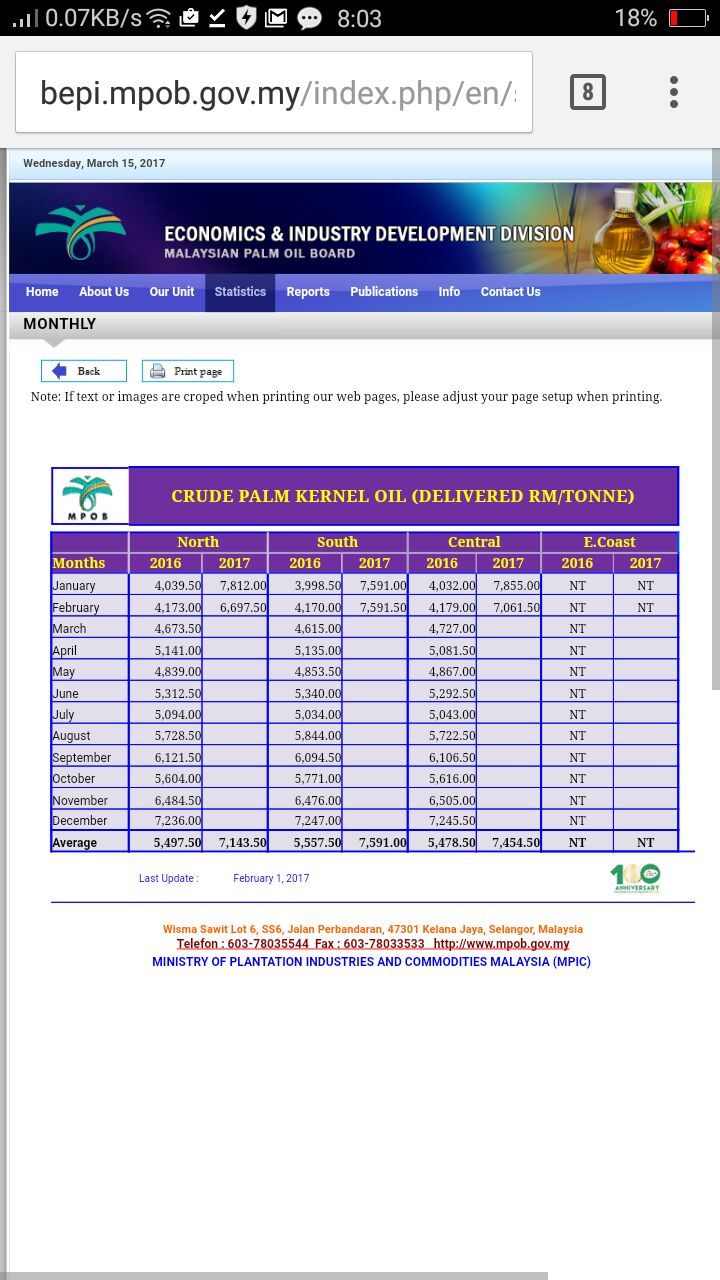

2) Rise in Palm kernel Oil price

Crude Palm Oil price have been in the limelight in the past few months, hitting it's peak at January 2016. Almost all the plantation related stock quarter results as at 31st December 2016 appeared to be in good shape with thicker margin.

Taking one example for margin breakdown as at 31st December (Extacted from THPLANT QR):

To zoom in further, Palm Kernel OIl price rises almost 70% year-to-year as at 31st December 2016 and hitting it's peak at January 2017.

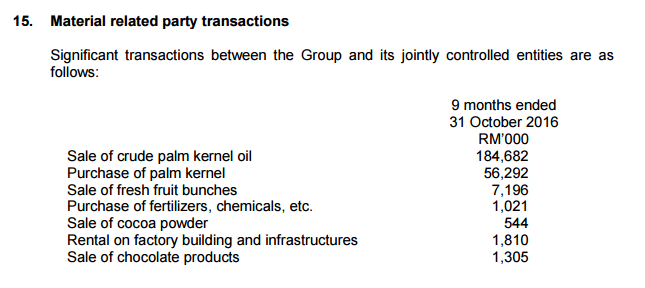

To eloborate further, 97.54% revenue of TECGUAN comes from palm oil products segment (whereby more Crude Palm Kernel Oil have taken most portion out of it, as shown in material related parties transaction below) while 2.46% comes from Cocoa Products. In the last QR, TECGUAN mentioned "The operating profit for the current quarter increased to RM3.96 million from RM2.72 million in the preceding year corresponding quarter. The increase was mainly attributed to the increase in selling price and favourable foreign exchange recognised."

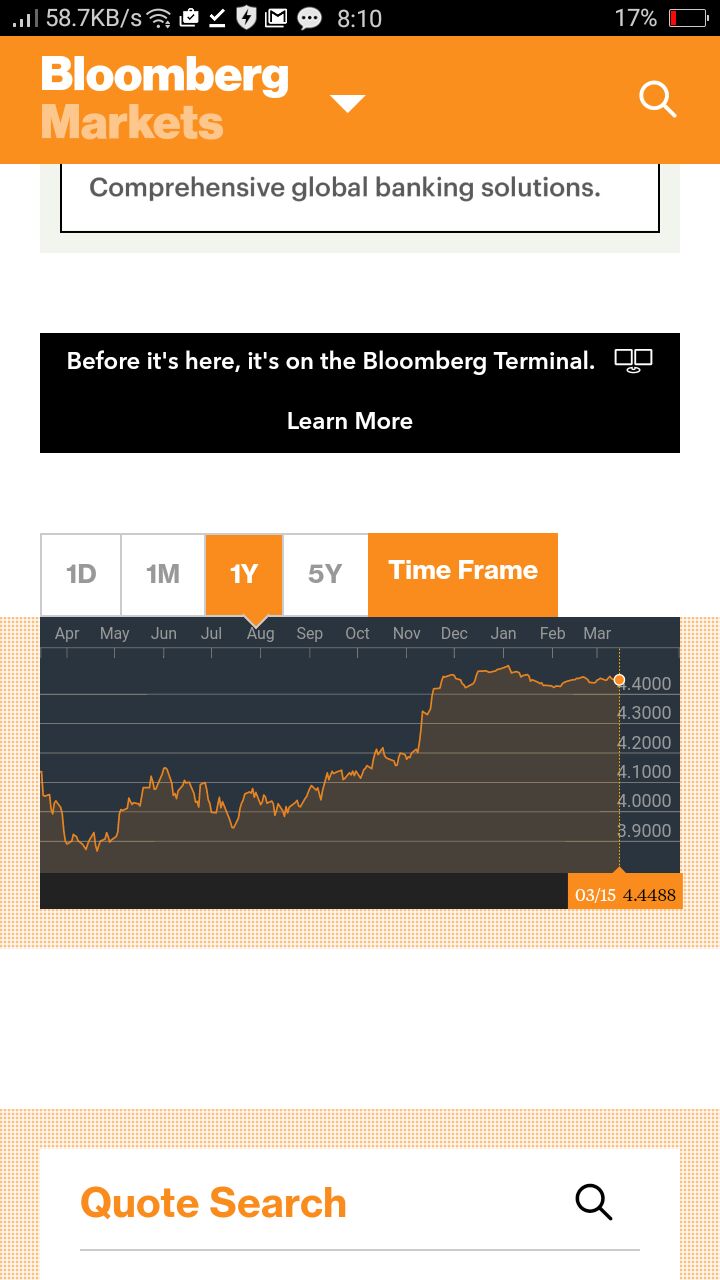

3) Favourable to USD exchange rate

Aside from sales higher margin, USD plays a major role in TECGUAN.

In Nov, USD started to rise from 4.2 to 4.5 (Jan), an increase of 7%. Tecguan also mentioned in its latest annual report that every 5% strengtened in USD will lead to an additional of 5.3mil profit to its company and visa versa. Next, in its latest QR, there has been 46mil of Cash and Receivable quoted in USD remain unhedge, while there is only 3mil of borrowing and trade payables quoted in USD remain unhedge. In other words, 43mil ( 46 mil - 3 mil ) of unhedge net assets is beneficial from rise in USD.