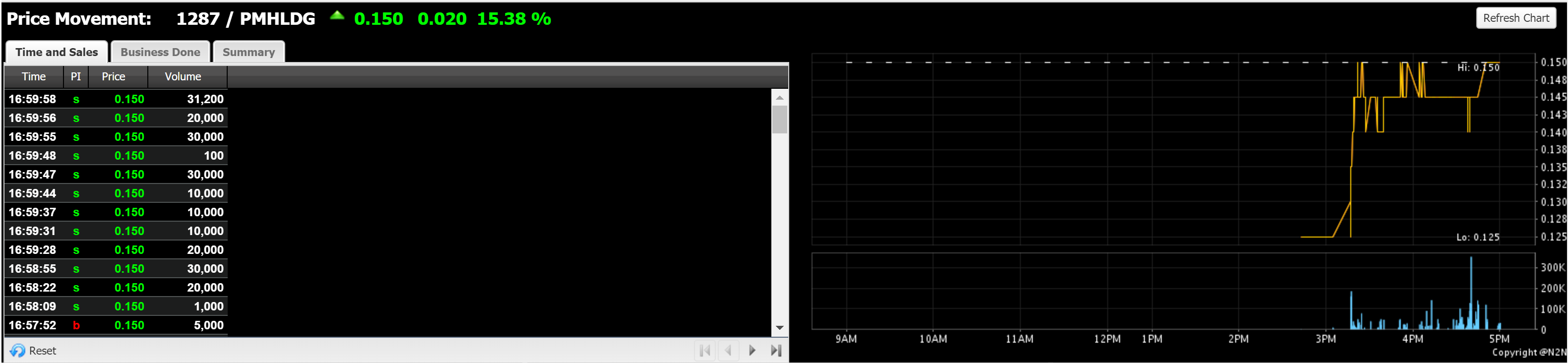

PMHLDG (1287) PAN MALAYSIA HOLDINGS BHD - 2nd Offer From Dr. Yu Kuan Chon.

This afternoon market talks that Dr. Yu Kuan Chon will made offer to buy out the PMHLDG (1287) controlling stakes 69% stakes from Tan Sri Khoo Kay Peng. This cause the PMHLDG share price closed at 4 months high 15sen. If market talk is true, PMHLDG share price likely will hit 50sen !! Will the history repeat ??

Look at chart below. PMHLDG share price surge from 10sen to 50sen within 2 weeks after Dr Yu Kuan Chon making first offer during 15 Dec 2014.

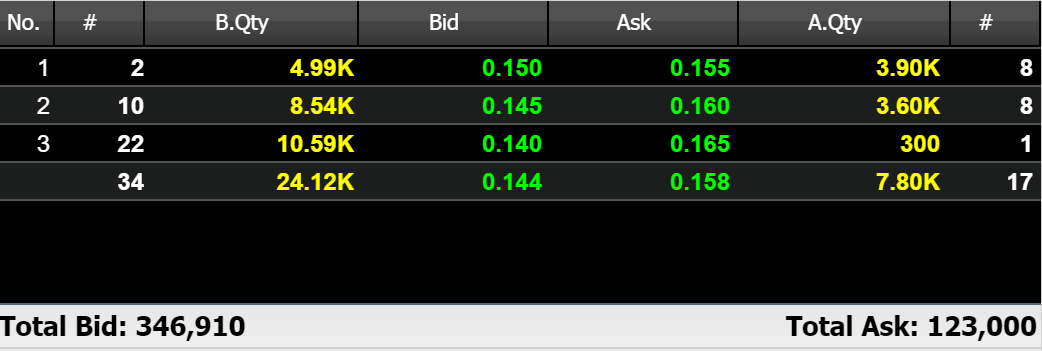

Technically, PMHLDG break its trading box resistance 14.5 and closed at 15sen. It is an Ultra Strong BULLISH signal. It will hit 20sen very very soon. Strong Buy !!

Dr

Yu, who has made a name for himself as a savvy investor by taking up

strategic stakes in little-known companies, is the chairman and

executive director of public-listed family-run YNH Property Bhd.

His 31.72% interest in the Perak-based property company gives him a

worth of RM243.43mil based on the stock’s market capitalisation of

RM767.45mil as at last look. However, the medical

doctor-turned-entrepreneur caught the attention of the market in 2013,

when he went on to accumulate up to more than 8% of HLCap, putting him

in a strong bargaining position in relation to the planned buyout of the

stock that is ultimately controlled by tycoon Tan Sri Quek Leng Chan of

the Hong Leong group. HLCap shares soared from RM1.42 prior to Quek’s

takeover attempt in early 2013 to a record high of RM14.60 on June 17,

2014.

Dr Yu subsequently pared down his stake in the stock ahead of the

deadline given by Bursa Malaysia for it to maintain a minimum public

shareholding spread and in the process made a tidy sum of over RM70mil,

previous media reports indicated. Dr Yu still has a small stake in

HLCap.

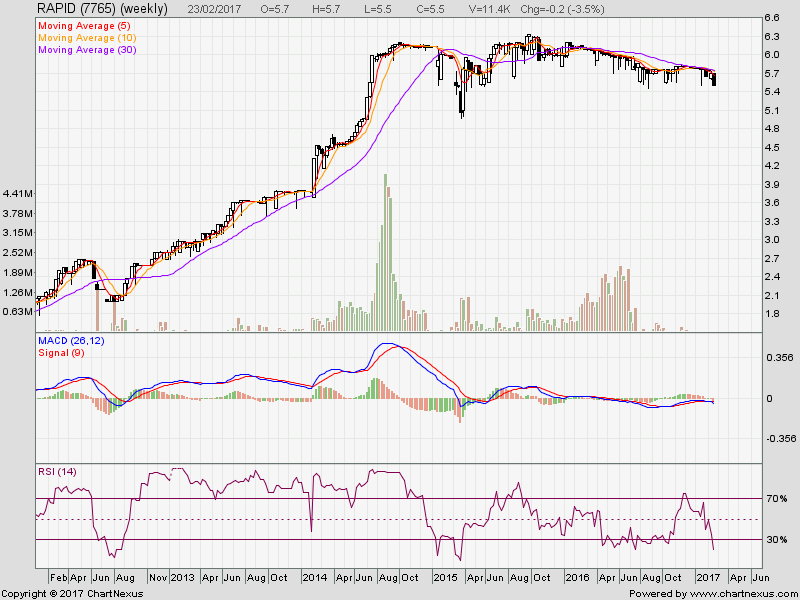

He is also a substantial shareholder of semiconductor firm Rapid Synergy Bhd with a 28.05% direct and indirect stakes.

In March last year, he emerged in little-known-but-cash-rich Imaspro Corp Bhd with slightly more than 5%. He subsequently raised his stake in the pesticide and fertiliser maker, now owning 17.48% based on Bloomberg data.

When the PM Holdings deal was announced 15 months ago, a spokesperson for Dr Yu told StarBizWeek that

the entrepreneur saw significant potential in businesses under the

company, including stockbroking. He also reiterated that his investment

was for the long term and expects to make a decent return on investment.

The spokesperson said that Dr Yu’s entry was at a low base and felt

that potential would come from increasing interest from retail

investors. “So, we plan to build up this business by hiring the right

people. There is a lot of potential,” the spokesperson had then said.

PM Securities is considered a small player in the stockbroking industry and operates nine branches.

If Dr Yu proceeds with the deal minus PM Securities, the main asset he

would be buying would be the Corus Paradise Resort in Port Dickson and

surrounding land.

The 10-storey resort hotel sits on 55,745 sq m that carries a net book value of RM23.64mil and was last revalued in 1993.

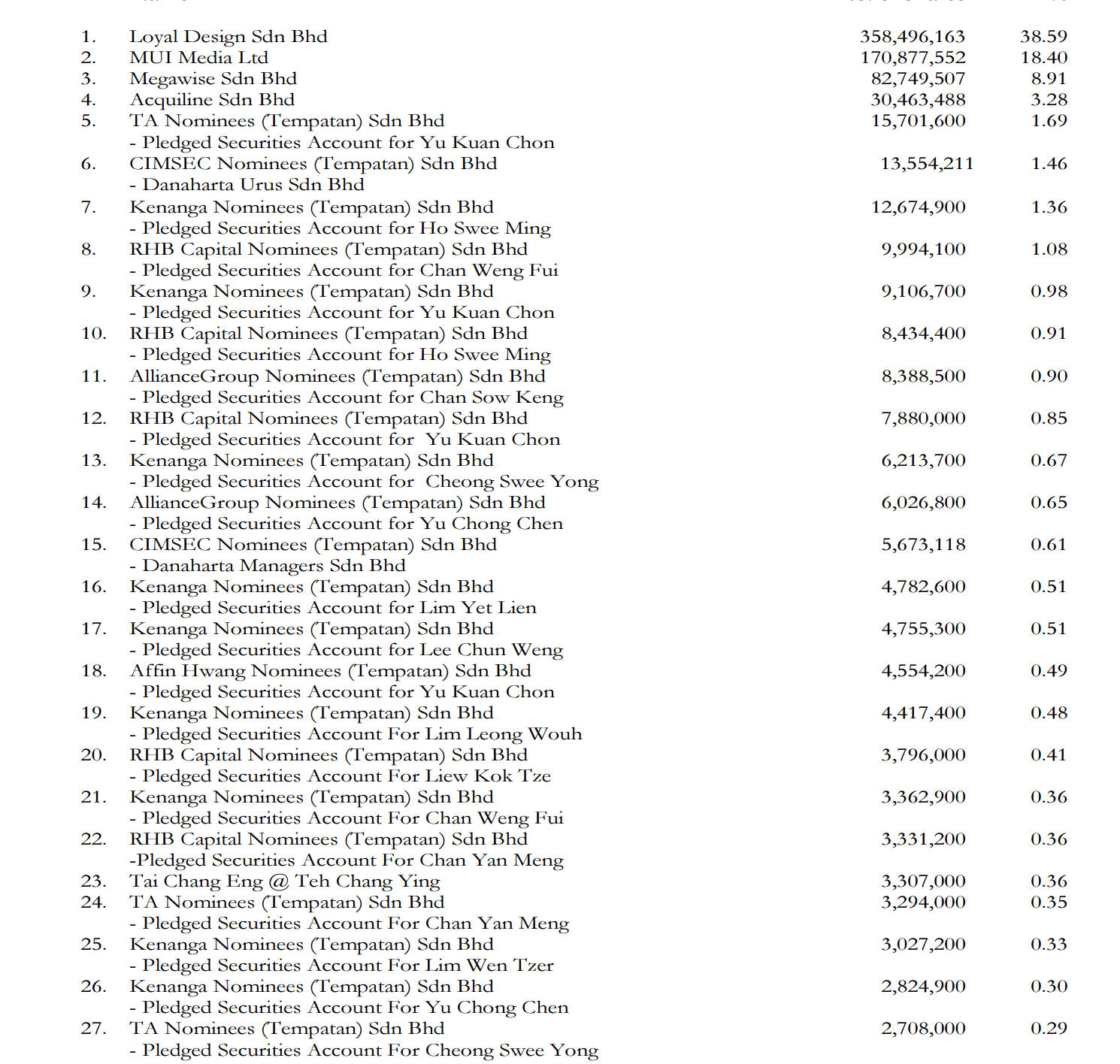

Although Dr Yu failed to takeover the PMHLDG. He still hold 11% stakes

in PMHLDG through himself and associates such as : Ho Swee Ming, Chan

Sow Keng, Yu Chong Chen, Chan Weng Fui and Lim Wen Tzer.

Based on the track record of Dr.Yu, he made handsome gain from his

investment such as Rapid, Imaspro and HLCAP. When Dr.Yu announce to take

over PMHLDG, PMHLDG share price hit 52sen. This is the magic of Dr. Yu.

更多既时股市资讯,请加入我们的TELEGRAM

WELCOME JOIN MY TELEGRAM

For more Real time information

PLEASE CLICK THIS LINK TO JOIN US

请按这个LINK 加入我们的TELEGRAM获取既时免费分享资讯

https://telegram.me/wecanstock

https://telegram.me/wecanstock

PMHLDG (1287) PAN MALAYSIA HOLDINGS BHD - 2nd Offer From Dr. Yu Kuan Chon.

http://klse.i3investor.com/blogs/Stockoftheday/118187.jsp