SOLUTN (0093) - Solution Engineering Holdings Berhad: Three reasons make stock price heading north

Solution Engineering Holdings Berhad (SEHB) is a Malaysia-based company engaged in investment holding and provision of management services. The Company, through its subsidiaries, is engaged in designing and development of equipment for bio-lubricant project and for engineering education and research and provision of training and curriculum content development. SEHB products are utilized in public and private universities, university colleges, polytechnics, skilled training centers, advanced technical institutions and colleges. Its subsidiaries are Solution Engineering Sdn. Bhd., Solution Biogen Sdn. Bhd., and Solution E & E Technology Sdn. Bhd.

There are three reasons that will make the stock price heading north:

- Strong fundamental

-Cold eye is major shareholder

-Diposal High EPS coming in FY17

FUNDAMENTAL

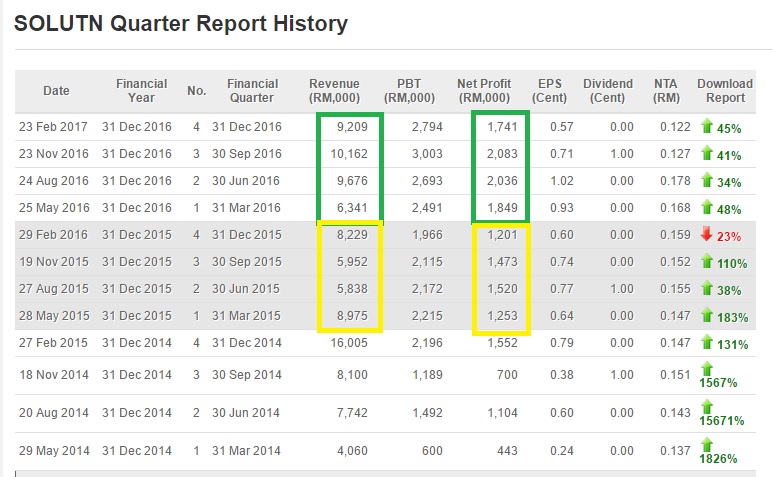

The growth in net profit for the past 5 years showing that the company is puttig hardwork to improve its profit margin, controlling the administration&distibution expenses. Comparing FY16, the company revenue so recovering back from GST impact last year, where the profit margin has record high in he history. The profit margin has achieve as high as 21.8%, purely from operating business, without any other income which is rarely found in ACE listed company

Solution quarter results in terms of revenue and net profit, showing great improvement over quarters, this figures have confirmed that Solution Engineering Bhd is a growth company, based on the growth rate, we are expecting revenue of RM40millions in FY17. In addition, solutn is very generous to give out dividend each year to attract investor attentions.

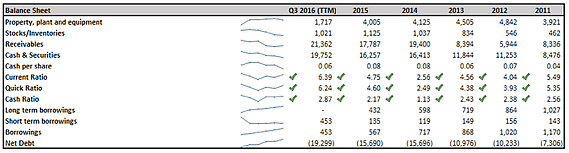

"From the figures, we find how amazing that SOLUTN is able to keep their healthy balance sheet over the years despite of those tough sales years. From Illustration 8, we can see that the management has been keeping their debts low to avoid the double edge effect of the leverage in their business. One notable highlight is their cash & securities have been growing from 8.4 mil (FY11) to 19.8 mil (FY16 Q3), which represents a CAGR of 20% over 5 years period. This indicates that real cash AKA Free Cash Flow (FCF) is generating from their operation. Having relatively huge pile of cash in hand, the company is currently a net cash company. All liquidity ratios such as current ratio, quick ratio, and cash ratio, have been at healthy level, which tell us that the company will not face any financial issue with this strong balance sheet. One might ask, why is the cash per share has dropped to 6 cents per share in FY16 Q3, this is due to dilution from 1:2 bonus issue last year. In overall, we are happy with the balance sheet of the company as it lowers the investment risks." From Author: Stockify http://klse.i3investor.com/blogs/stockify/115652.jsp

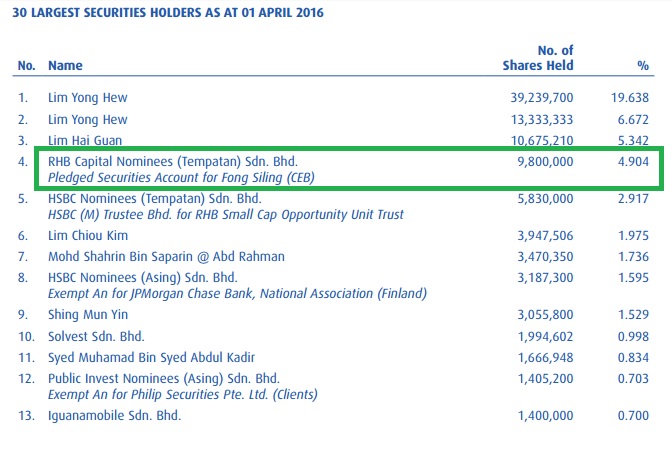

Major Shareholder

Solution also is one of the stockpick by Malaysia most famous fundamental investor, Mr. Fong siling AKA Coldeye. He has 9.8million shares or 4.9%, third largest major shareholder in the company, right after both company Director, Mr. Lim Yong Yew and Mr. Lim Hai Guan.

Mr. Fong siling AKA Coldeye, The largest pure investor in solutn

Coldeye will only sell out this shares when the stock is overpricing or fundamental turns bad. From the current stock prices, PE ratio, company growth rate and balance sheet, we believe that Coldeye is still holding high stake of solutn share.

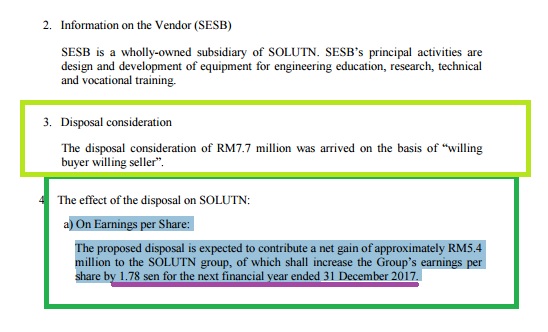

Disposal of property

In 2016 Oct, the company entered into SPA with Ventana Covering Sdn Bhd. , agreed to dispose a property for RM7.7 million, this figure will be reflecting in FY17

Solutn has approximately RM5.4 million or EPS 1.78 eps coming soon in FY17. So, if we considering the company operating latest EPS is 2.52 sens, if the results in FY17 could maintain at this figure, this means 2.52+1.78 = 4.3sens, which means in FY17 solutn earning per share will achieve 70% higher compared to FY16

From the chart above, the stock prices had been staying horizontal after bonus issue in 2016, then huge trading volume occurs in Oct 16 which trigger the stock price to move north, begins its first uptrend after bonus issue.

Its expecting this uptrend and current market sentiment, which is very bullist now, will continue to move up to above RM0.45, the price before bonus issue.

Source:

http://www.bursamalaysia.com/market/

http://klse.i3investor.com/blogs/stockify/114508.jsp

http://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=0093

This article do not make any recommandation, Trade at your own risk

Disclaimer: All Information is for education, self-improvement and

personal use purpose only, Not making any Buy/Sell Recommendations.

Kindly ask your remisier or dealer representative before making any

orders, trade at your own risk

Join my telegram if you like my channel : http://telegram.me/bbcstock

SOLUTN (0093) - Solution Engineering Holdings Berhad: Three reasons make stock price heading north

http://klse.i3investor.com/blogs/bbcstock/118490.jsp

http://klse.i3investor.com/blogs/bbcstock/118490.jsp