GHLSYS (0021) - (richDad) - GHLSYS: More than 50% upside (ALIBABA partnership is near term catalyst)

1. Main business = Payment Solution Provider. These descriptions are from their website which says “GHL

Systems Berhad (Stock Code GHLSYS 0021) is a leading payment solutions

provider in the region, deploying world-class payment infrastructure,

technology and services. The Group provides integrated end-to-end

payment solutions encompassing physical and virtual payments on sale and

rental basis, including Electronic Data Capture (EDC) terminals

compliant to the Europay-Mastercard-Visa (EMV) platform, contactless

readers, network access routers, and online payment gateways.” In

lay man term, imagine you use credit card to pay RM100 for groceries at

TESCO, 1% of it goes to GHLSYS as they are the system provider. This

explanation may not be 100% accurate, but it is enough to understand the

business model.

To fully understand what GHLSYS does you can visit their website here

http://www.ghl.com/overview/

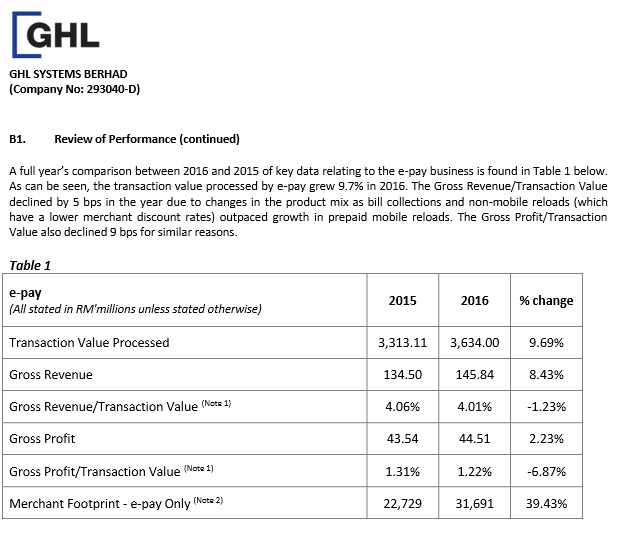

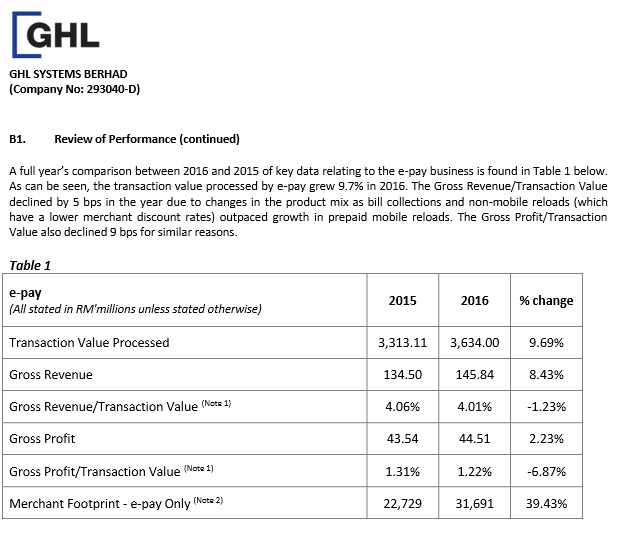

2. Strong FY16 earnings (+75% to RM18.12m). Reason for the earnings surge can be seen below.

3. Starts paying dividend of 0.5 sen in FY16. While the amount is small, it is the first dividend and it seems like they are going to consistently share their profit with shareholders in the future.

4. Partnership with ALIBABA to propel the Company to new high. Everyone know how big ALIBABA is. The news from Starbiz says…. “GHL Systems Bhd has partnered AliPay to offer Malaysian in-store merchants and online merchants an alternative payment method. In a filing with Bursa Malaysia on Monday, the payment services provider said Malaysia was the second Asean country where it had teamed up with AliPay, one of the largest global mobile and online payment platforms with over 400 million users. AliPay is China’s leading third-party online payment solution, owned by the Alibaba Group.”

You can read the full story here

http://www.thestar.com.my/business/business-news/2017/04/03/ghl-partners-alipay-to-offer-alternative-payment-option/

5. Long term value is RM1.75 per share. There is more than 50% upside that I am looking at. Out of the 50% upside, about 30% will be from FY17 earnings growth and 20% from FY18 growth. I also assume the Company maintain its PE of around 40x. Historically, they are growing their earnings at 75% rate in FY16 so my assumption of 30% growth is reasonable.

For record purpose, the share price is RM1.14 based on 3-April-2017 closing price.

GHLSYS (0021) - (richDad) - GHLSYS: More than 50% upside (ALIBABA partnership is near term catalyst)

http://klse.i3investor.com/blogs/richDad/119771.jsp

To fully understand what GHLSYS does you can visit their website here

http://www.ghl.com/overview/

2. Strong FY16 earnings (+75% to RM18.12m). Reason for the earnings surge can be seen below.

3. Starts paying dividend of 0.5 sen in FY16. While the amount is small, it is the first dividend and it seems like they are going to consistently share their profit with shareholders in the future.

4. Partnership with ALIBABA to propel the Company to new high. Everyone know how big ALIBABA is. The news from Starbiz says…. “GHL Systems Bhd has partnered AliPay to offer Malaysian in-store merchants and online merchants an alternative payment method. In a filing with Bursa Malaysia on Monday, the payment services provider said Malaysia was the second Asean country where it had teamed up with AliPay, one of the largest global mobile and online payment platforms with over 400 million users. AliPay is China’s leading third-party online payment solution, owned by the Alibaba Group.”

You can read the full story here

http://www.thestar.com.my/business/business-news/2017/04/03/ghl-partners-alipay-to-offer-alternative-payment-option/

5. Long term value is RM1.75 per share. There is more than 50% upside that I am looking at. Out of the 50% upside, about 30% will be from FY17 earnings growth and 20% from FY18 growth. I also assume the Company maintain its PE of around 40x. Historically, they are growing their earnings at 75% rate in FY16 so my assumption of 30% growth is reasonable.

For record purpose, the share price is RM1.14 based on 3-April-2017 closing price.

GHLSYS (0021) - (richDad) - GHLSYS: More than 50% upside (ALIBABA partnership is near term catalyst)

http://klse.i3investor.com/blogs/richDad/119771.jsp