MUDAJYA (5085) - Mudajaya Group Berhad: Mudajaya Return?

After writing 3 posts, I have stopped to write as I need to focus my time on reading and analyzing some companies.

However, today news just trigger my memory on an article that I have written which to be exact was on 1st Dec 2016.

Here it is (Mudajaya-Last String of Hope)

http://klse.i3investor.com/blogs/indianajones/110728.jsp

and when I checked back there are some readers comments there

When the quarter result released that time it was so bad, that most people act rationally (Yes, it is rational, I will explain later) to sell out. I have decided to take a deep look into this aging Giant.

There are many strategies in investment. Buying a turnaround company is one of the most profitable and yet it challege a person's courage, vision, and rationaity. One example is Warren Buffett bought into preference shares of Bank of America in 2007 in financial crisis.

Cut it short, I will explain some of my thinking why I think positively when Mudajaya is in pain?

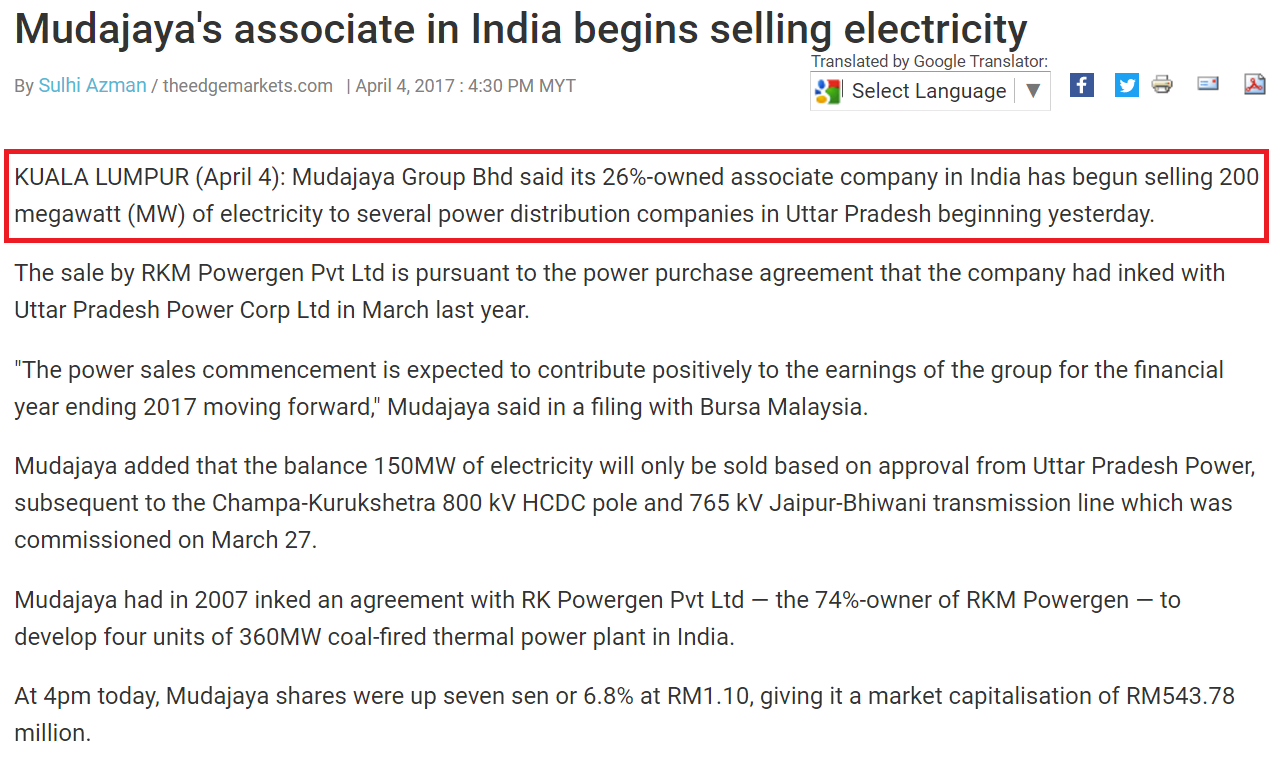

1) The major issue of Mudajaya is their project with RK Powergen in India. In their 2Q report, there were killed mainly by the interest/ deprecation cost that cannot be contained anymore after the COD. Mudajaya has a 26% stake in the joint venture RKM.

While the 74% hold by the RK Powergen India. First, let us see is there any proble why the power distribution keep delaying? As mentioned in my previous article, technically Unit 1 and 2 has done commission and is READY for power distribution. The blocking item is the agreement between this IPP with other power distributor (malaysia only have TNB as power distributor). As the time I wrote the previous article, there is no update and everyone is anxious will the things just.........

My Rationality: If you are the owner of RKM, now your house pipe leak, water splash all over your face. Will you just sit there and do nothing? If the leaks getting more serious, who will get drown? It is RKM (owned 76%, it means 76% loss will be attributed in their account)

So, I know definitely there have no other way than speed up the process. Why let a cash generating unit be idle, and let yourself burnt?

Secondly, India is still vastly short of electricity. So, demand is there.

So, the real rootcause very likely be (sorry I cannot disclose it here). But, if the authorities (buyer & seller) push ahead, it can be fast. So it is as simple as that.

So what happens then?

3rd March 2017

4th April 2017 (TODAY news)

Mudajaya has started selling electricity beginning on 3rd of April 2017 to several parties in Uttar Pradesh

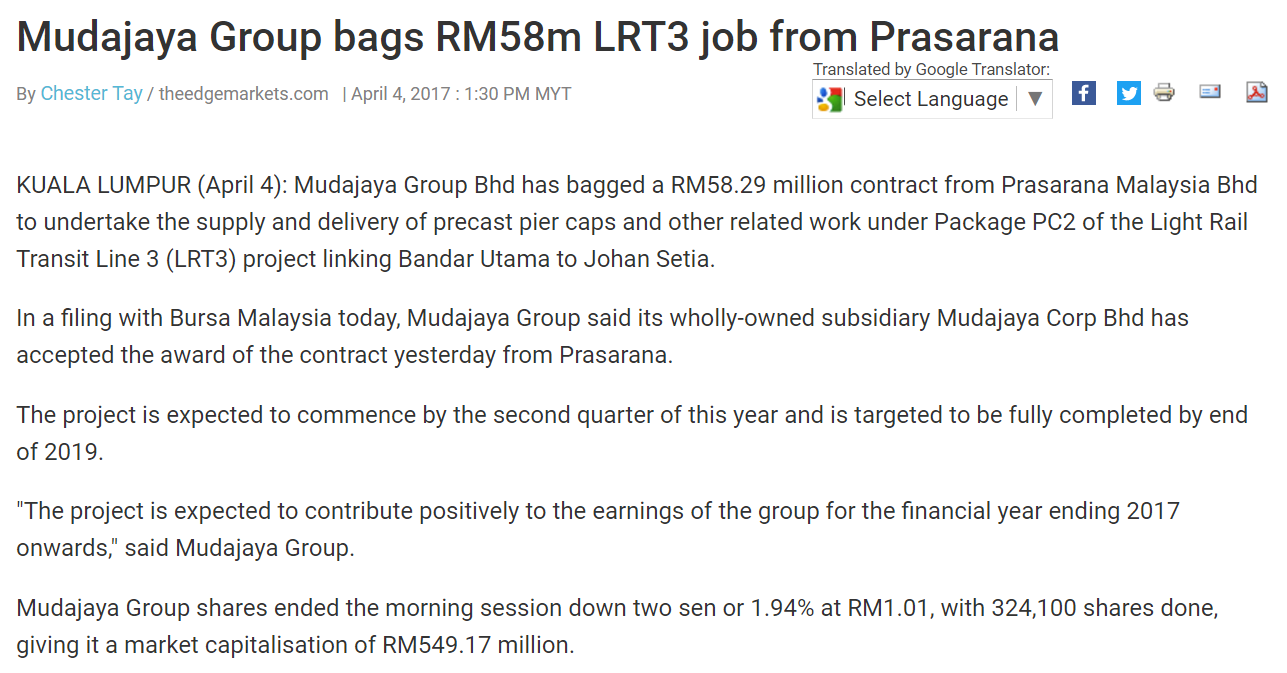

2) Proejct replenishment capabilities.

Before 2016, Mudajaya has been ignored by analayst as it did not able to replenish its project. However, if you notice, there is a change of management happens in April of 2015.

My Rationality: As I mentioned in previous article, I believed this is one of the rootcause that company not performing previously. So, now we have another CEO on stage, does he able to help clinch project as Mudajaya has been very long in handling big project. They have expertise and know how.

New CEO appointment

http://www.theedgemarkets.com/en/node/193003

So, let'see if this had been the real root cause and what happend after change of CEO?

- Obtained a 49MW LSSPV plant worth 270 mil in Sungai Siput, Kuala Kangsar (21st Dec 2016)

-Get A MRT2 project worth 558.64mil on building viaduct gateway .( 20th Dec 2016)

- Get a project worth 810mil to build a bypass in Tyn Dr Lim Chong Eu and Ayer Hitam after site possession which expect in 2H FY17 (2nd Dec 2016)

- Get 1.333 bil project for Pan-Borneo highway with JV with Musyati (70:30) (28 July 2016)

4th April 2017 (TODAY news)

It is about RM2.6 BIL projects (new project) on hand waiting to be completed !! Not forgetting the remaining project on hand yet to be delivered.

Share price has slowly climbed from 73 sen to today RM 1.1

All the facts shown. It is just time for them to execute and perform what at their mean level.

As mentioned earlier, I did say people act rationally when bad things/news comes, and act irrationally when excitement/ good news approaching.

Why I said so? When bad things come, figures look bad, news title is pessimistics. Well, it is normal for you to sell and vice versa for the good news.

But before you press the button, did you communicate with inner self, DOES IT MAKE REAL SENSE?

If you look thru the whole anaylsis, I just apply a concept root causing and is a solution placed? Well, patience is needed in some cases.

Like Buffett said: You can't get a child in a month by making 9 women pregnant" . Certain things need time to be accomplished.

Lastly, I only can said "Autobot, Transform !!"

I end my noise here.

Thaks for reading (if youlike it, just please click a Like, so I roughly know how many like the articles)

MUDAJYA (5085) - Mudajaya Group Berhad: Mudajaya Return?

http://klse.i3investor.com/servlets/cube/andyhard.jsp