Invest in stocks is never easy, I have been trying to look, listen, read, study & make judgement based on all news & reports to see how things are going & what is going to be.

When I look back over my investing performance since August 2015, I always feel lucky, because I know luck play a part beside hardworks.

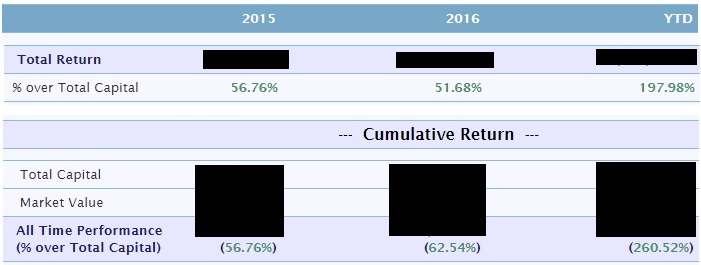

Stock Performance Since August 2015

I have been monitoring my investment activities using the portfolio function offered by i3, it has been very useful. Thanks to i3 website for such great & free offering.Please note that some of the info were erased for whatever purposes.

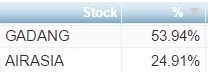

Stocks Performance in 2015

(Gain less than 10% were not shown)

I came to know ICapital in 2007 & had bought & kept ICapital until August 2015, that earned me a handsome return of 24% over the period of 8 YEARS!!! Well done to TTB & his team!

I started my journey back to Bursa with Airasia when it was RM0.95, before it went down further to 0.79.

The one that really built my confidence was Gadang, I bought it when it was RM1.45 & made good return by selling it from RM2.50 down to RM2.15.

Stocks Performance in 2016

(Gain less than 10% were not shown)

If 2015 is my returning year & my initial capital was RM200, I topped up another RM300 cash into my investment fund & applied CIMB margin facility of RM500, making total fund of RM1,000.

The first half of 2016 was relatively quiet to me, made some but also loss some, overall still positive.

The second half of 2016 was all about steel & Ekovest, these counters were my main contribution to my return in 2016.

First bought Mycron @ 0.44 & topped up on the way up to 0.82, sold all @ 1.12.

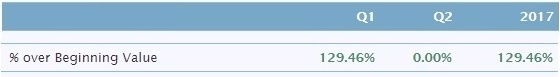

Stocks Performance in 2017

Performance over the first 3 months based on the beginning value as at 1/1/2017:

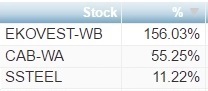

Individual stocks performance:

First bought Ekovest-WB @ 0.336 (after split price) & top up more when price up, average purchase price was 0.476 & sold all at average price @ 1.22.

First bought CAB-WA @ 1.16, sold gradually on the way up & final batch was sold @ 1.93.

During the 3 months period, I also bought & sold AWC, EG & EG warrant, but since the gains were less than 10%, I didn't show these counters in the list.

Top 10 Counters (Based on Earnings)

Earnings since August 2015 = RM2,600

Total investment fund = RM1,000 Total Return Over Investment Fund = 260%

As mentioned earlier, my total capital investment fund is RM1,000, included in the fund was CIMB margin finance of RM500. My actual invested capital was RM500.

Total Return Over Invested Capital = RM2,600 / RM500 = 520%

TOP 10 Loss Making Decision

My first principle is "try not to lose money", therefore I only buy profit making company & set my cut-loss target at 10%.My second principle is "let the profit fly".

Each of the following counters were suffering losses of not more than 0.5% over total investment fund due to very small quantity purchased except for Shell (HengYuan).

I suffered 2% loss of investment fund in Shell (HengYuan) & cut loss after realising it was not my cup of tea, the loss was the price I paid.

I sold all my Gkent also after realising I was misled by the director in the news & IB's reports on the contents of outstanding order book, making small loss in GKent. Thanks to wangge & Chelsea for highlights in their comments & email.

About Myself:

I am kiasi type of people & my degree of tolerating loss is quite low, that's the reason I set my cut-loss target at 10%.I love to know how people conduct their businesses & I love figures & stock market since I was 16.

I ran away stock market from the day I learned & paid for my lesson when I was 21. I realised it was never easy to make a living purely from stock market.

CIMB Share Margin Facility (Interest Rate = 4.5% pa)

My invested capital is my 1 year's income & margin finance facility limit is also equilavent to my 1 year's income.

Beside that, I have other savings, emergency fund & business cash which are few times of my invested capital.

I treated share margin facility as my business finance in stock market.

I spent at least 3 hours everyday in reading reports, books, newspapers & doing analysis.

I love figures & I love what I am doing now, in business, family life & stock market.

I subscribed Sin Chew, The Star, The Edge Weekly & Focus & I try to read all good sharing from all members in i3.

I love to read books & highly recommend:

1. The Intelligent Investor by Benjamin Graham

2. All books from Cold Eyed (冷眼)

3. Beating the Street by Peter Lynch

My advice

Always remember this, making money is never easy, whether in the stock market or out of stock market. No one will want to give us even a single cent if we don't work really really hard.

Enhance accounting skills & understand the contents in the annual & quarterly reports is way to start understand a company.

WISH ALL THE BEST & GOOD LUCK TO EVERYONE IN MAKING MONEY FOR BETTER FUTURE.

http://klse.i3investor.com/blogs/moneymoney/120544.jsp