POHUAT (7088) - "暴发"Pohuat,财7岭0发8发8

POHUAT (7088):

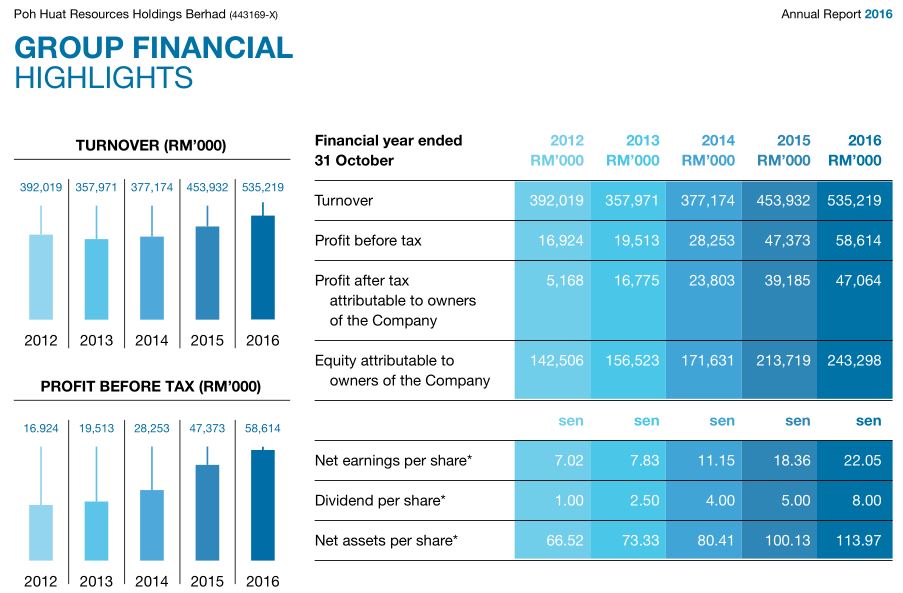

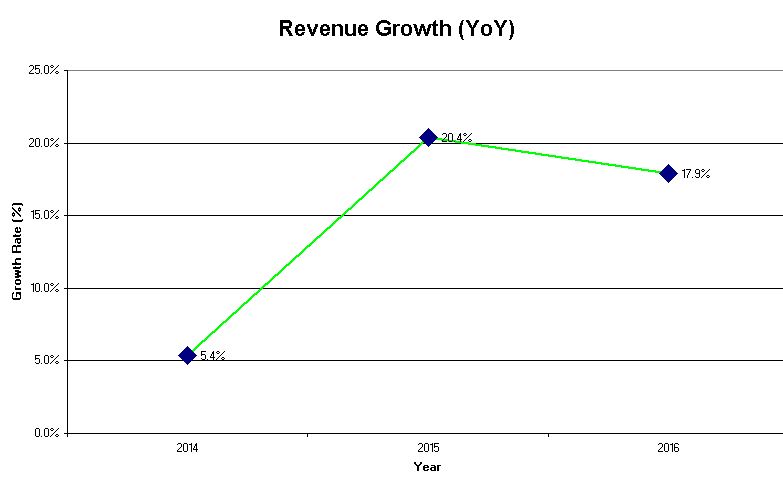

1) Annual Revenue grows 17.9% in 2016 compare to 2015.

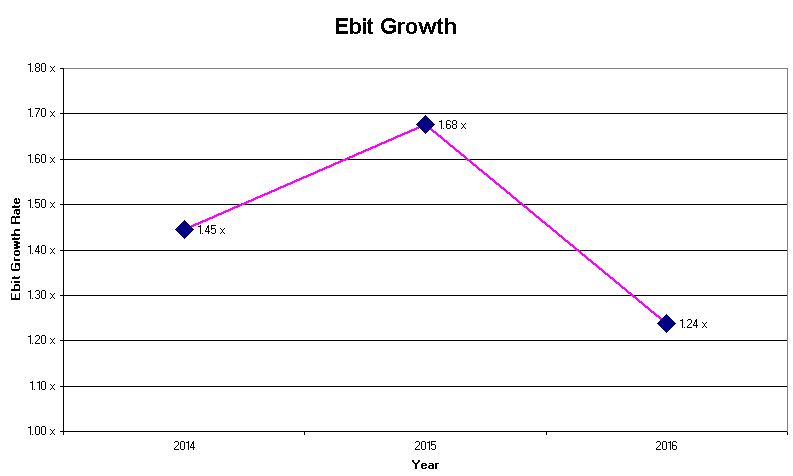

2) COGS is well maintained at 80% of revenue.

3) EBITDA is in steady path 24% growth rate in 2016 compared to 2015. Although the growth rate is not sexy as 2015 (68%) versus 2014, the consistent growing is well projected.

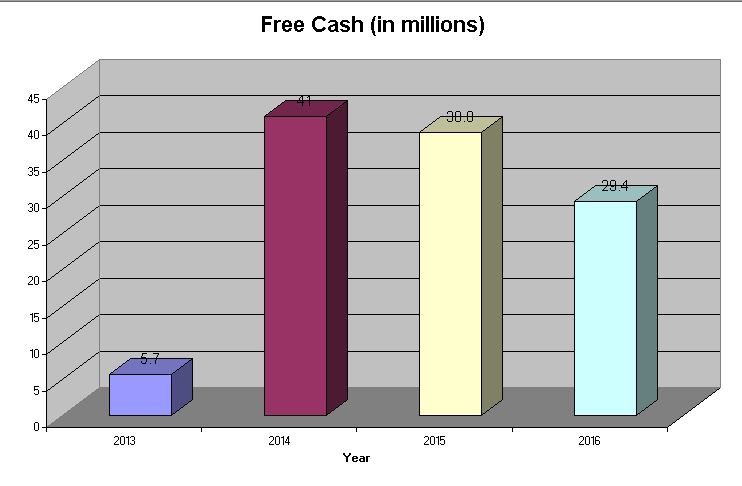

4) Consistently hold a number of free cash at 29.4 millions in 2016.

2) COGS is well maintained at 80% of revenue.

3) EBITDA is in steady path 24% growth rate in 2016 compared to 2015. Although the growth rate is not sexy as 2015 (68%) versus 2014, the consistent growing is well projected.

4) Consistently hold a number of free cash at 29.4 millions in 2016.

With the good indicator below:

i) EV / EBIT: 6.34 < 8; PE: 7.50 < 10

ii) Book value: 1.70

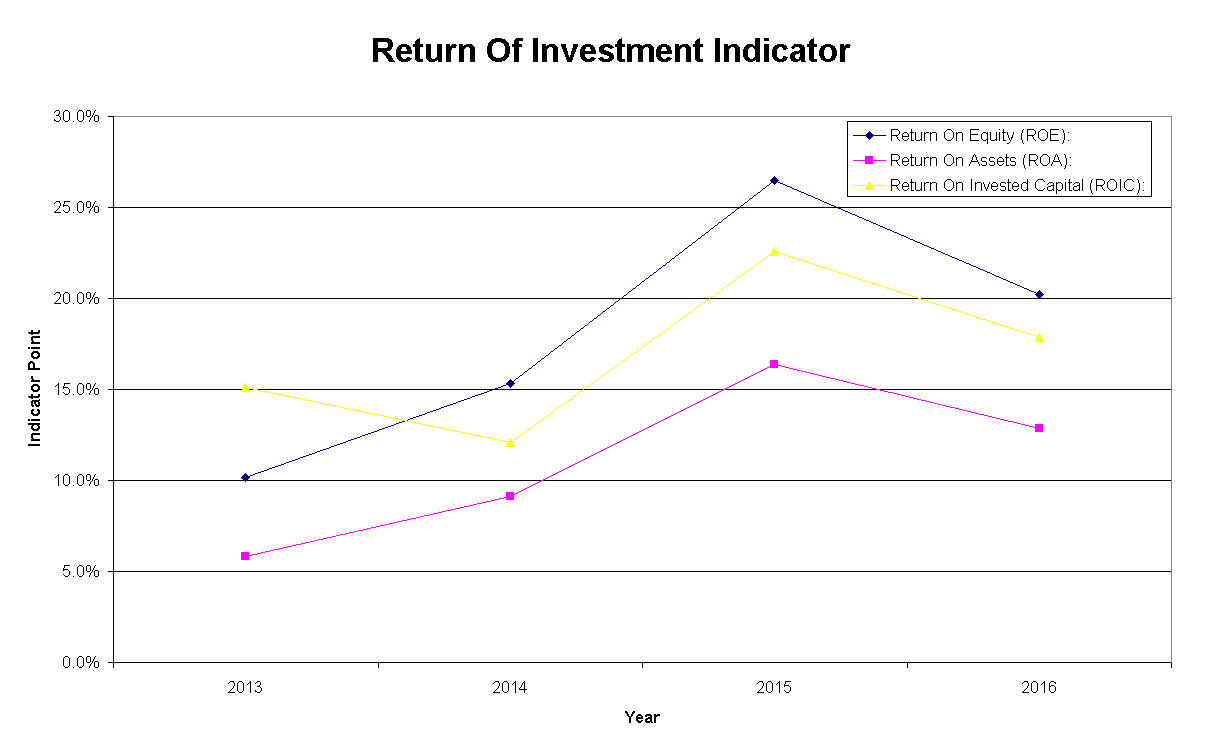

iii) ROE: 20.2%

iv) ROA: 12.8%

v) ROIC: 17.8%

i) EV / EBIT: 6.34 < 8; PE: 7.50 < 10

ii) Book value: 1.70

iii) ROE: 20.2%

iv) ROA: 12.8%

v) ROIC: 17.8%

It is strong believe that the POHUAT is a resilient and high growth

company. It is undervalue and should be traded at PE: 15.18 to reflect

the stock price RM 3.60#

POHUAT (7088) - "暴发"Pohuat,财7岭0发8发8

http://klse.i3investor.com/blogs/resilient_pohuat1/121848.jsp