TAS (5149) - TAS - THE BUILDER

TAS - THE BUILDER

Given if you have missed the KGB, PTB, LNGRES, SYMLIFE, FARLIM, JERASIA, RCECAP, etc we don't think you will want to miss this. TAS has released the latest Quarter Report in 20 April 2017 and the result is excellent hence trigger us to study more about this counter. Based on the below facts we highlighted, we are virtually vertain that TAS will be the upcoming underlying GEM.

Company Background

TAS is primarily involved in shipbuilding. The vessels constructed by this group are predominantly sold to overseas customers. TAS was tightly linked with O&G sector however TAS's harbour tugs and landing craft can be use other sectors like commodities.

Recovery of Oil/ Commodities Price

Since Donald Trump has been elected as President of United States, a lot of commidities have been very bullish which resulted in price surge in commodities. We believe this has slowly recovered a lot of sector like Steel, Oil, Bauxite, Metals and others. With the recovery, in a world of free trades, many countries tend to import and export commodities to the other countries. There are few ways to transport that, first by airplace, second by boat, third by train (given short distance and if they have linked). TAS established at 1977, full of expertise in the industry for more than 40 years. They know what the market needs hence they kept winning projects.

(Source: Bloomberg, Commidities are bullish)

(Source: Bloomberg, high probabilities OPEC will extend oil production cut to boost oil price)

Keep nailing project

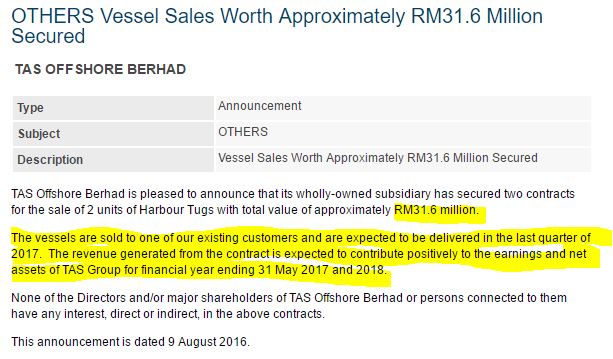

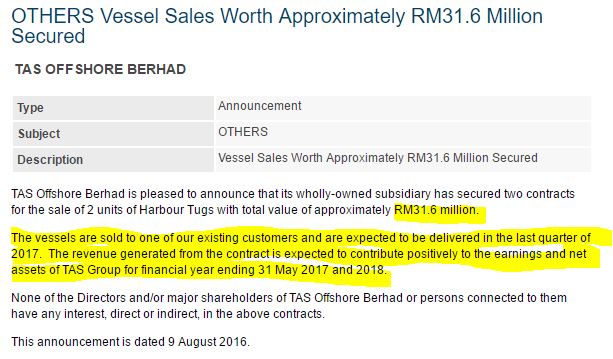

Enclosed below with the few announcements public might overlook. TAS has at August 2016 and December 2016 won two projects on sales of harbour tugs and landing craff. Okay, project, what's the big deal? TAS FYE is fallen at 31 May 2017. If these two contracts are expected to contribute positively to the earnings on FYE ending 31 May 2017, do you believe next quarter (Q4 FYE2017) one last quarter TAS will recognise all the sales? What will the sales amount be, what will the profit be?

TAS might not enjoy a good year 2016. But what's over is over. They incurred impairment losses and that's it. They did what is required in term of accounting policies to show prudent result. Now in 2017, they started to win more projects more sales coming in. A splendid good start for the company.

Prospect

Like we said, TAS supplies craft to different industries (not limited to Oil). TAS is well recognised in Indonesia (you may check the quarter reportsssss), these are indeed great opportunites. If you are wondering whether coming this month, will there be any announcement on contract awarded to craft sales. We can't disclose too much, but wait for surprises.

Simple calculation

In stock market, you need to be very great in maths and common sense! One contract is worth RM17.29mil plus another contract is worth minimum RM12mil. There are at least revenue of RM30mil, with net margin of 15%, there will be RM4.5mil, equivalent to EPS of 2.5 cents. It is more than enough to turnaround the company.

(Disclaimer)

TAS (5149) - TAS - THE BUILDER

Given if you have missed the KGB, PTB, LNGRES, SYMLIFE, FARLIM, JERASIA, RCECAP, etc we don't think you will want to miss this. TAS has released the latest Quarter Report in 20 April 2017 and the result is excellent hence trigger us to study more about this counter. Based on the below facts we highlighted, we are virtually vertain that TAS will be the upcoming underlying GEM.

Company Background

TAS is primarily involved in shipbuilding. The vessels constructed by this group are predominantly sold to overseas customers. TAS was tightly linked with O&G sector however TAS's harbour tugs and landing craft can be use other sectors like commodities.

Recovery of Oil/ Commodities Price

Since Donald Trump has been elected as President of United States, a lot of commidities have been very bullish which resulted in price surge in commodities. We believe this has slowly recovered a lot of sector like Steel, Oil, Bauxite, Metals and others. With the recovery, in a world of free trades, many countries tend to import and export commodities to the other countries. There are few ways to transport that, first by airplace, second by boat, third by train (given short distance and if they have linked). TAS established at 1977, full of expertise in the industry for more than 40 years. They know what the market needs hence they kept winning projects.

(Source: Bloomberg, Commidities are bullish)

(Source: Bloomberg, high probabilities OPEC will extend oil production cut to boost oil price)

Keep nailing project

Enclosed below with the few announcements public might overlook. TAS has at August 2016 and December 2016 won two projects on sales of harbour tugs and landing craff. Okay, project, what's the big deal? TAS FYE is fallen at 31 May 2017. If these two contracts are expected to contribute positively to the earnings on FYE ending 31 May 2017, do you believe next quarter (Q4 FYE2017) one last quarter TAS will recognise all the sales? What will the sales amount be, what will the profit be?

TAS might not enjoy a good year 2016. But what's over is over. They incurred impairment losses and that's it. They did what is required in term of accounting policies to show prudent result. Now in 2017, they started to win more projects more sales coming in. A splendid good start for the company.

Prospect

Like we said, TAS supplies craft to different industries (not limited to Oil). TAS is well recognised in Indonesia (you may check the quarter reportsssss), these are indeed great opportunites. If you are wondering whether coming this month, will there be any announcement on contract awarded to craft sales. We can't disclose too much, but wait for surprises.

Simple calculation

In stock market, you need to be very great in maths and common sense! One contract is worth RM17.29mil plus another contract is worth minimum RM12mil. There are at least revenue of RM30mil, with net margin of 15%, there will be RM4.5mil, equivalent to EPS of 2.5 cents. It is more than enough to turnaround the company.

(Disclaimer)

Conclusion

With

the trilling events we have mentioned/updated above, we strongly

believe TAS is like KGB, do you sense the same? First result, next more

sales project awarded, next investment house highlight. The share price

should be valued at RM0.60 53% upside from current price. The recovery

of commodities will contribute positively to the company P/L.

Disclaimer:

The information contained in this channel is for general information purposes only and NOT a recommendation for buying or selling stock. Any reliance you place on such information which incur profits/losses is therefore strictly at your own risk. We are merely sharing our trades and hold no enforcement on issuing buy calls. If you share the same view with us on stocks, let time prevail.

Stock Alliance

The information contained in this channel is for general information purposes only. Any reliance you place on such information is therefore strictly at your own risk.

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

TAS (5149) - TAS - THE BUILDER

http://klse.i3investor.com/blogs/stockalliance/122160.jsp