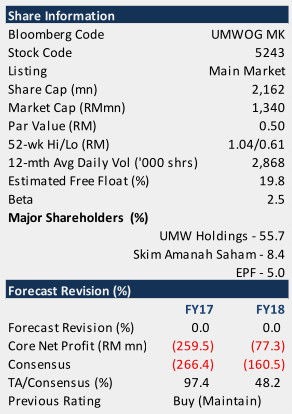

UMWOG (5243) - UMW Oil & Gas - TP: RM0.80

The News

●UMW Oil & Gas Corporation Bhd (UMWOG) has been awarded two new contracts from Petronas Carigali for the provision of drilling services as part of Petronas Carigali’s drilling programme.

● NAGA 3 will be contracted for 5 firm wells with the option to drill additional 1+1+1+1+1+1 wells (total: 6) whereas NAGA 4 is contracted to drill 2 firm wells with optional 1+1+1 wells (total: 3).

● The combined contract value for firm and optional wells amounted to USD34.81mn (RM151.1mn).

●UMW Oil & Gas Corporation Bhd (UMWOG) has been awarded two new contracts from Petronas Carigali for the provision of drilling services as part of Petronas Carigali’s drilling programme.

● NAGA 3 will be contracted for 5 firm wells with the option to drill additional 1+1+1+1+1+1 wells (total: 6) whereas NAGA 4 is contracted to drill 2 firm wells with optional 1+1+1 wells (total: 3).

● The combined contract value for firm and optional wells amounted to USD34.81mn (RM151.1mn).

Our View ●

The contract wins are a huge positive for UMWOG as the Group finally

has all its rigcontracted. Note that the main reason for its huge core

losses in FY16 was the Group’s idling fleet. It registered average

utilisation rate of 21% in FY16.

● Assuming one month per well, NAGA 3 & 4 will have contract tenure of 5- 11 months and 2-5 months respectively. Given the contract value of USD34.81mn, we estimate DCRs of USD70-75K/day which is cashflow positive and within expectations.

● We had mentioned in our previous report that Petronas would prioritise local rig players. Thus, the contract wins are within expectations. Assuming no delays and only firm wells are drilled, UMWOG’s average utilisation rate in FY17 will be 51% which is slightly lower than our forecasts of 52%.

● To recap, management revealed that it is bidding for 15 contracts in Malaysia. We expect UMWOG to secure the lion’s share of these contracts given its position as the only local jackup rig player with available rigs for hire.

● All in, we are rather positive on the news as UMWOG’s earnings visibility is clearer. Furthermore, with all rigs contracted, idling costs will be significantly reduced.

● Assuming one month per well, NAGA 3 & 4 will have contract tenure of 5- 11 months and 2-5 months respectively. Given the contract value of USD34.81mn, we estimate DCRs of USD70-75K/day which is cashflow positive and within expectations.

● We had mentioned in our previous report that Petronas would prioritise local rig players. Thus, the contract wins are within expectations. Assuming no delays and only firm wells are drilled, UMWOG’s average utilisation rate in FY17 will be 51% which is slightly lower than our forecasts of 52%.

● To recap, management revealed that it is bidding for 15 contracts in Malaysia. We expect UMWOG to secure the lion’s share of these contracts given its position as the only local jackup rig player with available rigs for hire.

● All in, we are rather positive on the news as UMWOG’s earnings visibility is clearer. Furthermore, with all rigs contracted, idling costs will be significantly reduced.

Impact ● Maintain our earnings forecast as the contract wins are within expectations.

Impact ● Maintain our earnings forecast as the contract wins are within expectations. Valuation

● Maintain Buy on G with unchanged TP of RM0.80 based 0.9x FY18 P/B. We believe UMWOG is staged for a turnaround given 1) relieve of short-term liquidity risk and 2) increase in rig utilisation rates. Risks to our call include 1) failure to sure

source: TA Securities Research – 16/5/2017

UMWOG (5243) - UMW Oil & Gas - TP: RM0.80

http://klse-online.blogspot.com/2017/05/umw-oil-gas-tp-rm080.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+klse-online+%28KLSE+online%29