1. Recent Performance

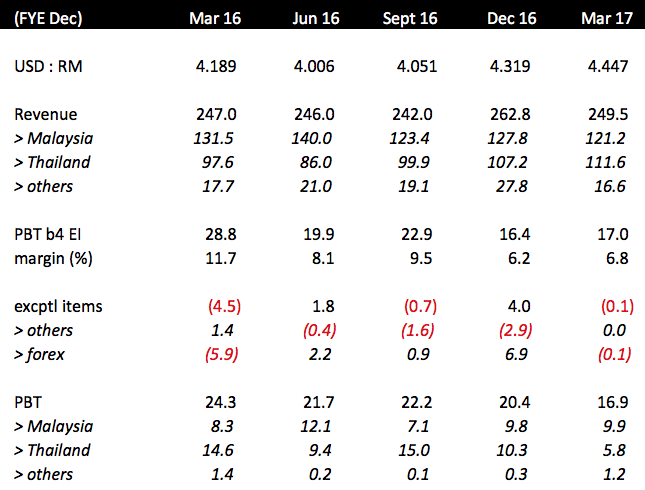

On 23 May 2017, Evergreen released a weak set of result for the quarter ended 31 March 2017. As a result, share price declined from more than 90 sen to the current around 80 sen.

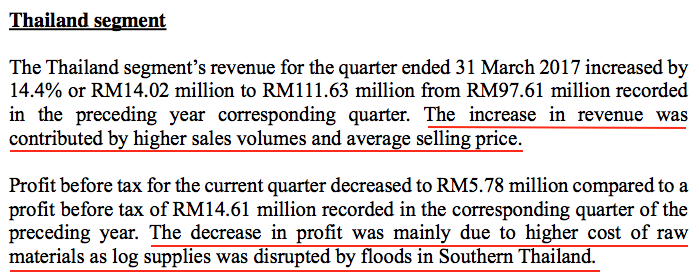

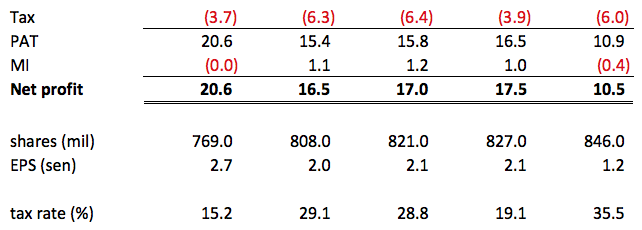

The weak result was mostly caused by its Thailand operation, which saw PBT declined from previous Q's RM10.3 mil to RM5.8 mil. Thailand division's revenue remained strong (an indication of favorable market condition), but its profit margin was adversely affected by high rubber log price caused by flood disruption.

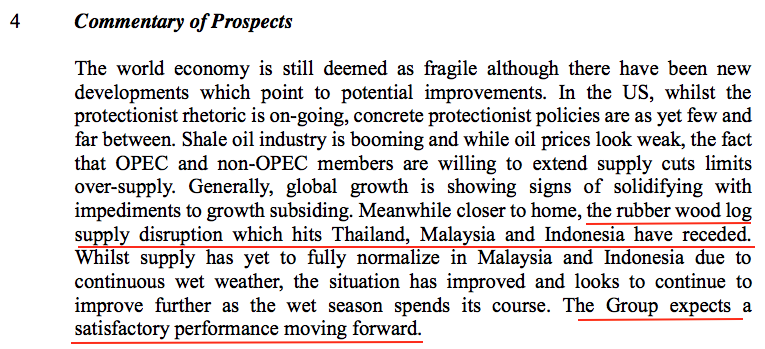

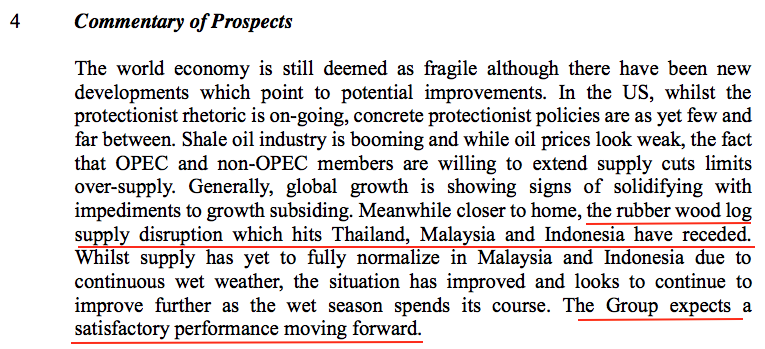

However, the worst should be over. According to the company, rubber wood supply has more or less normalised.

(Source : March 2017 quarterly report)

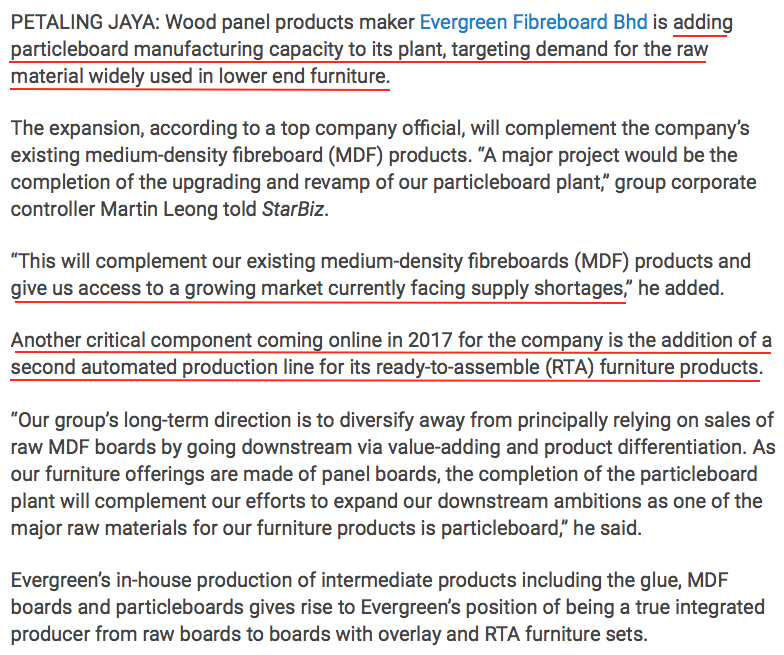

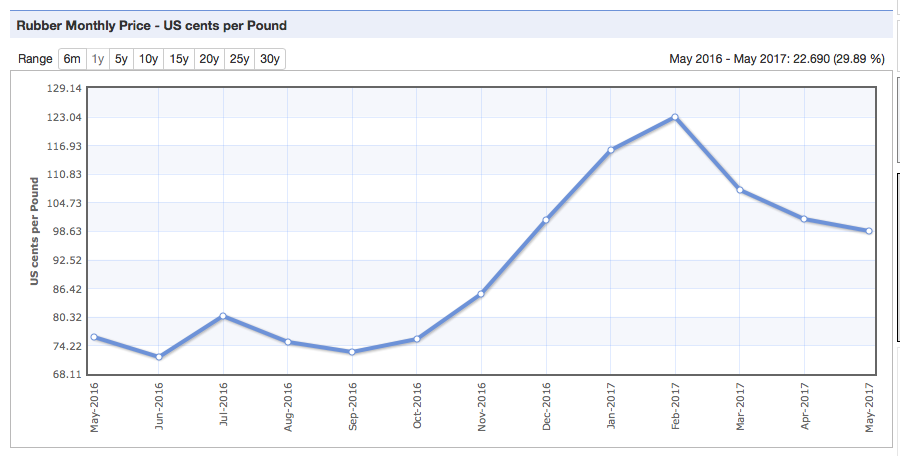

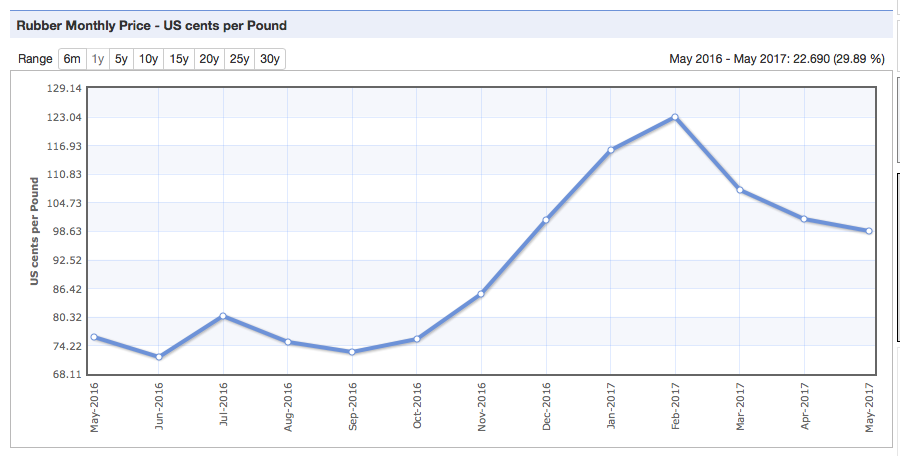

To have a better feel of the timing, I did a quick check of international rubber price. As shown in chart below, rubber price peaked in February 2017. I believe that reflects the timing of the flood receding and normalisation of operation for rubber plantations. If that is the case, the coming quarter from April to June 2017 should be largely free of the negative impact of the flood (just my estimate).

2. Capex

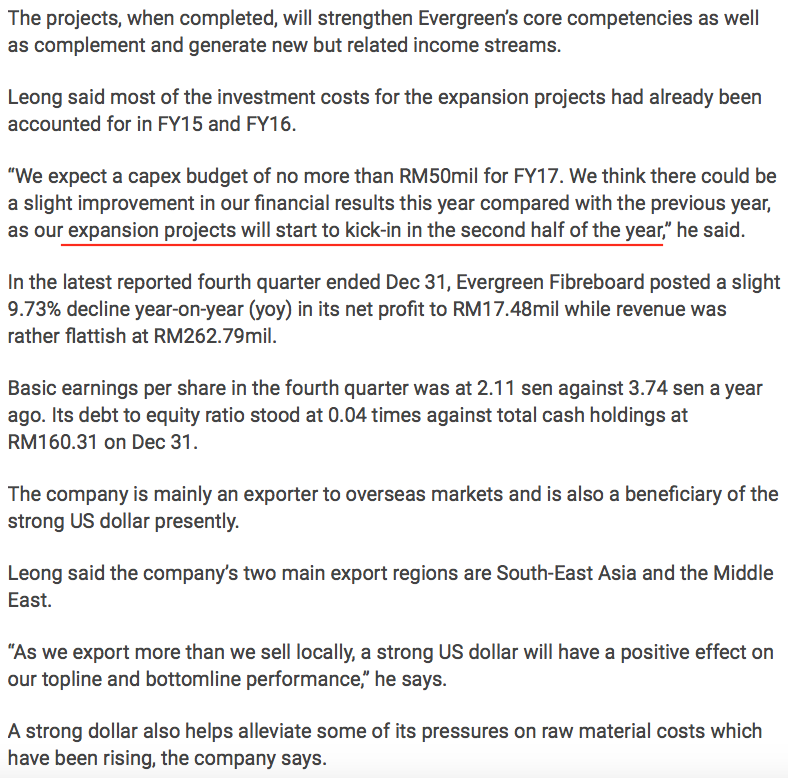

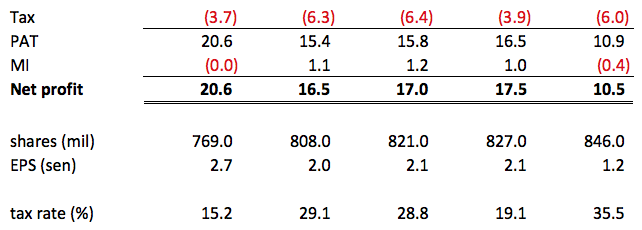

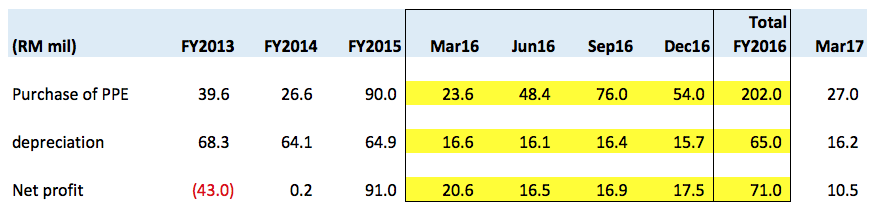

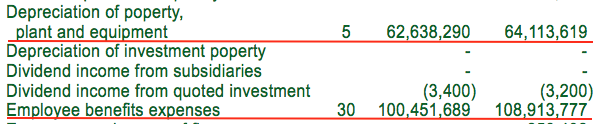

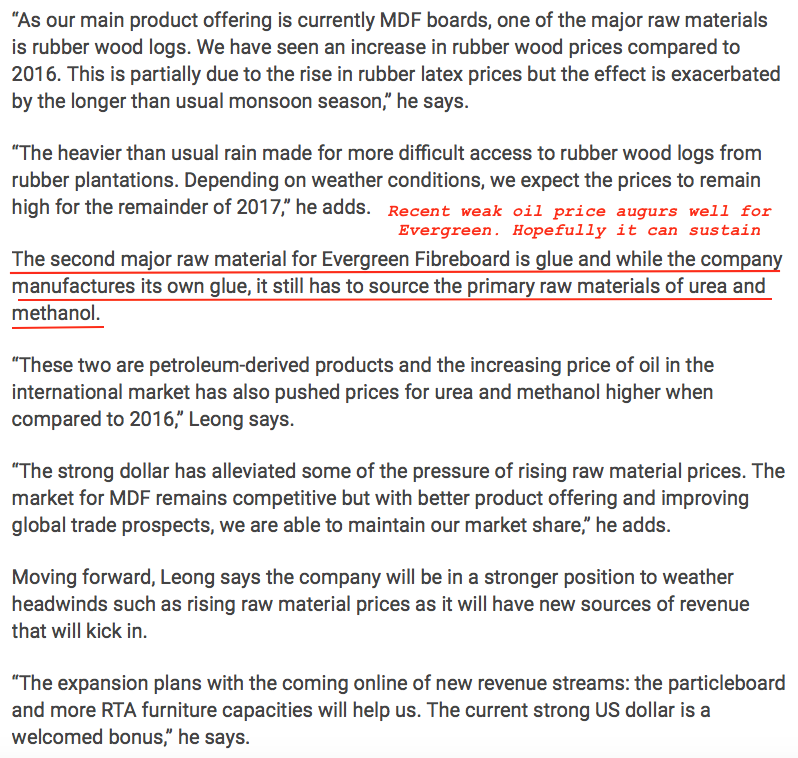

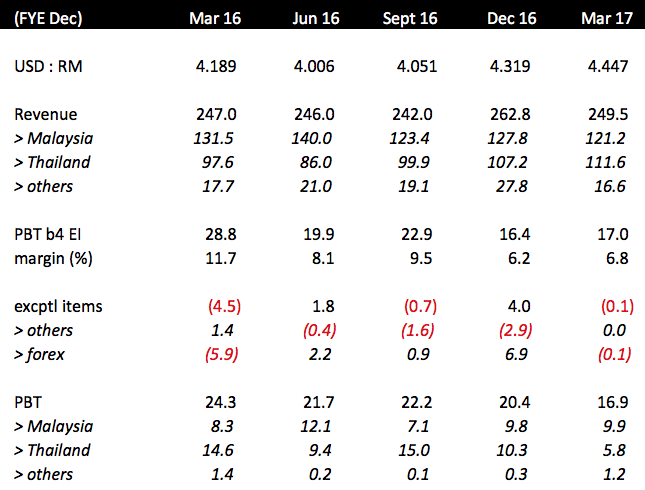

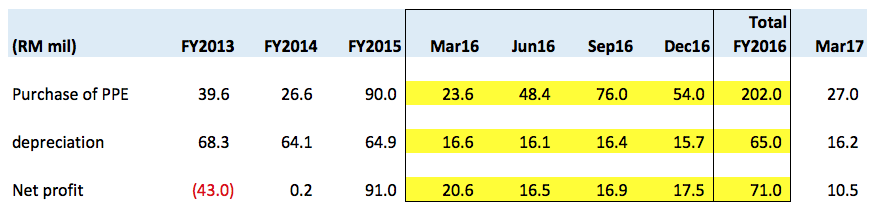

In FY2016, Everygreen invested a total of RM202 mil to purchase new machineries. However, profit has not improved at all. (please refer to table below)

This has caused certain investors to become uneasy and suspect that the company has been siphoning money out. Is that really the case ?

CKCS The HIGH CAPEX for YEARS ended with DISAPPOINTING RESULTS. HIGHLY SUSPECT THEY SIPHONED MONEY OUT OF THE COMPANY THROUGH HIDEOUS MEANS THROUGH CAPEX AND FLOW TO THIS FATTY HENRY S KUO IN THE USA! It's impossible that its MASSIVE CAPEX COULD NOT EVEN ABLE TO LIFT UP EARNINGS FOR YEARS ALREADY WAW?!?! Seriously?

Do u expect this company to be well managed? If so, it wouldn't turned itself into such poor state! Wake up!

20/06/2017 12:38

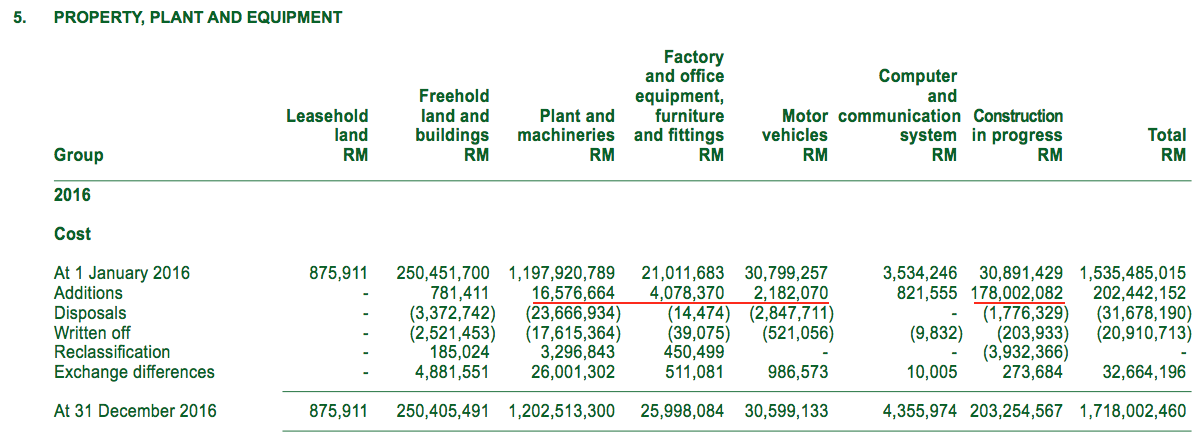

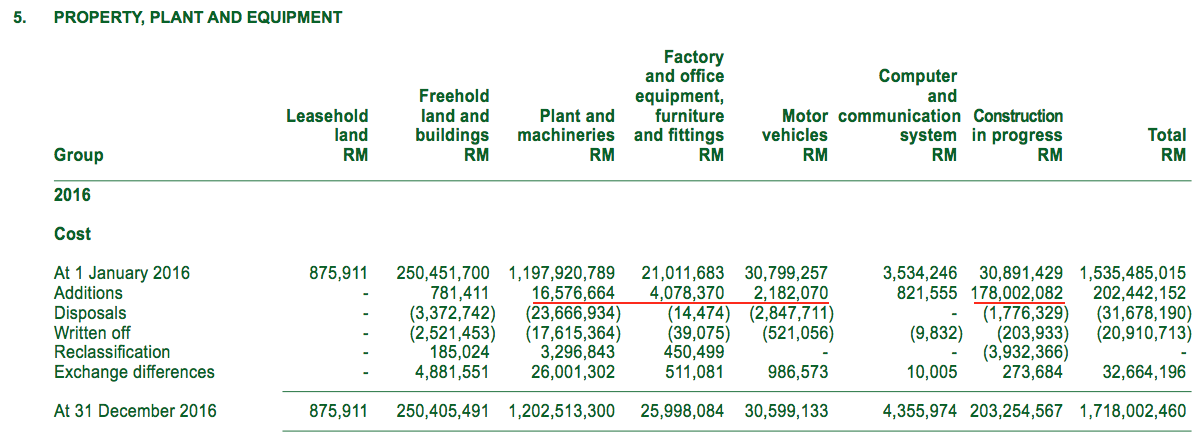

I was suspicious too. So I decided to take a closer look. In the recently released FY2016 annual report, I found this piece of interesting information which might explain why profit has not been going up despite heavy capex over past 12 months.

As shown above, the bulk of the RM202 mil invested (amounting to RM178 mil) is still "Construction in Progress". The remaining RM24 mil spent on machineries and equipment was apparently for replacement purpose since group depreciation is approximately RM65 mil per annum.

I hope this is sufficient to put the issue to rest. The new capacity has not started production, so there is no positive impact on earning yet.

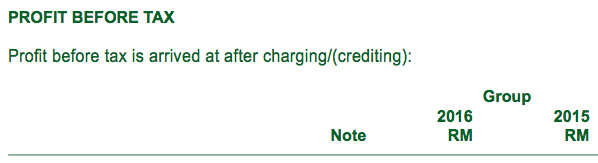

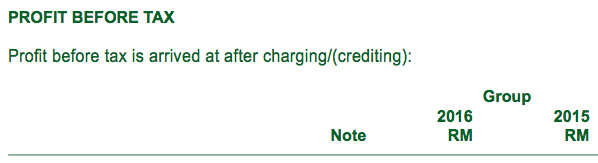

Another piece of interesting information I picked up from FY2016 annual report was the reduction in wages from RM109 mil to RM100 mil (with no corresponding increase in depreciation charges).

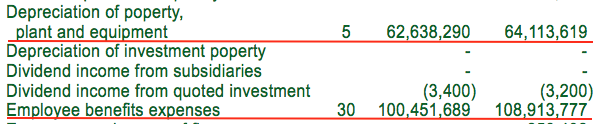

This is no small feat as our government has been busily increasing wages in 2016 for foreign workers. The company has this to say in the annual report :-

I am happy that the company has been investing in new machineries. Without the RM9 mil cost saving, earnings could have been worse with the ever rising wages.

The group's balance sheet remains strong despite heavy capex over past two years. As at 31 March 2017, the group's borrowings, cash and shareholders funds is RM207 mil, RM137 mil and RM1,144 mil respectively. This translates into net gearing of 6%.

According to the company, the capex programme is at its tail end and spending will revert to normal level soon.

3. Industry Prospects

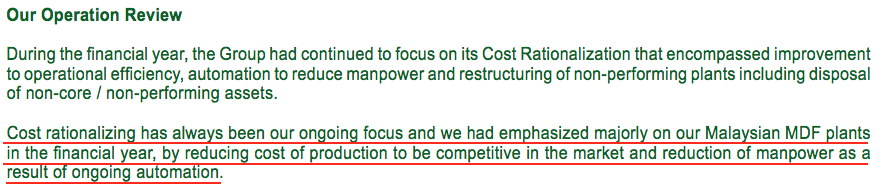

Since 2015, China has imposed restriction on logging. That caused many particle board and medium density fiber board manufacturing plants to shut down. In 2016, the Chinese government further tightened up the screw by imposing more stringent environmental regulation (this round it hits paper manufacturers, which caused paper price to go up substantially).

(Source : Mieco 2016 annual report)

The curtailment of capacity caused China to import more boards and wood products from overseas. In my opinion, this latest changes are structural in nature and should be permanent. Things will only get worse for China based manufacturers going forward as the government gets more and more serious about cleaning up the environment.

4. Middle East Turmoil ?

In FY2016, Evergreen exported 42% of its products to Middle East. Recently, Saudi Arabia and several other countries imposed sanctions on Qatar. Certain investors fret that Evergreen will be adversely affected by the "Middle East turmoil".

Don't think so lah.

The Middle East is always in trumoil. We have seen worse than this before. War, violence, embargoes... all these things are a permanant feature of the Middle East. The recent sanctioning of tiny Qatar looked like a storm in tea cup.

Anyway, the best way to gauge whether Middle East is in turmoil is by looking at oil price. Recently, oil price has been sliding all the way down to USD 45 per barrel. This does not look like a Middle East in turmoil.

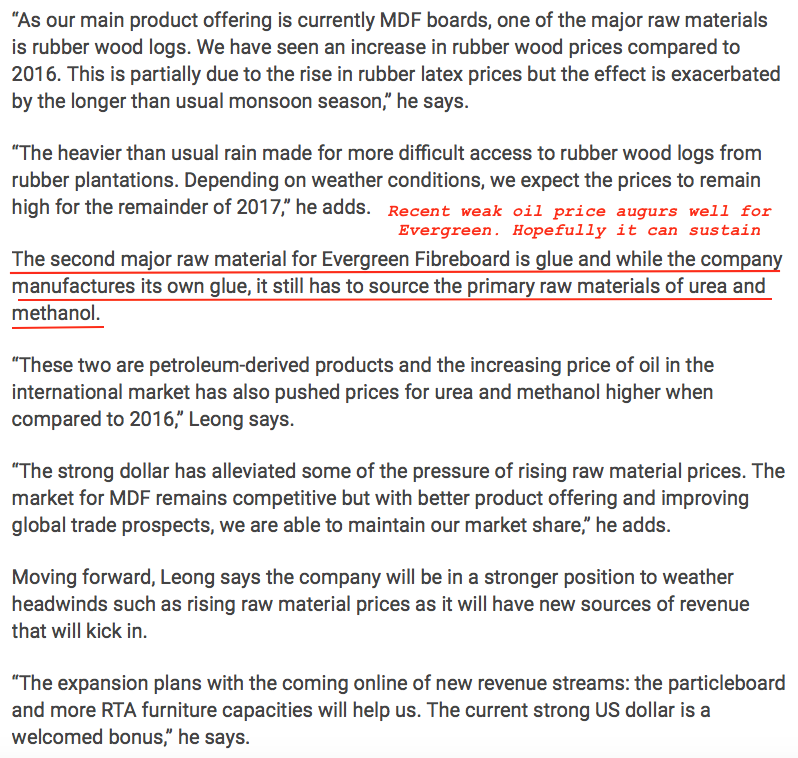

5. Group Prospects

(Source : FY2016 Annual report)

6. Concluding Remarks

I believe the worst has been over for Evergreen.

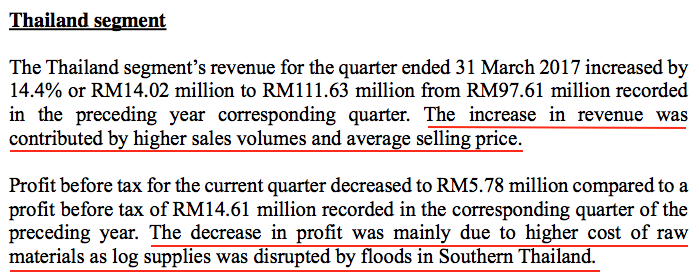

Log price has come down, industry condition remains favorable, new capacity coming onstream, lower oil price will lead to cheaper glue cost.

All these factors combined should lead to stronger profitability going forward. Keep this stock on your radar.

Appendix - The Star Article Dated 10 April 2017

http://klse.i3investor.com/blogs/icon8888/125782.jsp

On 23 May 2017, Evergreen released a weak set of result for the quarter ended 31 March 2017. As a result, share price declined from more than 90 sen to the current around 80 sen.

The weak result was mostly caused by its Thailand operation, which saw PBT declined from previous Q's RM10.3 mil to RM5.8 mil. Thailand division's revenue remained strong (an indication of favorable market condition), but its profit margin was adversely affected by high rubber log price caused by flood disruption.

However, the worst should be over. According to the company, rubber wood supply has more or less normalised.

(Source : March 2017 quarterly report)

To have a better feel of the timing, I did a quick check of international rubber price. As shown in chart below, rubber price peaked in February 2017. I believe that reflects the timing of the flood receding and normalisation of operation for rubber plantations. If that is the case, the coming quarter from April to June 2017 should be largely free of the negative impact of the flood (just my estimate).

2. Capex

In FY2016, Everygreen invested a total of RM202 mil to purchase new machineries. However, profit has not improved at all. (please refer to table below)

This has caused certain investors to become uneasy and suspect that the company has been siphoning money out. Is that really the case ?

CKCS The HIGH CAPEX for YEARS ended with DISAPPOINTING RESULTS. HIGHLY SUSPECT THEY SIPHONED MONEY OUT OF THE COMPANY THROUGH HIDEOUS MEANS THROUGH CAPEX AND FLOW TO THIS FATTY HENRY S KUO IN THE USA! It's impossible that its MASSIVE CAPEX COULD NOT EVEN ABLE TO LIFT UP EARNINGS FOR YEARS ALREADY WAW?!?! Seriously?

Do u expect this company to be well managed? If so, it wouldn't turned itself into such poor state! Wake up!

20/06/2017 12:38

I was suspicious too. So I decided to take a closer look. In the recently released FY2016 annual report, I found this piece of interesting information which might explain why profit has not been going up despite heavy capex over past 12 months.

As shown above, the bulk of the RM202 mil invested (amounting to RM178 mil) is still "Construction in Progress". The remaining RM24 mil spent on machineries and equipment was apparently for replacement purpose since group depreciation is approximately RM65 mil per annum.

I hope this is sufficient to put the issue to rest. The new capacity has not started production, so there is no positive impact on earning yet.

Another piece of interesting information I picked up from FY2016 annual report was the reduction in wages from RM109 mil to RM100 mil (with no corresponding increase in depreciation charges).

This is no small feat as our government has been busily increasing wages in 2016 for foreign workers. The company has this to say in the annual report :-

I am happy that the company has been investing in new machineries. Without the RM9 mil cost saving, earnings could have been worse with the ever rising wages.

The group's balance sheet remains strong despite heavy capex over past two years. As at 31 March 2017, the group's borrowings, cash and shareholders funds is RM207 mil, RM137 mil and RM1,144 mil respectively. This translates into net gearing of 6%.

According to the company, the capex programme is at its tail end and spending will revert to normal level soon.

3. Industry Prospects

Since 2015, China has imposed restriction on logging. That caused many particle board and medium density fiber board manufacturing plants to shut down. In 2016, the Chinese government further tightened up the screw by imposing more stringent environmental regulation (this round it hits paper manufacturers, which caused paper price to go up substantially).

(Source : Mieco 2016 annual report)

The curtailment of capacity caused China to import more boards and wood products from overseas. In my opinion, this latest changes are structural in nature and should be permanent. Things will only get worse for China based manufacturers going forward as the government gets more and more serious about cleaning up the environment.

4. Middle East Turmoil ?

In FY2016, Evergreen exported 42% of its products to Middle East. Recently, Saudi Arabia and several other countries imposed sanctions on Qatar. Certain investors fret that Evergreen will be adversely affected by the "Middle East turmoil".

Don't think so lah.

The Middle East is always in trumoil. We have seen worse than this before. War, violence, embargoes... all these things are a permanant feature of the Middle East. The recent sanctioning of tiny Qatar looked like a storm in tea cup.

Anyway, the best way to gauge whether Middle East is in turmoil is by looking at oil price. Recently, oil price has been sliding all the way down to USD 45 per barrel. This does not look like a Middle East in turmoil.

5. Group Prospects

(Source : FY2016 Annual report)

6. Concluding Remarks

I believe the worst has been over for Evergreen.

Log price has come down, industry condition remains favorable, new capacity coming onstream, lower oil price will lead to cheaper glue cost.

All these factors combined should lead to stronger profitability going forward. Keep this stock on your radar.

Appendix - The Star Article Dated 10 April 2017