According to PPHB's quarterly report ended 31 March 2017, nearly all of its revenue and earnings come from manufacturing segment.

The manufacturing segment includes carton, offset printing, and paper products.

Given the range of products and services, Executive Director - Mr Koay KC, who attended Harvard Business School's Owner/President Management Program, identified PPHB as different from typical paper and corrugated packaging companies.

Today PPHB is a total (one-stop) customized packaging (product) solution (service) provider, spanning from artwork design and shape design, production, warehousing, and to packing and delivery services.

The company is also flexible in meeting small businesses' needs. Solutions are even offered to small customers who do not meet the minimum order quantity.

PPHB is clearly not involved in a typical volume game.

This motivates us to better understand the business of PPHB.

Low cost business model

How PPHB creates and captures customer value is described by its low cost business model.

This is an extremely well established business model, but certainly not homogeneous.

Look at Amazon. It employs a classic fixed cost business model by using the Internet to get maximum leverage out of its fixed assets.

Then think of AirAsia, whose aim is to earn revenue from the drive of significant volumes of customers and ancillary sources by charging a very low price.

Both examples above bank on productivity to bloat market share. They become profitable once they achieve enough sales volume exceeding their fixed cost base.

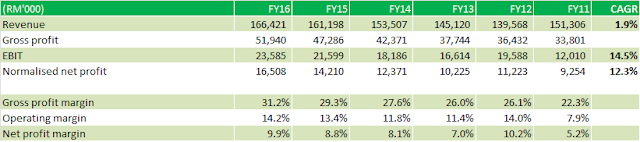

In contrast, PPHB employs "efficiency first, market share later" approach in its low cost business model. The numbers (are the highest among its peers) and their trend lines speak for themselves.

Efficiency simply means producing the same amount of output using less costs.

PPHB configures every single aspect of their operation so as to drive out cost. The cost savings are then passed on to customers in lower prices. Compounded by its superior service-oriented production nature, PPHB offers unusual value to its customers while earning unusual returns for itself.

This concurs with what Tony Nicely said about Geico: "We've been able to increase our brand awareness markedly, and gained fairly significant market share. But that's not important... ultimately the real satisfaction - what's really important - comes from doing right by the customer. It comes from saving people money and giving them excellent service. That's what keeps us going. That's what our real accomplishment is."

Low costs permit low prices, and low prices attract and retain good customers.

Consequently, investors can no longer understand market share by looking at the portion of the industry's sales commanded by PPHB. Clientele could be a better proxy here.

Run as designed, clientele of PPHB expanded. None of their big clients now constitutes more than 5% of their annual revenue. What a diversified customer base!

Although every new addition only moves the revenue marginally, its efficiency ensures more earnings are retained from every single income.

Most important of all, the formula of efficiency is replicable, and can readily be applied to any expansive plan of PPHB .

Building blocks of competitiveness

Mr Koay believes that PPHB - and other paper and corrugated packaging companies that focused on efficiency - provides a benefit for customers even those who patron other companies.

By default, the industry sells a commodity and is as competitive as any industry. So no matter what kind of products companies sell, no matter what distribution system companies use, in the long run, inefficient companies will be losing market share.

On that note, the low cost business model of PPHB saves customers, and continue to save customers a lot of money directly. That proven record definitely stimulates competitors to be better than they would be.

However, it will be hard for competitors to match PPHB's competitive advantages.

PPHB's most immediately recognizable advantage is its superior services at low operational cost.

That competitive strength flows directly from the commitment of its sales and operation teams to work closely with customers for producing one-stop complete solutions - encompassing artwork design, box design, production, inventory holding, packing, delivery and, most importantly, costing.

Upon receiving purchase orders from customers, who make early placement for future use, the operation team simulates the optimal inputs-output levels using its self-developed software. The same attention to details is also given to small orders.

Being green, restaurateurs like this lunch tray of PPHB. Made from a top grade Australian paper material, it can contain liquid food for more than 5 hours without thinning the tray and releasing toxic. Artwork printing on the outlook is only cost efficient for orders above 10,000 units. Below that minimum order quantity, customers are offered a solution (i.e., a logo sticker which might need to be sought from a third party) to meet their branding objective by PPHB.

Such operational excellence is the masterpiece of the skilled operation team. Noteworthy is that they are armed with scalable analog (manual) machinery, which is being gradually replaced by modern digital (automatic) machinery. The equipment can be set to run at a faster pace for large production volume and decelerated for producing small outputs.

As such, the efficiency of PPHB is not bound to economies of scale. Rather, its ability to produce a predetermined output using the least cost is driven by the Lean Manufacturing System & Process, which is designed to eliminate wastes and non-value adding production activities.

Because it is so significant, allow us to rewind: low costs permit low prices, and low prices attract and retain good customers. The final segment of a virtuous circle is drawn when customers recommend PPHB to their business partners. PPHB gets more referrals, and this gives PPHB enormous savings in customer acquisition expenses. That makes PPHB costs even lower.

Admittedly, PPHB does not have a Coke formula locked away in a vault. What it does have is the know-how of dealing directly with customers, and the ability to continue to make changes necessary to be a leader in product variations (i.e. in terms of product design) and innovative one-stop solutions.

When traders bring in new orders, PPHB's operation team works directly with the end customers to generate their desired solutions. Nonetheless, traders still receive their commensurate rewards.

This proves that PPHB is quick to impress their potential customers.

Wicked pricing power paths way to the winner

The success of PPHB can be further understood from how its business model and strategies interact with models of other players in the industry.

When production costs increase, competitors tend to pass on the increased costs to customers by increasing average selling price.

In that notion, the pricing decision-making lies in between two elements: (1) companies must attain returns above their cost of capital, and (2) they sell products and services for prices that customers are willing to pay.

By exercising pricing power, competitors put their offerings to the test in search of a new equilibrium.

In order to achieve a sustainable equilibrium, customers must receive better value in return, such as better quality and improved experience, justifying their higher acquisition costs.

While it is already challenging for competitors to step up their offering, ubiquitous access to information on products and price comparison makes it harder for customers to accept price hike.

Therefore, it was not surprising that only a few competitors successfully increased their average selling price. For those who did, like other commodity-like industries, their capacity to increase prices and maintain/increase gains was limited.

In fact, they raised prices at the risk of losing business to a competitor. Continued use of the power to increase prices may make them vulnerable.

In line with the essence of capitalism, those who are willing to charge less and bring more utility to customers (than competitors) win.

That opened winning formula underscores that pricing power has a broader meaning, and PPHB's management understands that much earlier than competitors.

Companies who charge less through improved efficiency (rather than passing all costs onto customers) is practically exercising their pricing power in returning greater value to customers.

PPHB is certainly the elite in that aspect among its peers in the paper and corrugated packaging industry.

Mr Koay reflected the following:

"It is a typical view that there is a threshold limit to efficiency. In fact, we can save what we use. We look at our operation and ask ‘is there any way we can further reduce the costs and prices and improve our quality?"

This concludes the beauty of PPHB’s business model and strategies. It forfeits pricing power (for premiums), creates greater value for customers, and is someway disrupting the ecology of the commodity-like industry..

The Maestro

With Mr Koay at the helm, PPHB is reaching levels of performance that we would only a few years ago have thought possible.

The last captain who scored consecutive winning streaks like PPHB has retired from HPI Resources Bhd after its buyout at 1.4x price-to-book value and 9.08x enterprise value-to-EBIT by Oji Paper Group. In comparison, PPHB is just selling for slightly above half of those benchmarks.

That mis-price could be attributed to the absence of a strategic plan and public communication with financial anlysts.

Focused on what he could do best for the company, Mr Koay takes a long-term perspective on where the world is going to be, and leverages on freedom to act on the basis of that perspective.

It is then not too hard to understand why he immensely enjoys visiting foreign paper and corrugated packaging plants as his best hobby. Mr Koay is a learning machine.

Good practices (lessons) are adopted and practiced in PPHB, i.e. sales and cash flow are scrutinized on weekly basis with the ultimate aim to fulfill the most important metric - free cash flow.

As a result, operating cash flow is consistently higher than earnings.

Mr Koay is prudent in spending hard earned cash for maintenance and expansion. And the resultant returns have been impressive: every dollar spent as capital expenditure has created RM2.07 value and realized in the form of free cash flow.

His target is to par down debts and have zero borrowings.

In achieving that, Mr Koay values the people who work for and with PPHB to be great asset. The company employs merit system, emphasizing results and rewards, opportunities for advancement, a pleasant workplace, and happiness until their retirement. For example, sales force are given liberty to innovate and earns comparable income to the management.

Mr Koay underscored that all business must be conducted ethically. Honesty and integrity are at the top of the list. But these human qualities not only have to be there, there has to be a perception that they are there.

He sees the management as the trustee of all shareholders to run the company.

"We focus on where we have the most opportunity... we do not pay dividend and buy back shares so long that we can grow more than their returns..."

That is common sense and very much fits within the Buffett's capital allocation framework.

Extraordinary capital expenditure was made to acquire digital (automatic) machine in FY16. While it gradually replaced the fully depreciated machinery, analog (manual) machinery was transferred to support the operation of the Burmese JV. This enabled the Burmese business partner to produce larger cartons and meet the increasing demand from food and beverages manufacturers. Most importantly, the winning formula of efficiency was transferred and put to test. As a result, the JV has achieved the breakeven point within the first 6 months of its establishment.

The execution is simply outstanding. However, Mr Koay does not think that Ornapaper and Master Pack is a good fit for acquisition. "The culture is so different..." he said.

Mr Koay is eyeing "end pack" - an integrated warehousing, packing and delivery solutions - the most desired end-state of all packaging companies.

Takeaways

Combine great ideas with a great manager, we are certain to obtain great results. That mix is alive and well at PPHB. Through this letter, we have learned that PPHB is of:

√ Durable business: On-going need or want for paper and corrugated packaging products;

√ Wide moat: Efficiency-led low cost business model that reinforced by top grade services;

√ Value-based track record: Effective capital expenditure resulted in increasing earnings, margins and cash flow while competitors struggle; and

√ Competency and integrity: Our business is managed by a caliber, good man.

I would like to thank both Mr Koay and Ms Chiang, who gave me the opportunity to learn a great deal about the business that I partially owned. And I hope you benefit too.

They were informed that I and my partners bought PPHB cheap in relative to its intrinsic value.

In return, I promised to give a bible on Warren Buffett's corporate notes to Mr Koay. The intrinsic value of that book is infinitely greater than the price (RM40) I personally paid for and the international delivery lead time (1 month).

In the next series, we will relate what we have discussed to key financial information of PPHB. This is alarmingly necessary since conventional metrics provide false business implication to investors. Appropriate understanding of this key financial information will reduce the perceived uncertainty of PPHB's outlook to a large extent.

Stay tuned.

http://valueveins.blogspot.my/2017/06/still-on-pphb-business-moats-pricing.html