PWF (7134) - PWF CONSOLIDATED: High Dividend Yield, Undervalued with Upside Potential of 27%! (WealthWizard)

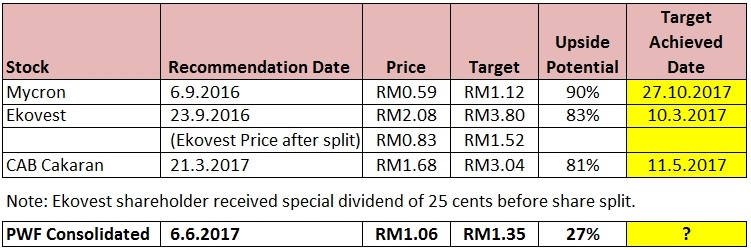

I had written articles for the following 3 companies & all my targets were met within 2-6 months period.

Today, I wish to share another undervalued company, that's PWF Consolidated

My target price will be RM1.35, representing potential upside of 27% based on yesterday's closing of RM1.06.

PWF Consolidated Berhad is one of the largest poultry players in Malaysia, click here for more details about the company.

For explanation on GKent, please refer to the final notes below.

WHY PWF Consolidated?

PWF has delivered outstanding results in the latest quarter and it has attracted me to relook on this company. Click here to see more.

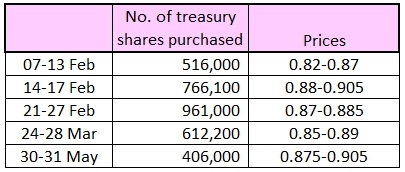

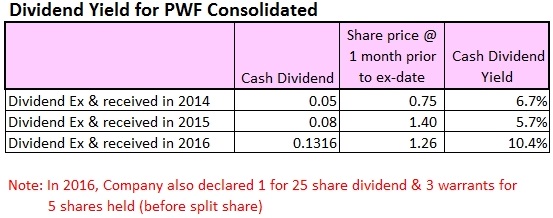

I have initially been misled by the dividend records that shown here.

In fact, PWF is the only poultry company rewarding its shareholders by giving more than 5% dividend yield in last 3 years!

Source: i3investor.com / Bursa Malaysia

Dividend Yield 5%+ for Last 3 Years (2014-2016)

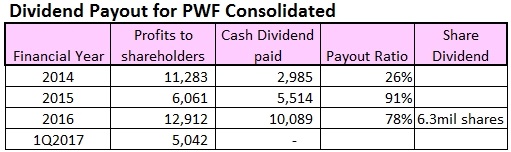

Broilers' Price To Increase in Bulan Ramadhan & Hari Raya

Broilers' price is expected to go up during the months of Ramadhan & Hari Raya. Traditionally, all poultry companies will do well during the period due to high market demands for broilers during the festive period.Broilers' price had stayed at RM6.10 during the 2016 Bulan Ramadhan & Hari Raya period. Click here to view last year's price.

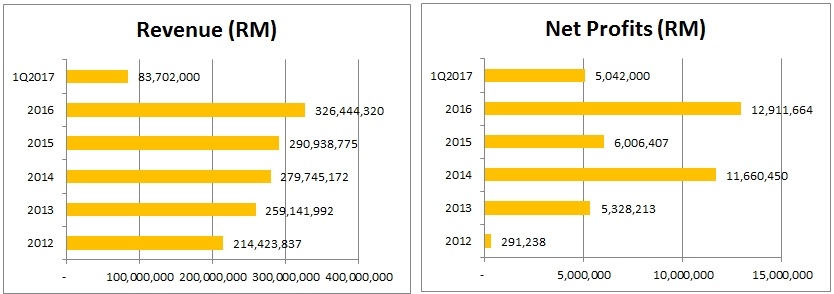

Financial Performance of PWF vs Others

Explanation for lower profit recorded in 2015:

strong USD that has adversely affected imported cost of raw material used in the manufacturing of poultry feed.

strong USD that has adversely affected imported cost of raw material used in the manufacturing of poultry feed.

Basis of Target for PWF

Expansion Plans & Future Prospects of PWF

In Annual Report 2016:

The Group will continue to invest in the organic growth of the business & intends to spend over RM100mil in expanding the farm capacity of our broiler, breeder and layer farms over the next three years. This will involve the development of new farms, and the conversion of existing open-house system broiler farms to close-house system.

The Group will continue to invest in the organic growth of the business & intends to spend over RM100mil in expanding the farm capacity of our broiler, breeder and layer farms over the next three years. This will involve the development of new farms, and the conversion of existing open-house system broiler farms to close-house system.

The management has begun to see more

positive signs of improved business sentiments, with exports picking up

in the first two months of FY2017. A more optimistic economic

environment will be favorable to consumer spending. Hence, despite the

forecast of a moderate growth rate, the Group is expected to benefit from the resilient domestic economy and improving consumer sentiments in FY2017.

FINAL NOTES:

Special thanks to wangge & Jay for their comments & alerts in my previous article about Gkent. Because of their sincere words, I realised I had made a serious mistake in understanding the order book of Gkent. I will write a separate article to explain in details. Click here to view what they commented.

All the working, calculation &

assumptions are presented based on my personal own judgement &

findings and are for sharing purposes only.

I never think I can move anything unless the thing wants to move by itself.

Do your homework, read all news/reports, make your best judged assumptions & understand the business before investing any company.

Invest with FREE money only, using emergency fund to invest is gambling, crazy & suicide act.

I never think I can move anything unless the thing wants to move by itself.

Do your homework, read all news/reports, make your best judged assumptions & understand the business before investing any company.

Invest with FREE money only, using emergency fund to invest is gambling, crazy & suicide act.

I welcome

& feel thankful to all constructive comments, opinions & ideas

and I will not waste time to respond to any baseless accusation. Thank

you.

PWF (7134) - PWF CONSOLIDATED: High Dividend Yield, Undervalued with Upside Potential of 27%! (WealthWizard)

http://klse.i3investor.com/blogs/wealth123/124570.jsp