3 risks to consider before investing in Hengyuan

1) Earnings expectations could be too optimistic

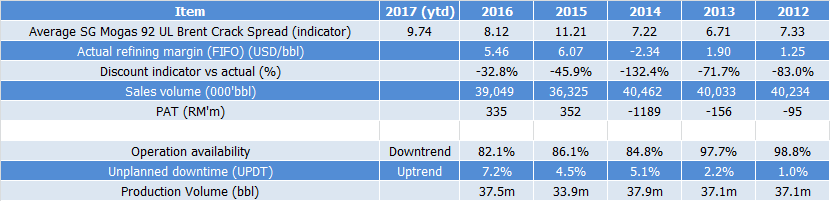

Historical data obtained from Hengyuan’s annual report shows that the company’s actual refining margin (FIFO) between 2012 and 2016 has been at a discount ranging from -32.75% to -132.41% against the average Singapore Mogas 92 UL Brent Crack Spread for each year (the benchmark indicator used for refining margins). While this could be due to inventory purchased earlier at different price levels, we find the disparity to be too large to be used accurately.

In some forecasts used, the discount rate was only -10%. This could overestimate earnings by between 22.75% to a 122.41%.

The current run up in share price is based on the notion that 2Q17 earnings and beyond will be better or on par with that recorded in 1Q17. However, the average Singapore Mogas 92 UL Brent Crack Spread for 2Q17 was in fact lower at 9.4, compared to 10.1 in 1Q17. Hence, earnings could come in below expectations in the coming quarterly announcement.

Meanwhile, another assumption used is by taking Hengyuan’s daily production capacity and multiplying it by the number of days in a year. This does not factor in the fact that refineries require maintenance – both planned and unplanned. The annual report shows that operational availability averaged about 90% between 2012 and 2016. However, we also see an increase in unplanned downtime from just 1.03% in 2012 to 7.2% in 2016. Why? Because as the refinery gets older, so does its equipment efficiency and reliability. Thus, we do not rule out the possibility of higher unplanned downtime in the coming quarters and years.

2) Crack spreads are highly volatile

Examining the average quarterly change (%) in crack spreads, we find that the volatility to be very high ranging from -36% to +46%. In 2Q16 and 3Q16, crack spreads fell -24% and -36% respectively. Such large swings appear to be the norm in the petroleum refining industry due to a variety of factors, chief among them are the cost of feedstock and supply demand dynamics.

While crack spreads certainly appear to on a positive trend since 4Q16, we are unsure as to how they will perform in the future. Investors should not discount the possibility of large downswings.

As such, we think that it would be unwise to use the price-to-earnings ratio to value the company, as earnings could be erratic.

3) Hengyuan Shandong’s low entry price

What is curious to us is not Hengyuan’s ability to purchase the 51% stake at RM1.92 but why Shell is willing to part with its stake at such a steep discount.

After all, Shell is a listed multinational and it is answerable to its shareholders. Surely, the disposal price must be justified. Obvious reasons would be its unwillingness to invest further, which begs further questions on the viability of these investments. Royal Dutch Shell has been in the industry for decades, most likely, they know what they are doing.

https://boost.my