I see there are so many people writing articles and commentaries in i3investor on Hengyuan. Even during last week end, Mr Ooi Teik Bee with 4 of his friends who are also his clients came from KL to my house in Ipoh. He strongly recommended me to buy Hengyuan.

But he was pleasantly surprised that I told him that I started buying as soon as I saw that the company has been producing increasing profit in the last 2 quarters which were 69.27 sen EPS for quarter ending Dec 2016 and 93.14 sen for quarter ending March 2017, totalling 162.41 sen. Based on the result of the last 2 quarters, its annual profit will be about Rm 3.25 EPS. That is why so many investors are chasing to buy it because it is selling at P/E 2.

Where can you find such a good stock selling at such low P/E?

It complies with my share selection golden rule which has a long proven track record.

Based on my golden rule, I have bought so much shares of Latitude Tree, Lii Hen, VS Industry, Eversendai and JAKS and became the second largest shareholders of each of the companies. The share price of each of these companies has gone up several hundred per cent with 3 years. If you look at the price charts of Latitude and Lii Hen, you will see that each of them has gone up more than 800 per cent and VS has gone up more than 550 per cent. Eversendai and JAKS has gone up about 50 per cent in the last few months. They will continue to go higher when they continue to show increasing profit.

Fundamental Business Factors that would affect profit:

During my last 60 years in doing business, I must examine all the factors that affect the bottom line. In the case of refining petroleum, the profit depends on the crude oil price in the open market, refining cost and the selling price of the refined oil. There is an oversupply of crude oil in the world and this situation will continue for a long time to come. Hengyuan is currently sells most of its product to Shell Stations and the pump price is controlled by the Government which is always high to protect Petronas.

Moreover, Hengyuan can sell its product to its own petrol stations in China. This does not sound right but if you examine it closely you will understand what I said. China buys most of its crude oil from the Middle East and ship it to China. The ships have to travel and past Port Dickson, the location of Hengyuan’s refinery on the way to China. Whether Hengyuan refines its crude oil in China or in Port Dickson makes very little difference because the refining process cost is very small in comparison with the selling price.

Currently the local demand for refined oil is more than supply until the completion of the new refinery in about 2 years.

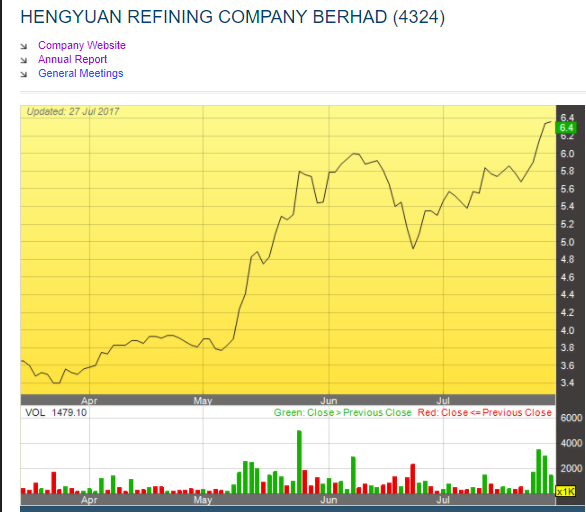

The price chart shows Hengyuan’s share price is on an uptrend which is a buy signal according the expert chartists.

Mr Ooi Teik Bee’s recommendation:

If you are a subscriber, you should have received Mr Ooi Teik Bee’s recommendation of Hengyuan with a target price of Rm 15.93.

I am obliged to tell you that I have quite a lot of Hengyuan and I am not asking you to buy it. But if you decide to buy it, you are doing at your own risk.

As much as I am reluctant to post this piece on i3investor to avoid seeing some stupid commentaries, Mr Ooi Teik Bee asked me to post it to teach people how to make more money.

http://klse.i3investor.com/blogs/koonyewyinblog/128718.jsp