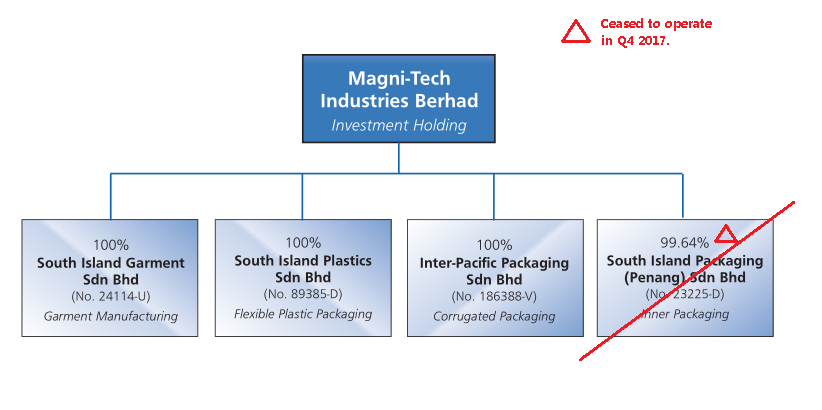

A. Company composition (1. Garment-major, 2. Packaging-minor)

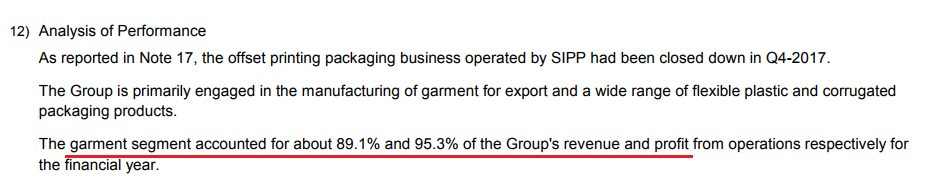

B. Refer news for SIPP ceased: http://www.theedgemarkets.com/article/magni-tech-shuts-down-printing-packaging-unit

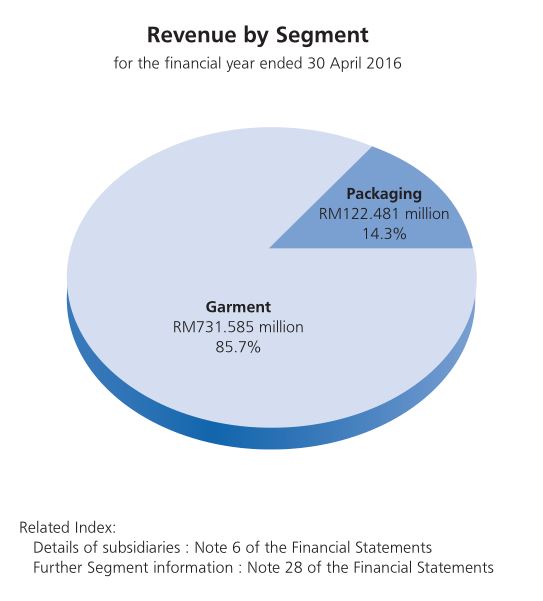

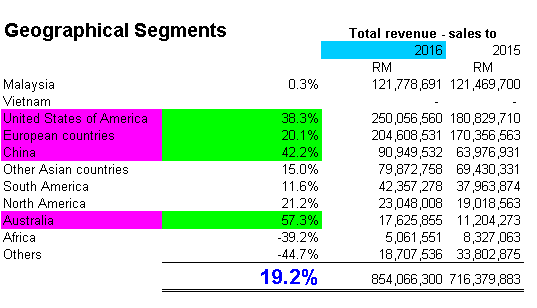

C. Latest revenue composition from Quarter 4, 2017:

D. Their business (Refer: http://www.magni-tech.com.my/?mod=pages&function=show_page&page_id=67)

Business

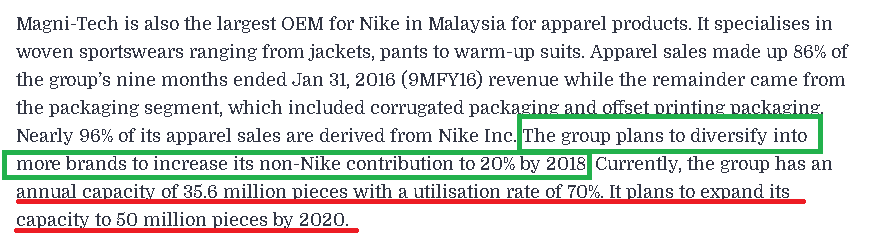

Apparel BusinessFor the financial year ended 30 April 2017, the garment business accounted for 89.1% of the Group's revenue.

The Group’s garment business is undertaken by its wholly-owned subsidiary, South Island Garment Sdn Bhd (SIG) which has its manufacturing facilities in Malaysia. SIG also operates in Vietnam through joint business collaborations with its Vietnamese partner.

With about 40 years of experience in the apparel industry, SIG has built a good reputation in this industry and is known among its customers as a reliable and consistent manufacturer of high-quality and sophisticated woven sportswear. SIG mainly exports its products to international markets such as the USA, European Countries, South America, China, Japan, Mexico, Australia and Canada.

Packaging Business

The packaging businesses are undertaken by

Magni’s 2 subsidiaries which have manufacturing facilities in Malaysia.

The packaging products are typically used by the manufacturing

sector, such as the food, beverage, healthcare, rubber based, consumer

household and electronic sub-sectors. Although the packaging products

are mainly sold locally, a high percentage of them are used in the

packaging of manufactured products destined for the export markets.

E. Company in expansion for next 4 years:

Old news dated Apr 2017: http://www.theedgemarkets.com/article/magni-tech-diversify-more-apparel-brands

F. Would it benefited from those block countries in recovery??

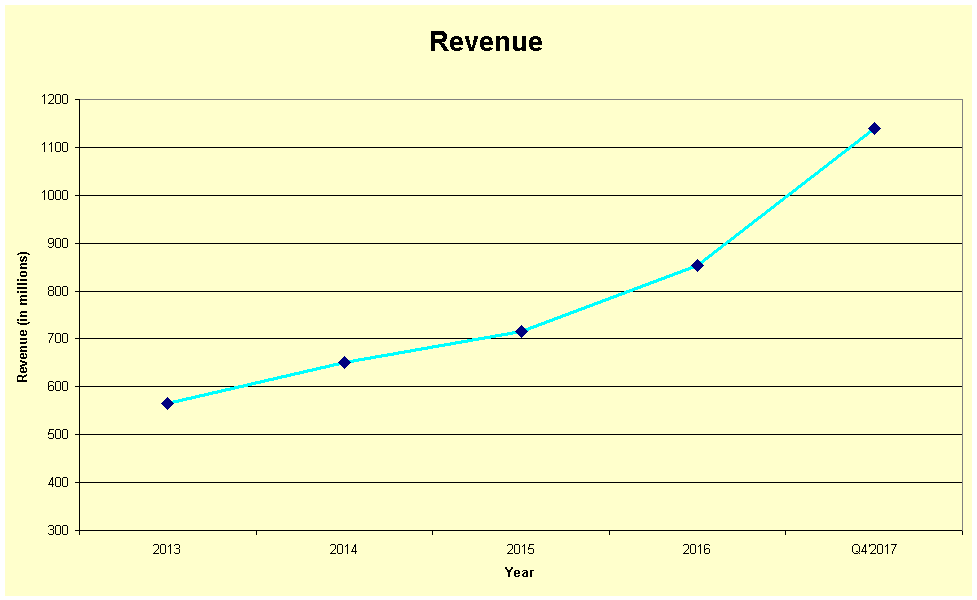

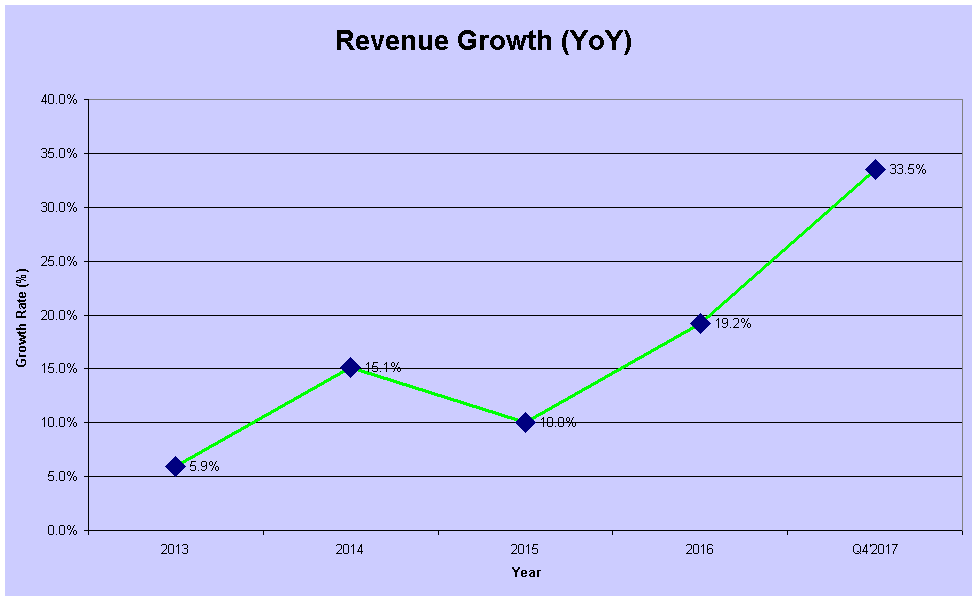

G. Revenue in growth:

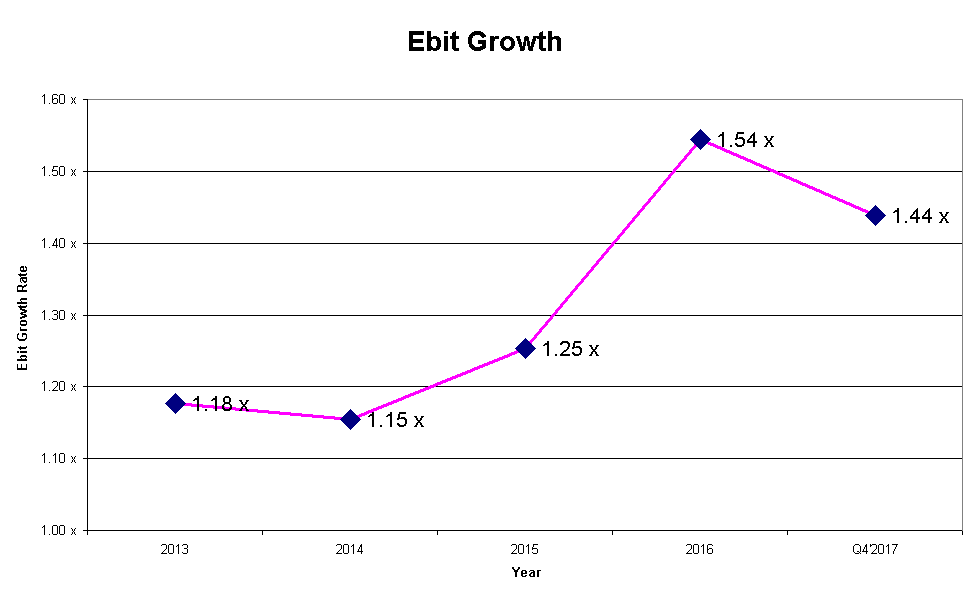

H. Operation profit is well projected:

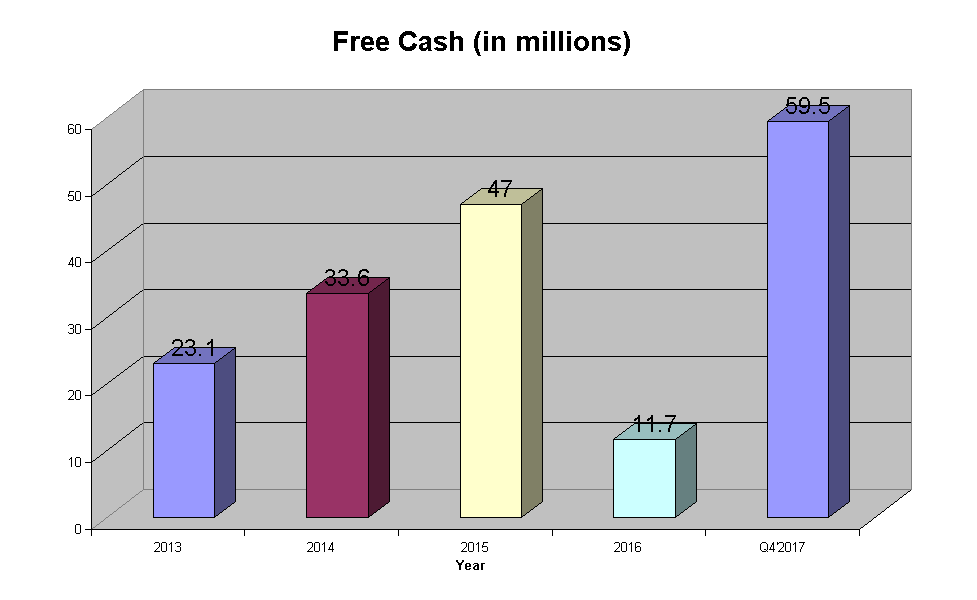

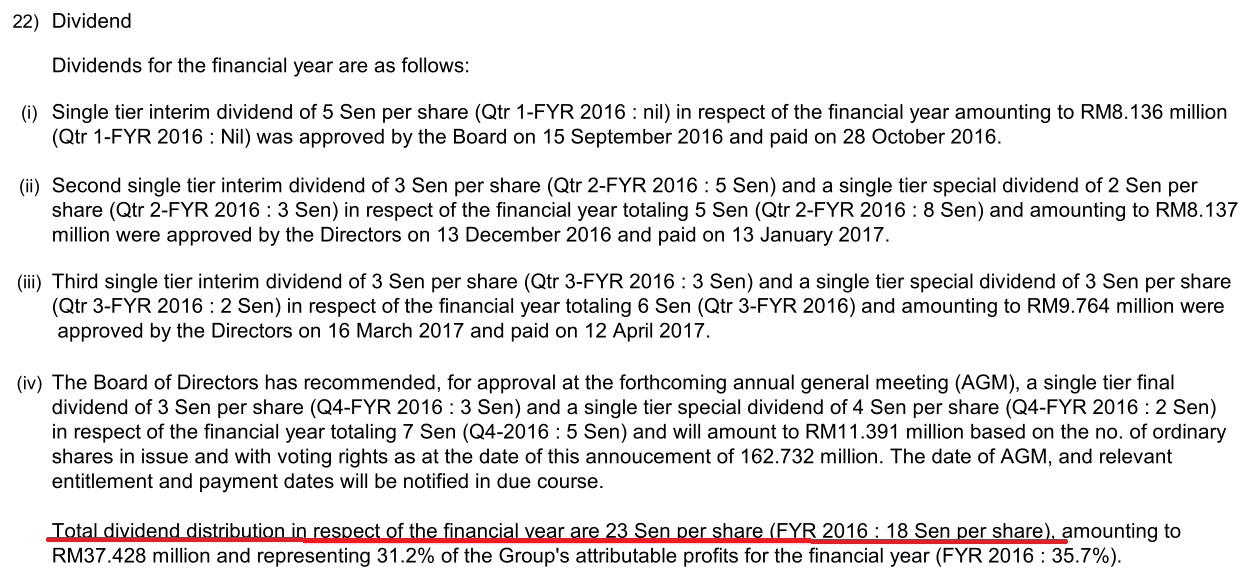

I. It is a cash rich company with reasonable dividend yield:

J. It is consider a high ROI company.

K. Fundamental:

i) EV / EBIT: 6.74; PE: 9.92

ii) Book value: 2.94

iii) ROE: 32.8%

iv) ROA: 27.2%http://klse.i3investor.com/blogs/Your%20MaGnI/127556.jsp