知情人士透露,伯克希尔哈撒韦公司(Berkshire Hathaway Inc.)旗下的能源公司 Energy Future 近达成收购Oncor的协议,后者是美国最大输电公司之一,为约1,000万德克萨斯州人提供服务。

Energy Future 是 Oncor 的多数股东,Oncor广被视为该公司的核心资产。

知情人士表示,收購重組Oncor的金额超过175亿美元。

截至3月31日,伯克希尔哈撒韦握有965亿美元现金,巴菲特5月告诉股东,他迫切想要找到地方花掉这笔现金。

自2014年以来,有一家公司叫 NextEra就一直寻求收购Oncor,希望将这一能稳定产生现金的公司加入其能源业务组合。

但德州监管部门否决了这笔交易,称其不符合公众利益。

老實說,我不明白為何巴菲特在低利率和能源價格低的時候,投資 Oncor 這電廠幹嘛?

若根據巴菲特當別人『貪婪我恐懼,別人恐懼我貪婪』的逆向思考原則,現在實在不應該是增持電廠公司的時候?

因為 Oncor 非上市公司,所以無法知道它的股價。

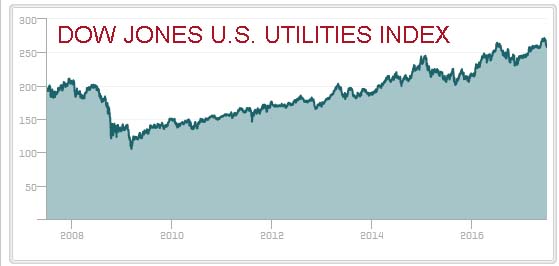

不過根據【DOW JONES U.S. UTILITIES INDEX】走勢,現在公用事業,的確出於高價位區。

或許,巴菲特有他我不懂的理由吧?

Oncor 的簡介:

Oncor Electric Delivery serves miles and miles of Texas' vast energy

market. The company operates the regulated power assets of parent Energy

Future Holdings, which include about 120,000 miles of transmission and

distribution lines serving more than 400 cities and 91 counties situated

in the eastern, north-central, and western portions of the state. The

company provides power to more than 3.2 million meters in homes and

businesses. Oncor Electric Delivery maintains streetlights in its

service territory. The utility also provides services to competitive

retail electric providers. In 2016 NextEra Energy agreed to the company

in a deal valued at $18.4 billion.

http://klse.i3investor.com/blogs/adi/127393.jsp

http://klse.i3investor.com/blogs/adi/127393.jsp