Background Information

Systech has three (3) operating subsidiaries :-

(i) Syscatech Sdn Bhd (“Syscatech”), which is principally involved in software solutions to the members’ centric industry such as the direct selling industry and retail industry;

(ii) Mobysys Sdn Bhd (“Mobysys”), which is principally involved in franchise software system; and

(iii) SysArmy, which is principally involved in Big Data Analytics and related applications focusing on cyber security services. SysArmy is 51% owned.

(i) Syscatech Sdn Bhd (“Syscatech”), which is principally involved in software solutions to the members’ centric industry such as the direct selling industry and retail industry;

(ii) Mobysys Sdn Bhd (“Mobysys”), which is principally involved in franchise software system; and

(iii) SysArmy, which is principally involved in Big Data Analytics and related applications focusing on cyber security services. SysArmy is 51% owned.

The group reported net profit of RM2.71 mil for the FY ended March 2017. Based on market cap of RM95 mil, PER is 35 times. This PER is not low, but not unreasonable. This is because Systech is an ACE company and supposedly has "high growth" potential.

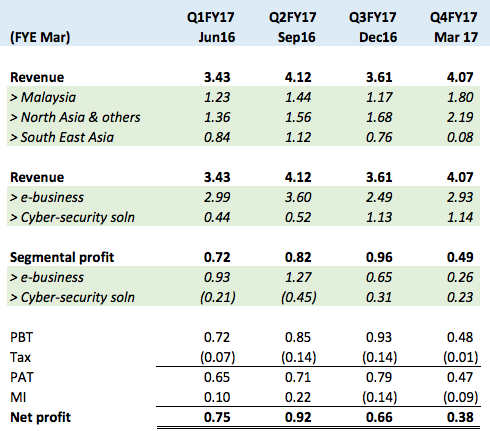

The following table sets out the group's P&L over past 4 quarters :-

Commentaries :-

(a) The group derived 50% of its revenue from overseas, most of which is from North Asia (China).

(b) Traditionally, e-Business (Syscatech and Mobysys) accounted for 2/3 of revenue. However, in recent two quarters, Cybersecurity business started maturing, contributing closed to 25% of revenue (they secured more customers).

(c) Not only revenue, Cybersecurity division has also started contributing to operating profit in latest two quarters (RM0.23 mil out of RM0.49 mil in latest quarter). However, there is earning leakage due to 49% MI.

Mergers & Acquisitions

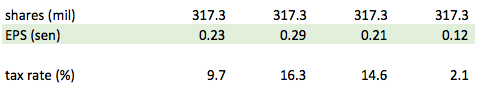

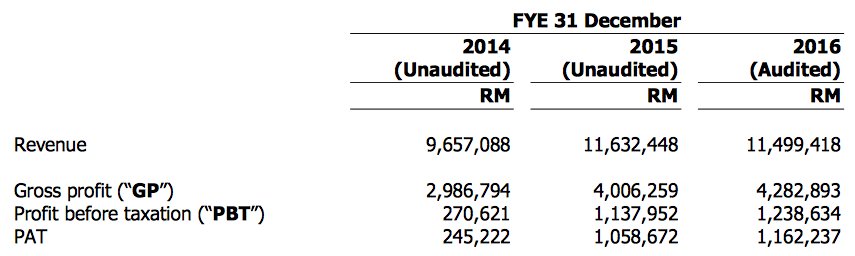

On 10 April 2017, Systech announced that it proposed to acquire 51% equity interest in Postlink Pte Ltd for RM9.8 mil. Postlink provides services to SGX listed companies for their annual reports. It has a proper profit track record.

In the latest FY, Postlink reported net profit of RM1.16 mil. This translates into transaction PER of 16 times.

Based on 51%, Systech's portion of Postlink profit is RM0.59 mil. This is not a small amount as it is almost 22% of Systech's FY2017 total net profit of RM2.71 mil.

The consideration is to satisfied by RM1.6 mil cash and 30 mil new Syatech shares issued at 27 sen per share. The acquisition will be earning accretive.

I am positive about the acquisition. Even though Systech is buying Postlink at 16 tims PER, it is doing that by issuing new shares at 32 times historical PER (RM0.27 / RM0.085).

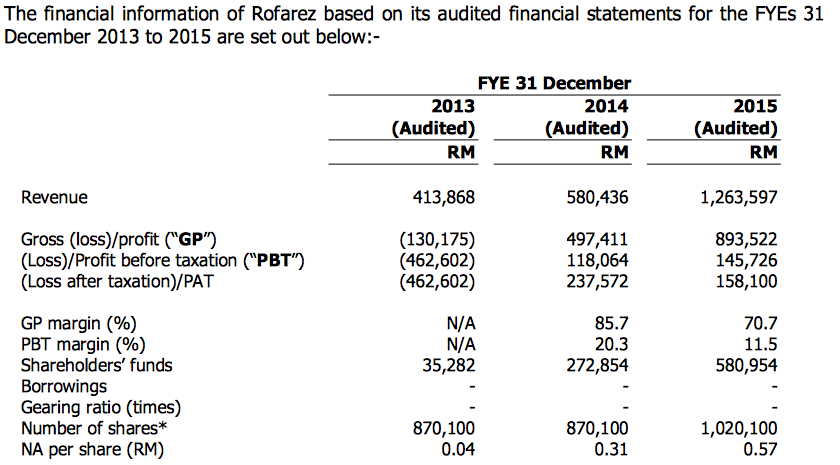

On 25 May 2017, Systech announced that it s acquiring 50% equity interest in Rofarez Solution for RM1.5 mil. Rofarez provides accounting and finance software through Cloud technology. It reported PAT of RM0.16 mil in FY2015.

Systech will book in PAT of RM0.08 mil based on 50% equity interest.

Conclusion

Overall, I found Systech to be a well managed company. I said so because it has proven itself by nurturing Cybersecurity division into a profitable entity. It is now buying two profit generating assets (Postlink is quite sizeable, Rofarez is still small). After the acquisitions, PER will drop from the existing 30 times plus to 20 times plus. The stock has done well over past 12 months. However, for those that has high risk tolerance, it might still have legs.

http://klse.i3investor.com/blogs/light/127327.jsp