TIGER SYNERGY, NEAR TERM TP: 11.5SEN-12SEN

-

The

Company has recently signed a memorandum of agreement with Prosma Bhd, a

holding company for the assets of Sekretariat Komuniti Prefer Malaysia

(SKPM), to develop a RM100 million affordable condominium in Gombak.

-

http://www.theedgemarkets.com/article/tiger-synergy-build-rm100m-renttoown-condo

-

This will be its game changer to its earnings in FY18 and onwards.

It will contribute RM30 million to its bottomline over the next three

years, which will turnaround its financial loss to earnings in 2H2017

(FY18).

-

Take up rate for this property product is surely high demanded as the concept is based on rent-and-own later.

-

I am sure there will be more follow up this kind of projects upon completion of this project.

-

I have calculated its discounted cash flow earnings of this project alone is worth EPS of 1.8sen.

Source: http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=196417&name=EA_FR_ATTACHMENTS

Source: http://www.bnm.gov.my/index.php?ch=statistic&pg=statistic_bnchmkstk&lang=en

-

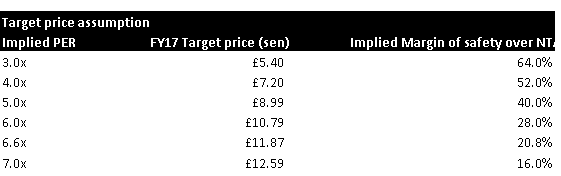

EPS 1.8sen is translate into PER 3.6x only. This EPS is discounted to FY17, which ended in June 2017!

-

Not to mention its nine

property projects with gross development value (GDV) of RM2 billion to

be launched within the next five years, of which 40% are "affordable"

for customers earning above RM5,000 per month. This could be worth more to its bottomline. But we assume that zero contributions at the moment for worst case scenario.

-

As

Malaysia construction works is picking up specifically MRT line 2

projects, LRT3 to kick in, TRX and many more, it will help to boost its

manufacturing and trading and construction segments. But we assume that zero contributions at the moment for worst case scenario.

-

All

in all, if our target price is only based on affordable condo in Gombak

only, its share price could reach 11.5sen-12sen based on around 6.6x

PER. This would translate into 0.8x PBV. Still 20% discount to its NAV

of 15sen!

-

I think it is reasonable to apply 20% discount to NAV based on rule of thumb for any measurement.

-

As

this TP is based on FY17, which ended in June 2017 and now we are now

in 2H2017 (FY18), the share price should react now rather than later!

-

It is an arbitraging opportunity at worst case scenario!

-

From

technical analysis perspective, it has been maintaining above 6sen

since broken above horizontal consolidation band and made first attempt

at 8.5sen resistance. 11.5sen-12sen is not far sighted.

-

With chaikin money flow indicator shows positive inflow of money to TIGER, it is possible to reach there soon!

http://klse.i3investor.com/blogs/tradingideas/126605.jsp