On

5 June 2017, China company Hengan International Ltd acquired 50.4%

equity interest in Wang Zheng at RM1.14 per share (triggering MGO).

Hengan is listed on Hong Kong Stock Exchange. It has market cap of HKD70

billion (RM38 billion) and is the largest producer of sanitary napkins,

baby diapers and tissue papers in China. The take-over generated a lot

of excitement in the market and Wang Zheng's share price went up to as

high as RM1.60.

Wang-Zheng Berhad (Wang-Zheng) is an investment holding company. The Company's subsidiaries include Quality Hero Corporation Sdn. Bhd., which is engaged in manufacturer of adult and baby diapers, sanitary napkins and its related products; Modern Alpine Sdn. Bhd, which is engaged in trading of papers and related products, and Wang-Zheng Corporation Sdn. Bhd, which is engaged in distribution of disposable fiber based products.

Observations :-

(a) The bulk of the revenue was from paper products. Disposable products (napkins, diapers, etc) accounted for 1/3 of revenue only.

(b) However, disposable products have higher PBT margin (10% vs. 3%). A such, PBT contribution is almost 50%.

(c) The group reported strong net profit of RM8.3 mil in June 2016 quarter. However, there was a gain on disposal of RM5.9 mil. If that item is excluded, net profit would be RM2.4 mil only.

(d) The group reported another strong set of result in December 2016 quarter. However, that was due to positive tax rate. If we adjust the tax rate back to 25%, net profit would be RM3.5 mil only.

(e) By making the adjustments as set out above, group net profit in FY2016 was RM9.8 mil only.

(f) Based on RM1.14 per share, Hengan is acquiring Wang Zheng at valuation of RM182 mil. Based on net profit of RM9.8 mil, PER would be 18.6 times (not cheap).

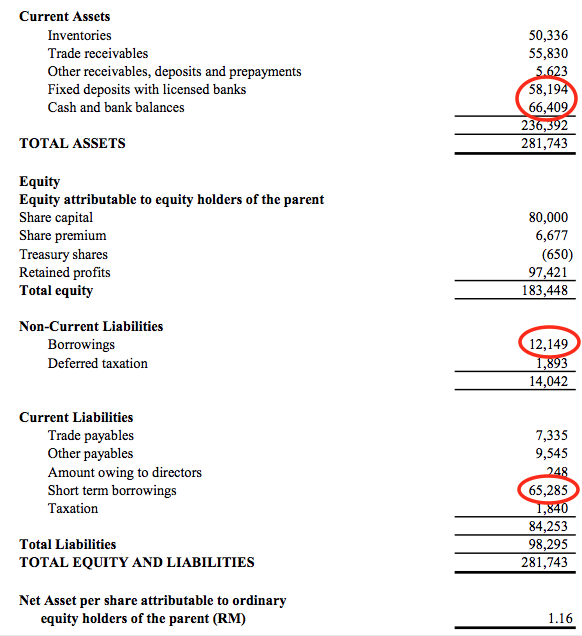

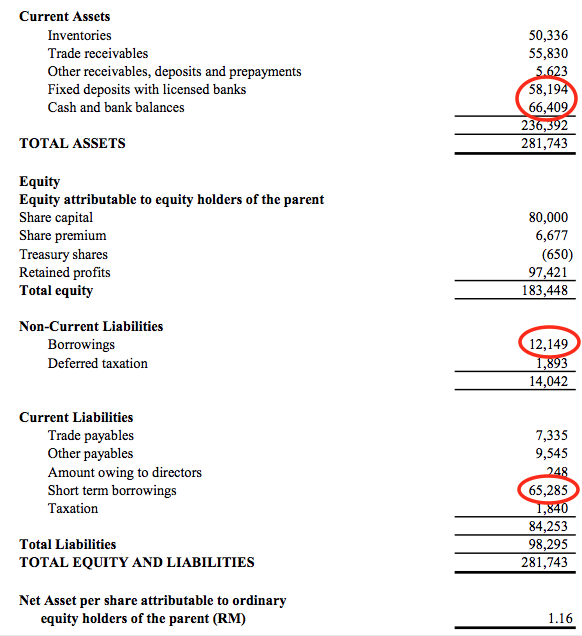

(g) However, Wang Zheng has strong balance sheet. It has net cash of RM47 mil. Excluding the net cash, valuation would drop to RM135 mil. That would translate into a more palatable PER of 13.8 times.

(h) Note : the transaction price of RM1.14 was very closed to Net Assets per share of RM1.16. That could be one of the key parameter for pricing.

Remarks

The entry of Hengan fired many people's imagination. Post announcemnet, share price of Wang Zheng has gone up to as high as RM1.60 before retracing to current level of RM1.40+. I agree that the potential is there. However, no hurry to rush in unless price drops to a more attractive level (let's say, RM1.20 ?).

KIV

http://klse.i3investor.com/blogs/light/126509.jsp

Wang-Zheng Berhad (Wang-Zheng) is an investment holding company. The Company's subsidiaries include Quality Hero Corporation Sdn. Bhd., which is engaged in manufacturer of adult and baby diapers, sanitary napkins and its related products; Modern Alpine Sdn. Bhd, which is engaged in trading of papers and related products, and Wang-Zheng Corporation Sdn. Bhd, which is engaged in distribution of disposable fiber based products.

Observations :-

(a) The bulk of the revenue was from paper products. Disposable products (napkins, diapers, etc) accounted for 1/3 of revenue only.

(b) However, disposable products have higher PBT margin (10% vs. 3%). A such, PBT contribution is almost 50%.

(c) The group reported strong net profit of RM8.3 mil in June 2016 quarter. However, there was a gain on disposal of RM5.9 mil. If that item is excluded, net profit would be RM2.4 mil only.

(d) The group reported another strong set of result in December 2016 quarter. However, that was due to positive tax rate. If we adjust the tax rate back to 25%, net profit would be RM3.5 mil only.

(e) By making the adjustments as set out above, group net profit in FY2016 was RM9.8 mil only.

(f) Based on RM1.14 per share, Hengan is acquiring Wang Zheng at valuation of RM182 mil. Based on net profit of RM9.8 mil, PER would be 18.6 times (not cheap).

(g) However, Wang Zheng has strong balance sheet. It has net cash of RM47 mil. Excluding the net cash, valuation would drop to RM135 mil. That would translate into a more palatable PER of 13.8 times.

(h) Note : the transaction price of RM1.14 was very closed to Net Assets per share of RM1.16. That could be one of the key parameter for pricing.

Remarks

The entry of Hengan fired many people's imagination. Post announcemnet, share price of Wang Zheng has gone up to as high as RM1.60 before retracing to current level of RM1.40+. I agree that the potential is there. However, no hurry to rush in unless price drops to a more attractive level (let's say, RM1.20 ?).

KIV

http://klse.i3investor.com/blogs/light/126509.jsp