HENGYUAN Q2-2017 EPS, Just 19 cents.

I am writing this article to ensure the investors in i3 are fully aware what to expect on the coming quarter results of Hengyuan and make their investment or trade decisions accordingly

Now let us get an estimate for Hengyuan Q2 2017 earnings accordingly:

Earnings factor (1): the refining margin

This is called the profit due to CCS Margin.

CCS Profit = Refining Throughput, (Barrels/day) x No. of days in operation (Days) x Refining CCS Margin (USD/Brl) x Exchange rate (RM/USD)

Using a realistic estimate of the expected Q2 average refining margin of 8USD/brl, HRC CCS profit is as per below:

= 112k bpd x 90 days x 8 USD/brl x 4.3 RM/USD

= 346 M

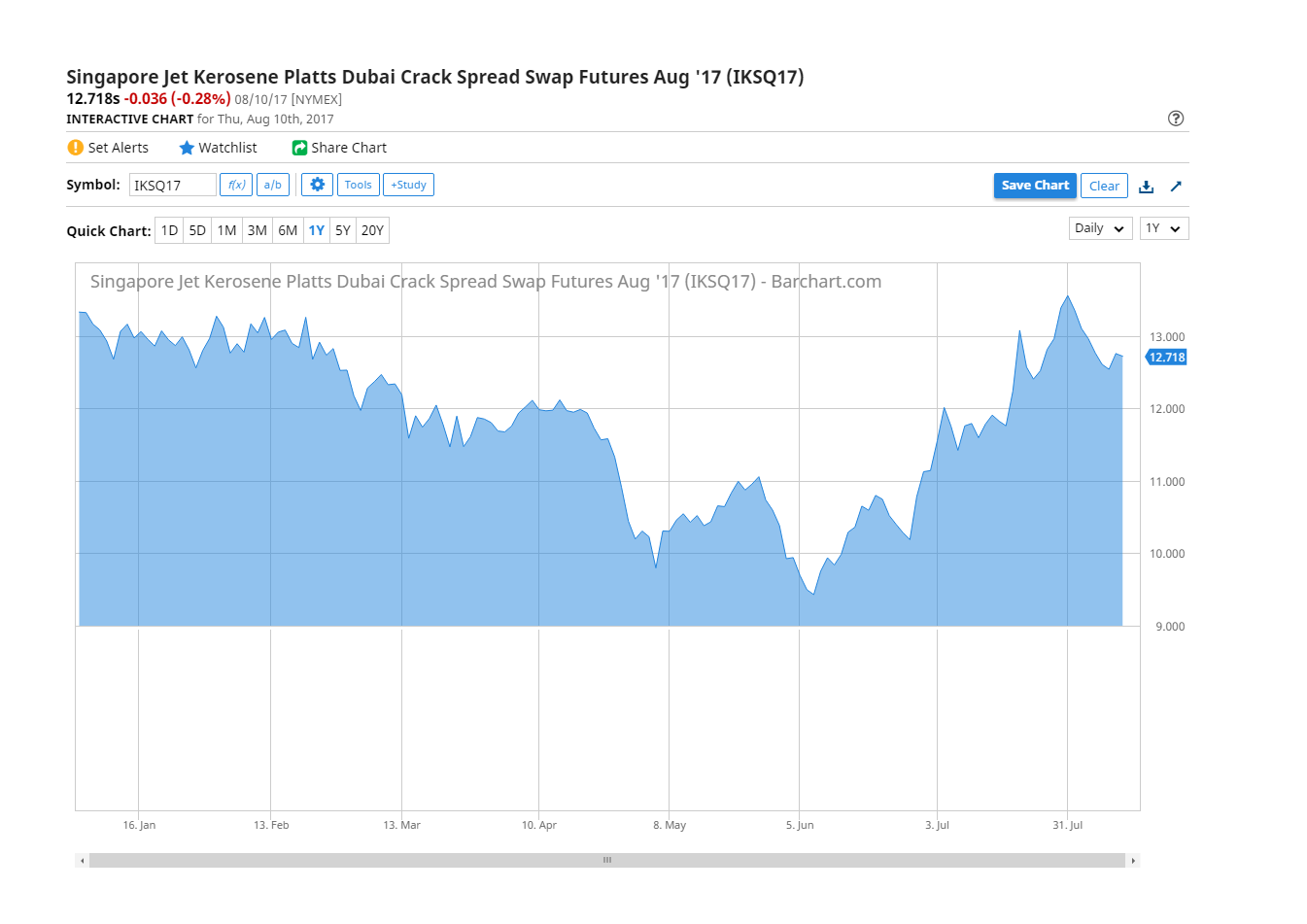

Note there are significant drop in overall Refining Margin due to Jet Fuel oil crack spread and Diesel fuel margins which had dropped significantly compared to Q1 as can be seen on below chart April - June 17:

Note: the above chart is with reference to Dubai Crude and HRC feed is Brent. The margin above has to be reduced by ~ 3 USD/brl to compare with Brent. Considering the dip in Gasoline crack spread also during the same period, the CCS margin is estimated to be max 8 USD/brl instead of 9 USD/brl as observed for Q1 2017 for HRC.

Earnings factor (2): Inventory gain / loss,

The is simply the valuation of their Inventory (consisting of both product and feed crude) as per the market valuation at end of the reporting period. One can view this similar to how a property company re-values its asset as per latest market pricing or how the Forex effects reported for assets or debts held in different currency than RM.

The oil price used by the company during the reporting period is quite dependent on the date they chose as a reference, we may only use the Brent closing price on the last week of the month as an approximate indicator.

As such taking a conservative approach, I estimate that Brent price used ~ 45 USD/brl as reported on 26June17 for qtr ending Jun17 and 53 USD/brl on 30 March17 for qtr ending Mar17. The difference is 8 USD/brl. The value of Inventory of HRC as of Mar17 in balance sheet is 1,075M (RM) is taken as 250M in terms of USD.

(A) Inventory size in Barrels = Inventory value / Price of Brent during reporting period

= 250M / (USD 53/brl)

= 4700k brl (approximately)

Since HRC is operating at a throughput of 112k barrels per day, their inventory turnover in days is calculated as per below:

= 4700 / 112

= ~ 40 days (exactly as per what they had reported on their website, ‘Future of HRC’ on stockholdings)

(B) The inventory loss = Ending Value of inventory (Jun 17) – Starting Value of Inventory (Mar 17)

Starting Value of Inventory (Mar17) = Inventory (barrels) x Starting Price of Brent (USD/barrel)

= 4700k barrels x USD 53/brl

= 250M

Ending Value of Inventory (Jun17) = Inventory (barrels) x Ending Price of Brent (USD/barrel)

= 4700k barrels x USD 45/brl

= 211M

Thus, the inventory loss is

= 211M – 250M

= - 39M USD

= - 167M RM

The Total Effect (1)+(2) , Is the FIFO profit which will be the reported Gross profit is simply the addition of the CCS Profit with Inventory gain/loss.

Refineries divide the FIFO profit by the barrels processed to obtain FIFO refining margins.

Thus, the FIFO Profit (GROSS PROFIT):

= CCS Profit + Stock gain/loss

= 346M – 167 M

= 179 M

Taking HRC’s Sales & Admin overhead costs, Other expenses and Finance costs which comes to approximately 120M, the Net profit would be:

= 179M – 120M

= 59 M (this results with an EPS of only 19 cents for Q2 -17 for HRC assuming no tax as per previous qtr).

However, one must be made aware that the Inventory gain/loss is a temporary phenomenon which will be offset later if the crude price reverts back to where it started. Imagine if the Brent price closing for the month Sept 17 is back to 53 USD/brl. The same inventory loss now will result with inventory gain.

(I felt it is important to enlighten i3 members on the above, as we have Superinvestor who will sell off the moment latest result drops significantly below preceding qtr and TA Sifu who may just trigger cut loss subsequently. People will be lost for words on why the earnings drop so much. This information should be equally important for superinvestor and TA sifu to act accordingly).

References:

http://english.yonhapnews.co.kr/business/2017/07/26/0503000000AEN20170726002551320.html

http://in.reuters.com/article/southkorea-s-oil-idINL3N1KH1BB

S-Oil reported a 117.3 billion won ($104.9 million) operating profit for the three months to end-June, down 82 percent fall from a year ago and down 65 percent from the previous quarter due to a fall in crude prices and weak inventory valuation, the company said.

http://klse.i3investor.com/blogs/Insight1/129795.jsp