1. Why Petronm can attract so many loyal members (4 mil++)?

As I mentioned in my part 2 article (https://klse.i3investor.com/blogs/david_petronm/127424.jsp), Petronm has shown big increment in their retail loyal members from 2 mil++ to 4 mil++. The reason for the big increment maybe due to Petronm seems to provide the best loyalty card and best benefit as compared to others to redeem petrol or other products. Let see some reviews from online on 5 brands Petrol retailers in Malaysia.

http://www.nonillustrationpurposes.com/compare-save/comparison-which-petrol-loyalty-card-helps-you-to-drive-an-extra-mile-free-of-charge/

https://www.imoney.my/articles/5-petrol-brand-loyalty-cards-you-need-to-get

Petronm’s rebete of the loyalty card is 1 point for every RM1 spent as compared to 1 point to 1 litre (RM2++) spent on other companies. Of course, BHP also provide 1 point for RM1 spent but their point will be expired in years where Petronm never expired.

I view this big loyal member base is a strong support for their retail business as retail can generate stable recurring income in addition of the increasing refinery business income.

2. Quality of Earnings (cash flow)

As I mentioned in my Petronm’s part 5 article, cash flow is one of the important metric of a company earning quality. (https://klse.i3investor.com/blogs/david_petronm/129620.jsp)

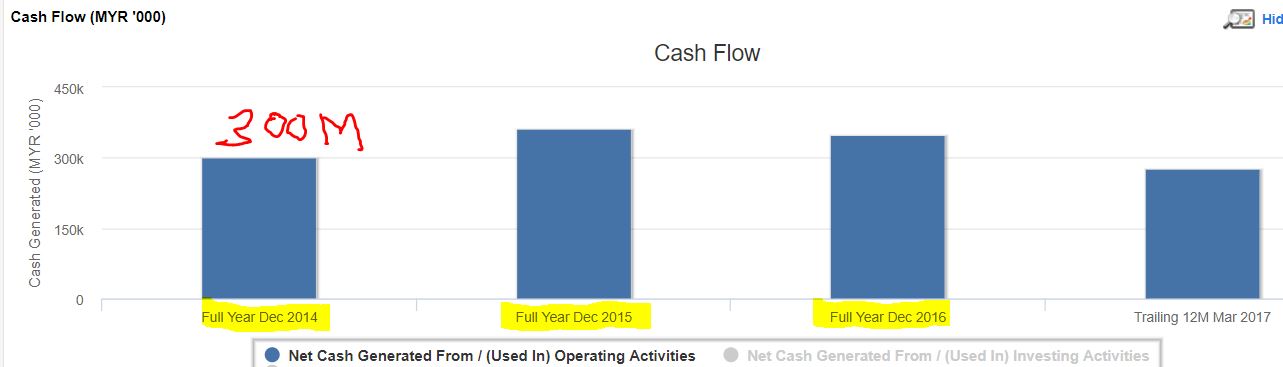

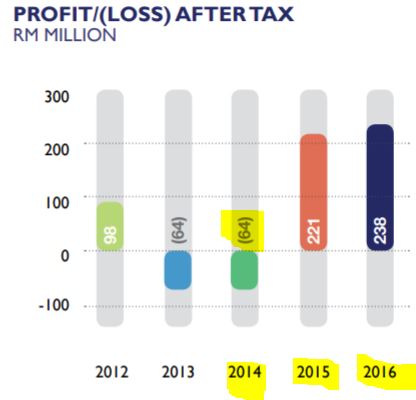

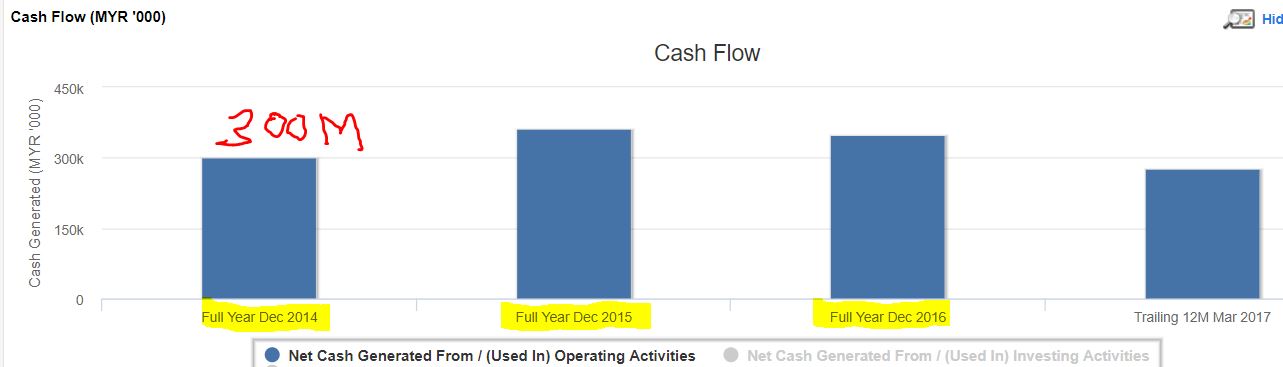

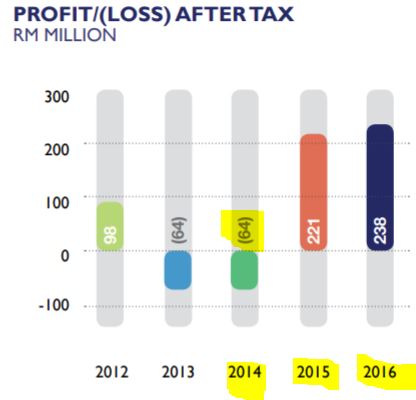

Let us go through Petronm’s cash flow, and profit for the past 3 years as below:

Cash flow from Operation for past 3 years

Source: Annual report 2016

From the above two graphs, we can observe that even Petronm suffered loss of RM64 mil in 2014, it still generate positive Cash flow from operation of about RM300 mil.

We also can observe from the cash flow graph that it also generated about RM350 mil cash from operation in 2015 and 2016 although its full year net profits were RM221 mil and Rm238 mil in 2015 and 2016 respectively.

Where did this positive cash flow go? Let examine the net debt of Petronm for past 3 years as below:

From this table, we can notice that net debt of Petronm has been reduced substantially from RM634 mil in 2014 to RM49 mil in Q1’17.

Another usage of the company cash is on dividend payout, capex, and inventory.

Let us go through another important ratio on the quality of earning. The formula of this ratio is as below:

Quality of Earnings = Operating Cash Flow/Net profit

A ratio of higher than 0.8 is consider good, a ratio of higher than 1 is excellent, and if higher than 1.4 is consider superior.

When the ratio higher than 1, it indicate that you generate more free cash than your actual net profit (this is due to high depreciation of factory, equipment etc). This is very important as this will eventually improve the company cash flow and determine the theoretical capability of a company dividend payout.

Strong operating cash flow is very important to measure the company earning quality as it give a theoretical cash value that can be “put” into shareholders pocket (like dividend payout). Or it can perform the expansion with internal generated fund without the need to raise fund through right issue or loan stock (Petronm never have right issue).

3. Another Perspective of Petronm profit estimation from Petron Corp’s result

From my Petronm Part 5 article (https://klse.i3investor.com/blogs/david_petronm/129620.jsp), I have estimated Petronm profit from its operation. I would like to estimate how much the possible loss of profit io Petron Corp Bataan Refinery 45-day shut down to estimate Petronm coming result.

Petron Corp Bataan refinery is a relatively new plan as it completed a upgrade in 2014 and has a rated capacity of 180kbpd. Some of the online info for Petron Corp Bataan refinery are as below:

http://www.hydrocarbons-technology.com/projects/petron-bataan-refinery-philippines/

http://www.petron.com/refinery.html

Petron corp Bataan (Philippines) should be a complex refinery system where it enjoy higher margin as compared to simple refiner. Let calculate what the possible loss in these 45 days shut down.

For this estimation, let start with inventory/stock loss calculation by assuming Bataan refinery running at 75% of its rated throughput --> 75% --> 135kbpd

1. inventory/stock loss, I assume it keeps 18 days of stock

Stock loss = 135k barrels x 18 days(48.2 – 52.95)

= USD -11.54mil

= RM-49.63mil

2) Refinery Loss due to shut down (assume the plant still running at 30% of capacity during the shutdown and USD7 as margin, complex refiner margin should be higher than 7) (based on estimated throughput per day of 135k).

= -135k barrels X 45 days X USD7.0 X 0.7

= - USD 29.77mil

= - RM 128mil

Total possible loss due to 45 days shut down = -49.63mil + (-128mil) = - RM177.63 mil

During the shut down, refinery production may not cut out totally. I assume 30% of the production still running. The loss has not included overhead cost during the shut down.

This calculation is just to show that refinery plant shut down in Petron Philippines can reduce the group net income significantly. Anyway, I still unable to estimate accurately for the Petron Malaysia’s income from the Petron Corp Philippines’s result as too many unknown parameters.

Before I summarize this article, let go through the latest Singapore gasoline crack spread as below:

Source: CME website

Summary

1. With strong cash flow and future profit visibility, Petronm forward 6 months or future PE or valuation can be attractive.

2. From past records, Q4 (Oct-Dec) result is a peak season for Petronm and this may further increase the projected full year EPS.

3. As long as current refinery margin (crack spread) can be maintained till Dec 2017, I would project Petronm may produce a record high profit in 2017.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/david_petronm/129801.jsp

As I mentioned in my part 2 article (https://klse.i3investor.com/blogs/david_petronm/127424.jsp), Petronm has shown big increment in their retail loyal members from 2 mil++ to 4 mil++. The reason for the big increment maybe due to Petronm seems to provide the best loyalty card and best benefit as compared to others to redeem petrol or other products. Let see some reviews from online on 5 brands Petrol retailers in Malaysia.

http://www.nonillustrationpurposes.com/compare-save/comparison-which-petrol-loyalty-card-helps-you-to-drive-an-extra-mile-free-of-charge/

https://www.imoney.my/articles/5-petrol-brand-loyalty-cards-you-need-to-get

Petronm’s rebete of the loyalty card is 1 point for every RM1 spent as compared to 1 point to 1 litre (RM2++) spent on other companies. Of course, BHP also provide 1 point for RM1 spent but their point will be expired in years where Petronm never expired.

I view this big loyal member base is a strong support for their retail business as retail can generate stable recurring income in addition of the increasing refinery business income.

As I mentioned in my Petronm’s part 5 article, cash flow is one of the important metric of a company earning quality. (https://klse.i3investor.com/blogs/david_petronm/129620.jsp)

Let us go through Petronm’s cash flow, and profit for the past 3 years as below:

Cash flow from Operation for past 3 years

Source: Annual report 2016

From the above two graphs, we can observe that even Petronm suffered loss of RM64 mil in 2014, it still generate positive Cash flow from operation of about RM300 mil.

We also can observe from the cash flow graph that it also generated about RM350 mil cash from operation in 2015 and 2016 although its full year net profits were RM221 mil and Rm238 mil in 2015 and 2016 respectively.

Where did this positive cash flow go? Let examine the net debt of Petronm for past 3 years as below:

|

Borrowings |

Trailing 12 months (mil) |

2016 (mil) |

2015 (mil) |

2014 (mil) |

|

Net Debt (Long Term Debt + Short Term Debt - Cash and cash equivalent) |

49

|

133

|

385

|

634

|

Another usage of the company cash is on dividend payout, capex, and inventory.

Let us go through another important ratio on the quality of earning. The formula of this ratio is as below:

Quality of Earnings = Operating Cash Flow/Net profit

|

|

2016 |

2015 |

2014 |

|

(Operating Cash Flow/Net profit) |

1.473 |

1.629 |

NA (due to loss making) |

When the ratio higher than 1, it indicate that you generate more free cash than your actual net profit (this is due to high depreciation of factory, equipment etc). This is very important as this will eventually improve the company cash flow and determine the theoretical capability of a company dividend payout.

Strong operating cash flow is very important to measure the company earning quality as it give a theoretical cash value that can be “put” into shareholders pocket (like dividend payout). Or it can perform the expansion with internal generated fund without the need to raise fund through right issue or loan stock (Petronm never have right issue).

3. Another Perspective of Petronm profit estimation from Petron Corp’s result

From my Petronm Part 5 article (https://klse.i3investor.com/blogs/david_petronm/129620.jsp), I have estimated Petronm profit from its operation. I would like to estimate how much the possible loss of profit io Petron Corp Bataan Refinery 45-day shut down to estimate Petronm coming result.

Petron Corp Bataan refinery is a relatively new plan as it completed a upgrade in 2014 and has a rated capacity of 180kbpd. Some of the online info for Petron Corp Bataan refinery are as below:

http://www.hydrocarbons-technology.com/projects/petron-bataan-refinery-philippines/

http://www.petron.com/refinery.html

Petron corp Bataan (Philippines) should be a complex refinery system where it enjoy higher margin as compared to simple refiner. Let calculate what the possible loss in these 45 days shut down.

For this estimation, let start with inventory/stock loss calculation by assuming Bataan refinery running at 75% of its rated throughput --> 75% --> 135kbpd

1. inventory/stock loss, I assume it keeps 18 days of stock

Stock loss = 135k barrels x 18 days(48.2 – 52.95)

= USD -11.54mil

= RM-49.63mil

2) Refinery Loss due to shut down (assume the plant still running at 30% of capacity during the shutdown and USD7 as margin, complex refiner margin should be higher than 7) (based on estimated throughput per day of 135k).

= -135k barrels X 45 days X USD7.0 X 0.7

= - USD 29.77mil

= - RM 128mil

Total possible loss due to 45 days shut down = -49.63mil + (-128mil) = - RM177.63 mil

During the shut down, refinery production may not cut out totally. I assume 30% of the production still running. The loss has not included overhead cost during the shut down.

This calculation is just to show that refinery plant shut down in Petron Philippines can reduce the group net income significantly. Anyway, I still unable to estimate accurately for the Petron Malaysia’s income from the Petron Corp Philippines’s result as too many unknown parameters.

Before I summarize this article, let go through the latest Singapore gasoline crack spread as below:

Source: CME website

Summary

1. With strong cash flow and future profit visibility, Petronm forward 6 months or future PE or valuation can be attractive.

2. From past records, Q4 (Oct-Dec) result is a peak season for Petronm and this may further increase the projected full year EPS.

3. As long as current refinery margin (crack spread) can be maintained till Dec 2017, I would project Petronm may produce a record high profit in 2017.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/david_petronm/129801.jsp