Profit Sustainable or not?

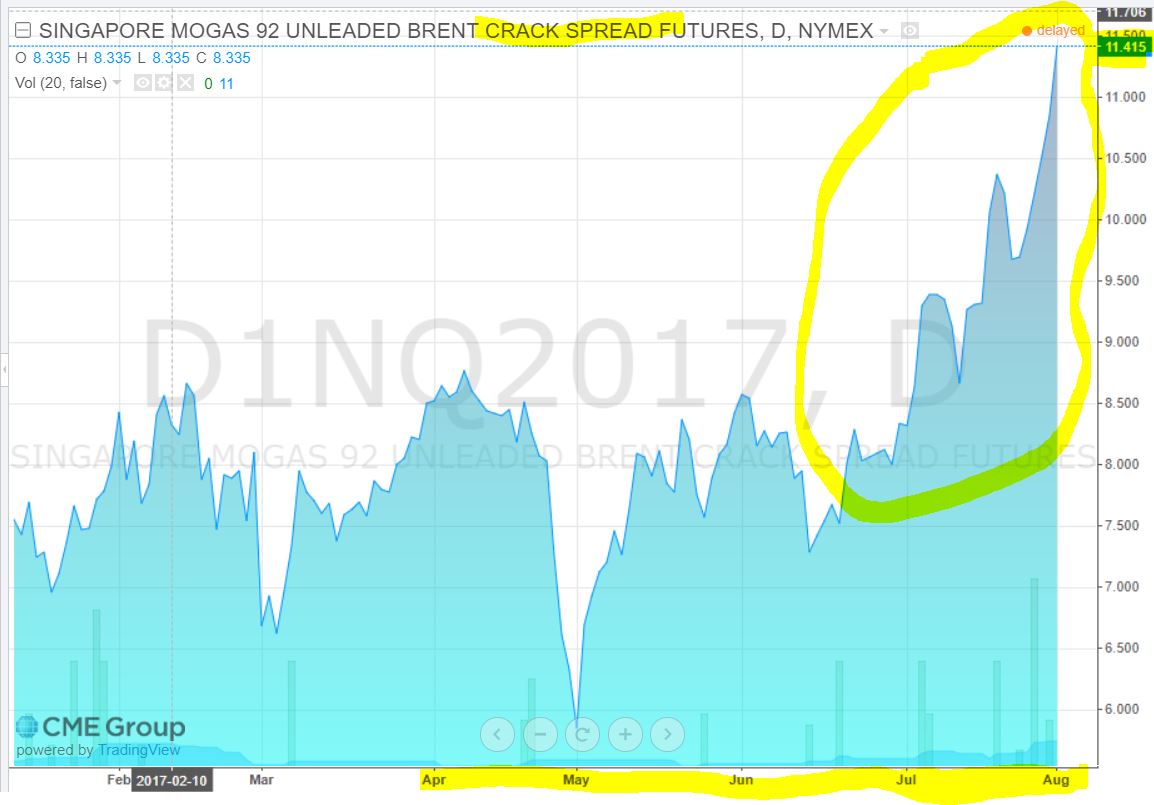

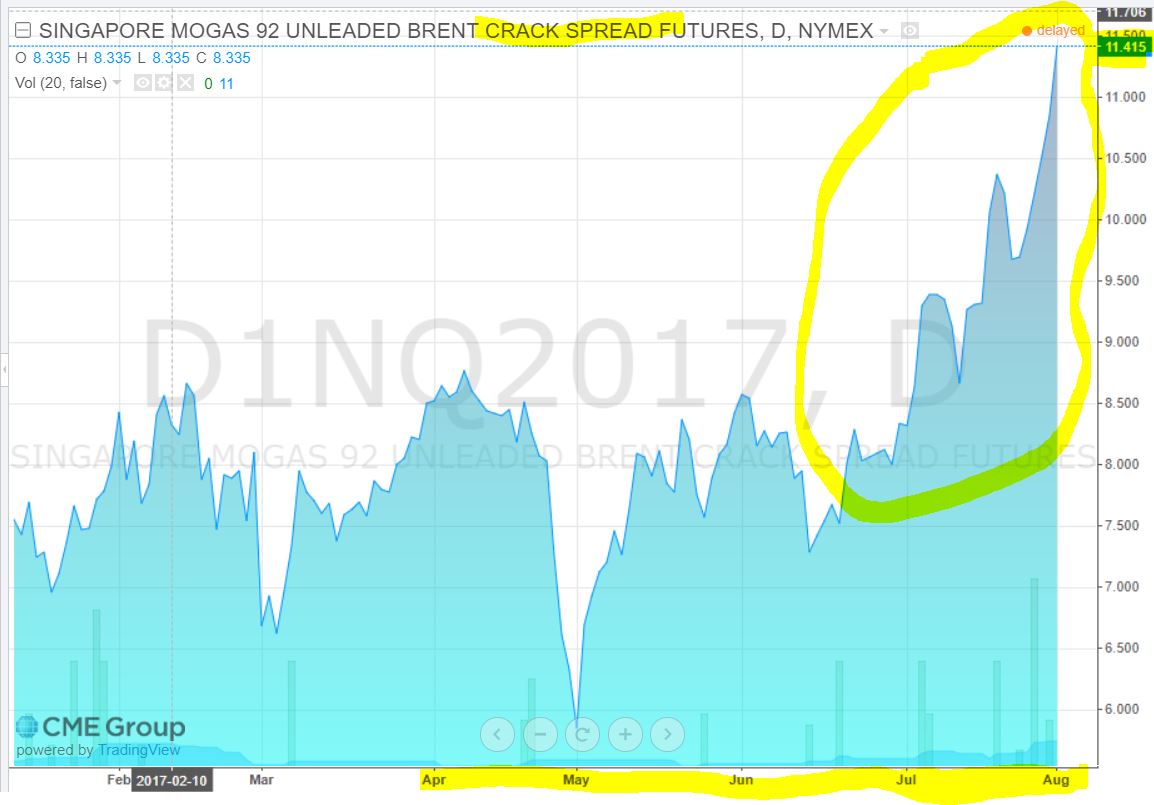

From recent Hengyuan’s price fluctuation, some of you may ask around should I sell it? Or should I keep buying it or should I hold it? As we know, future profit of Hengyuan is highly depending on crack spread. Let us go through the recent gasoline crack spread graph (refinery margin) from CME website (updated to early August).

Gasoline: Source CME website (gasoline is the main product of HY)

I believe the message from the above graph (crack spread) is more convincing as compared to thousands of my words for the future profitability of Hengyuan. In Chinese we say 一幅图胜过千言万语.

For those like to see some numbers, let me calculate the EFFECT on profit if crack spread (refinery margin) expanded by 1 USD/barrel

= 112 kbpd x 90 days x 1 USD x RM 4.3/USD

= RM43.3mil increase in Gross profit per quarter

RM43.3mil --> extra EPS of 14.4 sen / quarter

Still not convincing enough?

Let me perform a simple calculation for the margin (crack spread) per barrel for result of Q1’17 of HY. HY achieved RM395.6 mil gross profit in the quarter 1 of 2017 as shown in the figure below.

Source: Q1’17 report

In Q1’17, it also reported total sales volume of 10.1 million barrels of oil

Gross Profit margin per barrel = 395.6 mil / 10.1 mil

The actual profit margin can be varied depending on when they buy the crude oil, hedging contract price, operation efficiency (simple or complex refinery), unplanned downtime etc.

Concern about higher stock loss?

What I can observe is before Dec 2016 Hengyuan (former Shell) is under Dutch controlled management, but after Dec 2016 it is under China-controlled management team. Do you think Hengyuan will follow exactly the same Dutch style of management or keep the same crude oil stock level? Of course, I cannot know exactly what HY’s management team thinking but I maybe able to guess some from their Q1 report data.

Let us see an interesting data on Fair value (gain)/loss on derivatives (Q1’17 report) as table below.

Source: Q1’17 report

The figure of derivatives in Q1’17 has become Zero as compared to RM91 mil loss in Q1’16. That mean there is no hedging in Q1’17 on the currency or crude oil price changes. What I can imagine if Hengyuan continue with zero hedge (or minimum hedge), then they may not keep high number of stock-day. Logically, most businesses should not keep high level of stock (unless want to increase production) as it may affect your cash flow.

Concern about Future of Refinery Industries?

No 1: Correlation of Crude oil price with Crack Spread (Refinery Margin)

I think the easiest way to show whether there is strong correlation or not between crude oil price and crack spread is through two graphs below:

What I can observe from the two charts is there is no direct or strong correlation between crude oil price and crack spread in the period of 1H2017 (Jan-June). When crude oil price decreased in June, crack spread initially decreased but later increased all the way up to July (from mid of June of CME graph). More specifically, crude oil dropped from USD54 to USD44 (mid of May to mid of June) but crack spread generally stabilized at range of USD8 (refer graph from mid of May to early June), it even increased back to USD9 in early July (refer graph from early June to early of July).

From early of July to end of July, although there is some fluctuation (up and down) in crude oil price, but crack spread actually go up from USD9 to 11+ and then retraced to USD10.9 (early of Aug).

In short, there is small correlation between crude oil price and crack spread but no direct or strong correlation. In fact, crude oil market is a different market with petroleum refined products market.

What are the factors determine the crack spread of petroleum refined products? I would say supply and demand. Supply is determined by Asia’s refinery capacity and demand is decided by consumption (land vehicles, factory, Airplane etc). We should be able to calculate the supply capacity of SEA countries but demands is growing as the vehicle population is growing. Public may not able to access exact demand data but we can gather supply throughput data from online sources to have a general picture of future trend. I am not an expert in crack spread prediction but I can see current trend is uptrend. As long as this crack spread can be maintained around USD6-USD8 level (extra is bonus), I believe strong profit result in Q1’17 of Hengyuan is sustainable for the remaining period of 2017.

In fact, recent crude oil price up will result in Stock GAIN for HY in coming Q3 quarter result (to be released in Nov 2017)

No 2: Why Royal Shell wants to sell its refinery business so cheap to Hengyuan?

Some of you maybe curious on why Shell is willing to sell with its refinery business stake at such a steep discount to HY. A lot of you do not believe there is “big frog jumping around the street”

My deduction for this concern is Shell is not interested in small operations and also its global restructuring exercise after crude oil plunge from 2014. Malaysia refinery capacity is relatively small as compared to its Singapore refinery capacity (Shell Singapore capacity is 500 kbpd, HY capacity is 156 kbpd). This is like if you own 5 luxury cars then you can sell your Myvi at much lower than market price if you don’t need it anymore.

The capacity of 156 kbpd is good enough for Hengyuan to expand its first oversea business. This is similar to Esso sold its refinery and retails businesses to Petron in 2012 as the business is big enough for Petron but relative too small for Esso-Exxon. I believe Petronm success (debt reducing every year) can be repeated in Hengyuan especially in the booming time of refinery margin.

No 3: Concern on Petrol car ban – replaced with Electric car?

Another concern from reader for refinery industries is the threat from electric cars (totally no gasoline and diesel consumption in car). Let us glance through one recent news on the petrol car possible ban as below:

http://www.dailypost.co.uk/news/motoring/petrol-diesel-car-ban-uk-13386734

What can you see from the news? It is not yet confirmed (word set to is used) and 2040 it is too long for me from now.

Assume this policy really confirmed to be implemented in Asia, let see what is the practical limitation of electric car as compared gasoline (petrol) and diesel car. The world most sophisticated electric car is produced by Tesla. Let see what are the possible limitations and the technology of Tesla offered (without considering the price)

Tesla supercharging stations charge with up to 145 kW of power distributed between two adjacent cars, with a maximum of 120 kW per car. That is up to 16 times as fast as public charging stations; they take about 20 minutes to charge to 50%, 40 minutes to charge to 80%, and 75 minutes to 100%.

Even with supercharging station (public charging stations are much slower, 16 times slower), it still needs 20 min to charge to 50% (Tesla Model S model 75% fully charge can go for 265 miles). If you want to travel from KL to Penang (distance is about 355km) and if your car run out of battery, if you want to charge your battery at supercharging station, you need to wait at least 20 min and in case the station is occupied, then you need to wait a total of 40 min charging time (for 50% battery level, in fact 50% level of battery is not enough for you to complete the journey from KL to Penang). Then let us think how long the time we take to refuel to full in our petrol car? 3 min or 5 min? Another scenario is if you stuck at traffic jam in KL and run out of battery in your electric car, then you may need to wait at least 20 min to X min of time (depend the station occupied or not) to recharge depend on the availability of the charging station. You can Google how many supercharging station available in Asia or Malaysia. Another concern is I cannot imagine the repair cost if your electric car rinsed in water especially KL is a flooded-proned area (maybe those who possess hybrid car know what I mean if your car ever stuck in flood).

Will Malaysia implement similar petrol car ban in future? If you are aware of Petronas mega investment in Pengerang, Johor (RM60 billion investment in Refinery and Petrochemical Integrated Development (RAPID) (http://www.mprc.gov.my/our-businesses/pengerang-integrated-petroleum-complex-pipc)

Then you will know Malaysia is NOT likely to ban petrol car. As we know Petronas contributes nearly 30% of income to our government. Petrol car ban will greatly affect Petronas’s income. Do you think government will get a stone throw to its own leg?

Summary

I don’t want to write summary in this article but I wish to show you some recent news as below:

https://www.rt.com/news/398028-shell-rotterdam-refinery-fire-shutdown/

After the Sheel Europe refinery fire, let see what happen after this fire to Asia’s crack spread as in the news below:

http://www.bunkerportsnews.com/News.aspx?ElementId=0e02ceb3-36e6-475a-8d95-427f3f4f33c5

Let see how long needed to repair the damage refinery plant (actually I doubt it can be done in two weeks)

http://www.bunkerportsnews.com/News.aspx?ElementId=0e02ceb3-36e6-475a-8d95-427f3f4f33c5

For those interested on technical analysis on Hengyuan, please refer to the chart below where I can notice uptrend momentum continue. DE (Deviation Expert) signal shows a positive inflow fund with 8 Red bars consecutively for 8 days from 25 July to 3 Aug (mean fund inflows > outflows in this period).

I wish to end this article with Hokkien words : HengYuan HengYuan Sibeh HENG ah.

Stay tune for my Hengyuan’s Part 4 article for its possible foreign exchange gain or loss, further cash flow and debt analysis, valuation analysis etc.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is my own imagination for all the assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/davidtslim/129193.jsp

From recent Hengyuan’s price fluctuation, some of you may ask around should I sell it? Or should I keep buying it or should I hold it? As we know, future profit of Hengyuan is highly depending on crack spread. Let us go through the recent gasoline crack spread graph (refinery margin) from CME website (updated to early August).

Gasoline: Source CME website (gasoline is the main product of HY)

I believe the message from the above graph (crack spread) is more convincing as compared to thousands of my words for the future profitability of Hengyuan. In Chinese we say 一幅图胜过千言万语.

For those like to see some numbers, let me calculate the EFFECT on profit if crack spread (refinery margin) expanded by 1 USD/barrel

= 112 kbpd x 90 days x 1 USD x RM 4.3/USD

= RM43.3mil increase in Gross profit per quarter

RM43.3mil --> extra EPS of 14.4 sen / quarter

Still not convincing enough?

Let me perform a simple calculation for the margin (crack spread) per barrel for result of Q1’17 of HY. HY achieved RM395.6 mil gross profit in the quarter 1 of 2017 as shown in the figure below.

Source: Q1’17 report

In Q1’17, it also reported total sales volume of 10.1 million barrels of oil

Gross Profit margin per barrel = 395.6 mil / 10.1 mil

= RM39.17

= USD9.1

The achieved USD9.1 gross profit margin is quite close

to my estimated figure of crack spread of USD8.25 to USD9 (part 1’s

article at https://klse.i3investor.com/blogs/davidtslim/128328.jsp).The actual profit margin can be varied depending on when they buy the crude oil, hedging contract price, operation efficiency (simple or complex refinery), unplanned downtime etc.

Concern about higher stock loss?

What I can observe is before Dec 2016 Hengyuan (former Shell) is under Dutch controlled management, but after Dec 2016 it is under China-controlled management team. Do you think Hengyuan will follow exactly the same Dutch style of management or keep the same crude oil stock level? Of course, I cannot know exactly what HY’s management team thinking but I maybe able to guess some from their Q1 report data.

Let us see an interesting data on Fair value (gain)/loss on derivatives (Q1’17 report) as table below.

Source: Q1’17 report

The figure of derivatives in Q1’17 has become Zero as compared to RM91 mil loss in Q1’16. That mean there is no hedging in Q1’17 on the currency or crude oil price changes. What I can imagine if Hengyuan continue with zero hedge (or minimum hedge), then they may not keep high number of stock-day. Logically, most businesses should not keep high level of stock (unless want to increase production) as it may affect your cash flow.

Concern about Future of Refinery Industries?

No 1: Correlation of Crude oil price with Crack Spread (Refinery Margin)

I think the easiest way to show whether there is strong correlation or not between crude oil price and crack spread is through two graphs below:

What I can observe from the two charts is there is no direct or strong correlation between crude oil price and crack spread in the period of 1H2017 (Jan-June). When crude oil price decreased in June, crack spread initially decreased but later increased all the way up to July (from mid of June of CME graph). More specifically, crude oil dropped from USD54 to USD44 (mid of May to mid of June) but crack spread generally stabilized at range of USD8 (refer graph from mid of May to early June), it even increased back to USD9 in early July (refer graph from early June to early of July).

From early of July to end of July, although there is some fluctuation (up and down) in crude oil price, but crack spread actually go up from USD9 to 11+ and then retraced to USD10.9 (early of Aug).

In short, there is small correlation between crude oil price and crack spread but no direct or strong correlation. In fact, crude oil market is a different market with petroleum refined products market.

What are the factors determine the crack spread of petroleum refined products? I would say supply and demand. Supply is determined by Asia’s refinery capacity and demand is decided by consumption (land vehicles, factory, Airplane etc). We should be able to calculate the supply capacity of SEA countries but demands is growing as the vehicle population is growing. Public may not able to access exact demand data but we can gather supply throughput data from online sources to have a general picture of future trend. I am not an expert in crack spread prediction but I can see current trend is uptrend. As long as this crack spread can be maintained around USD6-USD8 level (extra is bonus), I believe strong profit result in Q1’17 of Hengyuan is sustainable for the remaining period of 2017.

In fact, recent crude oil price up will result in Stock GAIN for HY in coming Q3 quarter result (to be released in Nov 2017)

No 2: Why Royal Shell wants to sell its refinery business so cheap to Hengyuan?

Some of you maybe curious on why Shell is willing to sell with its refinery business stake at such a steep discount to HY. A lot of you do not believe there is “big frog jumping around the street”

My deduction for this concern is Shell is not interested in small operations and also its global restructuring exercise after crude oil plunge from 2014. Malaysia refinery capacity is relatively small as compared to its Singapore refinery capacity (Shell Singapore capacity is 500 kbpd, HY capacity is 156 kbpd). This is like if you own 5 luxury cars then you can sell your Myvi at much lower than market price if you don’t need it anymore.

The capacity of 156 kbpd is good enough for Hengyuan to expand its first oversea business. This is similar to Esso sold its refinery and retails businesses to Petron in 2012 as the business is big enough for Petron but relative too small for Esso-Exxon. I believe Petronm success (debt reducing every year) can be repeated in Hengyuan especially in the booming time of refinery margin.

No 3: Concern on Petrol car ban – replaced with Electric car?

Another concern from reader for refinery industries is the threat from electric cars (totally no gasoline and diesel consumption in car). Let us glance through one recent news on the petrol car possible ban as below:

http://www.dailypost.co.uk/news/motoring/petrol-diesel-car-ban-uk-13386734

What can you see from the news? It is not yet confirmed (word set to is used) and 2040 it is too long for me from now.

Assume this policy really confirmed to be implemented in Asia, let see what is the practical limitation of electric car as compared gasoline (petrol) and diesel car. The world most sophisticated electric car is produced by Tesla. Let see what are the possible limitations and the technology of Tesla offered (without considering the price)

Tesla supercharging stations charge with up to 145 kW of power distributed between two adjacent cars, with a maximum of 120 kW per car. That is up to 16 times as fast as public charging stations; they take about 20 minutes to charge to 50%, 40 minutes to charge to 80%, and 75 minutes to 100%.

Even with supercharging station (public charging stations are much slower, 16 times slower), it still needs 20 min to charge to 50% (Tesla Model S model 75% fully charge can go for 265 miles). If you want to travel from KL to Penang (distance is about 355km) and if your car run out of battery, if you want to charge your battery at supercharging station, you need to wait at least 20 min and in case the station is occupied, then you need to wait a total of 40 min charging time (for 50% battery level, in fact 50% level of battery is not enough for you to complete the journey from KL to Penang). Then let us think how long the time we take to refuel to full in our petrol car? 3 min or 5 min? Another scenario is if you stuck at traffic jam in KL and run out of battery in your electric car, then you may need to wait at least 20 min to X min of time (depend the station occupied or not) to recharge depend on the availability of the charging station. You can Google how many supercharging station available in Asia or Malaysia. Another concern is I cannot imagine the repair cost if your electric car rinsed in water especially KL is a flooded-proned area (maybe those who possess hybrid car know what I mean if your car ever stuck in flood).

Will Malaysia implement similar petrol car ban in future? If you are aware of Petronas mega investment in Pengerang, Johor (RM60 billion investment in Refinery and Petrochemical Integrated Development (RAPID) (http://www.mprc.gov.my/our-businesses/pengerang-integrated-petroleum-complex-pipc)

Then you will know Malaysia is NOT likely to ban petrol car. As we know Petronas contributes nearly 30% of income to our government. Petrol car ban will greatly affect Petronas’s income. Do you think government will get a stone throw to its own leg?

Summary

I don’t want to write summary in this article but I wish to show you some recent news as below:

https://www.rt.com/news/398028-shell-rotterdam-refinery-fire-shutdown/

After the Sheel Europe refinery fire, let see what happen after this fire to Asia’s crack spread as in the news below:

http://www.bunkerportsnews.com/News.aspx?ElementId=0e02ceb3-36e6-475a-8d95-427f3f4f33c5

Let see how long needed to repair the damage refinery plant (actually I doubt it can be done in two weeks)

http://www.bunkerportsnews.com/News.aspx?ElementId=0e02ceb3-36e6-475a-8d95-427f3f4f33c5

For those interested on technical analysis on Hengyuan, please refer to the chart below where I can notice uptrend momentum continue. DE (Deviation Expert) signal shows a positive inflow fund with 8 Red bars consecutively for 8 days from 25 July to 3 Aug (mean fund inflows > outflows in this period).

I wish to end this article with Hokkien words : HengYuan HengYuan Sibeh HENG ah.

Stay tune for my Hengyuan’s Part 4 article for its possible foreign exchange gain or loss, further cash flow and debt analysis, valuation analysis etc.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is my own imagination for all the assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/davidtslim/129193.jsp