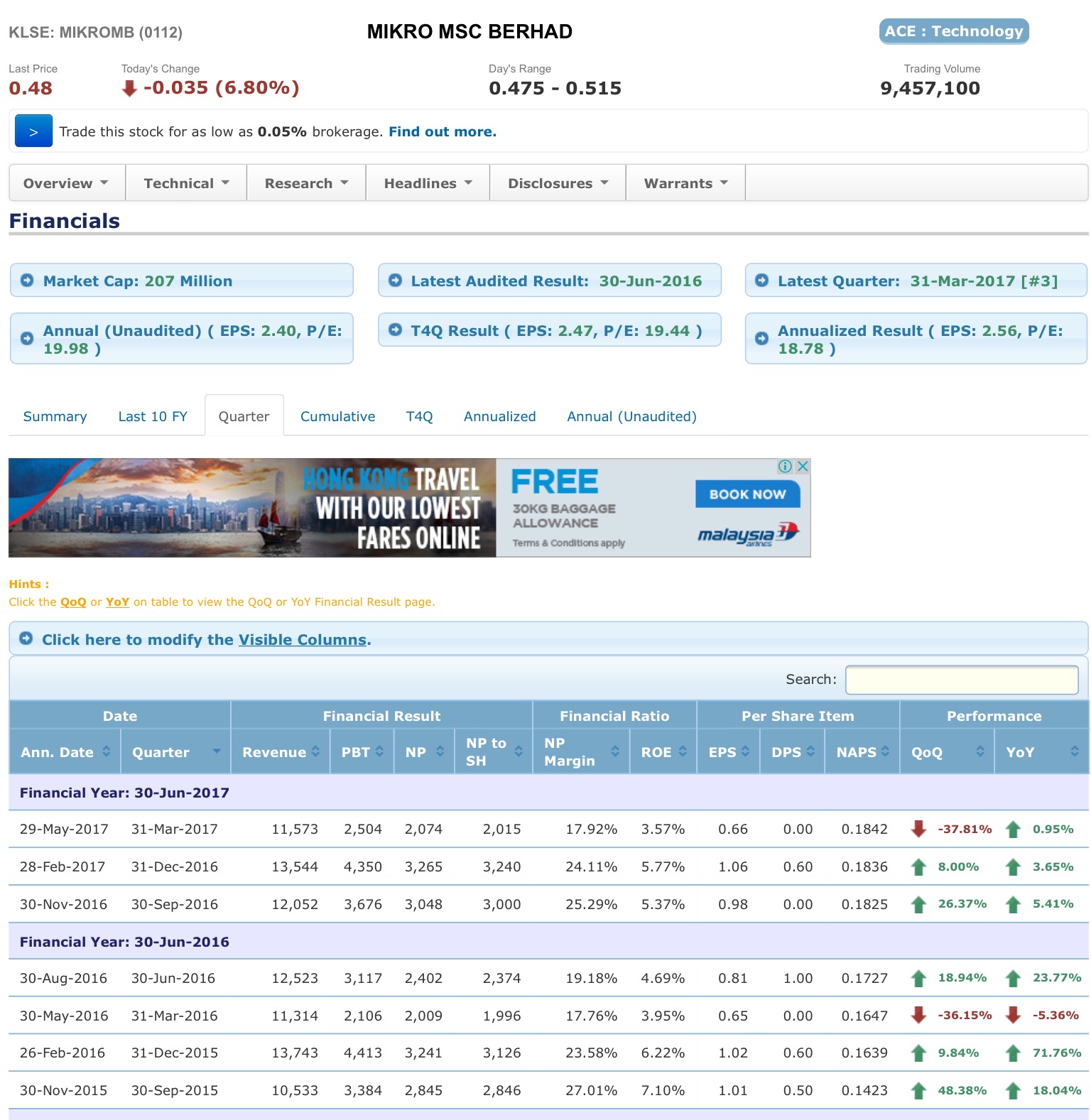

T4Q P/E = 19.44

T4Q EPS GROWTH = 7%

PEG RATIO = 2.44 (>1 = OVERVALUED)

PEG RATIO = 1 (FAIR VALUE = 18 sen)

P/NAV = 2.61

**main concerns**

1) Lower Revenue growth: 4.44% in first 9 month FYE 30 June 2017.

2) Other factors like fluctuation in material costs & currency might affect Mikro MSC profitability

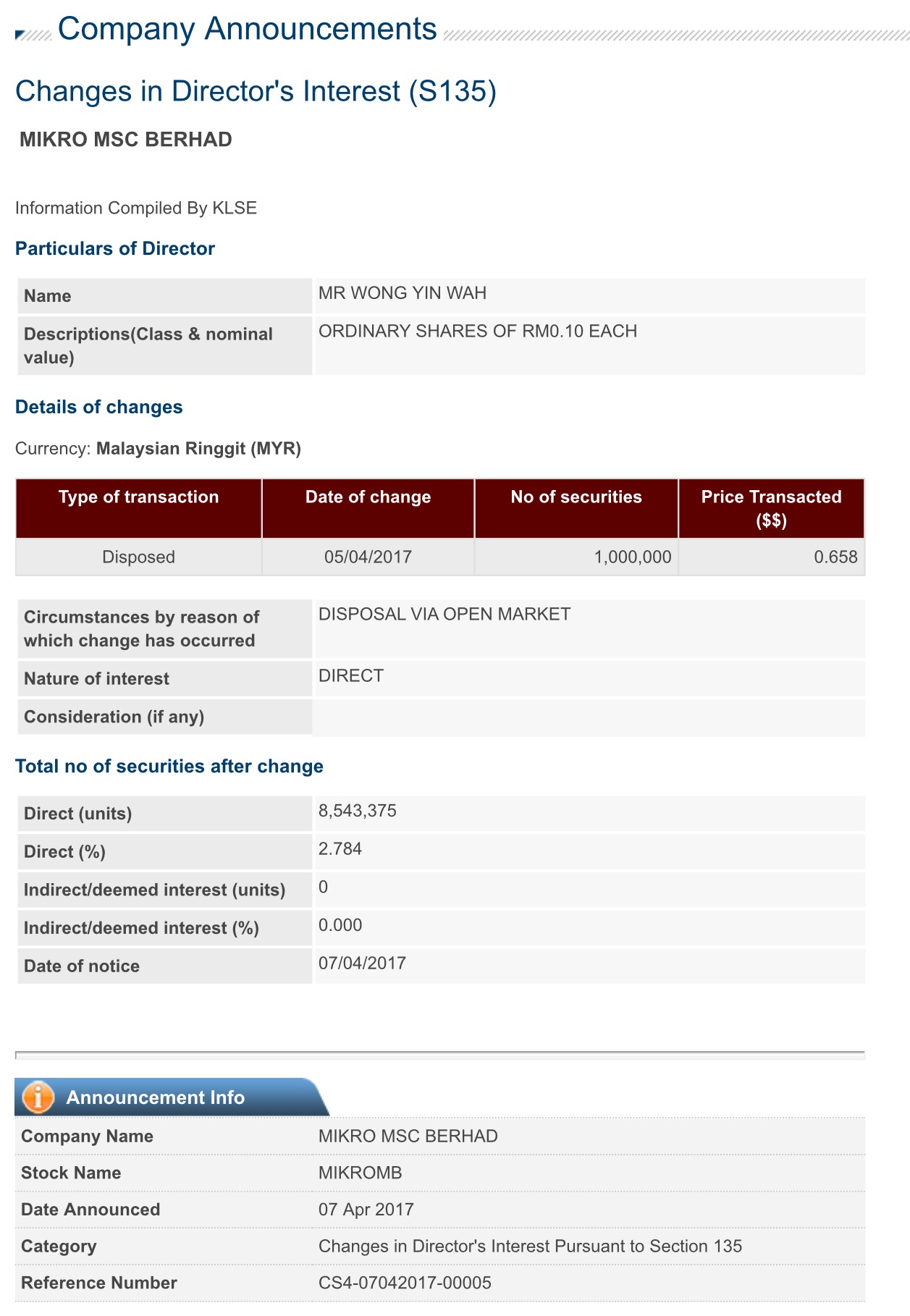

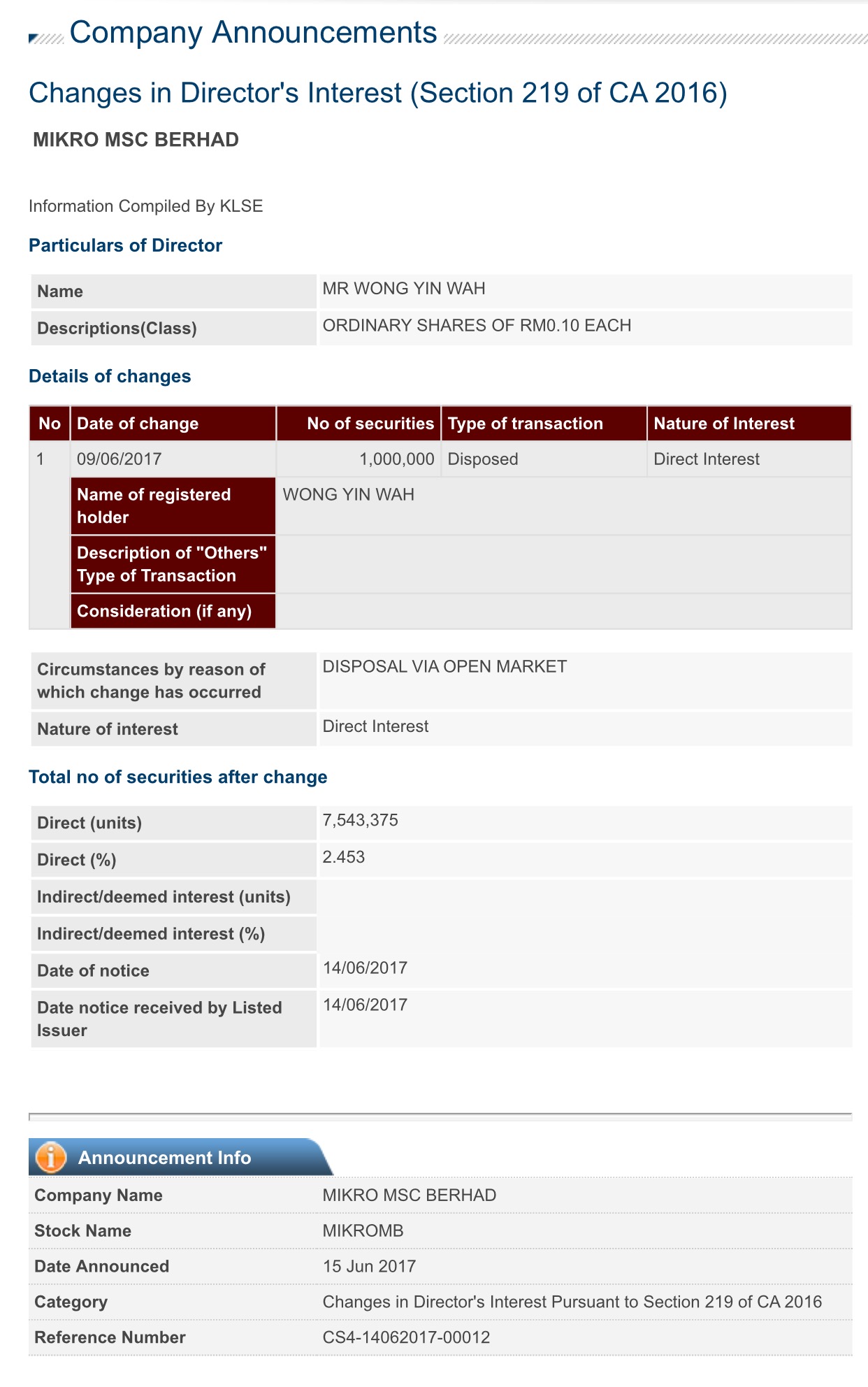

3) Insider selling by Director (1 million shares at $0.658 - price after bonus issue is 47 sen)

Disclaimer:

Please be informed that the information above is solely for the sharing purposes and does not constitute a buy or sell call.

http://klse.i3investor.com/blogs/Goodstockbadstock/128915.jsp