1) Bumi Armada is the Fifth Largest FPSO operator in the world. A floating production storage and offloading (FPSO) unit is a floating vessel used by the offshore oil and gas industry for the production and processing of hydrocarbons, and for the storage of oil.

2) Four major FPSO projects in 2017 that could generate improved cash flow includes

- Armada Olombendo (Contributed in Q2 Earnings )

-Armada LNG Mediterrana (Contributed in Q2 Earnings )

-Karapan Armada Sterling III (Slight Contribution in Q2 Earnings )

- Armada Kraken (Slight Contribution in Q2 Earnings )

3) Current Issues & Risks

Armada Kraken faced some problems in operational efficiency. (According to its client, Enquest insisted that the “operational issues” would not persist beyond this year and the performance of individual oil wells at Kraken had so far been better than expected, it said. Kraken just requires some “fine tuning” ). However, Armada Kraken — has completed the offloading of its first cargo on Sept 12, 2017 which was the FASTEST oil delivery at the North Sea in the last 10 years.

4) Armada’s latest orderbook as at 30 June 2017 stands at a whopping RM23.7b. The optional extension orderbook stands at RM13.3b. Tenderbook for projects in West Africa, Brazil and India. Healthy operating cash flow was seen for Q2FY17. Armada’s recent two quarters have been improving and its prospects seem to be brighter than ever. Earnings seem to double for FY17 and is climbing nearer to its glory days.

5) The recent uptrend in oil prices is a bonus. Many O&G counters have rebounded significantly for the past week and the trend is strong with O&G stocks. Armada is deeply undervalued at this point as compared to its historical earnings. In Q2 FY11, Armada’s revenue was RM392 million and net profit achieved was 60.92 million (EPS of 2.64 ). It was valued at over RM 12 Billion.

6) Armada’s reigning CEO, Mr Leon A. Harland who had experience In the world’s largest FPSO operator, SBM Offshore states that 2017 year will be a transition year as they complete major projects whereby he looks to fine-tune the organisation in preparation for the next stage of growth.

Therefore, Armada’s financial performance is indeed recovering and it may actually morph into something bigger.

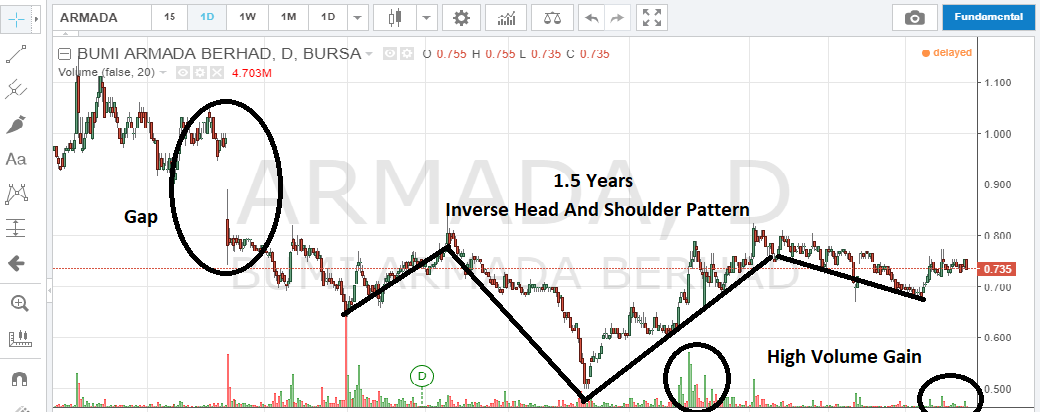

7) Technical Analysis : Inverse Head and Shoulder Pattern. There is a high possibility that it may fill up the huge gap created on 7th March 2016. If the theory of Technical Analysis ever existed, Armada should go up.

8) On 7th March 2016, Armada’s share price plummeted 25% from 1.00 to 0.75 in a single day which wipped out RM1.466 billion in value due to termination of contract by Woodside Petroleum.

However, Armada has filed claim for damages from Woodside worth USD 275.813 million (RM 1.158 Billion ) and the management is of the view that there are reasonable grounds to expect a favourable outcome as stated in Q2FY17 report. Can Armada’s share price increase 25% in a single day when they win the court case?

9) Armada C27 expires in 137 days and is now trading at 0.035. Its exercise price is only 0.835 with a conversion ratio of 1:1. IF Armada goes to RM 1.00, C27 is worth 0.165.

Potential return = 471.43%

Bumi Armada used to be a massive giant in the FPSO industry and it actually still is.

At 0.735, Bumi Armada…….. a penny stock.

|

| ARMADA (5210) - Unleash The Kraken - Bumi Armada |

Seriously?

Trade at your own risk

GreenTrade$ WILL NOT be held responsible for any losses or decisions made

http://klse.i3investor.com/blogs/greentrade/132560.jsp