Join our telegram for fastest update: http://telegram.me/share4u88

The Oceancash Group has come a long way from a humble beginning in 1997 as a resinated felt and non-woven manufacturer operating from rented premises. The nucleus of The Group was founded by Mr. Tan Siew Chin and Mr. Lo Pong Kiat. They have contributed and laid the foundation of what Oceancash Pacific Berhad is today. Over the years, The Group has expanded its range of products and services with its growing list of customers in South East Asia, China and Japan.

Oceancash Felts

Oceancash Felts Sdn. Bhd. (OFSB), a wholly owned subsidiary of Oceancash Pacific Berhad (OPB), is principally involved in the manufacturing of resinated felts and thermoplastic felts for heat insulation and sound insulation which include but not limited to; interior and exterior trims in automobiles, noise damper for compressors of split unit air conditioners as well as insulation in buildings including roofs, walls, partitions, and carpet underlay. Being one of the leading felts manufacturer in South East Asia with its long-standing expertise, Oceancash Felts Sdn. Bhd. is committed to working closely with existing and potential customers from around the world to develop and produce top-quality acoustic and thermal insulation felts.

Oceancash Nonwoven

Oceancash Nonwoven Sdn. Bhd. (OCN), a wholly owned subsidiary of Oceancash Pacific Berhad (OPB), was incorporated on December 21, 1999 in Malaysia. The principal activities of OCN are in the manufacturing and trading of air-through bonded nonwoven, and thermal bonded nonwoven, which are widely used in the disposable hygienic products industry. Its application include top-sheets, second layer, acquisition distribution layer (ADL), and back-sheet for diapers, sanitary napkins, wet wipes, and surgical apparels including caps, masks, and gowns.

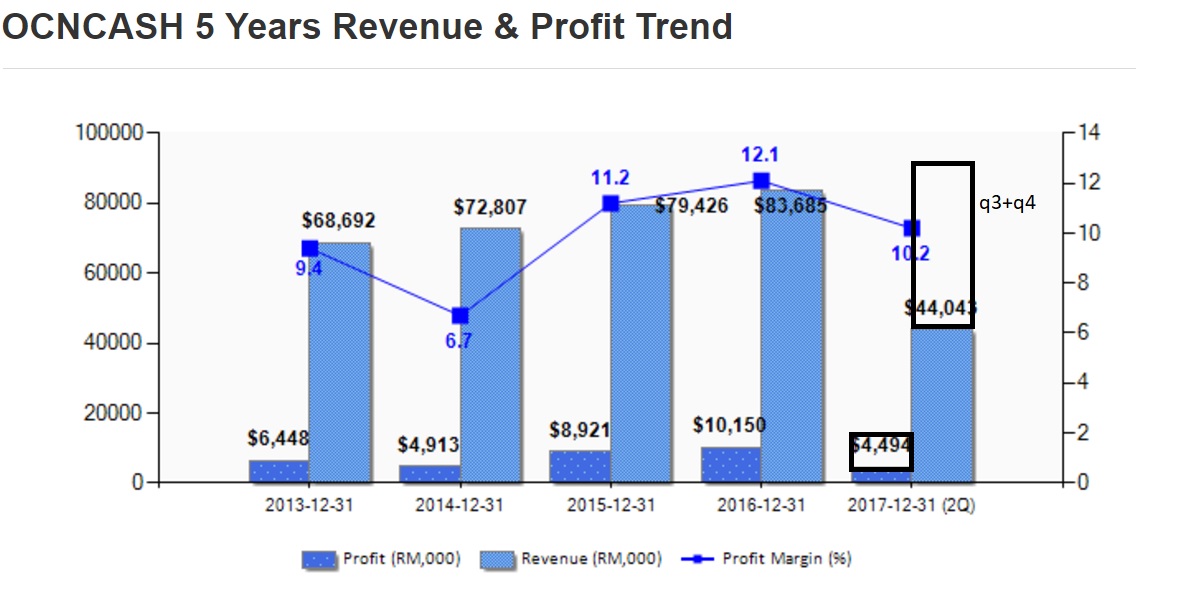

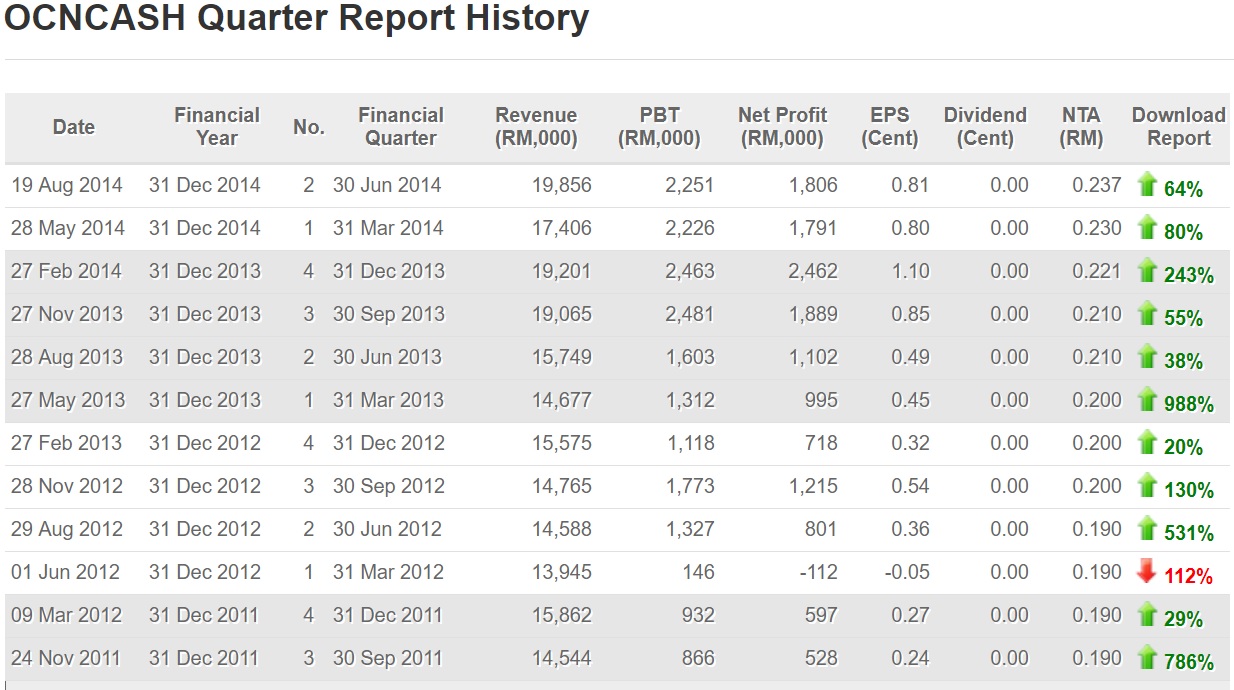

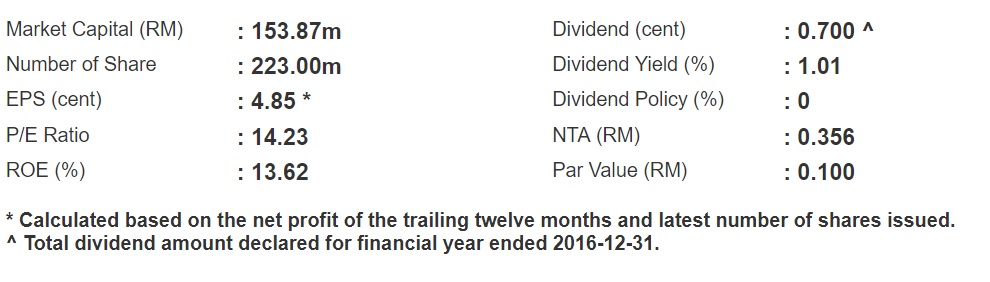

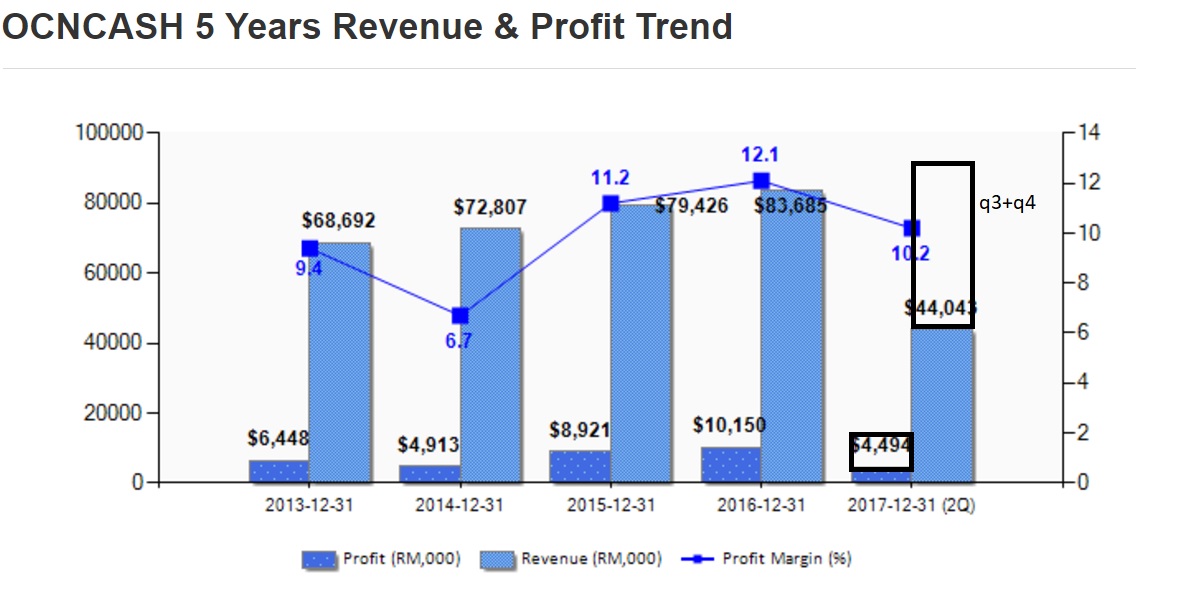

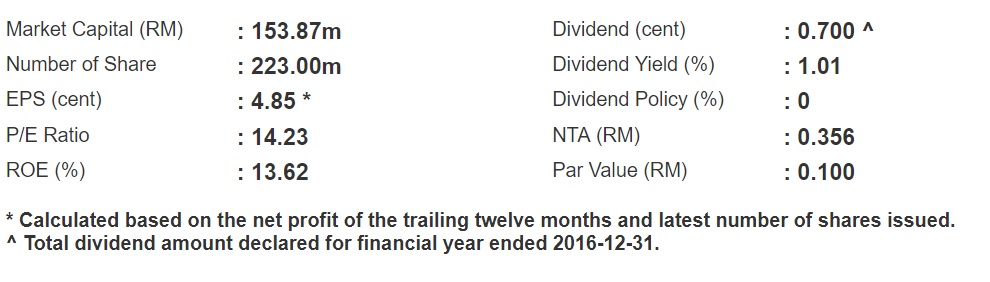

Since 2008, OCNCASH has been profitable for nine consecutive years in terms of performance in ACE market. Its turnover for the past five years is higher year after year, from FY12 RM59m to FY16 RM84m, equivalent to 9% compound annual growth rate, mainly due to the growth of non-woven business.

Profit of OCNCASH performance is also in steady growth, from FY12's RM2.6m higher to FY16 RM10.2m, equivalent to 40% compound growth. As a result of the reimbursement of a PE modular machine at FY14, the Group account in one off non-core loss of RM1.69m. Excluding this expense, its FY14 actual profit is RM6.60m, higher than FY13 RM6.45m. Its performance in recent years is mainly due to the growth of sales, the strength of the dollar against the ring, and the tax return (Provision of deferred tax).

In the FY16, its non-wovens business accounted for 63% of the overall turnover, car carpets business accounted for the remaining 37%. As the non-woven fabric is slightly lower than the car felt, its profit contribution fell slightly to 58%. Basically, the contribution of the two businesses is an average, forming a complementary relationship.

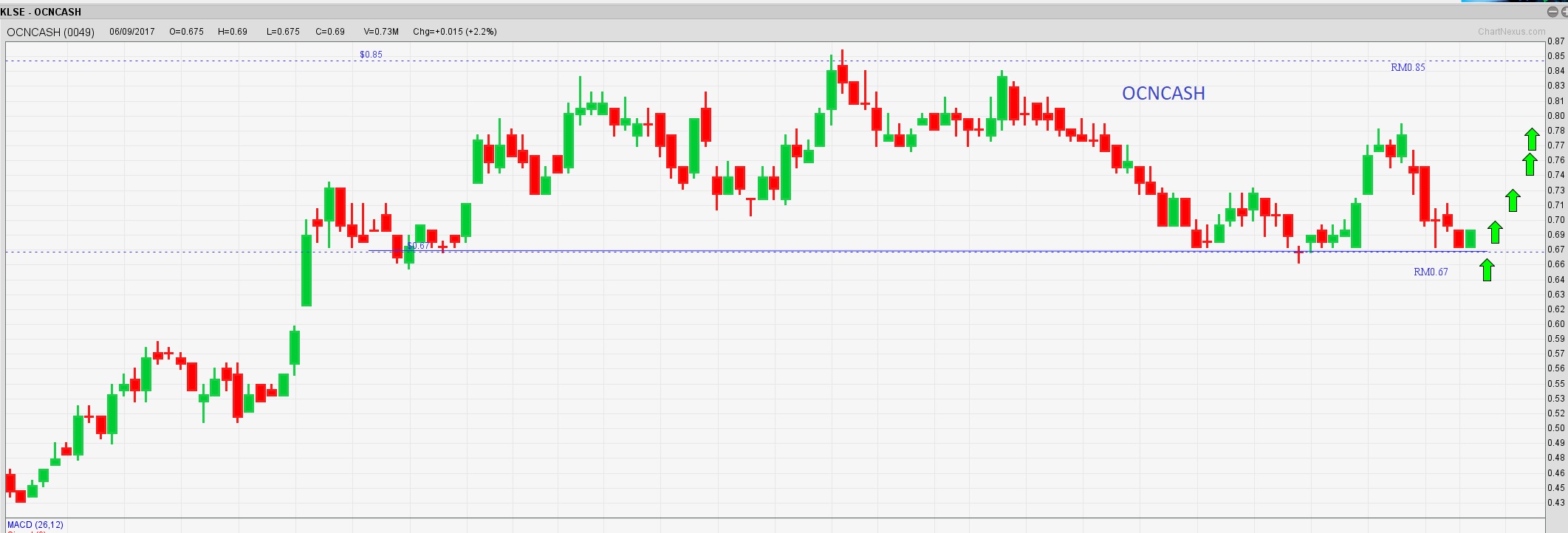

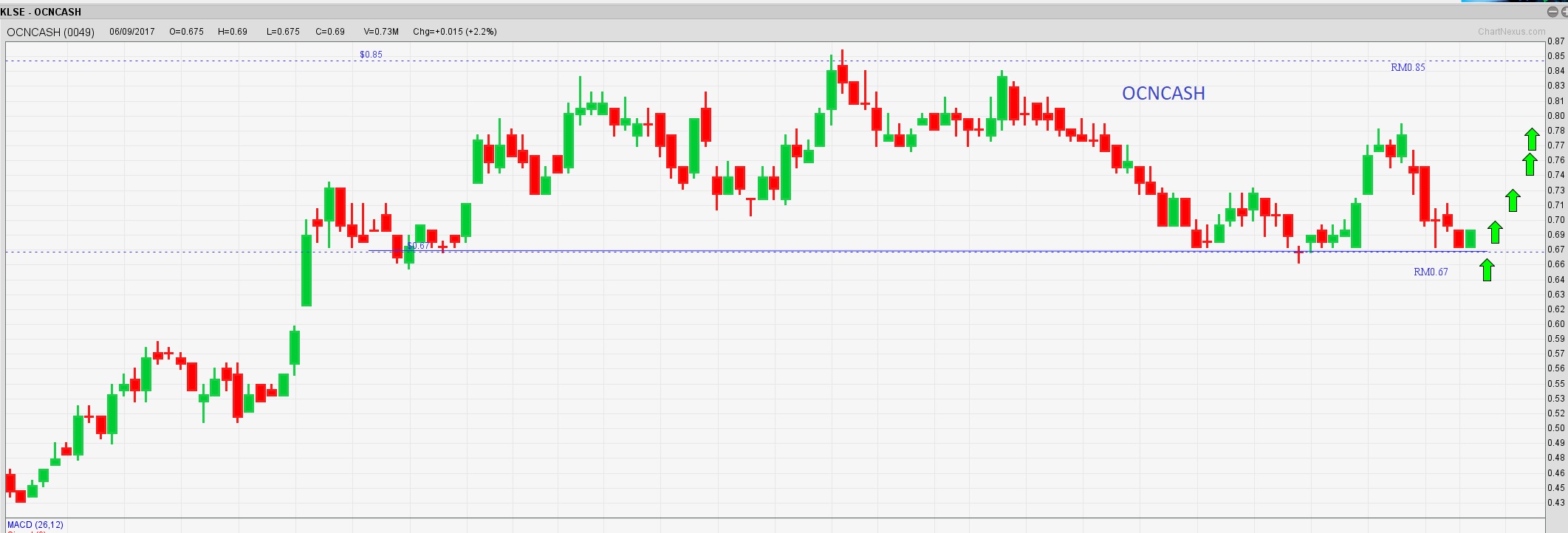

From the technical chart, oceancash has found its current support at RM0.67 and resistance at RM0.85, we are placing the cut loss point slightly lower than the support price at RM0.66. The current price is now at RM0.69, if the stock price refuse to reach the cut loss price, we are targeting the stock price at RM0.85

For short term

Entry price RM0.69

TP1 RM0.75

TP2 RM0.85

CL RM0.66

For Contra

Entry price RM0.69

TP1 RM0.78

CL RM0.66

Join our telegram for fastest update: http://telegram.me/share4u88

The Oceancash Group has come a long way from a humble beginning in 1997 as a resinated felt and non-woven manufacturer operating from rented premises. The nucleus of The Group was founded by Mr. Tan Siew Chin and Mr. Lo Pong Kiat. They have contributed and laid the foundation of what Oceancash Pacific Berhad is today. Over the years, The Group has expanded its range of products and services with its growing list of customers in South East Asia, China and Japan.

Oceancash Felts

Oceancash Felts Sdn. Bhd. (OFSB), a wholly owned subsidiary of Oceancash Pacific Berhad (OPB), is principally involved in the manufacturing of resinated felts and thermoplastic felts for heat insulation and sound insulation which include but not limited to; interior and exterior trims in automobiles, noise damper for compressors of split unit air conditioners as well as insulation in buildings including roofs, walls, partitions, and carpet underlay. Being one of the leading felts manufacturer in South East Asia with its long-standing expertise, Oceancash Felts Sdn. Bhd. is committed to working closely with existing and potential customers from around the world to develop and produce top-quality acoustic and thermal insulation felts.

Oceancash Nonwoven

Oceancash Nonwoven Sdn. Bhd. (OCN), a wholly owned subsidiary of Oceancash Pacific Berhad (OPB), was incorporated on December 21, 1999 in Malaysia. The principal activities of OCN are in the manufacturing and trading of air-through bonded nonwoven, and thermal bonded nonwoven, which are widely used in the disposable hygienic products industry. Its application include top-sheets, second layer, acquisition distribution layer (ADL), and back-sheet for diapers, sanitary napkins, wet wipes, and surgical apparels including caps, masks, and gowns.

Since 2008, OCNCASH has been profitable for nine consecutive years in terms of performance in ACE market. Its turnover for the past five years is higher year after year, from FY12 RM59m to FY16 RM84m, equivalent to 9% compound annual growth rate, mainly due to the growth of non-woven business.

Profit of OCNCASH performance is also in steady growth, from FY12's RM2.6m higher to FY16 RM10.2m, equivalent to 40% compound growth. As a result of the reimbursement of a PE modular machine at FY14, the Group account in one off non-core loss of RM1.69m. Excluding this expense, its FY14 actual profit is RM6.60m, higher than FY13 RM6.45m. Its performance in recent years is mainly due to the growth of sales, the strength of the dollar against the ring, and the tax return (Provision of deferred tax).

In the FY16, its non-wovens business accounted for 63% of the overall turnover, car carpets business accounted for the remaining 37%. As the non-woven fabric is slightly lower than the car felt, its profit contribution fell slightly to 58%. Basically, the contribution of the two businesses is an average, forming a complementary relationship.

OCNCASH's nonwovens revenue has grown in the past four years, rising

from FY13's RM40m to FY16's RM53m, thanks to higher sales in the local

and Japanese markets.

In recent years, the demand for disposable hygiene products has risen

rapidly in China and Southeast Asia. In order to meet the demand, many

Japanese diapers and personal care products manufacturers have shifted

the focus to the Southeast Asian market. As a non-woven manufacturer,

OCNCASH certainly can not miss this trend. The group purchased an

additional Spooling Machine at FY14 and further optimized its production

line to produce more upscale nonwovens.

These investments in FY15 and FY16 began to see the return. In addition

to reaching new customers, OCNCASH's existing customers also put more

orders to the group, driving its turnover for the first time

breakthrough RM50m. It is worth mentioning that its FY14 downturn in

profit performance mainly due to assume a RM1.69m mechanical

reimbursement losses. At the same time, the management did not make a

detailed explanation of the superior performance of FY13.

According to management, OCNCASH is expected to acquire new and old

customer orders for Spooled Nonwoven in the second half of 2017. They

also expect local brands of diapers and personal care products

manufacturers to switch to Air-Through Nonwoven in the near future to

replace existing low-end nonwovens. This ensures that local

manufacturers can compete with Japanese brands. As a result, the demand

for high quality ventilated nonwovens in the Southeast Asian market will

remain strong.

In the FY17Q1, although nonwovens turnover increased 14% yoy, but its

profit fell 43% year on year, in addition to paying higher taxes, the

Group also bear a very high operating costs to prepare for the upcoming

orders. Looking ahead, OCNCASH is expected to achieve better performance

once new orders have been made.

Transfer to main board requirements

In order to transfer from Ace market to main board, OCNCASH must meet one of the following conditions:

Profit after taxation of RM20m over the past 3 to 5 years and profit after tax RM6m in the latest fiscal year

Market value must reach RM500m

Infrastructure project enterprise o Infrastructure concession (Concession) or licensed at least 15 years, the project value is higher than RM500m

In the past four years (FY13-16), OCNCASH's accumulated after-tax profit is RM30.4m, while its FY16's after-tax profit is RM10.2m. In other words, the group has already reached the profit conditions of the profit test. However, the management does not seem to apply for a transfer board. To be sure, once OCNCASH apply for a transfer, in the future it will get more investors or fund favors and become a catalyst for stock price increases.

In order to transfer from Ace market to main board, OCNCASH must meet one of the following conditions:

Profit after taxation of RM20m over the past 3 to 5 years and profit after tax RM6m in the latest fiscal year

Market value must reach RM500m

Infrastructure project enterprise o Infrastructure concession (Concession) or licensed at least 15 years, the project value is higher than RM500m

In the past four years (FY13-16), OCNCASH's accumulated after-tax profit is RM30.4m, while its FY16's after-tax profit is RM10.2m. In other words, the group has already reached the profit conditions of the profit test. However, the management does not seem to apply for a transfer board. To be sure, once OCNCASH apply for a transfer, in the future it will get more investors or fund favors and become a catalyst for stock price increases.

From the technical chart, oceancash has found its current support at RM0.67 and resistance at RM0.85, we are placing the cut loss point slightly lower than the support price at RM0.66. The current price is now at RM0.69, if the stock price refuse to reach the cut loss price, we are targeting the stock price at RM0.85

Valuation

Conclusion

OCNCASH's blanket business in Malaysia coverage about 60% of the

market, mainly contributed by automotive and air conditioning industry.

More than 80% of the Group's non-wovens are exported to more than 10

countries worldwide. On the whole, its products have always been demand.

With the global population growth, the Group's future performance is

expected to get better.

Affin Hwang Maintain BUY With a New Target Price of RM0.88

Cimb Maintain BUY with target price of RM0.81

Our recomendation would beCimb Maintain BUY with target price of RM0.81

For short term

Entry price RM0.69

TP1 RM0.75

TP2 RM0.85

CL RM0.66

For Contra

Entry price RM0.69

TP1 RM0.78

CL RM0.66

Join our telegram for fastest update: http://telegram.me/share4u88

By Rainbow

DISCLAIMER : Investment involve risk, including possible loss of

principle and other losses. This article and charts are provided for

information only and should not be construed as a solicitation to buy or

sell any of the instruments mentioned herein. The author may have

positions in soe of these instruments. The author shall not be

responsible for any losses or lost profits resulting from investment

decisions based on the use of the information contained herein. If

investment and other professional advice are required, the services of a

licensed professional person should be sought.

http://klse.i3investor.com/blogs/rainbowshare4u/131656.jsp

http://klse.i3investor.com/blogs/rainbowshare4u/131656.jsp