“Ben Graham taught us to look at stocks as businesses, use the market’s fluctuations to your advantage, and seek a margin of safety. A hundred years from now, these will still be the cornerstones of investing.” – Warren Buffett quoted in The Warren Buffett Way by Robert G Hagstrom, 2005

Buffett's investment framework

We adopt Buffett and Munger's Four Filters framework in governing our investing process and decisions.

Buffett and Charlie look for companies that have (1) a business we understand; (2) favorable long-term economics; (3) able and trustworthy management; and (4) a sensible price tag.

Buffett also has phrased the Four Filters framework as below:

"When buying companies or common stocks, we look for (1) understandable

first-class businesses, (2) with enduring competitive advantages,

(3) accompanied by first-class managements, (4) available at a bargain price."

It is uncommon to find stocks that meet all the Four Filters.

Buffett says, "[W]e continue to think that it is

usually foolish to part with an interest in a business that is both understandable

and durably wonderful. Business interests of that kind are simply too hard to

replace."

"Regardless of price, we have no

interest at all in selling any good businesses that Berkshire owns."

With regard to Berkshire‘s portfolio of companies, he noted in his 1996 letter to shareholders that:

"We continue to make more money when snoring than when active. … [Y]ou simply want to acquire, at a sensible price, a business with excellent economics and able, honest management. Thereafter, you need only monitor whether these qualities are being preserved.""Following Ben's teachings, Charlie and I let out marketable equities tell us by their operating results - not only by their daily, or even yearly, price quotations - whether our investments are successful."

PPHB as a case study

In our posting on 7 March 2017, we identified PPHB as a Buffett-like stock after passing all Four Filters.

It is best followed up for educational purpose here since we have written extensively on PPHB and the company has published its 6-month financial results of FY17 vis-a-vis made a corporate exercise.

The business

PPHB is a total (one-stop) customized corrugated and paper packaging (product) solution (service) provider, spanning from artwork design and shape design, production, warehousing, and to packing and delivery services.

PPHB is favored as it is unlikely to experience major change. We are certain that its products possess enormous competitive strength ten or twenty years from now. Its products cost little to customers who need packaging to protect their goods and leave a good impression to their receivers.

The management

In FY16, based on its Annual Report 2016, PPHB invested RM13.59m for organic growth in terms of (1) factory building expansion and (2) machinery (operational facilities upgrade).

In the Q1 of FY17, the management guided that "we will continue to strengthen our position and expand customer base amidst the continuous competition and challenges faced. Our effort in enhancing operational efficiency and effectiveness ... cost control measures will be continued."

It was further indicated in its recent circular to shareholders in relation to the proposed bonus issue and a share issuance scheme that:

- Revenue increased by 8.03%, significantly higher than its previous 1.9% CAGR. This suggests that customer base vis-a-vis scale of operation have expanded, resulting likely from increasing customer demands and orders.

- All profit margins have increased marginally. They indicate improved efficiency as an effect of cost control measures.

- Compounding both revenue growth and improved margins, net profit for the first half of FY17 has increased by 9.56%.

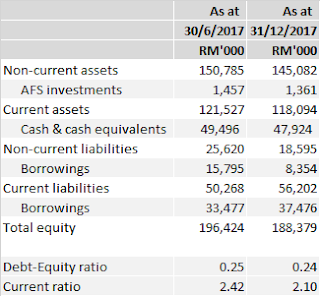

A quick glance on Balance Sheet finds that the fundamental of PPHB is still solid albeit a slight decrease in the cash holding.

From Cash Flows Statement, we learn that:

- Operating cash flow is not far from that of net profit, suggesting acceptable quality of earnings. The lower cash receipt is attributed to increased receivables and inventories (since cost of raw materials has been increasing) and decreased payables.

- Free cash flow is negative for the first time since FY11. Operating cash flow and additional cash were used to acquire property, plant and equipment.

Taken together, they offer a clear explanation to why the cash holding of PPHB has reduced.

The moat

PPHB creates value to customers by charging less to customers through improved efficiency (rather than passing all costs

onto customers).

As shown above, PPHB has already made a significant CapEx so far.

Although no information is readily available to elaborate the objective of the CapEx, the management once again guided that "we will continue to

strengthen our position and expand customer base amidst the continuous

competition and challenges faced. Our effort in enhancing operational

efficiency and effectiveness ... cost control measures will be

continued" in the Q2 report of FY17.

It is likely that PPHB has taken an ex-ante action to widen its moats.

We also hold a view that continuous enlarged CapEx as agitation to

challenge its competitors and get ready for the coming wave of

e-commerce that driven by Alibaba's trade and logistics hub in Malaysia.

The price

PPHB's share

price closed at RM1.46 as at 30 Aug 2017. It is still behind its

intrinsic value (approximately RM1.85/share at the time of writing).

It is likely to

trend downward if its shareholders do not understand the main factor

(tax provision as explained earlier) that lowered the net profit of Q2

year-on-year, and overlook its significant CapEx in driving potential

growth.

If that is the case, there will be opportunities for shareholders and investors to acquire this quality company cheap.

Takeaway

It is clear that the management has kept their words and produced satisfactory operating results to date.

Importantly, the management has continued seeking and reaping moat

widening opportunities in relation to its top grade services in its

efficiency-led low cost business model.

Based on these evidences, it can be concluded that all qualities of PPHB that we identified earlier are being preserved.

Buffett's approved disposal

In his 1989 letter to shareholders, Buffett advocates selling early when you’ve bought a “cigar butt” —

a mediocre company with one puff of pleasure left before it sinks

permanently into oblivion. Such companies are out of favor for good

reason and sell at very low prices. They may have one last gasp of

success causing the stock to go up temporarily, and when that bounce

happens, Buffett says you need to sell immediately: “Time is the friend

of the wonderful business, the enemy of the mediocre.

When its comes to quality businesses, Buffett says "sometimes (not all

the time)... we will sell a security that is fairly valued or even

undervalued because we require funds for a still more undervalued

investment or one we believe we understand better."

That note effectively suggests that a disposal is approved if one finds a

better company that sails through the Four Filter at a higher standard

than an existing holding.

"We need to emphasize,

however, that we do not sell holdings just because they have appreciated or

because we have held them for a long time. (Of Wall Street maxims the most

foolish may be “You can’t go broke taking a profit.”) We are quite content to

hold any security indefinitely, so long as the prospective return on equity

capital of the underlying business is satisfactory, management is competent and

honest..."

"[W]hen we own portions of

outstanding businesses with outstanding managements, our favorite holding

period is forever. We are just the opposite of those who hurry to sell and book

profits when companies perform well but who tenaciously hang on to businesses

that disappoint. Peter Lynch aptly likens such behavior to cutting the flowers

and watering the weeds."

"Interestingly, corporate managers

have no trouble understanding that point when they are

focusing on a business they operate: A parent company that owns a subsidiary with superb long-term economics is not likely to sell that entity regardless of price. “Why,” the CEO would ask, “should I part with my crown jewel?” Yet that same CEO, when it comes to running his personal investment portfolio, will offhandedly—and even impetuously—move from business to business when presented with no more than superficial arguments by his broker for doing so. The worst of these is perhaps, “You can’t go broke taking a profit.” Can you imagine a CEO using this line to urge his board to sell a star subsidiary? In our view, what makes sense in business also makes sense in stocks: An investor should ordinarily hold a small piece of an outstanding business with the same tenacity that an owner would exhibit if he owned all of that business."

focusing on a business they operate: A parent company that owns a subsidiary with superb long-term economics is not likely to sell that entity regardless of price. “Why,” the CEO would ask, “should I part with my crown jewel?” Yet that same CEO, when it comes to running his personal investment portfolio, will offhandedly—and even impetuously—move from business to business when presented with no more than superficial arguments by his broker for doing so. The worst of these is perhaps, “You can’t go broke taking a profit.” Can you imagine a CEO using this line to urge his board to sell a star subsidiary? In our view, what makes sense in business also makes sense in stocks: An investor should ordinarily hold a small piece of an outstanding business with the same tenacity that an owner would exhibit if he owned all of that business."

As an implication, we should push the "sell" button when a company is no longer a star as defined by the Four Filters.

Being a co-owner

We practically "bring" our invested companies with us at all time and refer prospective customers to the management, sometimes, at our own cost.

For example, in our recent acquisition due diligence exercise on an Australian dairy farm, we introduced PPHB as to how it would create value to one of the Malaysia's largest fresh milk producers (traders soon). The COO was interested in exploring further and we immediately passed his personal contact to Mr. Koay (MD of PPHB) on the next working day.