6 Nov 2017, 09:55 AM

Hi Guys,

I think almost all investors do not realise the goods of Malaysia's Budget 2018 for local tourism industry as the beneficiary is normally Genting Bhd and indirectly to big cap consumer stocks. It seldom benefits small-mid cap or penny stocks.

But this time around, I found Ho Wah Genting Bhd (HWGB) is the direct beneficiary of tourism theme and will gain from the rising trend of footfall to Genting Highlands Resort.

You can say HWGB is just a penny stock now but I am sure it would become sooner-than-later a stable and profitable company.

When

people start to realise HWGB's potential profit, the share price may

shoot up similar to other penny stocks with better fundamental prospect

such as Palette, Muiind, Cuscapi, Keyasic - just to name a few.

For

example, Palette was trading at only 5 sen in August this year but now

it is being traded at 40sen above. More than 700% in 3 months.

Unbelieveable. Yes, of course it was because of new shareholders came on

board and strong turnaround of quarter results.

But do you know behind the scene of what they know before the rally in share price of Palette?

They

know something that you dont know. That's why they are ahead of us and

some of us missed the boat. They have actually in the stock before the

news came out about their emergence in the stock. AND nobody realise Palette's earnings prospect when they penetrated into Russia that time until the results out recently.

So, it is about discovery of new Gem just like I want to do the same here to HWGB. Nobody realise it yet.

Game changer for HWGB

HWGB typically does manufactures and trading various types of wire and cable, moulded power supply cord sets and cable assemblies, offers a wide variety of travel packages and tours across the globe and tin mining activities.Fundamentally, its profitability is inconsistent over the last 5 years.

However, this inconsistency could end this year and a new chapter of HWGB's earnings prospect would begin next year. A new JV partner has been brought in to turn HWGB's profitability around.

HWGB has recently tied up with Dufry International AG, a member of Dufry Group to incorporate a company for the operation of a duty and tax free shop in SkyAvenue mall located at the popular tourist spot in Malaysia, Genting Highlands Resort, Pahang, Malaysia.

Dufry is wholly owned by Dufry AG, and it is a member of Dufry Group, which is the leading global travel retailer with operations in approximately 62 countries, comprised of more than 2,200 shops located at airports, railways, cruise liners, seaports, and other touristic locations.

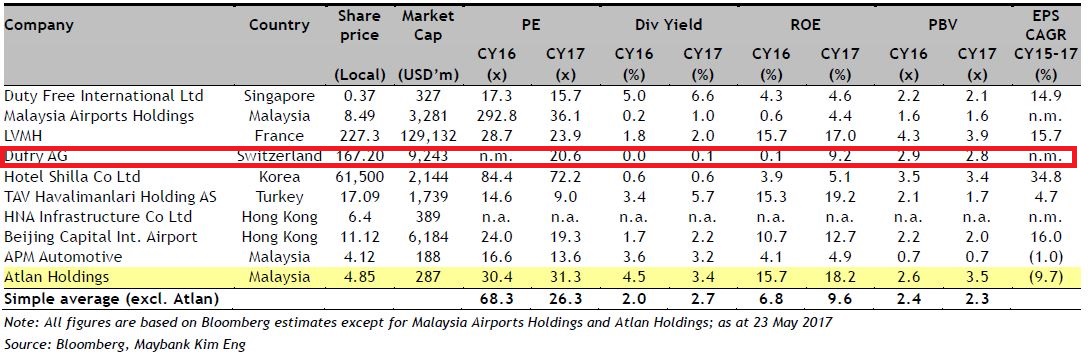

Dufry is also larger than domestic's duty free operators, Atlan, MAHB and APM Automotive

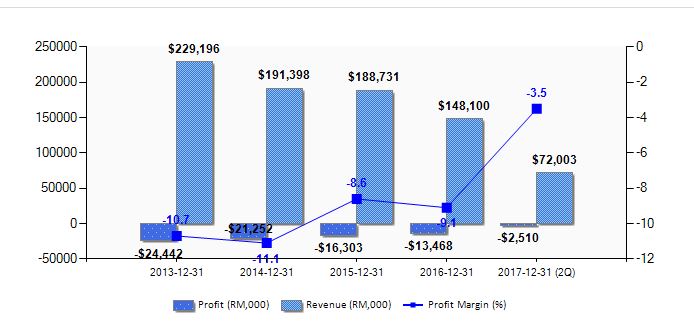

Dufry's sales/turnover and gross profit are impressive and on healthy growth over the last five years.

Dufry's 9M17 sales continued to chalk growth.

With this partnership, it would potentially help HWGB to generate more revenue and make profit going forward.

AND we are not only talking about strong partner but also robust tourism sector and growing number of visitors to Genting Highlands Resort, Pahang.

Simple equation = the more rosy tourim sector and crowds from various countries particularly China tourists visit Genting Highlands, the more they shop at HWGB-Dufry's duty free shops at Genting there. Therefore, the more income HWGB can earn.

Tourism sector

In 2016, the tourist arrivals to Malaysia increased by 4.3 percent from 25.7 million in 2015 to 26.8 million in 2016. Similarly, tourist receipts rose by 18.8 percent from RM69.1 billion in 2015 to RM82.1 billion in 2016. The country’s stronger tourism data in 2016 was attributed to improved flight accessibility and travel facilitation as well as favourable foreign exchange rate.

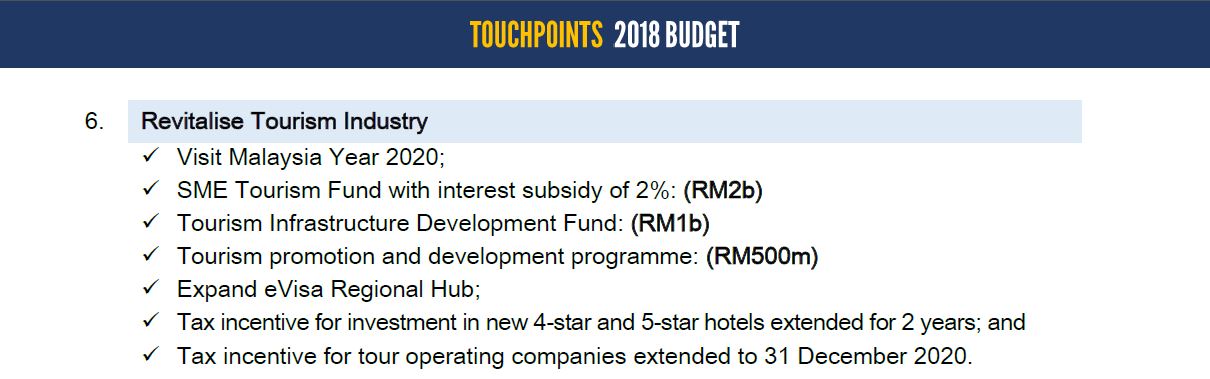

Recall that our Prime Minister had highlighted tourism theme in the Budget 2018 recently.

HWGB to benefit from potential strong visitors to Genting Highlands Resort

Visitor

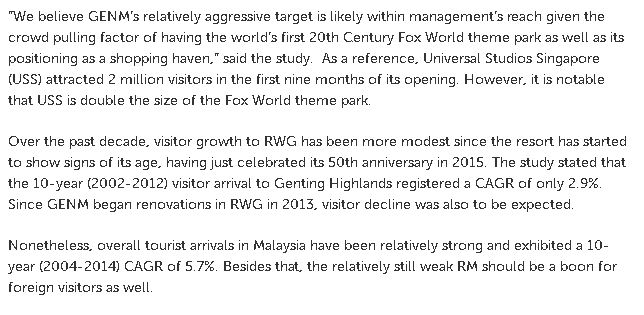

arrivals for the resort are set to grow sharply and the management

expects Resorts World Genting (RWG) to record 30 million visitors

annually by 2020.

The current expansion plans in Genting Highlands under the Genting Integrated Tourism Plan (GITP) are set to lure in more visitors.

An

additional RM5.38billion capital expenditure has been allocated towards

expanding Genting's gaming capacity in the podium (Sky Plaza).

Among

other expansion, the Fox World theme park will also ramp up its

offerings and cost about RM2billion (previously RM1billion) to create.

Affin

Hwang Research also states that the world’s first 20th Century Fox

World theme park will be crowd pulling factor to Genting.

Conclusion

My opinion, HWGB is

on right track to return to black and in a position to chalk robust

both revenue and profit growth from a strong partnership with Dufry and

to benefit from short-to-long-term booming tourism sector.

In fact, HWGB

is the only penny stock that benefit directly from tourism industry.

The share price is relatively cheaper at 5sen only as compared to

Genting, or Atlan or MAHB or APM Automotive.

It

also provide as cheaper alternative stock for a duty free operator

rather than go into expensive duty free operator stocks like Atlan or MAHB or APM Automotive.

Furthermore, I believe the share price of HWGB is yet to reflect all these positive catalysts. The stock is being trading at all time low.

Judging by potential profit, the stock could make a comeback to return to its glory days. 6 years back, the stock traded at high of 80-90sen. There

is no specific timeframe to fly but time will tell. U will not know

when to fly but when it comes, u sure will regret to miss it!

While

dodgy stock like DGSB can fly about 3x of PBV just because of makeup

story of DFTZ, why not to HWGB with better earnings prospect too. HWGB is now trading at 1x PBV of 6sen. If we apply the same 3x PBV for HWGB, it could be trading at 18sen at least!

My investment philosophy; whoever makes an early move, they will be the one gain the most!