Inta Bina Group was incorporated on 11 March 2015

under a public limited company. Inta has secured Construction Industry

Development Board of Malaysia (CIDB)’s G7 registration, the highest

grade available. This G7 class enables Inta to undertake building and

civil engineering construction projects of any size and value within

Malaysia. In other words, G7 grade allows Inta to tender construction

projects in Malaysia that are of unlimited value.

Inta Bina Group is a building contractor with more than 25 years of operating history in the construction industry in Malaysia. Inta has completed more than 110 building construction projects with a total contract value of more than RM2 Billion, mainly in the Klang Valley and Johor. From these 110 building completion projects, Inta has never experiencing any non-completions save for one industrial project which was terminated in 1999 due to the developer's payment default.

Let see Inta past and current clients list as below:

1. Eco World Development Group Bhd (Main client)

2. Mitraland Group SB (Main client)

3. Gamuda Bhd

4. Engtex Group Bhd

5. Mah Sing Group Bhd

6. Paramount Corporation Bhd

7. Plenitude Bhd, Selangor Dredging Bhd

8. Tropicana Corporation Bhd

9. SP Setia Bhd

10. Notable non-public listed property developers such as Perdana ParkCity SB and Singapore-listed Lum Chang Holdings Limited.

Unbilled contract valued from Mitraland and Eco World on 31 March 2017 amount is RM322 mil (about 66% revenue of FY2016).

Most of Inta’s projects are also assessed under both CONQUAS and QLASSIC by the Building and Construction Authority Singapore and CIDB respectively. QNQUAS is a recognized benchmarking tool to measure the quality of building projects among industry players in Malaysia that reflects corresponding workmanship standards. Since 2015, Inta has participated in 51 building construction projects which CONQUAS scores have already been given. As at 15 April 2017, respective projects have achieved an average CONQUAS scoring of 78.2%, against industry average of 76.0%. In certain projects, Inta has achieved a CONQUAS score of 80.0% and above, the group was rewarded by clients with incentives ranging from 0.25% to 1.00% of the contract sum.

Fundamental Data

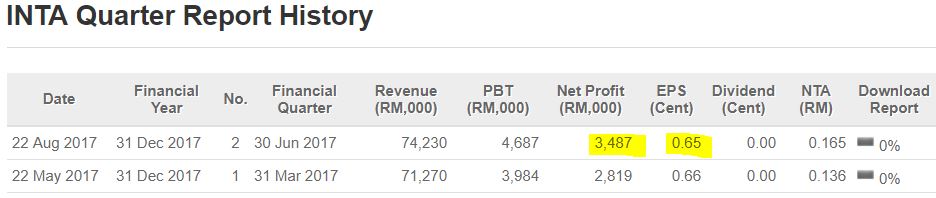

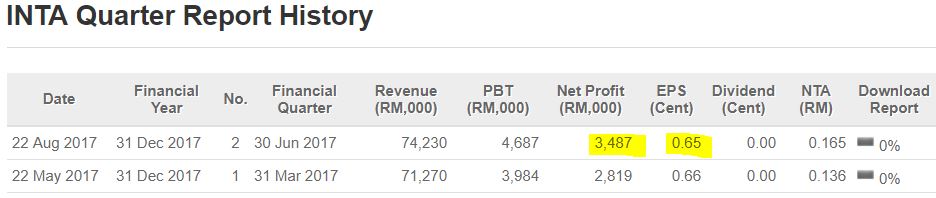

Due to Inta is just listed in Bursa from 25 May 2017, we can only access to two quarters results from Bursa website. The chart below shows Inta’s revenue and net profit for Q1’17 and Q2’17.

Source: www.malaysiastock.biz

For a more comprehensive overview of Inta’s past financial results, let us go through the following table (from Inta’s prospectus)

Source: Prospectus of Inta

Orderbook

One of the important valuation metrics for construction counter is the total orderbook. Let us see the latest orderbook value of Inta provided in their latest quarter report as below:

Source: Inta Q2’17 report

Form the Q2’17 report, we can observe that Inta’s unbilled order book amounts to RM618.79 million on 30 June 2017.

Coming quarter Profit Forecast for Q3’17 (July-Sept 2017)

Let me have a forecast analysis for their coming profit for its Q3’17 (to be released in Nov) based on the orderbook value and past profit margin.

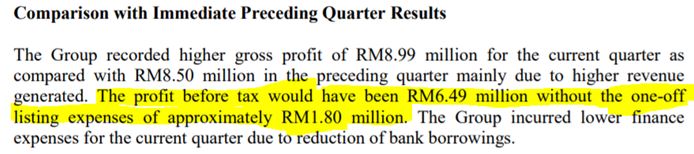

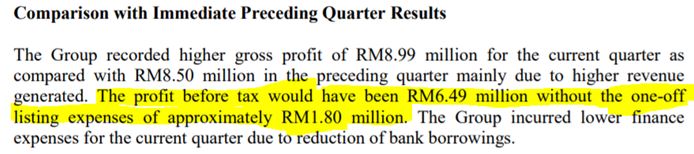

Before we start the profit estimation, let us have a look on the on the comparison of result as per in their Q2’17 report

Source: Inta Q2’17 report

The Profit before tax in Q2’17 would have been RM6.49 mil if we exclude the one-off listing expenses. Assuming income tax rate of 25% (as per Q2 rate), the net profit margin (NPM) of Inta is as per below:

NPM = (6.49 X 0.75 / 74.2) X 100% = 6.6 %

Assuming RM618.79 mil orderbook could be completed in about 2 years’ timeframe with a net profit margin of 6.6%,

1) Estimated Net profit per year, NP = 618.79 mil / 2 years X 0.066 = RM20.42 mil

2) NP in a quarter = 20.42 mil / 4 = RM5.1 mil.

For forward 12-months, the estimated net profit is RM20.42 mil --> EPS of 3.82 sen

For coming Q3 result the forecast net profit is RM5.1 mil --> EPS of 0.95 sen.

The estimated EPS of 0.95 cent is an improvement of 46% QoQ (quarter over quarter). There are no YoY (year over year) data for comparison as it is just listed in May 2017.

Let us have a look on Inta forward 9-12 months fair value as table

below (with 3 different PE) based on the estimated EPS of 3.82 cents

(due to current industry average PE is about 14.4)

Let see the PE and orderbook comparison with its peers of similar capital size construction counters as table below:

Based on current price of RM0.38 with a possible 0.95 cent EPS in the

coming quarter result, Inta possible forward 12-month PE (annualize EPS

3.82 sen) could be improve to 10. Most of the small and medium capital

average construction counters PE is about 14.4x which imply that

possible target price for Inta is in the range of 50 cents (PE 13x) and 58 cents (PE 15x).

Main Catalysts for future profit growth:

1. IBS (Industrialised Building System) - Improvement in cost competitiveness by IBS adoption as it will reduce project labour cost and shorten the construction period. With IBS adoption, aluminium and steel system formworks can be reused that is suitable for mass construction of buildings with repetitive design. 5 million (18.7%) from IPO proceeds is to invest in the Industrialised Building System (IBS) and machinery

2. Already qualified to transfer to Main Board as Inta already fulfilled Main Board profit requirement (past 3 years total net profit more than 20 mil).

3. Possibility to secure more projects from its tender book (total tender book of RM2B) especially from Eco World and other big property developers.

4. Inta has been actively in tendering for projects in the Klang Valley from private housing developers under the federal and state affordable housing initiatives such as Rumah Mampu Milik Wilayah Persekutuan and Rumah Selangorku (affordable housing project) which are still in demand.

Risk

1. Inta track records and the CONQUAS score show their commitment to quality in their works. Apart from ISO 9001:2008 certification, Inta's past and continued participation in projects assessed under CONQUAS has exhibited its commitment in providing quality construction services (some clients like SP Setia has demanded high quality of work in their housing projects).

2. Inta has invested in IBS technology system from their IPO proceeds which can reuse the Aluminium system formwork (up to 300 cycles). IBS also provides simplicity in assembly and swiftness during separation. It is suitable for mass construction of buildings with repetitive design and it is expected to save their cost and time.

3. Experience key management team, led by MD and Deputy MD (Mr Lim LJ and Teo HC) with both of them has more than 30 years of working experience in the construction industry.

4. With more than 25 years of operating history and participation in more than 110 building construction projects of various sizes and building types, Inta is a reliable partner choice for established property developers as Inta has never experiencing any non-completions of project except for one terminated project.

5. Inta past 3 years profit already qualified to transfer to Main Board as Inta already fulfilled Main Board profit requirement (aggregate of past 3 year profit of at least RM20 mil).

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/lionind/137704.jsp

Inta Bina Group is a building contractor with more than 25 years of operating history in the construction industry in Malaysia. Inta has completed more than 110 building construction projects with a total contract value of more than RM2 Billion, mainly in the Klang Valley and Johor. From these 110 building completion projects, Inta has never experiencing any non-completions save for one industrial project which was terminated in 1999 due to the developer's payment default.

Let see Inta past and current clients list as below:

1. Eco World Development Group Bhd (Main client)

2. Mitraland Group SB (Main client)

3. Gamuda Bhd

4. Engtex Group Bhd

5. Mah Sing Group Bhd

6. Paramount Corporation Bhd

7. Plenitude Bhd, Selangor Dredging Bhd

8. Tropicana Corporation Bhd

9. SP Setia Bhd

10. Notable non-public listed property developers such as Perdana ParkCity SB and Singapore-listed Lum Chang Holdings Limited.

Unbilled contract valued from Mitraland and Eco World on 31 March 2017 amount is RM322 mil (about 66% revenue of FY2016).

Most of Inta’s projects are also assessed under both CONQUAS and QLASSIC by the Building and Construction Authority Singapore and CIDB respectively. QNQUAS is a recognized benchmarking tool to measure the quality of building projects among industry players in Malaysia that reflects corresponding workmanship standards. Since 2015, Inta has participated in 51 building construction projects which CONQUAS scores have already been given. As at 15 April 2017, respective projects have achieved an average CONQUAS scoring of 78.2%, against industry average of 76.0%. In certain projects, Inta has achieved a CONQUAS score of 80.0% and above, the group was rewarded by clients with incentives ranging from 0.25% to 1.00% of the contract sum.

Fundamental Data

Due to Inta is just listed in Bursa from 25 May 2017, we can only access to two quarters results from Bursa website. The chart below shows Inta’s revenue and net profit for Q1’17 and Q2’17.

Source: www.malaysiastock.biz

For a more comprehensive overview of Inta’s past financial results, let us go through the following table (from Inta’s prospectus)

Source: Prospectus of Inta

Orderbook

One of the important valuation metrics for construction counter is the total orderbook. Let us see the latest orderbook value of Inta provided in their latest quarter report as below:

Source: Inta Q2’17 report

Form the Q2’17 report, we can observe that Inta’s unbilled order book amounts to RM618.79 million on 30 June 2017.

Coming quarter Profit Forecast for Q3’17 (July-Sept 2017)

Let me have a forecast analysis for their coming profit for its Q3’17 (to be released in Nov) based on the orderbook value and past profit margin.

Before we start the profit estimation, let us have a look on the on the comparison of result as per in their Q2’17 report

Source: Inta Q2’17 report

The Profit before tax in Q2’17 would have been RM6.49 mil if we exclude the one-off listing expenses. Assuming income tax rate of 25% (as per Q2 rate), the net profit margin (NPM) of Inta is as per below:

NPM = (6.49 X 0.75 / 74.2) X 100% = 6.6 %

Assuming RM618.79 mil orderbook could be completed in about 2 years’ timeframe with a net profit margin of 6.6%,

1) Estimated Net profit per year, NP = 618.79 mil / 2 years X 0.066 = RM20.42 mil

2) NP in a quarter = 20.42 mil / 4 = RM5.1 mil.

For forward 12-months, the estimated net profit is RM20.42 mil --> EPS of 3.82 sen

For coming Q3 result the forecast net profit is RM5.1 mil --> EPS of 0.95 sen.

The estimated EPS of 0.95 cent is an improvement of 46% QoQ (quarter over quarter). There are no YoY (year over year) data for comparison as it is just listed in May 2017.

|

Inta’s EPS (Cent) |

|

|

Q1’17 |

0.66 |

|

Q2’17 (affected by listing expenses and Hari Raya) |

0.65 |

|

Q3’17 (July-Sept) - Forecast |

0.95 |

|

Inta’s fair value based on EPS of 3.82 sen |

|

|

PE15

|

0.58

|

|

PE13

|

0.50

|

|

PE11

|

0.42

|

Let see the PE and orderbook comparison with its peers of similar capital size construction counters as table below:

|

|

Orderbook |

Market Cap |

PE |

Price |

Ratio (Orderbook vs market cap) |

Net Profit margin |

Current price vs IPO price |

|

Inta |

619mil |

203mil |

?? |

0.38 |

3.04 |

6.6% |

38 sen vs 25 sen |

|

Advcon |

572mil |

466mil |

~13 |

1.16 |

1.22 |

9.1% |

1.16 vs 63 sen |

|

HSSEB |

500mil |

364mil |

24.6 |

1.14 |

1.37 |

7.8% |

1.14 vs 50 sen |

Main Catalysts for future profit growth:

1. IBS (Industrialised Building System) - Improvement in cost competitiveness by IBS adoption as it will reduce project labour cost and shorten the construction period. With IBS adoption, aluminium and steel system formworks can be reused that is suitable for mass construction of buildings with repetitive design. 5 million (18.7%) from IPO proceeds is to invest in the Industrialised Building System (IBS) and machinery

2. Already qualified to transfer to Main Board as Inta already fulfilled Main Board profit requirement (past 3 years total net profit more than 20 mil).

3. Possibility to secure more projects from its tender book (total tender book of RM2B) especially from Eco World and other big property developers.

4. Inta has been actively in tendering for projects in the Klang Valley from private housing developers under the federal and state affordable housing initiatives such as Rumah Mampu Milik Wilayah Persekutuan and Rumah Selangorku (affordable housing project) which are still in demand.

Risk

1. Property development projects slow down. I think property

sector has started to slowly recover but even at 2015-2017 Inta still

can show growth in their revenue and profit.

2. Foreign workers shortage (can be mitigated by IBS)

3. High steel (rebar) price.

4. Competition in the construction industry

Summary1. Inta track records and the CONQUAS score show their commitment to quality in their works. Apart from ISO 9001:2008 certification, Inta's past and continued participation in projects assessed under CONQUAS has exhibited its commitment in providing quality construction services (some clients like SP Setia has demanded high quality of work in their housing projects).

2. Inta has invested in IBS technology system from their IPO proceeds which can reuse the Aluminium system formwork (up to 300 cycles). IBS also provides simplicity in assembly and swiftness during separation. It is suitable for mass construction of buildings with repetitive design and it is expected to save their cost and time.

3. Experience key management team, led by MD and Deputy MD (Mr Lim LJ and Teo HC) with both of them has more than 30 years of working experience in the construction industry.

4. With more than 25 years of operating history and participation in more than 110 building construction projects of various sizes and building types, Inta is a reliable partner choice for established property developers as Inta has never experiencing any non-completions of project except for one terminated project.

5. Inta past 3 years profit already qualified to transfer to Main Board as Inta already fulfilled Main Board profit requirement (aggregate of past 3 year profit of at least RM20 mil).

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/lionind/137704.jsp