JHM (0127) - JHM CONSOLIDATION BHD BREAKOUT ON 3 NOV 2017 (10 CONSECUTIVE QUARTERS OF GROWTH)

As shown in the above screenshot, JHM rose 22 sen (a breakout) on 3 November 2017. It is due to the following news.

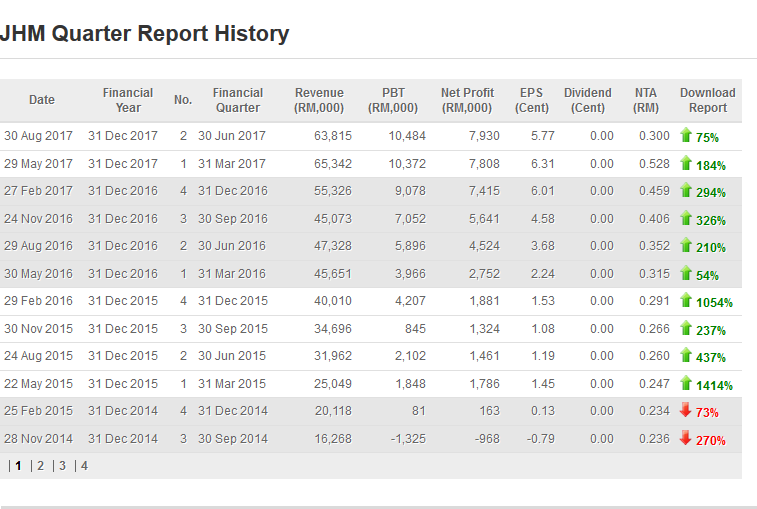

JHM is expected to announce its 3rd quarter results end of November 2017 after achieving 10 consecutive quarters of growth, as shown in the following table.

Before we look at the plans of JHM, let's review the business background of the renowned company.

JHM Consolidated Berhad is a Penang-based investment holding company. Through its subsidiaries, it operates in two segments: electronic products, which is engaged in manufacturing and assembling of components related to high brightness light emmitting diode (HB LED), direct current (DC) micromotor components and fine pitch connector pins. Its subsidiaries are Morrissey Technology Sdn Bhd, which is engaged in the design and manufacturing of precision miniature engineering metal parts and components; and Jingheng Electronic Precisiontechnology Sdn Bhd, which is engaged in the original design manufacturing of semiconductor light emmiting diodes components.

Let's take a look at the company's plans from present to past.

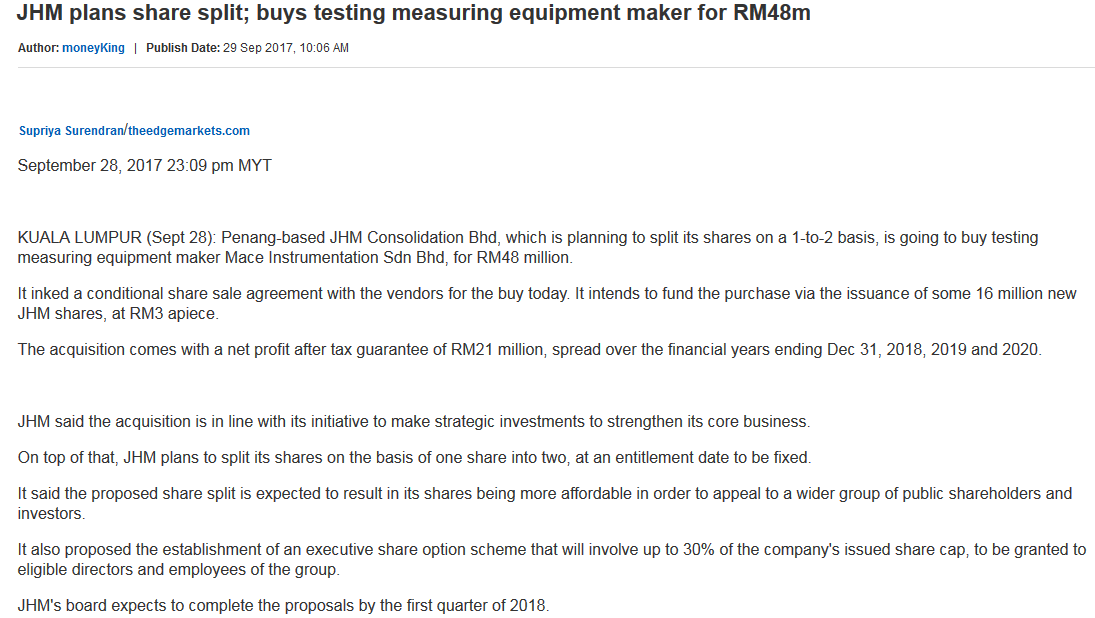

At this moment, it is taking a corporate exercise of a share split of 1 into 2.

Kindly please read carefully the above sentense in the second paragraph "It intends to fund the purchase of a testing measuring equipment maker via the issuance of some 16 million new JHM shares at RM3 apiece. Hence, logically the share price of JHM cannot be lower than RM3.

This is the second corporate exercise of JHM after it had successfully taken a bonus issues of 1 for 1. Its price one day before its ex date on 15 June 2017 was RM5.29. If history were to repeat itself, thus JHM share price should rise above RM5 before the ex-date for its share split of 1 into 2 this time.

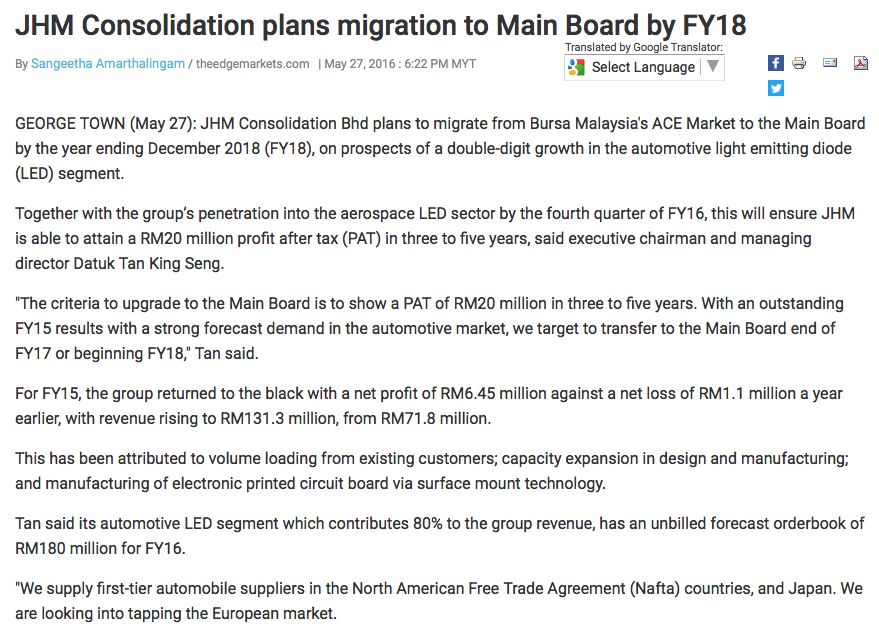

Next, JHM has planned to transfer its listing from the ACE Market to the Main Board by FY2018. The condition is that it must achieve a profit figure and uninterrupted profit after tax (PAT) of 3 to 5 full financial years with an aggregate of a minimum of RM20 million and a minimum of RM6 million PAT in the latest full financial year. Thus, its quarter results must keep on growing for the next 2 quarters (2 remaining quarters in 2017/18).

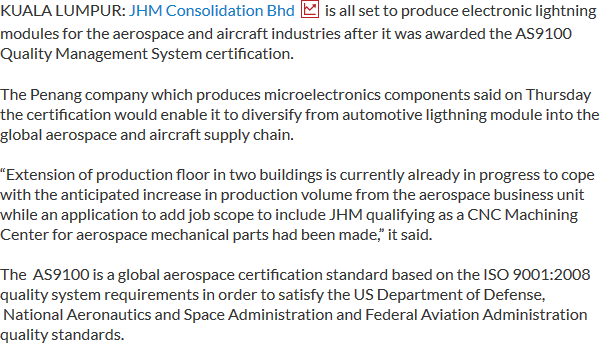

Finally, let's read JHM's successfull venture into aerospace and aircraft LED lighting.

Lastly, let's read the humble beginning of JHM when ICON8888 started blogging on JHM on 30 December 2015 as a penny share at RM0.47.

http://klse.i3investor.com/blogs/Chloe_Tai_Blog/137178.jsp