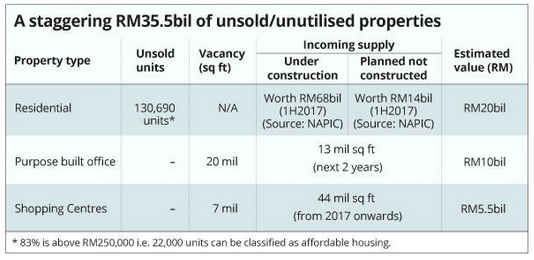

If you read the property outlook 2017 by CBRE-WTW and report by National Property Information Centre (NAPIC),

you likely would have noticed the undertone – softening residential

market and perhaps an even bigger problem lay in the overcapacity of

shopping mall (retail space per capita has exceeded Hong Kong &

Shanghai) and office tower (expected vacancies expected to rise to 32%

in 2021 from 24% in 2Q2017). And of course, a sharp slowdown in the

construction sector, which has the highest multiplier effect, will

probably lead to a general recession.

Source : The Star Online

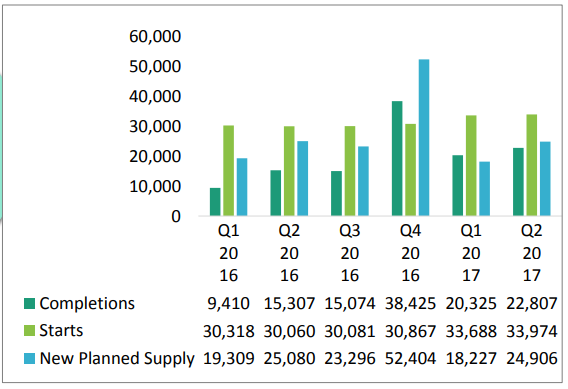

Soft Property Market, No Slowdown

But,

at least as of now, there is no slowdown detected. In the same NAPIC

slide, both Q1 and Q2 2017 jolted notable increase in number of starts

on YoY basic.

NAPIC: Residential Market Inventories.

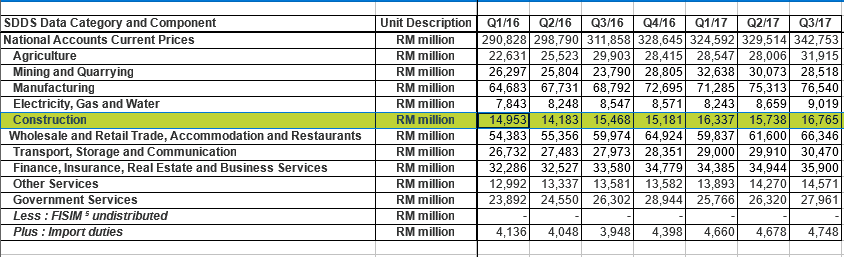

Construction Sector Is Still Growing

Let’s

try to check the latest Q32017 data from Bank Negara site. So far, the

construction sector is still growing. It must be noted that property

segment still account for more than 60% of all construction

activities.

Source: Bank Negara Website

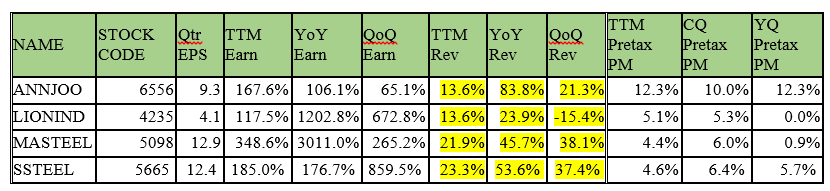

Good Results from Long Steel Product Subsector

Current

quarterly results from steel – long (steel bar/billet/wire) subsector

is still showing growth. Revenue is largely growing on TTM (Twelve

Trailing Months), YoY & QoQ basic. Pretax margin for current

quarter is mostly higher than TTM basic, which means margin is still

expanding.

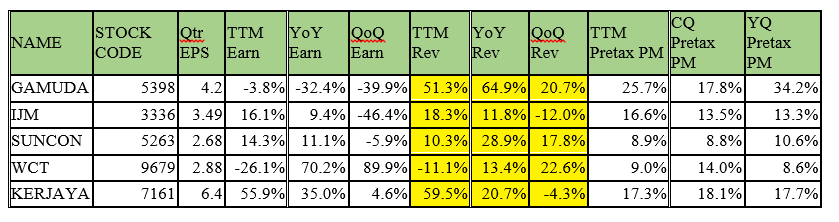

Reiterating that Construction Sector Is Still Growing

Similarly,

the biggest 5 construction companies by market cap are showing strong

revenue growth. Sharp contraction in QoQ earning for both Gamuda and

IJM can be attributed to one-off factor: the former due to impairment of

SMART tunnel while the latter due to inclusion of gain from land

disposal in the previous quarter.

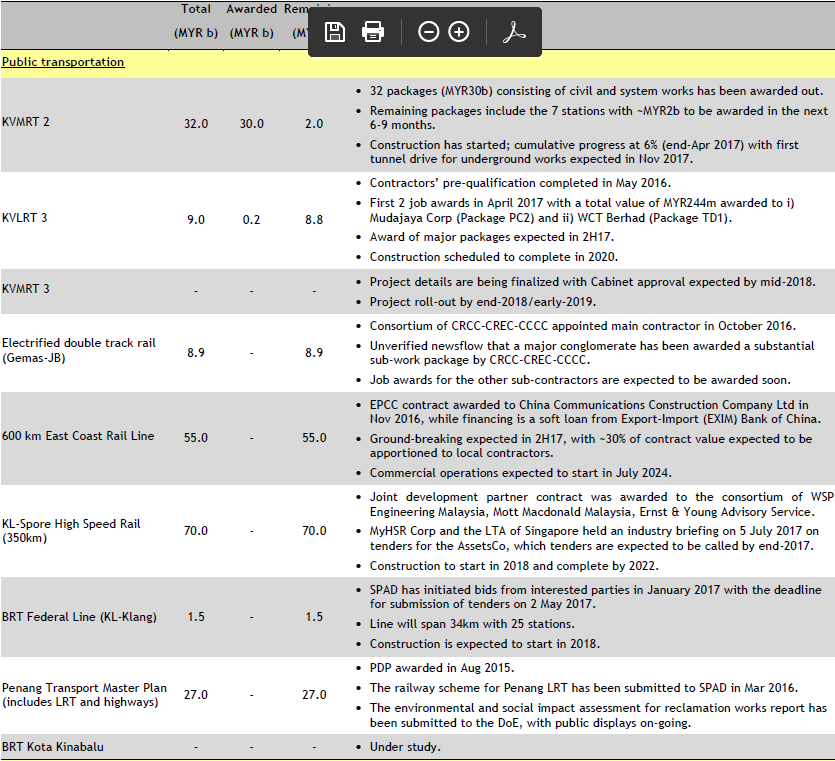

And of course, we must be aware of a glut of railway projects to be awarded in the coming months.

Conclusion

Properties

segment’s softness will be compensated by ramp-up in the infrastructure

segment. Over time, the growth rate should converge to the national GDP

growth rate. That said, we must always remember both the properties and

construction sector are cyclical stocks. Just ride the wave to the top,

we may never know where the top is but on balance, there should still

be a few quarters more to go. Caution is necessitated in a general

bearish market but there is no need for over-reaction.

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

http://klse.i3investor.com/blogs/20102017/139652.jsp

http://klse.i3investor.com/blogs/20102017/139652.jsp