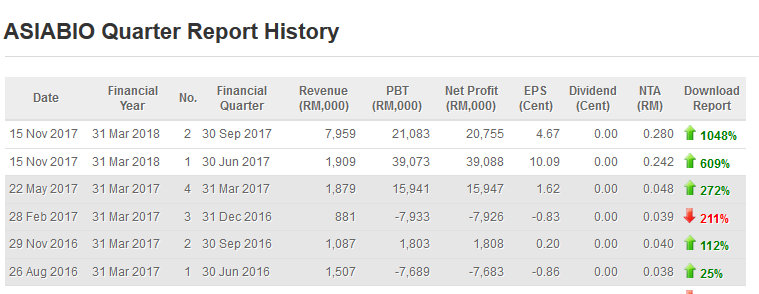

- Company returned to the black in FY17 after several years of losses.

- Its investments in several listed companies are starting to bring returns.

As with all marketable securities, the

Group's investments will always be subject to unpredictable market

forces. Nevertheless, the management remains optimistic that values in

the incubates will be maintained in the medium term. We anticipate that Focus's

Food & Beverage operations to continue to improve culminating with

additional new outlets being opened during the financial period.

Currently, Vsolar

is embarking on an alternative energy project involving the development

of a BioGas/Biomass energy generation plant. We anticipate that

submissions and applications to the relevant authorities will be made in

the short to medium term. NetX

on the other hand have seen positive growth in its payment solutions

operations and expects further improvements once its collaborative

efforts with Hello Digital (Cambodia), XOX Berhad and M3 Tech Berhad

bears fruit.

- The Board of Directors of the Company wishes to announce that the Company has changed its name to FINTEC GLOBAL BERHAD with effective from 6 December 2017

FINTEC GLOBAL BERHAD (formerly known as Asia Bioenergy Technologies Berhad)

Fintec Global Berhad, which incubates start-up technology companies and early stage high-growth companies, is finally seeing its investments bear fruit.

“The results of the last three quarters prove we are on the right path. Our investees are on more solid footing,” said executive director Steve Tan Sik Eek.

Its focus on technology incubation is concentrated around bio-based green technologies, particularly in the biofuels sector. Its subsidiary, AsiaBio Petroleum Sdn Bhd, is involved in oil and gas engineering and maintenance.

There is more to look forward to, says Tan. Last year, its subsidiary AsiaBio Capital Sdn Bhd has inked a memorandum of Understanding (MOU) with Hong Kong YRZC International Group Co Ltd., Shan Xi Hong Hui Food Limited Liability Co and Shan Dong Wang Jia Yuan Zi Halal Food Brewing Co to export halal food products to China.

“The parties are expected to enter into a partnership by year-end, says Tan. “We will go into a 50:50 partnership and set up three outlets.”

Mr Steve Tan Sik Eek’s statement was referring to the Share Subscription Agreement between NetX Holdings Berhad (“NetX”) and Flavors of Malaysia (“FoM”), which was announced to Bursa Malaysia Securities Berhad (“Bursa Securities”) by NetX on 25 May 2017, where NetX would subscribe equivalent to 51% of the issued and paid-up capital of FoM.

“The Company has set aside around RM60mil for the development of The Arch, a food and beverage (“F&B”) and lifestyle hub located at Jalan Tun Razak, adjacent to TREC Kuala Lumpur. Construction will begin early next year.”

Mr Edward Leung Kok Keong’s (executive director) statement was referring to Focus Dynamics Group Berhad (“Focus”)’s Circular to Shareholders dated 16 August 2017, where Focus has budgeted a funding requirement of RM60 million for the construction of The Arch. "We are bringing in international brands. It will be more focused on specialty brands, bespoke restaurants, lounges, concept clubs, artisan coffee spots and a convention area".

Another incubate, VSolar Group Bhd has had to change its strategy after its solar project hit a snag. In August 2017, VSolar entered into a partnership with KRU Energy Asia Pte Ltd, Rangkaian Iltizam Sdn Bhd and Kenneth Lee Wai Tong to jointly develop a 10MW biomass/biogas plant.

On 12 December 2017, AsiaBio successfully carried out a rights issue of up to 1.16 billion ICPS (ASIABIO-PA) at an issue price of 8 sen each, with up to 116 million free detachable warrants (ASIABIO-WB), on the basis of 10 ICPS and one free warrant for every five existing shares held in AsiaBio. It plans to raise a maximum of RM93.06 million through the exercise, which it plans to utilize for investments in its listed incubates and for working capital.

Conclusion

FINTEC GLOBAL BERHAD (formerly known as Asia Bioenergy Technologies Berhad) INCUBATEES

The Group’s current investment focus is on five key industries: Renewable Energy (VSolar Group Berhad), Engineering (AT Systematization Berhad), Food and Beverage (Focus Dynamics Group Berhad), Financial and Application Technology (NetX Holdings Berhad) and in Oil and Gas (AsiaBio Petrolelum Sdn Bhd).

"THE INCUBATEES ARE STARTING TO BEAR FRUIT".

IT IS THE NEW NORM OF "FINANCIAL TECHNOLOGY".

Foreign investors are making a strong return back to KLSE, as shown in the Bursa Malaysia Trading Participant Statistic in the link below:

http://www.malaysiastock.biz/Market-Statistic.aspx

Trend reversal detected such that the downtrend which started early of June 2017 has ended on 13/12/2017. I expect FBMKLCI to go up north due to yearend window dressing such that gainers in each trading day will be more than losers. In other words, any share a trader hit has a high probability to go up.