The stellar performance from recent quarter gives a dose of confidence in Hengyuan’s fundamental. Investors

begin to plow money in Henyuan, providing a positive boost to the share

price. The speed of the price appreciation is beyond our wildest dream.

To go from ~RM10.40 to ~RM19.00 in less than a month (and this is not a

microcap company), the author believes should be of a 5 or 6 sigma

event, statistically speaking. Or in lay man term, a very very rare occurrence!!

On

29 Dec, Hengyuan share price took a nosedive, from all time high of RM

19.2, Hengyuan closed on the last trading day of 2017 at RM 16.30 with

12.7 million shares done.

So, let's step back and see where Hengyuan is now? At RM 16.30, FY16 P/E is 14.6, FY17 P/E is 5.1 and P/B is 3.0

Note: FY16 Earning-1.12, FY 17 Earning (Annualized)-RM 3.22, NTA-RM 5.53

The average PE for world stock market

Let's for simplicity just focus on forward P/E, trailing P/E and P/B.

Note: Ignore CAPE (have no mean to calculate sector/company wise)

For Bursa, the comparative values are Forward P/E 16.1, Trailing P/E 16.4 and P/B 1.8 (from Maybank Research)

Sector valuation

(Top pure refiner from each country, except Sinopec. No European refinery companies included as most have huge E&P arm)

| Country | 2016A | 2017(Annualized) | P/B | |

| Hengyuan | Malaysia | 14.6 | 5.1 | 3.0 |

| Valero | USA | 38.5 | 18.2 | 2.0 |

| SK Innovation | S.Korea | 11.3 | 9.2 | 1.0 |

| JXTG | Japan | 15.9 | 10.1 | 1.1 |

| Sinopec | China | 13.2 | 13.8 | 0.8 |

On the P/E metric, Hengyuan looks to be undervalued vs both its peer or general stock market worldwide. Being a smallish refiner (~0.13m bpd) relative to its peers (generally in excess of 1-2m bpd capacity), Hengyuan is justifiably priced at a discount to its peer but probably not much less than PE 8-10. Refinery stocks are typically assigned lower PE compare with market in general as the industry is better known for its dividend rather than growth. However, on the P/B basic, Hengyuan looks to be over-valued. Does P/B really matter? Only if Hengyuan faces liquidation risk or it is about to be privatized, which is not likely for foreseeable future. Then, let's look at its earning sustainability in 2018.

Earning Sustainability in 2018

A very wise man recently shared his opinion on factors affecting future profit. May the author be pardoned for his audacity to add his humble views on the matters that would drive Hengyuan's 2018 profitability.

a) Refinery crack spread

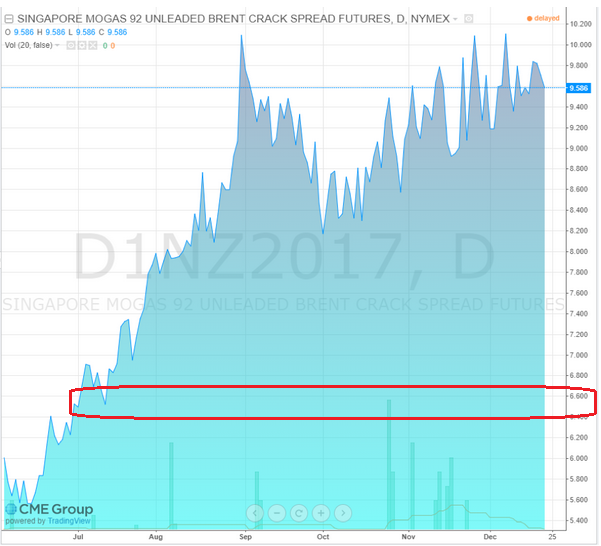

Let's compare two charts below. Both are drawn from the same source which is CME Singapore MOGAS 92 Unleaded Brent Crack Spread

Focus

on the red box drawn in 2nd chart which is to match the timeframe for

the 1st chart. Notice that the price in earlier July in first chart is

US$6.60 vs US$8.60 in second chart. The 1st chart invariably lead us to

conclude that the crack spread is rising rapidly while 2nd chart shows a

crack spread spike in 3rd quarter (with due credit to Hurricane Harvey)

but is otherwise range bounded. The first chart is drawn using Dec

future (D1NZ2017-

Character "Z" represents Dec) while the 2nd chart is from using the

front month future (in lay man term, July data using Aug future, Aug

data using Sept future...so on and so forth). The difference due to a

condition called backwardation in which the future curve is inverted in

the sense that near month future trade at higher price compare with the

later future month. So, yes, the crack spread is trading at near record

level in recent year and no, it is not dramatically much higher than the

earlier year.

This is related to valuation gain on inventories on hand. Brent crude begins the year at US$57.11 and likely to close 2017 at around US$66.41 (2 years high, a prelude to fat stockholding gain in 4Q). Will the crude oil post similar gain in 2018? No doubt crude oil demand is healthy as all regions in the world are currently posting best growth in recent years. But bear in the mind, the supply is artificially pulled down by OPEC's oil cut by as much as 1.8m bpd. So, the author hazards a guess the crude oil will reach as much as US$78 by mid- 2018 before retracing back all in the 2nd half. Of course, this is conditional on no Venezuela self-implosion and Saudi/Iran remains bff (Internet slang for best friend forever). On the other hands..well, let those will better handle on energy price to explain it...

c) Tax

Yeap, there are 2 sure things which are tax and death. Shell's SRC was taken over by Hengyuan at the most opportune time, super low entry price and plenty of tax loss carried forward. But hefty profit of over RM1b for the past 6 quarters has nearly fully utilized the tax loss. By the author's imprecise estimates, the tax loss will be fully utilized in 4Q2017. So, next year Hengyuan will have to pay 24% tax rate (most likely less due to tax allowance for capital expenditure for refinery upgrade).

d) Expected shutdown for 3Q2018 upgrade

Expected upgrade will likely be much longer than last round of major turnaround 3 years ago. Fixed costs ie employees' wages, PPE depreciation, etc still need to be paid despite not making any income. A conservative approach will need to zero out all the 3Q2018 earning.

Conclusion:

All in all, even factoring the same crack spread and stockholding gain in 2018 as in 2017, the tax will take off a quarter of the 2017 earning while another quarter will be deducted for 3Q2018 shutdown. That left 2018 earnings at best around 50-60% of 2017 annualized EPS of 322 cent. At the peak of RM 19.2, an attractive 2017 PE of 6.0 will turn into a prospective 2018 PE of 12.0, which for the author is fairly valued, but not extremely though.

If the meteoric rise of bitcoin in 2017 ever teaches the author a lesson, it is that as long as the pool of buyers keep expanding, the price will keep rising, the fundamental be damned. So, if investors continue to plow money in Hengyuan at current pace and given the scarcity of Hengyuan shares (the liquid part maybe just 100m+), RM20 will be smoked pretty soon. The author has not yet counted in the pool of local institutional players or the foreign funds...RM30 anyone?

Caveat emptor: “In the short run, the market is a voting machine, in the longer run, the market is a weighing machine” (Benjamin Graham: The Intelligence Investor)!!

Disclaimer:

A sharing of personal investment idea and thought and is not a recommendation to buy or sell.

http://klse.i3investor.com/blogs/20102017/142790.jsp

http://klse.i3investor.com/blogs/20102017/142790.jsp