Note: The pictures in this

blog didnt come out right, refer to this link for the spreadsheet of

the pictures, or open the pictures in a new tab.

https://docs.google.com/spreadsheets/d/1m-TarfVVci6X7GjnovZ1-J59ac2u8xnwZCmx-EcOWOE/edit?usp=sharing

Introduction

In general, most companies fall into 3 categories when it comes to valuations. They are

1. Any company other than those in the other 2 category.

2. Banks/ Non Deposit Taking Financial Institutions ("FI").

3. Insurance companies.

For companies in category one, one can pretty much use the full

spectrum of quantitative analytical tools. P/E, EV/EBIT, EV/EBITDA,

EV/FCF, DCF. Can count until the cows come home if you want.

For banks and insurance companies however, you need different tools.

Insurance companies is easily the most complicated one. There is "Combined Ratio", "Insurance Float" and "Cost of Float". All of which you need to slowly extract one by one from the annual reports, and that's why most screeners do not show it.

Personally, i've not had the time or motivation to really look at it yet. As this article will be about the valuations of banks, i won’t be going any further on that.

I'll will however state that, out of all the listed insurance companies in Malaysia, only TUNEPRO and LPI actually make consistently money on the premiums, everyone else loses money on the premium, but make it back in investment income. I don't hold shares in either, but feel free to study further.

Ok, lets now start with how to value banks and non deposit taking financial institutions.

Insurance companies is easily the most complicated one. There is "Combined Ratio", "Insurance Float" and "Cost of Float". All of which you need to slowly extract one by one from the annual reports, and that's why most screeners do not show it.

Personally, i've not had the time or motivation to really look at it yet. As this article will be about the valuations of banks, i won’t be going any further on that.

I'll will however state that, out of all the listed insurance companies in Malaysia, only TUNEPRO and LPI actually make consistently money on the premiums, everyone else loses money on the premium, but make it back in investment income. I don't hold shares in either, but feel free to study further.

Ok, lets now start with how to value banks and non deposit taking financial institutions.

Why is bank valuations different?

1. Whats wrong with P/E

Well, you can, but banks have a very interesting relationship with P/E.

The thing about banks is that their business consist wholly of cash, their product is cash, their asset is cash they borrow people, and their liabilities is cash people borrow them or deposit with them.

The thing about banks is that their business consist wholly of cash, their product is cash, their asset is cash they borrow people, and their liabilities is cash people borrow them or deposit with them.

This means that it would be incredibly foolish to pay say, 30 P/E for a

bank, as in saturated markets (Which all banks are in), it is

impossible to grow quickly (unless one were to take on risky

derivatives, or loan out money not caring about the borrower’s ability

to repay).

It is not possible to get an increase in deposits quickly without severely affecting cost of capital, as higher deposit rates are required. Banks in Malaysia are already at the edge with something like 0.9-1.7% margin.

Nor is it possible to source too much funds from the bond markets, it is first off, more expensive than deposits generally, and banking is all about management of cashflow, and bonds have covenants that may result in instant recall, thereby really screwing over your cash flow, it is also not easy to structure your bond to fit your cashflow schedule and requirements.

It is not possible to get an increase in deposits quickly without severely affecting cost of capital, as higher deposit rates are required. Banks in Malaysia are already at the edge with something like 0.9-1.7% margin.

Nor is it possible to source too much funds from the bond markets, it is first off, more expensive than deposits generally, and banking is all about management of cashflow, and bonds have covenants that may result in instant recall, thereby really screwing over your cash flow, it is also not easy to structure your bond to fit your cashflow schedule and requirements.

What im trying to say is, banks will find it close to impossible to

record double digits growth needed to justify P/E's above 15 due to the

saturated markets, they may try to rack up the leverage or risk they are

willing to bear to get that higher earnings, but that is also very very

difficult as banks are very very tightly regulated.

Even if they were not tightly regulated, the higher the risk/leverage

they are willing to bear, the higher the probability of bankruptcy. Yes,

you make more short term wise, but it’s easier to go bankrupt, and

these 2 set off against each other valuation wise (logically, but

markets are not logical).

The only exception is when kitchen sinking is being done, so there is a

depression of earnings beforehand, keeping valuations down. Like MBSB.

Except in MBSB’s case, where valuations are not really down either.

Funny story.

Early 2007, Warren Buffet was one of the biggest shareholders of the bank "Fannie Mae". When the CEO said that the bank were targeting for double digit growth in revenue and profit, Warren immediately started dumping the stock and was completely out by 2008.

The company, using CDO's and derivatives, as well as incresed leverage, met its target of double digit growth in 2008. It also went bankrupt during the financial crisis of 2008 and was one of the banks bought out by the government to prevent a meltdown in the financial markets.

Funny story.

Early 2007, Warren Buffet was one of the biggest shareholders of the bank "Fannie Mae". When the CEO said that the bank were targeting for double digit growth in revenue and profit, Warren immediately started dumping the stock and was completely out by 2008.

The company, using CDO's and derivatives, as well as incresed leverage, met its target of double digit growth in 2008. It also went bankrupt during the financial crisis of 2008 and was one of the banks bought out by the government to prevent a meltdown in the financial markets.

2. How about EV/EBIT?

Also known as earnings yield, or as Joel Greenblatt likes to call it,

the magic formula that beats the market (Do note it beat the market

then, now that everyone knows and since markets are a dynamic

environement, that stament may no longer hold true moving forward).

What is EV or Enterprise Value? EV is the real cost of the company if you were to buy outright. In essence it is:

Enterprise Value = Market Capitalization + Borrowings + Minority Interest – Cash and Cash equivalents.

Except in banks, all their liabilities is borrowings and all their

asset is cash and cash equivalents. Do the calculation and you basically

get back your Equity.

How about EBIT? Also know as Earnings before Interest and Tax.

All your expense is interest expense and all your earning is interest income wor. Habis. Count so hard, get back zero. Again irrelevant.

How about EBIT? Also know as Earnings before Interest and Tax.

All your expense is interest expense and all your earning is interest income wor. Habis. Count so hard, get back zero. Again irrelevant.

How to Value?

Banks are incredibly complex, with multiple products, segments etc etc.

It is close to impossible to do a proper detailed analysis even if

you're the analyst covering it. The only time a proper one is done, is

when there is a M&A going on.

However, this does not mean it is impossible. We can still do a rough, rule of thumb valaution. How?

Let’s try asking warren buffet.

However, this does not mean it is impossible. We can still do a rough, rule of thumb valaution. How?

Let’s try asking warren buffet.

“Well, a bank that earns 1.3% or 1.4% on assets is going to end up

selling above tangible book value. If it's earning 0.6% or 0.5% on asset

it's not going to sell. Book value is not key to

valuing banks. Earnings are key to valuing banks. Now, it translates to

book value to some extent because you're required to hold a certain

amount of tangible equity compared to the assets you have. But you've

got banks like Wells Fargo and USB that earn very high returns on

assets, and they at a good price to tangible book. You've got other

banks ... that are earning lower returns on tangible assets, and

they're going to sell -- they're going to sell for less”

“Banks are not going to earn as good a return on equity in the

future as they did five years ago. Their leverage is being restrained

for good reason in many cases. So, banks earn on assets but the ratio of

assets to equity, the leverage they have determines what they earn on

equity.”

If you lazy to read, what he is saying here is this.

For banks the key thing is a high Return on Asset (ROA), something above 1% shows that your asset is valuable and thus worth more. It does not look like much, but since most banks are very leveraged, that 1% can translate into much higher Return on Equity (ROE).

If you lazy to read, what he is saying here is this.

For banks the key thing is a high Return on Asset (ROA), something above 1% shows that your asset is valuable and thus worth more. It does not look like much, but since most banks are very leveraged, that 1% can translate into much higher Return on Equity (ROE).

Your ROA is in turn linked to your book value. The higher your ROA, the

more valuable your book value and the higher the “Price to Book” (P/B)

multiple people are willing to pay. An asset with a ROA of 1% should be

valued at 1 times Price to Book.

Except, that's not the end of it.

Because in investing, I’m not buying the asset, I’m buying the company. This means what I’m interested in, is the ROE not ROA.

If a bank has zero leverage, and the ROA is 1%. Using the previous rule of thumb, if I were to buy the bank at 1 times P/B, I would be buying a company with 1% ROE, and will be effectively valuing it at 100P/E, which is insane.

This means leverage is key. If the bank is leveraged 10 times instead. That 1% ROA, translates to 11% ROE. This means i'm paying a P/E of 9 times, much more reasonable.

Except, that's not the end of it.

Because in investing, I’m not buying the asset, I’m buying the company. This means what I’m interested in, is the ROE not ROA.

If a bank has zero leverage, and the ROA is 1%. Using the previous rule of thumb, if I were to buy the bank at 1 times P/B, I would be buying a company with 1% ROE, and will be effectively valuing it at 100P/E, which is insane.

This means leverage is key. If the bank is leveraged 10 times instead. That 1% ROA, translates to 11% ROE. This means i'm paying a P/E of 9 times, much more reasonable.

Which gives rise to this rule of thumb.

“The fair value of a bank with ROA of 1% and leverage of 10 times, is 1 time Book value”.

Except, it still isnt the end of it!

Because this rule of thumb does not price in the risk of bankruptcy due to leverage. And this can give rise to some pretty interesting edge cases.

One thing to note about banks is the method of recognition of liabilities and assets.

“The fair value of a bank with ROA of 1% and leverage of 10 times, is 1 time Book value”.

Except, it still isnt the end of it!

Because this rule of thumb does not price in the risk of bankruptcy due to leverage. And this can give rise to some pretty interesting edge cases.

One thing to note about banks is the method of recognition of liabilities and assets.

Liabilities : Marked to Cost.

What the bank owe, the bank must pay. This figure is absolutely fixed and set in stone.

Assets : Marked to Market.

Whatever asset the bank has, its value depends on what the market will

pay. Ie, it fluctuates. Due to leverage, if it drops low enough, a bank

can go bankrupt. Similar to margin call.

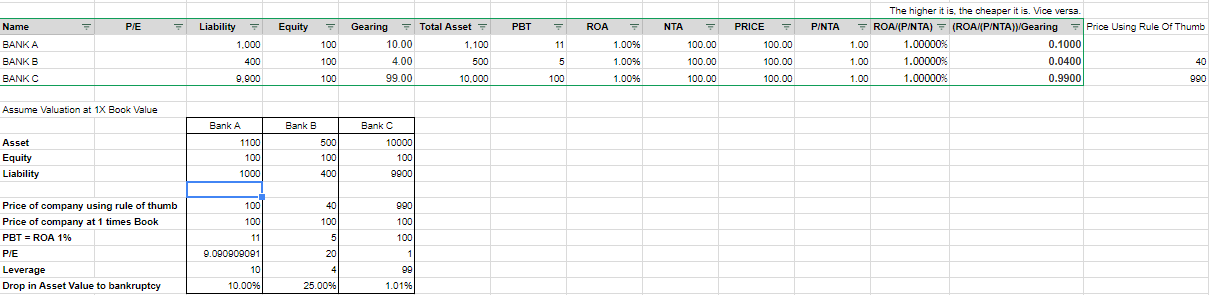

Lets Imagine Bank A, Bank B and Bank C.

Bank A

The bank has ROA of 1% and is leveraged 10 times. If an investor pays the 1X book value or RM100, he gets a company at a P/E of 9.1 and ROE of 11%. The bank also will not go bankrupt easily as asset values need to fall 10%, which is very unlikely. Pretty fair deal.

The bank has ROA of 1% and is leveraged 10 times. If an investor pays the 1X book value or RM100, he gets a company at a P/E of 9.1 and ROE of 11%. The bank also will not go bankrupt easily as asset values need to fall 10%, which is very unlikely. Pretty fair deal.

Bank B

Bank B is exactly the same as Bank A, except it is only leveraged 4 times instead of 10 times. In this case, using the rule of thumb, the value of the company is only RM40 despite book value being RM100, despite the quality of asset being the same and therefore just as valuable.

For this bank to go bankrupt, asset values need to fall by at least 25%, a drop which was only almost achieved for some banks in the 2008 crisis.

Bank B is exactly the same as Bank A, except it is only leveraged 4 times instead of 10 times. In this case, using the rule of thumb, the value of the company is only RM40 despite book value being RM100, despite the quality of asset being the same and therefore just as valuable.

For this bank to go bankrupt, asset values need to fall by at least 25%, a drop which was only almost achieved for some banks in the 2008 crisis.

Therefore, by being prudential and conservative, so much so that this

bank would actually survive the 2008 crisis comfortably, the market

punishes it by valuing its assets (which is just as valueble as Bank

A's) at 0.4 times book value instead of 1X.

Bank C

Now, Bank C is in every way the same as Bank A and Bank B. Except, at this bank, the CEO has got balls like Donald Trump. His balls literally clicks when he walks.

This bank has a leverage of a whopping 99 times. Absolutely insane. A mere 1% drop in asset value, the bank will go bankrupt.

If one were to pay book value of RM100 for this bank, the P/E will be 0.9. By this metric, it is even cheaper than Hengyuan was at RM2 during the start of the year.

Therefore, using the rule of thumb fair value, this bank should be worth RM990. IE, You should pay roughly 9.9 times book value for a company that can go bankrupt tomorrow. Insane.

Now, do you know what i mean when i say the valuation of banks is very interesting, and why M&A of banks take so long, valuation is hard.

Conclusion

There must be a balance, a bank cannot do business as if they must survive 2008, or it would be very hard to make money. On the other hand, they also cannot go crazy and leverage up to the moon.

Pre 2008, leverage in banks was in high teens, now it has dropped to roughly 10 times. Seems pretty balanced.

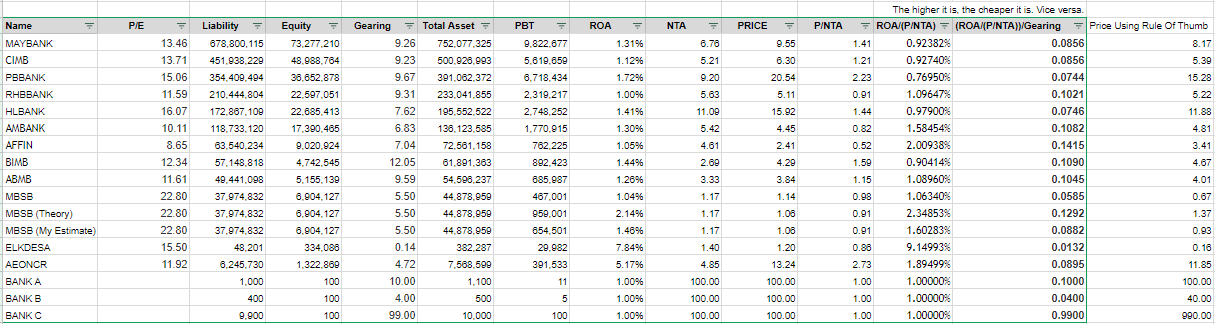

Rule of thumb table for all banks in malaysia

As it is christmas after all, i decided to give a present to I3 for all the information it has given to me this year.

Here is a valuation table i made for all banks in malaysia approximately 3-4 months ago. The data is not updated, but its a fairly decent reference. Some financial institutions are not included in this table as they are my favourite. Not going to give those away for free.

Now, Bank C is in every way the same as Bank A and Bank B. Except, at this bank, the CEO has got balls like Donald Trump. His balls literally clicks when he walks.

This bank has a leverage of a whopping 99 times. Absolutely insane. A mere 1% drop in asset value, the bank will go bankrupt.

If one were to pay book value of RM100 for this bank, the P/E will be 0.9. By this metric, it is even cheaper than Hengyuan was at RM2 during the start of the year.

Therefore, using the rule of thumb fair value, this bank should be worth RM990. IE, You should pay roughly 9.9 times book value for a company that can go bankrupt tomorrow. Insane.

Now, do you know what i mean when i say the valuation of banks is very interesting, and why M&A of banks take so long, valuation is hard.

Conclusion

There must be a balance, a bank cannot do business as if they must survive 2008, or it would be very hard to make money. On the other hand, they also cannot go crazy and leverage up to the moon.

Pre 2008, leverage in banks was in high teens, now it has dropped to roughly 10 times. Seems pretty balanced.

Rule of thumb table for all banks in malaysia

As it is christmas after all, i decided to give a present to I3 for all the information it has given to me this year.

Here is a valuation table i made for all banks in malaysia approximately 3-4 months ago. The data is not updated, but its a fairly decent reference. Some financial institutions are not included in this table as they are my favourite. Not going to give those away for free.

Looking at this table, we can see that Affin is the most undervalued

bank and Public Bank is the most highly valued bank in malaysia.

And for good reason, in the case of Public Bank, you are paying not

just for their high quality asset (highest in malaysia at 1.72% ROA).

But also for Teh Hong Piow, the fantastic management, the amazing

culture and the incredible track record.

Affin on the other hand, not that great of a bank, one of the smaller ones in malaysia. Management is not great, and it shows, severely undervalued. Also leverage is not that high, which means, the potential is there somewhat. I hold a very small 2% position in Affin. I can't help buying a little as it is very cheap. If it touches around RM3 given the current fundamentals, im out.

Affin on the other hand, not that great of a bank, one of the smaller ones in malaysia. Management is not great, and it shows, severely undervalued. Also leverage is not that high, which means, the potential is there somewhat. I hold a very small 2% position in Affin. I can't help buying a little as it is very cheap. If it touches around RM3 given the current fundamentals, im out.

Why Coldeye is wrong on MBSB.

For the last 1-2 years, Coldeye or "Fong Siling" have been pushing MBSB as his favourite. And he has put his money where his mouth is. Coldeye holds 13,300,000 shares in MBSB or 0.23% of the company. I have no doubt this is probably his largest position at roughly RM13.8 million.

This year, one of our veteran stockpickers ICON8888 have also chosen this stock as one of his favourite for 2018.

Allow me to (arrogantly) say why i think they are making a mistake. Feel free to correct me if you feel i have made a mistake, mispricing whatever risk or gains, or coming at it from a wrong perspective. I too like to make money, if im wrong, then im happy, cause i can buy some now.

Looking at the table above (Look at "MBSB"), at current ROA and leverage, the fair value of MBSB is actually RM0.67 compared to the RM1.04 as at 29 December 2017. This means it has about 35% more to drop before reaching fair value.

Except, it isnt so simple. According to management, the reason why earnings are so low, is due kitchen-sinking of impariment charges for the last 1-2 years to bring their provision standards in line with a typical bank in malaysia.

According to management, Impairment for the last 13 quarters total RM2.14 billion. Impairment relating to the exercise amount to RM1.6 billion.

What the management is saying here, is basically, if not for the impairment exercise, our profit will be higher. By how much then. Well taking RM1.6 billion divided by the number of quarters, that is approximately RM123 mil per quarter, or RM 492 million extra in earnings.

Now, if you think this management is 100% honest, no incentive to fry up price or make themselves look good, and like god, estimates is 100% correct.

We should then add back the RM492 million into the rolling earnings (look at "MBSB (Theory)"), the fair value now shoots up to RM1.37. This means MBSB is undervalued by RM0.33 or 24% compared to current market price. Now its definitely looking like a decent buy.

Except, what the management is also telling from that statement above, is that actual operating impairment is only RM540 million for 13 quarters, which is RM39.5 million per quarter RM158 million per year.

Given that MBSB asset size is RM44.9 billion, that transalates to an impairment rate of only 0.35%. For the record, Maybank's is roughly 0.5%.

Except, here is the kicker. Out of MBSB's RM44.9 billion net asset/loan portfolio, roughly RM22.6 billion are in the personal loan space.

As it is riskier, personal loans offer far higher effective interest rates compared to say a car loan or housing loan (Personal loan interest rates are on average 20% (RCECAP and AEONCR), compared to 4-5% for a car (brand new) or housing loan). Therefore, most personal loan companies have far higher impairment rates. RCECAP for example, one of the better run personal loan companies, have an impairment rate of 1.56%.

Now RCECAP and MBSB have this in common, for both of them, loan repayments are done via salary deductions. So this should mean less non-performing loans and therefore a lower impairment rate.

With the above in mind, I think MBSB's management estimate of the impairment rate of 0.35% is far too low.

Now, using RCECAP's impairment rate of the personal loan portion of the portfolio and Maybank's for the rest.

((RM22.6bil*1.56%)+(RM22.3bil*0.5))/RM44.9bil = 1.03%

MBSB's impairment should be somewhere near 1.03%. This transalates to roughly RM462.5 million per year for impairments, compared to the management estimate of RM158 million.

Plugging that into my table (refer to "MBSB(My Estimate)" the fair value of MBSB, assuming that my estimate of the future is perfect and i am god. Fair value of MBSB is only RM0.93. Ie, overpriced.

For the last 1-2 years, Coldeye or "Fong Siling" have been pushing MBSB as his favourite. And he has put his money where his mouth is. Coldeye holds 13,300,000 shares in MBSB or 0.23% of the company. I have no doubt this is probably his largest position at roughly RM13.8 million.

This year, one of our veteran stockpickers ICON8888 have also chosen this stock as one of his favourite for 2018.

Allow me to (arrogantly) say why i think they are making a mistake. Feel free to correct me if you feel i have made a mistake, mispricing whatever risk or gains, or coming at it from a wrong perspective. I too like to make money, if im wrong, then im happy, cause i can buy some now.

Looking at the table above (Look at "MBSB"), at current ROA and leverage, the fair value of MBSB is actually RM0.67 compared to the RM1.04 as at 29 December 2017. This means it has about 35% more to drop before reaching fair value.

Except, it isnt so simple. According to management, the reason why earnings are so low, is due kitchen-sinking of impariment charges for the last 1-2 years to bring their provision standards in line with a typical bank in malaysia.

According to management, Impairment for the last 13 quarters total RM2.14 billion. Impairment relating to the exercise amount to RM1.6 billion.

What the management is saying here, is basically, if not for the impairment exercise, our profit will be higher. By how much then. Well taking RM1.6 billion divided by the number of quarters, that is approximately RM123 mil per quarter, or RM 492 million extra in earnings.

Now, if you think this management is 100% honest, no incentive to fry up price or make themselves look good, and like god, estimates is 100% correct.

We should then add back the RM492 million into the rolling earnings (look at "MBSB (Theory)"), the fair value now shoots up to RM1.37. This means MBSB is undervalued by RM0.33 or 24% compared to current market price. Now its definitely looking like a decent buy.

Except, what the management is also telling from that statement above, is that actual operating impairment is only RM540 million for 13 quarters, which is RM39.5 million per quarter RM158 million per year.

Given that MBSB asset size is RM44.9 billion, that transalates to an impairment rate of only 0.35%. For the record, Maybank's is roughly 0.5%.

Except, here is the kicker. Out of MBSB's RM44.9 billion net asset/loan portfolio, roughly RM22.6 billion are in the personal loan space.

As it is riskier, personal loans offer far higher effective interest rates compared to say a car loan or housing loan (Personal loan interest rates are on average 20% (RCECAP and AEONCR), compared to 4-5% for a car (brand new) or housing loan). Therefore, most personal loan companies have far higher impairment rates. RCECAP for example, one of the better run personal loan companies, have an impairment rate of 1.56%.

Now RCECAP and MBSB have this in common, for both of them, loan repayments are done via salary deductions. So this should mean less non-performing loans and therefore a lower impairment rate.

With the above in mind, I think MBSB's management estimate of the impairment rate of 0.35% is far too low.

Now, using RCECAP's impairment rate of the personal loan portion of the portfolio and Maybank's for the rest.

((RM22.6bil*1.56%)+(RM22.3bil*0.5))/RM44.9bil = 1.03%

MBSB's impairment should be somewhere near 1.03%. This transalates to roughly RM462.5 million per year for impairments, compared to the management estimate of RM158 million.

Plugging that into my table (refer to "MBSB(My Estimate)" the fair value of MBSB, assuming that my estimate of the future is perfect and i am god. Fair value of MBSB is only RM0.93. Ie, overpriced.

Assumptions where i could have gone wrong.

1) For most loans, housing or motor, MBSB still takes back the money

via salary deduction, so the impairment rate may very well be lower than

Maybanks.

http://klse.i3investor.com/blogs/PilosopoCapital/142803.jsp

http://klse.i3investor.com/blogs/PilosopoCapital/142803.jsp