1. Target price reached after huge gain of 45% in 6 months. It's

time to take profit on PETRONM as it is very near to my target price of

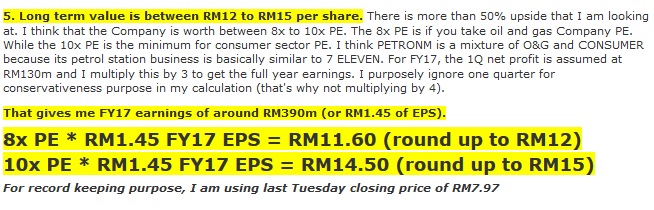

between RM12 to RM15. This is the proof of my blog in May. By using

latest share price of RM11.56, my return is 11.56/7.97 - 100% = 45% in 6 months.

https://klse.i3investor.com/blogs/richDad/122585.jsp

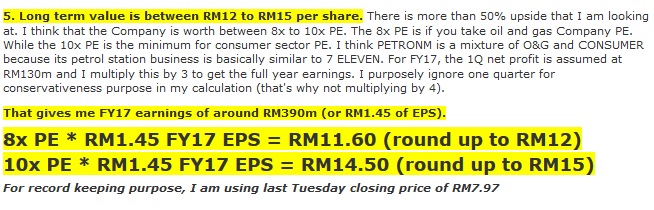

2. 4Q earnings likely to be weaker against 3Q as refinery margin has declined. Admittedly PETRONM earnings for 3Q this year is good. But it is mainly due to higher refinery margin caused by HURRICANE HARVEY. MOGAS 92 spread appreciated to the highest level in 2017 in Sep. However, things have normalized since then.

Here's the chart of Singapore Mogas 92 Unleaded (Platts) Brent Crack Spread Futures which tracks refinery margin

3. The recent result has no major surprise

My prediction for full year FY17 EPS is RM1.45 and PETRONM delivered RM1.13 in the first 9 months. The benchmark for 9 months is to be 75%, PETRONM delivered 78%. It is good (with 3% ahead) but not a major surprise.

CONCLUSION: PETRONM is still a good company, but in the near term most of the positive news are already out. So, I guess it makes sense to sell into strength.

http://klse.i3investor.com/blogs/richDad/140173.jsp

https://klse.i3investor.com/blogs/richDad/122585.jsp

2. 4Q earnings likely to be weaker against 3Q as refinery margin has declined. Admittedly PETRONM earnings for 3Q this year is good. But it is mainly due to higher refinery margin caused by HURRICANE HARVEY. MOGAS 92 spread appreciated to the highest level in 2017 in Sep. However, things have normalized since then.

Here's the chart of Singapore Mogas 92 Unleaded (Platts) Brent Crack Spread Futures which tracks refinery margin

3. The recent result has no major surprise

My prediction for full year FY17 EPS is RM1.45 and PETRONM delivered RM1.13 in the first 9 months. The benchmark for 9 months is to be 75%, PETRONM delivered 78%. It is good (with 3% ahead) but not a major surprise.

CONCLUSION: PETRONM is still a good company, but in the near term most of the positive news are already out. So, I guess it makes sense to sell into strength.

http://klse.i3investor.com/blogs/richDad/140173.jsp