So what happened today?

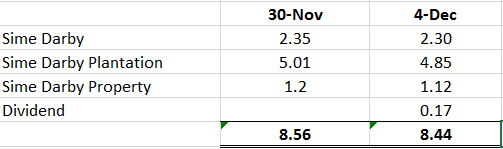

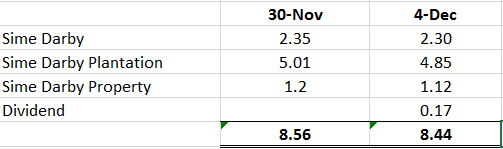

A snapshot of what happened on 4 December 2017 as below. When view in totality, there was a 1.4% drop from Thursday's price and a significant 5.6% decrease from Sime Darby's initial price of RM8.94 before the split. Again, we do not think that this movement has been a rationale one and believe investors are panic selling as the fundamentals remain intact.

Cumm-dividend and Ex-dividend strategy in works?

Recall our discussion in our previous blog post about the price of shares that do not adjust to their theoretical ex-price which leads to a potential profit opportunity. Refer to our posting below if you missed it:

https://klse.i3investor.com/blogs/wiz_of_finance/140213.jsp

In summary, the movement in Sime Darby's share price is one of this instance. Instead of adjusting by RM0.17, there was only an adjustment of RM0.05. Hence, if you bought the shares on cumm-date and disposed it on ex-date, you would have made 5% in a very short time. Of course there was also a positive momentum for Sime Darby shares which contributed to this.

Back to Sime Darby Plantation..is it overpriced?

Today the price of Sime Darby Plantation slid another 3%. As per our previous post, we believe that SD Plantation should be a safer bet. However, is this justified. Let us look at some of the points below:

So what should you do?

Again what we like to do here is to lay down the facts and allow you to make your own decisions. The aggressive scenario might be a stretch but that is precisely why we lay down the facts for your scrutiny and comments.

As always, please comment below should you have any opinions on this.

A snapshot of what happened on 4 December 2017 as below. When view in totality, there was a 1.4% drop from Thursday's price and a significant 5.6% decrease from Sime Darby's initial price of RM8.94 before the split. Again, we do not think that this movement has been a rationale one and believe investors are panic selling as the fundamentals remain intact.

Cumm-dividend and Ex-dividend strategy in works?

Recall our discussion in our previous blog post about the price of shares that do not adjust to their theoretical ex-price which leads to a potential profit opportunity. Refer to our posting below if you missed it:

https://klse.i3investor.com/blogs/wiz_of_finance/140213.jsp

In summary, the movement in Sime Darby's share price is one of this instance. Instead of adjusting by RM0.17, there was only an adjustment of RM0.05. Hence, if you bought the shares on cumm-date and disposed it on ex-date, you would have made 5% in a very short time. Of course there was also a positive momentum for Sime Darby shares which contributed to this.

Back to Sime Darby Plantation..is it overpriced?

Today the price of Sime Darby Plantation slid another 3%. As per our previous post, we believe that SD Plantation should be a safer bet. However, is this justified. Let us look at some of the points below:

- Plantation industry - No significant negative change in fundamentals of the industry. Peers like IOI Corp and KLK have not been trending down.

- Is SD Plantation Expensive? Let's do a little analysis shall we?

- Looking at Q1 results and stripping out the one-off gain, we can try to estimate the full year results for Sime. If we take a simple assumption of projecting it across 4 quarters, we get a full year result of RM1.5 bil. This implies a PE of 22x. If we add back the one-off gain of RM646 mil (why do we add it back? well the company has already achieved this in Q1 and this is already in the books), the projected full year profit can achieve a high of RM2.1bil, which implies a PE of 15x.

- How does this compare to its peers? The average PE is 25.7x and hence at current valuation, there could very well be upside.

- Let us look at what this implies to the share price. At an average PE of 25.7x and using our projected full year earnings excluding one-off, this implies a price of RM5.64 which is a 16% upside. This would be a more prudent approach

- If we want to be more aggressive, let us take the full year earnings estimates including one-off gain. With a PE of 25.7x, this implies a price per share of RM8.09, with a 67% upside!

- Valuation wise, our analysis implies a range of price per share between RM5.64 and RM8.09. This is a significantly wide range.

So what should you do?

Again what we like to do here is to lay down the facts and allow you to make your own decisions. The aggressive scenario might be a stretch but that is precisely why we lay down the facts for your scrutiny and comments.

As always, please comment below should you have any opinions on this.

Disclaimer: This is not a buy call. Please do your own research before investing.

Cheers,

Wiz_of_Finance

http://klse.i3investor.com/blogs/wiz_of_finance/140393.jsp

http://klse.i3investor.com/blogs/wiz_of_finance/140393.jsp