MAYBULK, SYSCORP

What to aim in year 2018? SHIPPING… SHIPPING… SHIPPING…

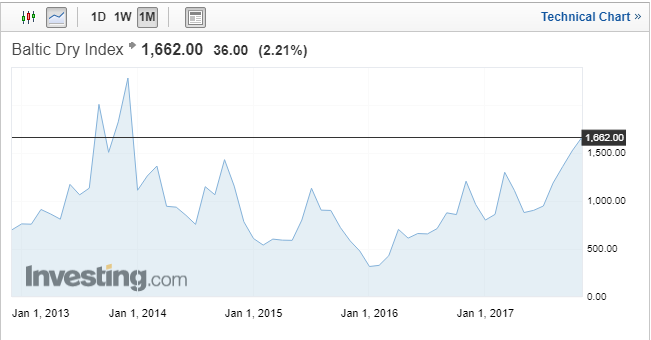

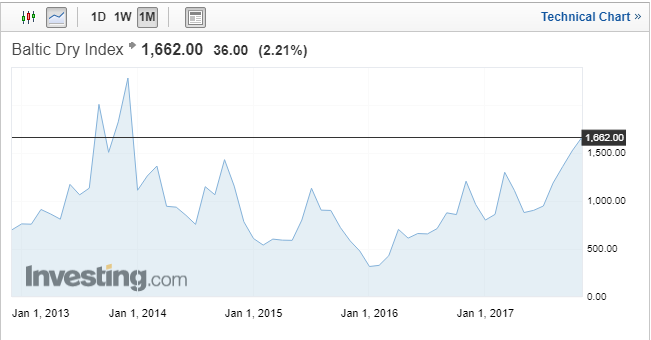

Baltic dry bulk index keep breaking new high, now in a positive momentum to test 5 years high.

Baltic dry bulk index is the price that shipping company can charge to their client for their service. When the index go higher, it means that it is positive for shipping company.

Shipping company has undergo 3 years losses as the Baltic dry bulk index below their cost (I expect the breakeven index for shipping company is around 1100 to 1200). As the index go up across 1200, the shipping company should turn into profit.

MAYBULK

Maybulk is partially own by Ppb group, which means Maybulk is indirectly own by Robert Kuok. The company will have 27 vessels in year 2018. The financial result is expecting turn into black on next year as Baltic dry bulk rise from the low of 400 to now over 1600. I believe that Baltic dry bulk index will back to 3000 next year, the price when year 2010. In year 2010, Maybulk achieve a profit of 236 million ringgit. If we calculate into earning per share of 24 cents. PE 15x, worth RM3.60 if Baltic dry bulk rise back to 3000. Don’t forget that the company already expand compare with year 2010, so the profit may more than what we expected.

Support price : 0.82

Resistance price : 0.885

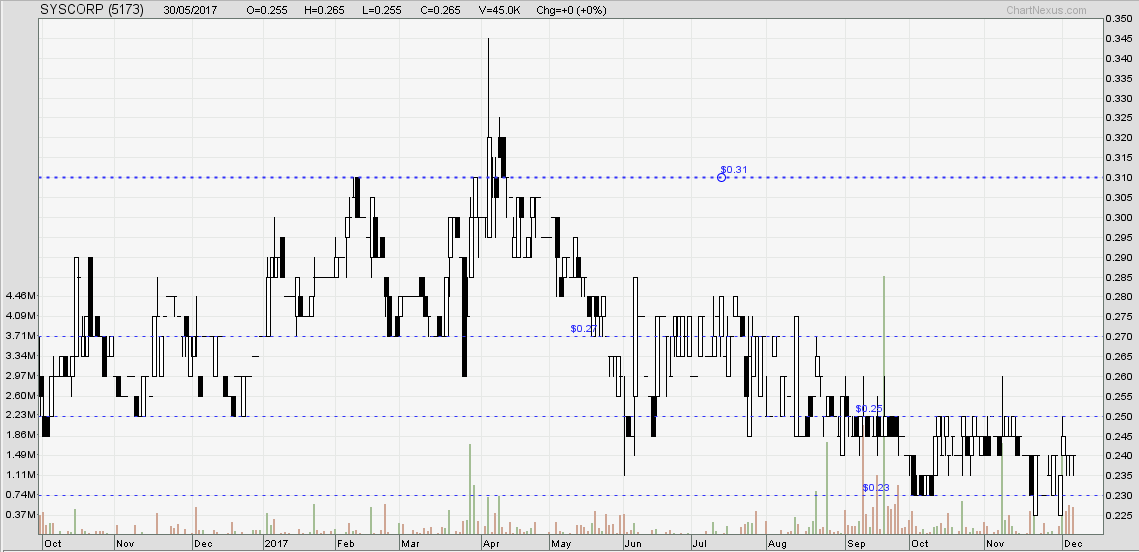

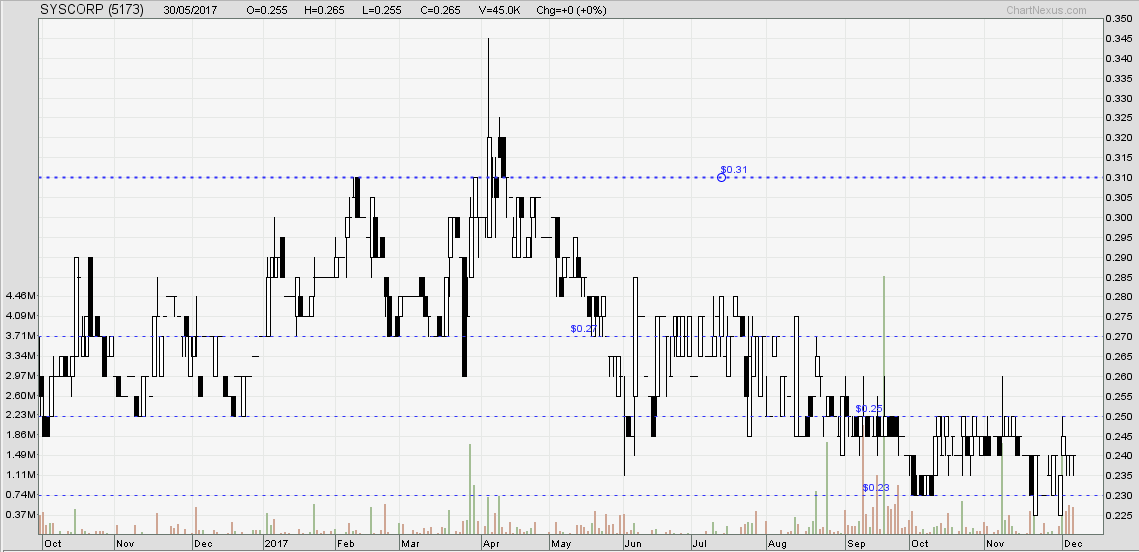

SYSCORP

Shin Yang Shipping Corporation (SYSCORP) is another company doing shipping business in listed company of Malaysia. For sure, Baltic dry bulk index rise will bring benefit for the financial of the company too. This company market capitalization is smaller than Maybulk, share price at bottom of the technical chart, suitable for those who like to have a bottom fishing.

Support price : 0.23

Resistance price : 0.25

GOOD LUCK & HAVE A NICE DAY

http://klse.i3investor.com/blogs/MAYBULKSYSCORP/140819.jsp

What to aim in year 2018? SHIPPING… SHIPPING… SHIPPING…

Baltic dry bulk index keep breaking new high, now in a positive momentum to test 5 years high.

Baltic dry bulk index is the price that shipping company can charge to their client for their service. When the index go higher, it means that it is positive for shipping company.

Shipping company has undergo 3 years losses as the Baltic dry bulk index below their cost (I expect the breakeven index for shipping company is around 1100 to 1200). As the index go up across 1200, the shipping company should turn into profit.

MAYBULK

Maybulk is partially own by Ppb group, which means Maybulk is indirectly own by Robert Kuok. The company will have 27 vessels in year 2018. The financial result is expecting turn into black on next year as Baltic dry bulk rise from the low of 400 to now over 1600. I believe that Baltic dry bulk index will back to 3000 next year, the price when year 2010. In year 2010, Maybulk achieve a profit of 236 million ringgit. If we calculate into earning per share of 24 cents. PE 15x, worth RM3.60 if Baltic dry bulk rise back to 3000. Don’t forget that the company already expand compare with year 2010, so the profit may more than what we expected.

Support price : 0.82

Resistance price : 0.885

SYSCORP

Shin Yang Shipping Corporation (SYSCORP) is another company doing shipping business in listed company of Malaysia. For sure, Baltic dry bulk index rise will bring benefit for the financial of the company too. This company market capitalization is smaller than Maybulk, share price at bottom of the technical chart, suitable for those who like to have a bottom fishing.

Support price : 0.23

Resistance price : 0.25

GOOD LUCK & HAVE A NICE DAY

http://klse.i3investor.com/blogs/MAYBULKSYSCORP/140819.jsp