--公司于31-10-2017有现金1714万,借款为4915万,库存为1.54亿

--2017年首季(8,9,10月)赚951万,估计ROLLING 四季度为3804万,

首季EPS=3.34SEN,估计ROLLING 四季度为13.9SEN,

取PE=10倍,股价=RM1.39

--公司的净赚副达6.9%,不断增长的国内外订单,2018年底在CHANGKAT,PENANG的新厂开始投入生产,因此成长是值得期待的.

只供参考,買卖自负

http://klse.i3investor.com/servlets/stk/7162.jsp

http://www.astino.com.my/

.

以上图片取自https://www.facebook.com/profile.php?id=100012662169557

A)取自网友:MARTINWANG

会看上Astino的原因主要:

1. 便宜.简单.容易.必需品.

2. 管理层在次货表现很好.

3. 有不錯的股息记彔.债务減少良好.

4. 掌控awning市场的60%以上.

5. 业務持继成長.

6. 有CSC做后盾.

7. 零售市场做得很成功,成本转价能力強.

B)∼∼取自网友:Ngmm 2017-12-3 (谢谢他的功课)

从11月份出炉的钢铁公司业绩参差不齐,总个来说长钢的业务表现比扁钢好,而扁钢下游公司则比中游来得好。然而,绝大部分的钢铁公司的股价都在业务出炉后纷纷下滑,唯有Astino在过去两天异军突起,再次回在1.00的水平。

从11月份出炉的钢铁公司业绩参差不齐,总个来说长钢的业务表现比扁钢好,而扁钢下游公司则比中游来得好。然而,绝大部分的钢铁公司的股价都在业务出炉后纷纷下滑,唯有Astino在过去两天异军突起,再次回在1.00的水平。

于是,我就去看了下bursa的公告,却发现原来在它的年报出炉了,近期很红的投资大师官有缘在30大股东榜上有名(第7,14,19的大股东,占

3.51%股权),同时上榜的还有海外价值投资型基金的Yeoman 3-Rights Value Asia Fund(0.73%股权)与CSC

Steel Holdings Berhad(0.76%股权)。这也难怪Astino在年报出炉后在逆市中被扯购走高。

让我感到兴趣的是为何官老爷与Yeoman会同时看上它呢? 官老爷比较偏向成长股,而Yeoman则以价值投资为主,它们能够同时看上一家公司,那就值得我们去留意一下了。

成长动力

1。年报的Management discussion and analysis中指出公司在Changkat, Penang的新厂建筑当中,目前投入20.9mil,预期会在明年年尾开始投入生产。

2。国外销售从去年的16mil增加到40mil营业额。

3。Agro facilities(家禽设备)深受本地与国外家禽业者的欢迎,订单不断。(https://www.youtube.com/watch?v=SdEs5bN_j_I&t=201s)

1。年报的Management discussion and analysis中指出公司在Changkat, Penang的新厂建筑当中,目前投入20.9mil,预期会在明年年尾开始投入生产。

2。国外销售从去年的16mil增加到40mil营业额。

3。Agro facilities(家禽设备)深受本地与国外家禽业者的欢迎,订单不断。(https://www.youtube.com/watch?v=SdEs5bN_j_I&t=201s)

价值

1。过去14年(上市至今),公司都能够维持15%以上的毛利(除了2009年金融风暴时的毛利只有12%)

2。负债比例(D/E)从5年前的0.53减少到0.14。

3。今年公司增加派息,宣布了额外1分的股息。(全年2分)

1。过去14年(上市至今),公司都能够维持15%以上的毛利(除了2009年金融风暴时的毛利只有12%)

2。负债比例(D/E)从5年前的0.53减少到0.14。

3。今年公司增加派息,宣布了额外1分的股息。(全年2分)

Astino是扁钢下游商家,业绩将会在这个月(12月)出炉,下游商家比中游好赚的话,那它即将出炉的业绩必会看到不俗的成长。就让我们拭目以待,它是否值得官老爷与Yeoman的错爱!

∼∼取自网友:Ngmm 2017-11-16

【astino】

1:债务表越来越健康:

Borrow:49m ,cash:17m

2:anglo house强劲增长

3:受惠于hrc板块涨幅

4:新厂年尾开始运作

5:股息1分的护航

6:预测yoy,qoq成长最少30%以上

Borrow:49m ,cash:17m

2:anglo house强劲增长

3:受惠于hrc板块涨幅

4:新厂年尾开始运作

5:股息1分的护航

6:预测yoy,qoq成长最少30%以上

随着股价从高峰在1.29下跌0.90左右,我觉得是一个很好的买入点

祝大家股市大赚钱

C)

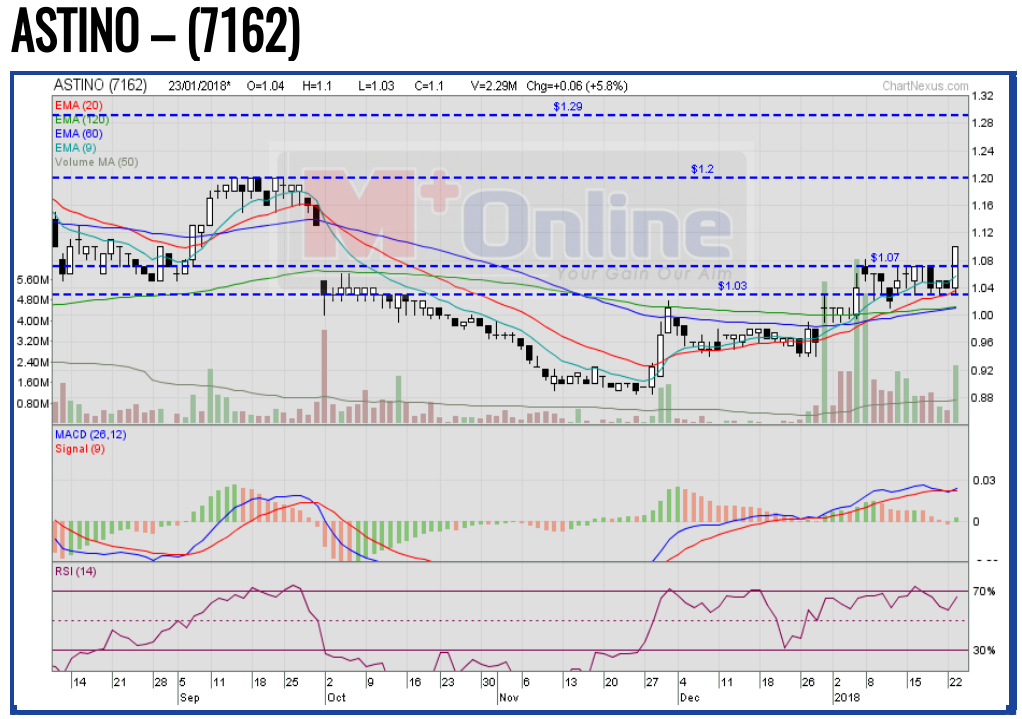

M+ Online Technical Focus - 24 Jan 2018

Author: MalaccaSecurities | Publish date:

ASTINO has broken out above the short term resistance of RM1.07 level with improved volumes. The

MACD Histogram has turned green, while the RSI is hovering above 50.

Price target will be envisaged around the RM1.20 and RM1.29 levels.

Support will be set around the RM1.03 level.

D)

Astino eyes new markets TheStarMon, Oct 09, 2017

Author: bali | Publish date:

Group executive chairman Ng Back Teng told StarBiz that the new products

are necessary as there are fresh opportunities in local and overseas

markets to tap into. (Building materials being produced at the Astino

plant. - Filepic)

NIBONG TEBAL: Astino Bhd![]() will

produce new building materials to capture new markets and boost its

growth in the 2018 financial year, which is projected to be very

challenging for the building materials and construction sectors.

will

produce new building materials to capture new markets and boost its

growth in the 2018 financial year, which is projected to be very

challenging for the building materials and construction sectors.

Group executive chairman Ng Back Teng told StarBiz that the new products

are necessary as there are fresh opportunities in local and overseas

markets to tap into.

“Furthermore the global economy is expected to grow moderately in tandem

with the ongoing slowdown in China, as well as the modest and uneven

recovery in the advanced economies.

“The local steel industries are expected to face a squeeze in profit

margins due to the weak domestic demand, high production costs and

foreign currency volatility.

“To meet these challenges, it is necessary to produce new building materials.

“The plan is to manufacture a new range of roofing tiles and roof truss

products soon, which we hope will raise our yearly output in 2018,” he

said.

In the 2017 financial year ended July 31, the output was 114,000 tonnes,

comprising building materials, roofing products, and agro-house multi

systems.

On the new RM60mil plant now being constructed in Nibong Tebal, Ng said

its completion in 2019 will boost production by 10% from 120,000 tonnes

per annum currently.

“With the additional capacity, the company could plan to increase the contribution of its export sales to Asean countries.

“Astino’s exports to the Philippines, Indonesia and Vietnam generate about 10% of the group’s annual revenue,” he added.

According to Ng, the new plant will enhance the group’s competitive edge

in the northern region, thus enabling it to capture new market share.

To date, the Astino group has six production facilities in Penang, Selangor, Melaka and Pahang.

Ng added that the central region is still the key market in the country.

“Renovation projects in the private sector are generating the most demand for building materials,” he said.

For the 2017 financial year ended July 31, Astino posted RM34.4mil in

net profit on the back of a RM500mil turnover, compared with RM30.3mil

and RM472.7mil respectively achieved in 2016.

Meanwhile, the Penang Master Builders and Building Materials Dealers

Association’s (PMBBMDA) immediate past president Datuk Lim Kai Seng said

about 40% to 50% of the RM200bil projected to be spent on construction

jobs in the country would be for building materials.

“The amount is more or less the same as what was spent on building materials in 2016.

“From January to June 2017, about RM40bil worth of construction jobs

were awarded in the country, of which about RM12bil were generated by

residential projects, according to the latest Construction Industry

Development Board (CIDB) report.

In Penang, Lim said the association was forecasting about RM8bil worth

of jobs to be given out in 2017, of which around RM3bil to RM4bil would

be spent on building materials, about the same as what was spent in

2016.

“The demand for building materials in Penang this year would be driven by residential and non-residential projects,” he added.

According to Transparency Market Research’s (TMR) report on the “Roofing

Market – Global Industry Analysis, Size, Share, Growth, Trends and

Forecast, 2016-2024”, the global roofing market is projected to reach

US$124.5bil by 2024 from US$71.23bil in 2015.

It will also expand at a compounded annual growth rate of 6.4% between 2016 and 2024.

The report said Asia-Pacific was the largest roofing market globally in 2015.

It said the growth of the region is primarily ascribed to the expansion

of the construction industry due to the increase in residential,

non-residential and commercial construction activities.

“In terms of volume, Asia-Pacific held more than a 40% share of the global roofing market in 2015.

“It is also projected to be the fastest-growing market for roofing during the forecast period.

“Demand for roofing in the region is estimated to be primarily driven by

an increase in construction activities and urbanisation, thereby

leading to the construction of medical centres, educational

institutions, commercial buildings, office spaces, hotels, etc in China,

India and Japan,” said the report.

TMR is a global market intelligence company which provides business information reports and services.

E)

与其食鱼,不如学会自渔-ASTINO三部曲实战例子

Author: ahpeng95 | Publish date:与其食鱼,不如学会自渔-ASTINO三部曲实战例子

上一期,作者提到“如何在逆向思维中操作HIBISCS,REACH这几档股票.”

如果有读者想游览,可以按这里https://klse.i3investor.com/blogs/RoadtoSuccess1/ .

这一回,作者会针对主题“与其食鱼,不如学会自渔”,以ASTINO作为实战例子.

首先,趋势面分析

东南亚股市普遍地再创新高,马来西亚为东南亚一带一路的中心.

目前KLCI INDEX站上1800之上,属牛市之势.

马币强势,原油价飙升,大宗商品必定也跟着飙升.

如果大选执政党稳定,外资和中国资金进入是否将带动主要做建筑材料的ASTINO呢?

ASTINO会不会成为基金经理们的囊中物呢?

第二,技术分析

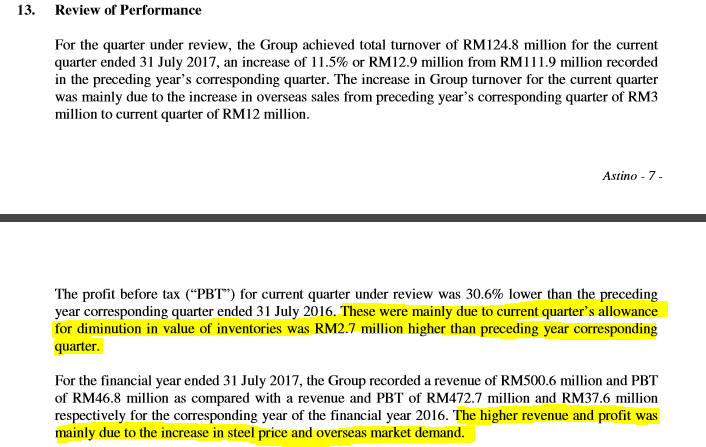

29/9/2017 ASTINO业绩出,不达市场预期,隔天开盘2/10/2017跳空下跌

28/12/2017 ASTINO业绩出,隔天29/12,交易量明显放大,有资金介入.

站稳在EMA50 和EMA25之上,差不多要金叉了.

有资金介入,交易量明显大于2/10/2017的量.

相信第一个TP会挑战前期高点RM1.29

第二个TP=(RM0.885+0.615(上一波的涨幅,下次有机会才画)=RM1.50左右),RM1.50为超涨区

第三,基本面分析

基本面方面,作者主要关注REVENUE和PAT是否有持续增长的潜能.

关注任何新闻与事件可能影响ASTINO的营业额与获利.

比如说:

29/9/2017的业绩不如预期,主要是因为存货, 从而也知道高Steel Price是有利于ASTINO.

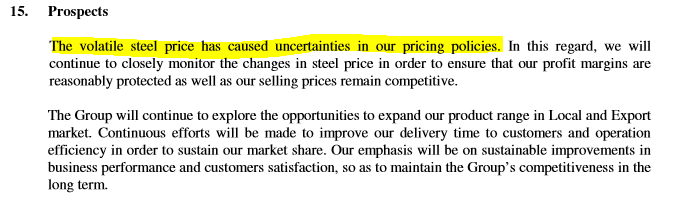

28/12/2017 的业绩也显示steel price volatility 将影响PRICING STRATEGY, 要关注其表现.

以上实战案列纯属参考,一切买卖自负.

如果觉得分析得不错,请按赞本专页:

https://www.facebook.com/财务自由之路-234151897108834/

F)

券商迎市场需求找出20小黑马 散户最爱小型股里再找强中强

大马股市开年後走势强劲,外资和散户大举进场买货,市场七年来首次出现超买,

接连多个交易日出现50亿股成交,市场必须消化庞大交易量,因此这几天的调整来得合理。

以大马本身的因素来说,马股俱备喘定後再涨条件,要顾虑的是外围因素影响,

包括美国股市是否会出现大幅度下跌调整。

大马股市最近大热的都是仙股和低价股,散户更是热衷於追买股价数十仙

至一令吉左右的小型资本股,券商MIDF倒是顺水推舟,迎合"市场需求"

推出一份有二十只小型股的建议名单。

MIDF证券研究以本身的五大条件进行筛选,找出二十只"小黑马",

这样的名单出炉,对该股票行的散户顾客是相当受欢迎。

恰巧在MIDF推出这份名单後,其中数家公司的股价正好猛涨,

《九点股票》为读者整理这二十家公司名单,并会在较後进行另一轮研究,

以找出更适合我们的上市公司名单。

9. 南亚工业(ASTINO 7162)

http://kongsenger.blogspot.my/2018/01/7162-astino-rm110.html