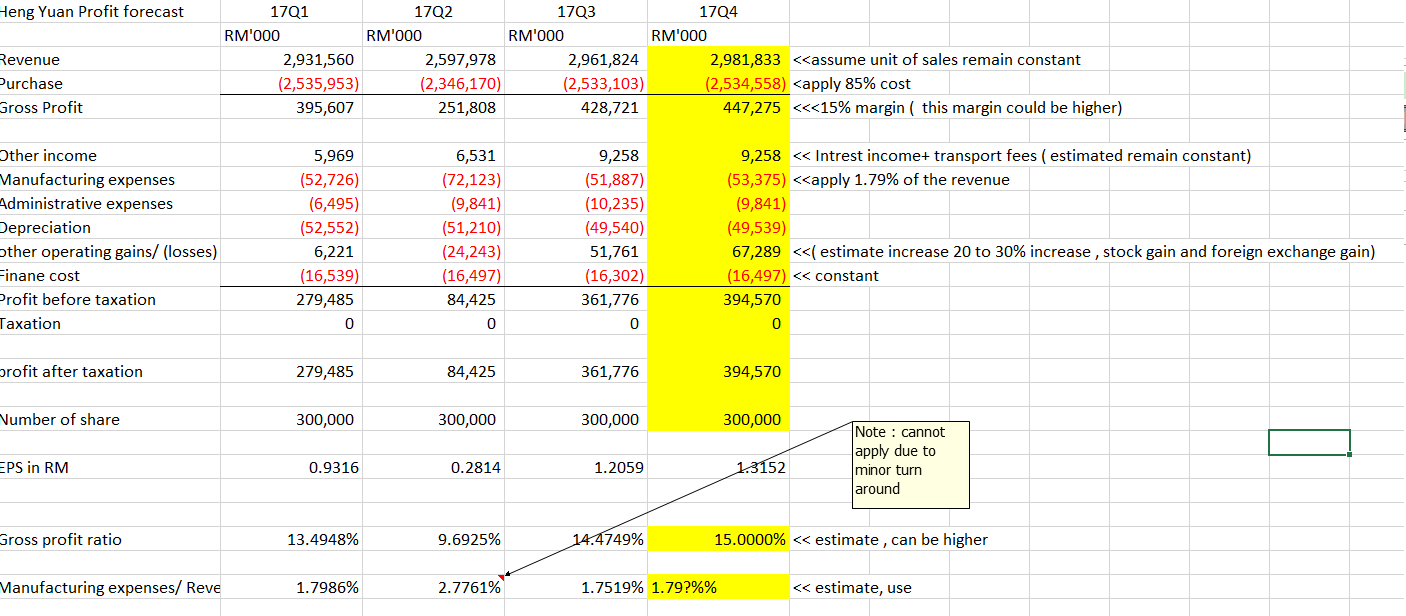

EPS for Q 4 should be around RM 1.31 +- 10%

the will be huge stockholding gain and foreign exchange gain, I might be under-estimated for this both gain

HENG YUAN Q3's note to account

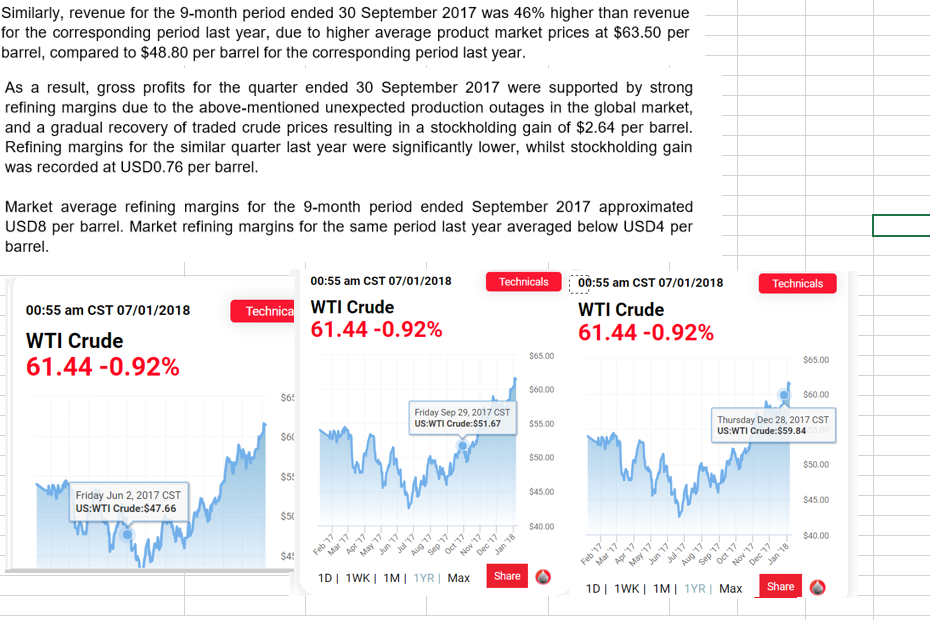

From above chart you may see there will be huge gain for stockholding gain, hence in the P/L "other operating gains/ (losses) "

I estimated it will be 30% increase in stockgain and foreign exchange gain (reaised).

why there will be foreign exchange gain ? this is because majority part

of the loan is used USD as the currency, while the RM is strengthen,

HRC need to pay less RM to it creditor ( loan). hence, from accounting

princeple it should record as other-income.

USD to RM

on 1 June 2017 4.288

on 29 Sept 2017 4.225

on 29 Dec 2017 4.063

now 3.995 HRC will benefit from it if the RM continue to strengthen !!

they have a 10-year product offtake agreement (POA)

covering gasoline, diesel and Jet with Shell Malaysia Trading Sdn Bhd

and Shell Timur Sdn Bhd (POA Buyers) for the supply of refined petroleum

products by HRC.

a 5-year crude oil supply agreement (COSA) with Shell International Eastern Trading Company (SIETCO) for the supply of crude oil to HRC; and

you know what , Refinering Margin and cost won't affect much, because they have a contract will the Shell.

hence, if barrel supply remain the same, I can guarantee HengYuan could

records Highest profit in Q4!!! should be above RM 1.3 !!

http://klse.i3investor.com/blogs/HengYuan_Q4EPS/143396.jsp

http://klse.i3investor.com/blogs/HengYuan_Q4EPS/143396.jsp