Some of you maybe monitoring Mogas 92 crack spread from CME website. But remember Malaysia has no

RON92 gasoline product for quite some time. To estimate Hengyuan profit

margin, we need to monitor Mogas 95, diesel and Jet fuel products as

these 3 products form more than 82% of HY products slate (refer to my part 5 and 7 articles for the pie charts)

https://klse.i3investor.com/blogs/davidtslim/140817.jsp

https://klse.i3investor.com/blogs/davidtslim/136032.jsp

You can also monitor another product (LPG) and you should find the spread also relatively higher in Q4'17 as compared to Q3,17.

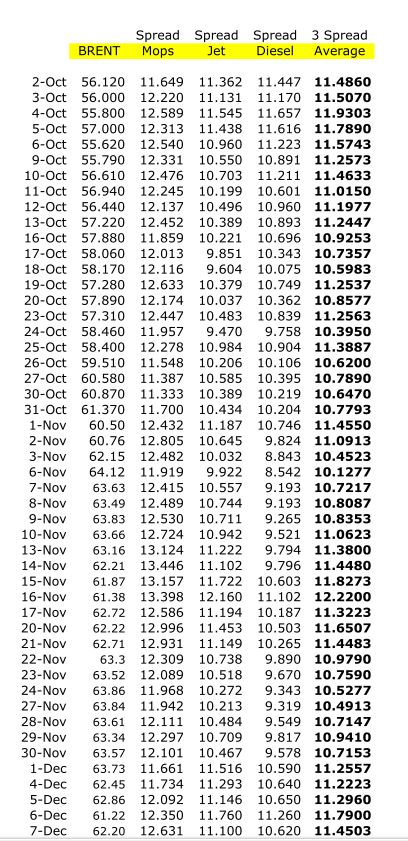

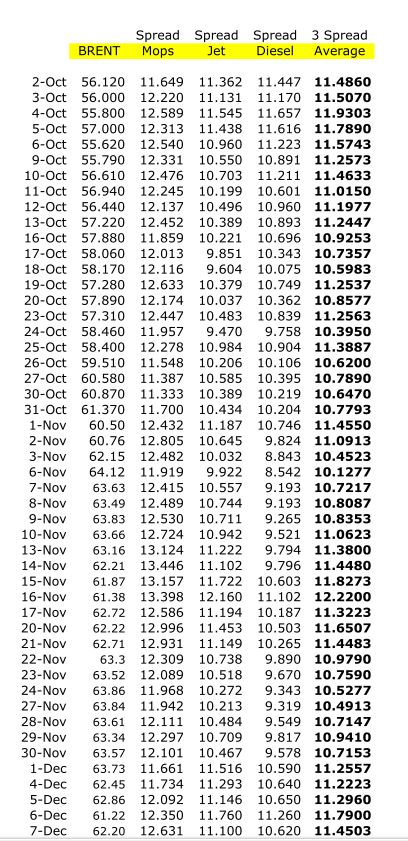

Let have a look on average spread data in Q4'17 extracted from CME website.

https://klse.i3investor.com/blogs/davidtslim/140817.jsp

https://klse.i3investor.com/blogs/davidtslim/136032.jsp

You can also monitor another product (LPG) and you should find the spread also relatively higher in Q4'17 as compared to Q3,17.

Let have a look on average spread data in Q4'17 extracted from CME website.

Source: CME webste (Oct, Nov and Dec data for the 3 products)

Summary:

1. Higher average spread in Q4. Average spread for Mogas 95, diesel, jet fuel is about USD11.2.

2. If we include LPG, Naphtha, propylene, fuel oil, average spread maybe around USD9.5-USD10

3. Sizable Inventory gain (higher than Q3) due to Brent oil closing price at around USD66 on 30 Dec 2017

4. Anticipated higher sales volume in Q4 as traditionally Q4 is HY peak season

5. Anticipated Forex gain as RM closed at around 4.05 on 30 Dec 2017

6. Strong RM in Jan 2018 may lead to lower import cost of their crude oil (buy crude oil in USD)

7. Flexibility of their refinery system.