Note : This article was emailed to my subscribers on 11 January 2017. By coincidence, on 13 January 2017, The Star came out with a similar article.

https://www.thestar.com.my/business/business-news/2018/01/13/reset-at-orion-ixl/

1. Background Information

Orion was previously known as CWorks Systems Bhd. It is principally involved in computerized maintenance management systems (CMMS). The CMMS is a preventive maintenance software which is designed to meet an entity’s needs of maintenance operations with functionalities such as asset management, work management, preventive maintenance, etc.

As at todate, Orion has 599 mil shares outstanding. Based on 15 sen share price, market cap is RM90 mil. It is listed on ACE.

It has RM5 mil cash, zero borrowings and shareholders’ funds of RM86 mil. Net asset per share is 14 sen.

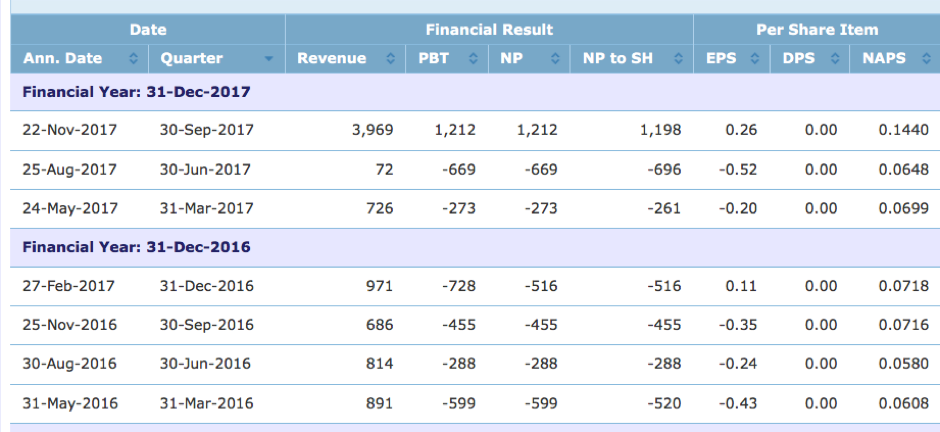

Orion has not done well in the past. However, earnings improved in latest quarter ended September 2017 due to contribution from new asset acquired (which is what makes this stock interesting, please read on).

2. Acquisition of ASAP Berhad (“ASAP”)

In October 2016, Orion announced the proposed acquisition of 100% equity interest in ASAP for cash consideration of RM73 mil. The acquisition was completed on 2 August 2017. It was funded by a rights issue at 17 sen per share, which was also completed in 2017.

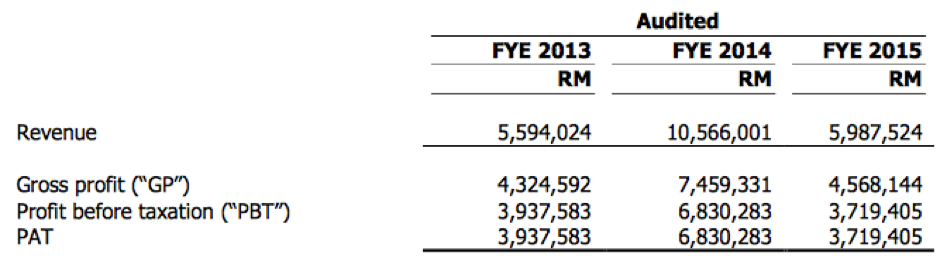

ASAP is in the same industry as Orion (market share of 9% vs. Orion’s 3%). ASAP has a respectable profit track record :-

What made the deal interesting was that the vendors of ASAP had provided a profit guarantee of RM7.5 mil per annum over the next two years (total RM15 mil).

3. Concluding Remarks

In FYE 31 December 2016, Orion incurred losses of RM1.75 mil. However, going forward, there will be guaranteed profit of RM7.5 mil per annum from ASAP (two years). On pro forma basis, net profit works out to be about RM5.8 mil.

Based on existing market cap of RM90 mil, the stock is trading at 15 times forward PER.

The ACE market traditionally trades at high PER. Will Orion have further upside ? Only time can tell.

For further details, please refer to the following blog articles by some other authors :

https://klse.i3investor.com/blogs/kianweiaritcles/143930.jsp

https://klse.i3investor.com/blogs/ifrit2020/140531.jsp

http://klse.i3investor.com/blogs/icon8888/144193.jsp