At the time this blog written, price now at RM 2.31 (syariah)

Supermax is not my main pick for investment, but this news make me pick this stock and hold for the next quarter just one month left.

News:

Affin Hwang Capital upgrades Supermax, raises target to RM3.10

KUALA LUMPUR (Jan 9): Affin Hwang Capital Research has upgraded

Supermax Corp Bhd to “Buy” at RM2.08 with a higher target price (TP) of

RM3.10 (from RM2.10) and said the stock was currently trading at an

undemanding 11.8x FY18E EPS (60% discount relative to peers).

In a note today, the research house said Supermax, like its peers,

should continue to benefit from the ongoing glove shortage, despite the

legal issue surrounding its founder.

“Delivery of earnings growth in FY18 will likely be the key re-rating catalyst.

“We raise the 12-month TP to RM3.10 based on a 17.8x CY18E PER,” it said.

----------------------------------------------------------------------------------------------------------

Affin hwang rise target buy RM 3.10 !, For me my personal target

around RM 2.70-2.90. But I believe after this, IB such kenanga, midf

might be revise target follow affin hwang. For me one factor that I will

pick this stock because Amanah Saham Nasional (ASN) have inside this

stock, and Tan Sri Rafidah Aziz inside this company. How about future

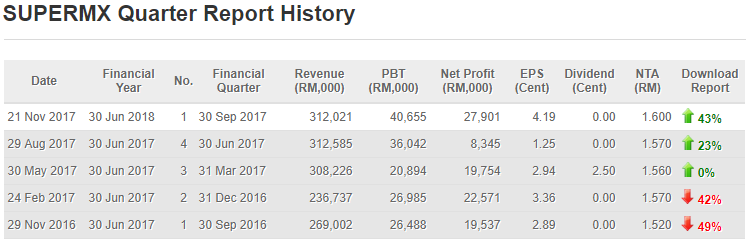

quarter in Febuary?

Quarter will out in Feb. just one month left. Revenue sure will

increase compare to last year and eps should be 4.5-5.7. Long invester

should buy and hold this stock until Febuary. Then how about cw? By the

end of this month, sure most cw will bacome expensive around RM

0.30-0.70cents. However c33 and others much safe bacause maturity around

Jun-July.

http://klse.i3investor.com/blogs/SASARANHARGASTOCK/143711.jsp