The Edge Financial Daily’s picks are based on some of the investment themes that fund managers are exploring in 2018. These themes include the turnaround of the badly hit oil and gas industry where many companies’ share prices have tumbled to all-time lows; better corporate earnings growth amid a synchronised global economy recovery; interest rate hikes globally; and a strengthening ringgit. Meanwhile, the e-commence boom that leads to stronger demand for logistics services and improved consumer sentiments that will boost private consumption could also be the buying impetus that drives investors’ interests. We did not make a selection based on the 14th general election theme as most research houses have said the market could return to fundamentals after the election.

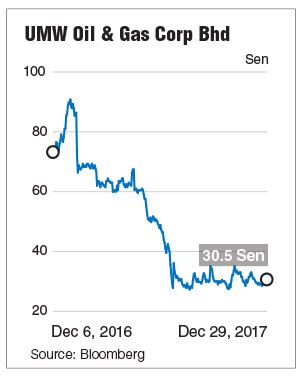

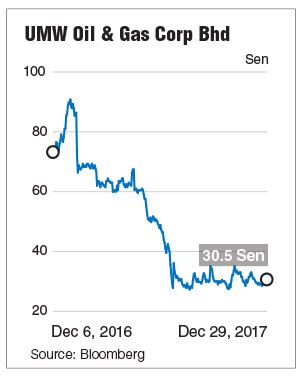

1. UMW Oil & Gas Corp Bhd - Bouncing back

UMW Oil & Gas Corp Bhd (UMW O&G) could turn around in 2018 as its earnings recovery is on sight. The country’s biggest jack-up rig operator has returned to the black in the third financial quarter ended Sept 30, 2017 (3QFY17), with a net profit of RM3.4 million, or 0.16 sen per share, compared to a net loss of RM135.4 million, or 6.26 sen per share. UMW O&G has seen its fleet utilisation improve from a dismal average of 21% in the 1QFY16 to 68% and 90% in 2QFY17 and 3QFY17 respectively.

According to TA Securities analyst Abel Goon, UMW O&G’s management expects the utilisation rate to be greater than 90% in 4QFY17, while FY18 will realise at least 80% utilisation rate.

“For UMW O&G, one of the key risks is the idling costs incurred. With the utilisation rate now back to about 90% level, the company should see a turnaround in 2018. Although the rates remain at a fairly low level, the company would turn profitable if the management could maintain the utilisation rate,” Goon told The Edge Financial Daily over a phone call.

He added that UMW O&G should be able to secure more drilling contracts from Petroliam Nasional Bhd’s (Petronas) prioritising local content. Based on UMW O&G management’s feedback, Goon pointed that Petronas requires at least 12 rigs in Malaysia for FY18. UMW O&G currently has seven premium jack-up rigs generating 99% of the group’s revenue.

Further, it is on a stronger financial footing after the completion of RM1.8 billion rights issue.

UMW O&G has guided that a one-time write-off of unamortised transaction costs plus potential asset impairment loss arising from a year-end review in 4QFY17 could weigh on its annual earnings for the financial year ended Dec 31, 2017 (FY17).

Goon reckons the market has priced in a large impairment in 4QFY17, which is why the share price remains at a subdued level. At the current price, UMW O&G is trading at about 0.5 times its book value, one standard deviation below its historical average, despite the expected turnaround in its operations, alleviations of short-term liquidity risks and upwards trajectory seen in oil prices.

TA Securities has set a target price of 51 sen a share, indicating a potential upside of 67.2% from its closing price of 30.1 sen last Friday.

Nonetheless, there remains downside risks for O&G players, especially if the crude oil price sees another sharp decline, which could lead to low utilisation rate. The higher-than-expected finance costs, despite the reduction in borrowings, could also hurt UMW O&G, which has a relatively high gearing level. — By Billy Toh

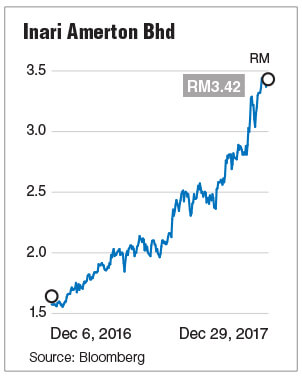

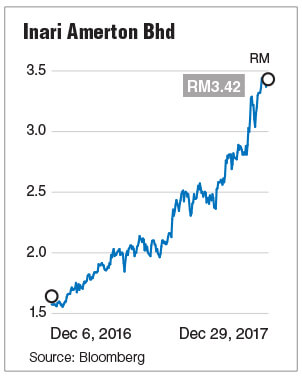

2. Inari Amertron Bhd - Riding on continuous firm demand

Inari Amertron Bhd, one of The Edge Financial Daily’s stock picks for 2017, is also one of the top performers for the year on Bursa Malaysia. It remains as one of our stock picks amid expectations that demand for radio frequency (RF) filters to stay strong despite saturating growth in the global smartphone market.

Affin Hwang analyst Kevin Low told The Edge Financial Daily that demand is driven by the increase in bandwidths and complexity in expanding the long-term evolution coverage, and that demand for RF will likely remain robust. Also, Inari’s customer, Broadcom, is a major player in this space.

“The number of Inari’s RF testers grew to 960 units and was projected to reach 1,000 units by end-2017. This had far exceeded our assumptions for FY18 (ending June 30, 2018) to FY20, as we had only expected the 1,000-unit mark to be hit by FY20,” Low said, adding that the Iris IR chip could be Inari’s new earnings driver.

Inari achieved a net profit growth of 42.4% in the first financial quarter ended Sept 30, 2017 (1QFY17) to RM68.4 million, from RM48 million in the previous corresponding quarter, mainly due to increased demand for its existing and new products which came on stream during the past two quarters.

The positive outlook is also supported by the upward forecast revision on global semiconductor sales by World Semiconductor Trade Statistics, which raised its forecast to an annual growth of 20.6% in 2017 and 7% in 2018. Similarly, other market researchers such as Gartner Inc and IC Insights have revised their forecasts upwards on the semiconductor industry due to exceptional growth in the memory device market.

Inari’s share price, which closed at RM3.40 last Friday, has exceeded the average 12-month target price of RM3.09 by analysts based on data compiled by Bloomberg.

Despite the optimism on demand, the slowdown in global demand for smart devices, loss of customer base, and the introduction of new technologies may render Inari’s products obsolete and could dampen its earnings prospects. Investors should also pay heed to a recent report on the forecasts cut on Apple’s iPhone X shipment by analysts citing tepid demand.

In the last five years, Inari’s investors would have seen an annualise gain of 101.3%. At the current level, the stock is trading at a trailing price-earnings ratio (P/E) of 27 times compared with Apple Inc’s 18 times. Despite the downside risks, Inari has a proven track record with a good management and is a leading RF test house in Asia, which fit into our selections. — By Billy Toh

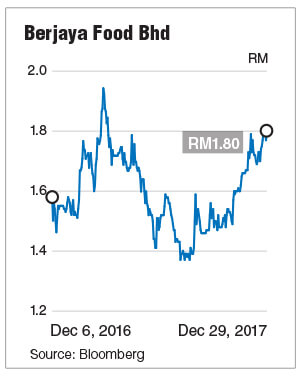

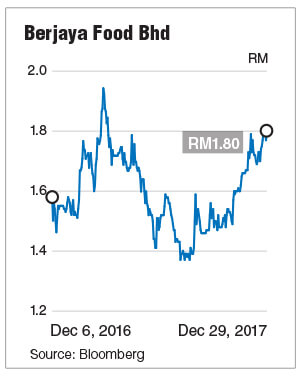

3. Berjaya Food Bhd - Extra shots from Starbucks

Berjaya Food Bhd (BFood) is expected to see its earnings growth moving forward supported by Starbucks due to its store expansion and recovery in same-store sales growth (SSSG). The company will also benefit from a strong ringgit, which will help to expand its profit margin, as up to 50% of its materials are imported.

According to the group’s latest financial results, BFood’s net profit grew 15.5% to RM5.8 million in the second financial quarter ended Oct 30, 2017 (2QFY18) from RM5 million a year ago, thanks to higher profit recorded by Starbucks’ operations in Malaysia and lower losses incurred by Kenny Rogers Roaster’s (KRR) operations in Indonesia arising from further closure of non-performing outlets.

RHB Research analyst Soong Wei Siang told The Edge Financial Daily that BFood’s management is looking to turn around KRR Malaysia in FY18 and had implemented changes such as introducing a new menu and moderating the prices of dishes served. He said BFood’s management also aims to improve service standards at KRR Malaysia to the level of Starbucks.

In previous quarters, BFood’s earnings were dragged down by KRR’s operations. With a potential turnaround at KRR Malaysia and the Starbucks-driven growth, Soong said this provides a two-pronged avenue to spur earnings growth. “The recent disposal of KRR Indonesia is earnings-accretive, and we believe it would continue to lift sentiments on the stock,” he said.

Nonetheless, BFood is currently trading at a lofty valuation. At its closing price of RM1.85 last Friday, BFood is trading at a trailing P/E of 55 times. In comparison, Starbucks Corp, listed in the US, is only trading at a trailing P/E of 26 times. The downside risks at the current price include a lower-than-expected SSSG growth and rising operating costs. — By Billy Toh

4. Straits Inter Logistics Bhd - Bunkering services fuel growth

The company seems to have gained a new lease of life. Its net profit jumped 63 times to RM631,000 in the latest third financial quarter ended Sept 30, 2017 (3QFY17) from RM10,000 in 3QFY16, while its revenue grew 63.4% to RM33 million from RM20.2 million during the same period.

It has secured a RM45 million bunkering services contract which will provide more stable revenue and wider margins compared with its oil trading operation.

According to Rakuten Trade Sdn Bhd head of research Kenny Yee, Straits Inter Logistics is the only listed bunkering company on Bursa. Bunkering is basically a “floating petrol station” for sea dwelling vessels.

“I think that while 3QFY17 shows a marked improvement, Straits Inter Logistics’ future earnings and prospect are bright. Currently, the trading and supply of oil products has been the main revenue contributor and the company is expected to move up the value chain with the acquisition of two bunkering vessels with a combined capacity of one million litres of premium oil,” Yee said.

The two bunkering vessels are docked at Pasir Gudang, Johor and Labuan, according to Yee, and he pointed out the bunkering operations from the Pasir Gudang port had only commenced in 4QFY17, indicating better results in the quarter.

In August last year, Straits Inter Logistics, formerly known as Raya International Bhd, unveiled a new corporate brand identity to reflect its new business direction, as a major marine logistics company providing premium oil bunkering services to marine and cargo bulk transporters, O&G vessels, floating production storage and offloading vessels, cruise ships and ferries.

Under new managing director Datuk Seri Ho Kam Choy, who replaced Datuk Tan Seng Hu, and with a healthy balance sheet with net cash of RM16.5 million arising from a completed rights issue exercise, Straits Inter Logistics is in a good position to expand its bunkering business.

With its share price leaping 94% in 2017, Straits Inter Logistics is trading at a trailing price-earnings ratio of 34.3 times; however, as earnings visibility improves with the start of its Pasir Gudang bunkering operations, the company’s earnings are expected to catch up with the valuation.

Yee has a target price of 31 sen a share for Straits Inter Logistics, indicating a potential upside of 19.2%. — By Billy Toh

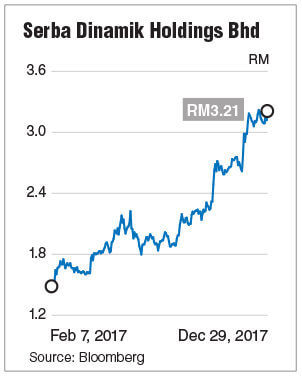

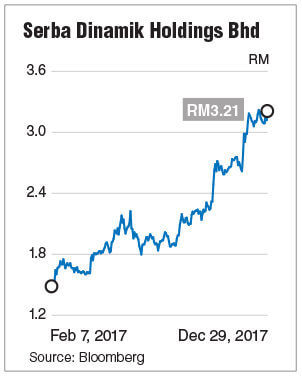

5. Serba Dinamik Holdings Bhd - Record high order book

Less than a year after its listing on Bursa, Serba Dinamik Holdings Bhd shares more than doubled to end 2017 at RM3.24, versus its initial public offering price of RM1.50. It has a market capitalisation of RM4.33 billion.

Despite the volatility in crude oil prices leaving most of Malaysia’s O&G players beleaguered, the company has seen earnings rise year-on-year. Its net profit jumped nearly four times to RM229.5 million in the first nine months of 2017 due to improved contributions from its operations and maintenance as well as engineering, procurement, construction and commissioning services.

Serba Dinamik, providing engineering solutions to O&G and power generation industries, is expected to benefit from a sector-wide recovery as oil prices stabilise, said PublicInvest Research deputy head of research Ching Weng Jin.

Affin Hwang Capital Research has raised its target price for the stock to RM4 from RM3.60, touting Serba Dinamik’s RM4 billion order book target for the latest financial year ending Dec 31, 2018 (FY18) as conservative as the company is expected to expand its asset ownership.

“An all-time high order book of RM5.3 billion should drive better earnings growth in the financial year ending Dec 31, 2018,” said the research house in a Dec 13 note.

It is screaming “buy” on the stock among analysts who track it, with consensus 12-month target price of RM3.61, according to Bloomberg data. — By Samantha Ho

6. CIMB Group Holdings Bhd - In calmer waters

An interest rate hike and improved loan growth amid stronger economic growth augur well for the banking sector in 2018. CIMB Group Holdings Bhd may benefit from healthier capital market activities going forward, according to TA Securities.

Analysts opine that better growth prospects across its Indonesian and Thai operations are also likely to support earnings. “While we forecast the overall credit charge to remain elevated, we believe the worst, in terms of asset quality, may be over,” TA Securities analyst Li Hsia Wong wrote in the research firm’s annual strategy report.

Credit costs for CIMB improved to 73 basis points in the third quarter ended Sept 30, 2017 from 78 basis points a year ago, despite a 9% quarter-on-quarter increase in absolute gross impaired loans.

Also in its annual strategy report, TA Securities highlights CIMB is trading at an attractive price-book value of 1.12 times compared with an industry average of 1.15 times with its large market capitalisation at peers’ average of 1.5 times.

Having rallied to a one-year high of RM7.08 at end-August last year, the share price retraced to RM6.54 last Friday. It has a market value of RM60.34 billion.

The group commands 18 “buy” calls, four “holds” and two “sells”, according to Bloomberg data. Out of 24 analysts, 21 have a consensus 12-month target price of RM6.87 a share. — By Samantha Ho

7. Muhibbah Engineering (M) Bhd - Contract wins to buoy Muhibbah

New contract wins and positive prospects in the construction, O&G, marine and aviation sectors are expected to continue driving earnings at Muhibbah Engineering (M) Bhd, which provides engineering and construction services.

The group recently secured a RM70 million contract to build a reinforced concrete jetty and platform from Tenaga Nasional Bhd, as well as a RM189 million work package for the mass rail transit 2. This brings its total order book to RM2.7 billion so far.

According to MIDF Research head of research Mohd Redza Abdul Rahman, Muhibbah is among the companies expected to benefit as an exporter of services and commodities.

“The group is expected to benefit from its exposure to Qatar and the tripling of its capacity there,” Mohd Redza told The Edge Financial Daily, noting the blockade on Qatar by other Gulf countries is unlikely to hamper the group.

Additionally, the group is expected to gain from higher aviation activity, with recurring income from its associate, Cambodia Airports, he said.

All seven analysts eyeing Muhibbah, and covered by Bloomberg, maintain a “buy” call on the counter, with a 12-month target price of RM3.65 a share. It last traded at RM2.84, with a market capitalisation of RM1.37 billion. — By Samantha Ho

8. Tenaga Nasional Bhd - Analysts screaming “buy”

Tenaga Nasional Bhd (TNB) saw its share price soaring further last week following the government’s decision to fork out RM929 million to subsidise electricity tariff for the first six months of 2018 and also to keep the base tariff at 38.53 sen/kWh until 2020.

Pending the release of regulatory period 2 (RP2) input details, most research houses have maintained their earnings forecasts and target prices for TNB.

Maybank IB Research, in its latest research note dated Dec 27, said every 0.5 percentage point lower weighted average cost of capital from 2018 impacts the research house’s target by RM1.30, barring any unforeseen circumstances.

“We see room for Tenaga to rerate as doubts over the pass-through mechanism eventually dissipate,” said Maybank IB Research.

“Tenaga is seen as a liquid proxy to GDP (gross domestic product) growth,” MIDF Research’s Mohd Redza told The Edge Financial Daily on a phone call, adding the utility firm is likely to benefit from an expected economic expansion in 2018.

He also pointed out the counter is among the stocks with a high trading velocity due to a strong following among local and foreign funds.

Over the past one year, the stock grew about 14.41% to RM15.26 last Friday. According to Bloomberg, of the 25 analysts covering the company, 20 of them have a “buy” call on the stock, four “holds” and one “sell”. — By Wong Ee Lin

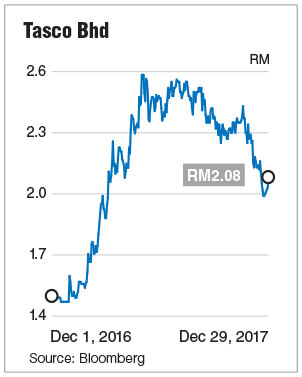

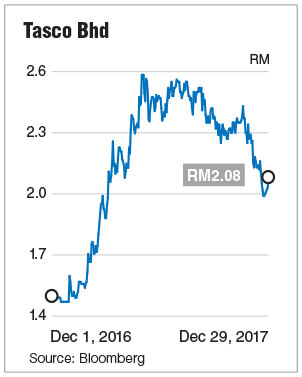

9. Tasco Bhd - Clientele diversification the key driver

Tasco Bhd has been strengthening its foothold in the logistics industry through diversifying its clientele and moving up the value chain by providing full-fledge logistics

solutions to customers. Going into 2018, analysts are sanguine on its future growth following its venture into the cold chain market.

It took over Gold Cold Transport Sdn Bhd, one of the largest cold chain logistics players in Malaysia, and MILS Cold Chain Sdn Bhd last year.

MIDF Research analyst Adam Mohamed Rahim said the contribution from this segment, which started in the second quarter ended Sept 30, 2017 (2QFY18), is expected to increase moving forward.

Adam added that Tasco’s regional distribution centre in the Digital Free Trade Zone for Renesas, one of the world’s largest producers of microcontrollers and microprocessors, is also one of the main drivers for Tasco’s “bright” outlook in 2018.

Additionally, he noted that Tasco has entered into a shareholder agreement with Yee Lee Corp Bhd’s wholly-owned subsidiary Yee Lee Trading Co Sdn Bhd, expected to provide expansion opportunities for Tasco, enabling the logistics player to access new markets and distribution networks.

On whether it is now a good time for investors to buy the stock, Adam reckons so, explaining that Tasco is currently trading at a P/E of 14 times — reasonable compared with most of its peers with a P/E of below 10 times and 20 times.

Over the past year, the stock has rallied 41.5% to close at RM2.08 in 2017. Analysts’ target price is between RM2.55 and RM2.69, according to Bloomberg data. — by Wong Ee Lin

10. MKH - Young trees to boost yield

MKH Bhd, having made its foray into the oil palm plantation business 10 years ago, sees most of its oil palm trees reaching prime age in 2017 and 2018.

With the expectation of better fresh fruit bunch (FFB) production to improve in the next few years, the plantation division is expected to sustain strong earnings growth and contribution to the group’s bottom line.

MKH’s share price fell nearly 68% to RM1.63 in 2017 after its net profit for the financial year ended Sept 30, 2017 (FY17) declined 36.37% to RM130.48 million from RM205.04 million, mainly due to the absence on a net project grant worth RM11.7 million from the government and lower sales revenue.

At the current level, MKH is trading at a trailing P/E of 5.8 times. In comparison, MKH trades at an average historical P/E of 9.5 times in the last five years.

According to TA Securities analyst Steven Soo, MKH’s share price has bottomed to a reasonable price level. Hence, he opines that the stock should recover in the second half of 2018.

With expectations of the CPO price at a sustainable level above RM2,300 and the attractive valuation that MKH offers, The Edge Financial Daily has selected MKH as one of the stock picks for 2018.

MKH’s exposure to the property and construction segment could also see a turnaround with its launches in Kajang 2 if sales exceed expectations.

MKH has deferred property launches on its prime land in Kajang and Semenyih over the past two years as it awaited the completion of key infrastructures such as the RM62 million flyover in Kajang 2, and the Sungai Buloh-Kajang mass rail transit line which has been operational since July 2017, according to AllianceDBS Research’s research report dated Nov 29.

The research house noted the stronger-than-expected sales from launches in Kajang 2 could be a re-rating catalyst.

Nevertheless, the key risks AllianceDBS pointed out is that MKH may face margin compression due to rising construction cost for property projects as well as exposure to fluctuations in crude palm oil prices which in turn could increase earnings volatility. — by Wong Ee Lin

http://www.theedgemarkets.com/article/top-10-stock-picks-2018

UMW Oil & Gas Corp Bhd (UMW O&G) could turn around in 2018 as its earnings recovery is on sight. The country’s biggest jack-up rig operator has returned to the black in the third financial quarter ended Sept 30, 2017 (3QFY17), with a net profit of RM3.4 million, or 0.16 sen per share, compared to a net loss of RM135.4 million, or 6.26 sen per share. UMW O&G has seen its fleet utilisation improve from a dismal average of 21% in the 1QFY16 to 68% and 90% in 2QFY17 and 3QFY17 respectively.

According to TA Securities analyst Abel Goon, UMW O&G’s management expects the utilisation rate to be greater than 90% in 4QFY17, while FY18 will realise at least 80% utilisation rate.

“For UMW O&G, one of the key risks is the idling costs incurred. With the utilisation rate now back to about 90% level, the company should see a turnaround in 2018. Although the rates remain at a fairly low level, the company would turn profitable if the management could maintain the utilisation rate,” Goon told The Edge Financial Daily over a phone call.

He added that UMW O&G should be able to secure more drilling contracts from Petroliam Nasional Bhd’s (Petronas) prioritising local content. Based on UMW O&G management’s feedback, Goon pointed that Petronas requires at least 12 rigs in Malaysia for FY18. UMW O&G currently has seven premium jack-up rigs generating 99% of the group’s revenue.

Further, it is on a stronger financial footing after the completion of RM1.8 billion rights issue.

UMW O&G has guided that a one-time write-off of unamortised transaction costs plus potential asset impairment loss arising from a year-end review in 4QFY17 could weigh on its annual earnings for the financial year ended Dec 31, 2017 (FY17).

Goon reckons the market has priced in a large impairment in 4QFY17, which is why the share price remains at a subdued level. At the current price, UMW O&G is trading at about 0.5 times its book value, one standard deviation below its historical average, despite the expected turnaround in its operations, alleviations of short-term liquidity risks and upwards trajectory seen in oil prices.

TA Securities has set a target price of 51 sen a share, indicating a potential upside of 67.2% from its closing price of 30.1 sen last Friday.

Nonetheless, there remains downside risks for O&G players, especially if the crude oil price sees another sharp decline, which could lead to low utilisation rate. The higher-than-expected finance costs, despite the reduction in borrowings, could also hurt UMW O&G, which has a relatively high gearing level. — By Billy Toh

2. Inari Amertron Bhd - Riding on continuous firm demand

Inari Amertron Bhd, one of The Edge Financial Daily’s stock picks for 2017, is also one of the top performers for the year on Bursa Malaysia. It remains as one of our stock picks amid expectations that demand for radio frequency (RF) filters to stay strong despite saturating growth in the global smartphone market.

Affin Hwang analyst Kevin Low told The Edge Financial Daily that demand is driven by the increase in bandwidths and complexity in expanding the long-term evolution coverage, and that demand for RF will likely remain robust. Also, Inari’s customer, Broadcom, is a major player in this space.

“The number of Inari’s RF testers grew to 960 units and was projected to reach 1,000 units by end-2017. This had far exceeded our assumptions for FY18 (ending June 30, 2018) to FY20, as we had only expected the 1,000-unit mark to be hit by FY20,” Low said, adding that the Iris IR chip could be Inari’s new earnings driver.

Inari achieved a net profit growth of 42.4% in the first financial quarter ended Sept 30, 2017 (1QFY17) to RM68.4 million, from RM48 million in the previous corresponding quarter, mainly due to increased demand for its existing and new products which came on stream during the past two quarters.

The positive outlook is also supported by the upward forecast revision on global semiconductor sales by World Semiconductor Trade Statistics, which raised its forecast to an annual growth of 20.6% in 2017 and 7% in 2018. Similarly, other market researchers such as Gartner Inc and IC Insights have revised their forecasts upwards on the semiconductor industry due to exceptional growth in the memory device market.

Inari’s share price, which closed at RM3.40 last Friday, has exceeded the average 12-month target price of RM3.09 by analysts based on data compiled by Bloomberg.

Despite the optimism on demand, the slowdown in global demand for smart devices, loss of customer base, and the introduction of new technologies may render Inari’s products obsolete and could dampen its earnings prospects. Investors should also pay heed to a recent report on the forecasts cut on Apple’s iPhone X shipment by analysts citing tepid demand.

In the last five years, Inari’s investors would have seen an annualise gain of 101.3%. At the current level, the stock is trading at a trailing price-earnings ratio (P/E) of 27 times compared with Apple Inc’s 18 times. Despite the downside risks, Inari has a proven track record with a good management and is a leading RF test house in Asia, which fit into our selections. — By Billy Toh

3. Berjaya Food Bhd - Extra shots from Starbucks

Berjaya Food Bhd (BFood) is expected to see its earnings growth moving forward supported by Starbucks due to its store expansion and recovery in same-store sales growth (SSSG). The company will also benefit from a strong ringgit, which will help to expand its profit margin, as up to 50% of its materials are imported.

According to the group’s latest financial results, BFood’s net profit grew 15.5% to RM5.8 million in the second financial quarter ended Oct 30, 2017 (2QFY18) from RM5 million a year ago, thanks to higher profit recorded by Starbucks’ operations in Malaysia and lower losses incurred by Kenny Rogers Roaster’s (KRR) operations in Indonesia arising from further closure of non-performing outlets.

RHB Research analyst Soong Wei Siang told The Edge Financial Daily that BFood’s management is looking to turn around KRR Malaysia in FY18 and had implemented changes such as introducing a new menu and moderating the prices of dishes served. He said BFood’s management also aims to improve service standards at KRR Malaysia to the level of Starbucks.

In previous quarters, BFood’s earnings were dragged down by KRR’s operations. With a potential turnaround at KRR Malaysia and the Starbucks-driven growth, Soong said this provides a two-pronged avenue to spur earnings growth. “The recent disposal of KRR Indonesia is earnings-accretive, and we believe it would continue to lift sentiments on the stock,” he said.

Nonetheless, BFood is currently trading at a lofty valuation. At its closing price of RM1.85 last Friday, BFood is trading at a trailing P/E of 55 times. In comparison, Starbucks Corp, listed in the US, is only trading at a trailing P/E of 26 times. The downside risks at the current price include a lower-than-expected SSSG growth and rising operating costs. — By Billy Toh

4. Straits Inter Logistics Bhd - Bunkering services fuel growth

The company seems to have gained a new lease of life. Its net profit jumped 63 times to RM631,000 in the latest third financial quarter ended Sept 30, 2017 (3QFY17) from RM10,000 in 3QFY16, while its revenue grew 63.4% to RM33 million from RM20.2 million during the same period.

It has secured a RM45 million bunkering services contract which will provide more stable revenue and wider margins compared with its oil trading operation.

According to Rakuten Trade Sdn Bhd head of research Kenny Yee, Straits Inter Logistics is the only listed bunkering company on Bursa. Bunkering is basically a “floating petrol station” for sea dwelling vessels.

“I think that while 3QFY17 shows a marked improvement, Straits Inter Logistics’ future earnings and prospect are bright. Currently, the trading and supply of oil products has been the main revenue contributor and the company is expected to move up the value chain with the acquisition of two bunkering vessels with a combined capacity of one million litres of premium oil,” Yee said.

The two bunkering vessels are docked at Pasir Gudang, Johor and Labuan, according to Yee, and he pointed out the bunkering operations from the Pasir Gudang port had only commenced in 4QFY17, indicating better results in the quarter.

In August last year, Straits Inter Logistics, formerly known as Raya International Bhd, unveiled a new corporate brand identity to reflect its new business direction, as a major marine logistics company providing premium oil bunkering services to marine and cargo bulk transporters, O&G vessels, floating production storage and offloading vessels, cruise ships and ferries.

Under new managing director Datuk Seri Ho Kam Choy, who replaced Datuk Tan Seng Hu, and with a healthy balance sheet with net cash of RM16.5 million arising from a completed rights issue exercise, Straits Inter Logistics is in a good position to expand its bunkering business.

With its share price leaping 94% in 2017, Straits Inter Logistics is trading at a trailing price-earnings ratio of 34.3 times; however, as earnings visibility improves with the start of its Pasir Gudang bunkering operations, the company’s earnings are expected to catch up with the valuation.

Yee has a target price of 31 sen a share for Straits Inter Logistics, indicating a potential upside of 19.2%. — By Billy Toh

5. Serba Dinamik Holdings Bhd - Record high order book

Less than a year after its listing on Bursa, Serba Dinamik Holdings Bhd shares more than doubled to end 2017 at RM3.24, versus its initial public offering price of RM1.50. It has a market capitalisation of RM4.33 billion.

Despite the volatility in crude oil prices leaving most of Malaysia’s O&G players beleaguered, the company has seen earnings rise year-on-year. Its net profit jumped nearly four times to RM229.5 million in the first nine months of 2017 due to improved contributions from its operations and maintenance as well as engineering, procurement, construction and commissioning services.

Serba Dinamik, providing engineering solutions to O&G and power generation industries, is expected to benefit from a sector-wide recovery as oil prices stabilise, said PublicInvest Research deputy head of research Ching Weng Jin.

Affin Hwang Capital Research has raised its target price for the stock to RM4 from RM3.60, touting Serba Dinamik’s RM4 billion order book target for the latest financial year ending Dec 31, 2018 (FY18) as conservative as the company is expected to expand its asset ownership.

“An all-time high order book of RM5.3 billion should drive better earnings growth in the financial year ending Dec 31, 2018,” said the research house in a Dec 13 note.

It is screaming “buy” on the stock among analysts who track it, with consensus 12-month target price of RM3.61, according to Bloomberg data. — By Samantha Ho

6. CIMB Group Holdings Bhd - In calmer waters

An interest rate hike and improved loan growth amid stronger economic growth augur well for the banking sector in 2018. CIMB Group Holdings Bhd may benefit from healthier capital market activities going forward, according to TA Securities.

Analysts opine that better growth prospects across its Indonesian and Thai operations are also likely to support earnings. “While we forecast the overall credit charge to remain elevated, we believe the worst, in terms of asset quality, may be over,” TA Securities analyst Li Hsia Wong wrote in the research firm’s annual strategy report.

Credit costs for CIMB improved to 73 basis points in the third quarter ended Sept 30, 2017 from 78 basis points a year ago, despite a 9% quarter-on-quarter increase in absolute gross impaired loans.

Also in its annual strategy report, TA Securities highlights CIMB is trading at an attractive price-book value of 1.12 times compared with an industry average of 1.15 times with its large market capitalisation at peers’ average of 1.5 times.

Having rallied to a one-year high of RM7.08 at end-August last year, the share price retraced to RM6.54 last Friday. It has a market value of RM60.34 billion.

The group commands 18 “buy” calls, four “holds” and two “sells”, according to Bloomberg data. Out of 24 analysts, 21 have a consensus 12-month target price of RM6.87 a share. — By Samantha Ho

7. Muhibbah Engineering (M) Bhd - Contract wins to buoy Muhibbah

New contract wins and positive prospects in the construction, O&G, marine and aviation sectors are expected to continue driving earnings at Muhibbah Engineering (M) Bhd, which provides engineering and construction services.

The group recently secured a RM70 million contract to build a reinforced concrete jetty and platform from Tenaga Nasional Bhd, as well as a RM189 million work package for the mass rail transit 2. This brings its total order book to RM2.7 billion so far.

According to MIDF Research head of research Mohd Redza Abdul Rahman, Muhibbah is among the companies expected to benefit as an exporter of services and commodities.

“The group is expected to benefit from its exposure to Qatar and the tripling of its capacity there,” Mohd Redza told The Edge Financial Daily, noting the blockade on Qatar by other Gulf countries is unlikely to hamper the group.

Additionally, the group is expected to gain from higher aviation activity, with recurring income from its associate, Cambodia Airports, he said.

All seven analysts eyeing Muhibbah, and covered by Bloomberg, maintain a “buy” call on the counter, with a 12-month target price of RM3.65 a share. It last traded at RM2.84, with a market capitalisation of RM1.37 billion. — By Samantha Ho

8. Tenaga Nasional Bhd - Analysts screaming “buy”

Tenaga Nasional Bhd (TNB) saw its share price soaring further last week following the government’s decision to fork out RM929 million to subsidise electricity tariff for the first six months of 2018 and also to keep the base tariff at 38.53 sen/kWh until 2020.

Pending the release of regulatory period 2 (RP2) input details, most research houses have maintained their earnings forecasts and target prices for TNB.

Maybank IB Research, in its latest research note dated Dec 27, said every 0.5 percentage point lower weighted average cost of capital from 2018 impacts the research house’s target by RM1.30, barring any unforeseen circumstances.

“We see room for Tenaga to rerate as doubts over the pass-through mechanism eventually dissipate,” said Maybank IB Research.

“Tenaga is seen as a liquid proxy to GDP (gross domestic product) growth,” MIDF Research’s Mohd Redza told The Edge Financial Daily on a phone call, adding the utility firm is likely to benefit from an expected economic expansion in 2018.

He also pointed out the counter is among the stocks with a high trading velocity due to a strong following among local and foreign funds.

Over the past one year, the stock grew about 14.41% to RM15.26 last Friday. According to Bloomberg, of the 25 analysts covering the company, 20 of them have a “buy” call on the stock, four “holds” and one “sell”. — By Wong Ee Lin

9. Tasco Bhd - Clientele diversification the key driver

Tasco Bhd has been strengthening its foothold in the logistics industry through diversifying its clientele and moving up the value chain by providing full-fledge logistics

solutions to customers. Going into 2018, analysts are sanguine on its future growth following its venture into the cold chain market.

It took over Gold Cold Transport Sdn Bhd, one of the largest cold chain logistics players in Malaysia, and MILS Cold Chain Sdn Bhd last year.

MIDF Research analyst Adam Mohamed Rahim said the contribution from this segment, which started in the second quarter ended Sept 30, 2017 (2QFY18), is expected to increase moving forward.

Adam added that Tasco’s regional distribution centre in the Digital Free Trade Zone for Renesas, one of the world’s largest producers of microcontrollers and microprocessors, is also one of the main drivers for Tasco’s “bright” outlook in 2018.

Additionally, he noted that Tasco has entered into a shareholder agreement with Yee Lee Corp Bhd’s wholly-owned subsidiary Yee Lee Trading Co Sdn Bhd, expected to provide expansion opportunities for Tasco, enabling the logistics player to access new markets and distribution networks.

On whether it is now a good time for investors to buy the stock, Adam reckons so, explaining that Tasco is currently trading at a P/E of 14 times — reasonable compared with most of its peers with a P/E of below 10 times and 20 times.

Over the past year, the stock has rallied 41.5% to close at RM2.08 in 2017. Analysts’ target price is between RM2.55 and RM2.69, according to Bloomberg data. — by Wong Ee Lin

10. MKH - Young trees to boost yield

MKH Bhd, having made its foray into the oil palm plantation business 10 years ago, sees most of its oil palm trees reaching prime age in 2017 and 2018.

With the expectation of better fresh fruit bunch (FFB) production to improve in the next few years, the plantation division is expected to sustain strong earnings growth and contribution to the group’s bottom line.

MKH’s share price fell nearly 68% to RM1.63 in 2017 after its net profit for the financial year ended Sept 30, 2017 (FY17) declined 36.37% to RM130.48 million from RM205.04 million, mainly due to the absence on a net project grant worth RM11.7 million from the government and lower sales revenue.

At the current level, MKH is trading at a trailing P/E of 5.8 times. In comparison, MKH trades at an average historical P/E of 9.5 times in the last five years.

According to TA Securities analyst Steven Soo, MKH’s share price has bottomed to a reasonable price level. Hence, he opines that the stock should recover in the second half of 2018.

With expectations of the CPO price at a sustainable level above RM2,300 and the attractive valuation that MKH offers, The Edge Financial Daily has selected MKH as one of the stock picks for 2018.

MKH’s exposure to the property and construction segment could also see a turnaround with its launches in Kajang 2 if sales exceed expectations.

MKH has deferred property launches on its prime land in Kajang and Semenyih over the past two years as it awaited the completion of key infrastructures such as the RM62 million flyover in Kajang 2, and the Sungai Buloh-Kajang mass rail transit line which has been operational since July 2017, according to AllianceDBS Research’s research report dated Nov 29.

The research house noted the stronger-than-expected sales from launches in Kajang 2 could be a re-rating catalyst.

Nevertheless, the key risks AllianceDBS pointed out is that MKH may face margin compression due to rising construction cost for property projects as well as exposure to fluctuations in crude palm oil prices which in turn could increase earnings volatility. — by Wong Ee Lin

http://www.theedgemarkets.com/article/top-10-stock-picks-2018