I am sure you have enjoyed super profit of more than 50% from my article written on UMWOG on 27th December 2017.

At the time of writing, it was 29.5sen only, just few days before the rally began. You can presume me either I can spot the signal before the rally begins OR my article itself drive the share price.

Here is the article: https://klse.i3investor.com/blogs/themagicofmerlin/142460.jsp

And this is the share price of UMWOG since I posted the article:

Despite this stock and other O&G stocks have rallied to new high of the year and return to its high in the past year, I still left wondering of why SUMATEC has yet moved up until now.

Therefore, I decided to dig further on its only assets in Khazakhstan and do some my own assumptions based on what the Management has guided in their results and recent announcements.

Amazingly, I found SUMATEC is damn huge undervalued. Looking at its current price of 5.5sen and table below, you may be surprised with it.

The market has underestimated potential value in SUMATEC and that is why, the share price fails to react to its potential value.

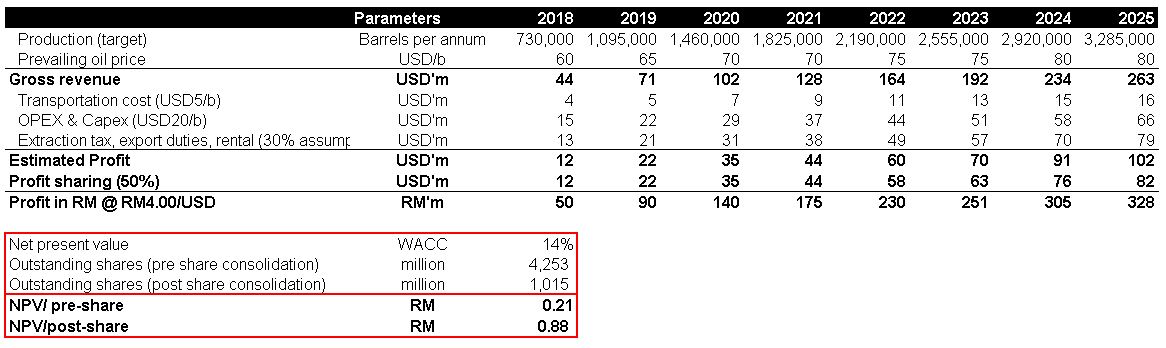

This is rakushechnoye asset, worth of 21sen pre-share consolidation as at FY18 DCF valuation upon expiring in 2025.

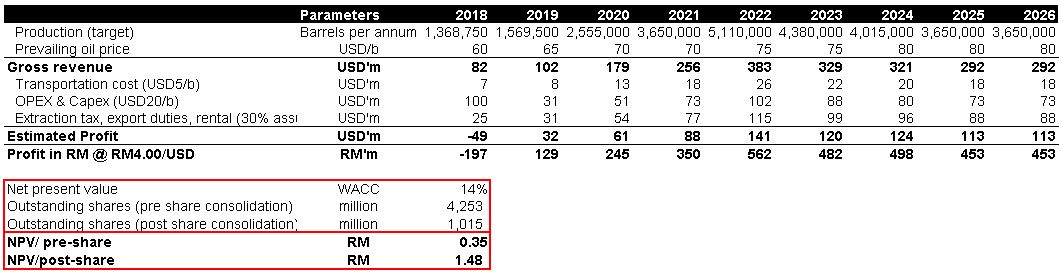

This is karaturun asset, worth of 35sen pre-share consolidation as at FY18 DCF valuation upon expiring in 2026.

In total, its assets in Khazakhstan is worth 56sen as of FY18 DCF valuation.

The valuation has considered in 100% stake in Rakushechnoye field.

Conservatively, oil price is assumed at only average of USD60/b for FY18 in my own projection and its production numbers are supervised by O&G expert in town.

My valuation of 56sen will remain unchanged unless Brent oil price falls below USD60/b.

Now I understand why Tan Sri Halim Saad and Co. is so keen to acquire 100% equity interest in Markmore Energy (Labuan) Limited from Markmore.

The potential return is greater!

Their projection (Halim Saad and Co.) could be worth much more than I value it myself as mine is on conservative side.

The following benefits of aquisition are as follow:

MELL through its wholly-owned subsidiary, Markmore Central Asia B.V. holds the entire participatory interest in CaspiOilGas LLP. COG in turn is the concession owner and operator of the Rakushechnoye Oil and Gas Field located in the Republic of Kazakhstan.

Cleaning up balance sheet

SUMATEC has also recently proposed for reconstruction of balance sheet .

Based on the audited financial statements for the FY16, the Sumatec group has accumulated losses of RM226.1 million against a share capital of RM541.3 million. Sumatec proposes to set-off its accumulated losses through the reduction of the share capital. Upon completion of the Proposed Capital Reduction, Sumatec proposes to consolidate every four (4) existing Shares into one (1) Share.

Based on the number of Shares in issue as at 25 October 2017, being the latest practicable date for purposes of this announcement, of 4,058,504,400, the Proposed Share Consolidation will consolidate the number of issued Shares to 1,014,626,100.

Free from debt this year and onwards to focus on future earnings growth

Together with above proposed acquistion and balance sheet reconstruction, SUMATEC has also proposed debt settlement exercise.

It is the intention of the Board to undertake a comprehensive settlement of all major debts/obligations owing to and by the Sumatec group in conjunction with the Proposed Acquisition.

This is to allow the Company to fully concentrate its resources to develop the Rakushechnoye Oil and Gas Field without being burdened by the existing debt obligations.

Currently, SUMATEC may be exposed to the following financial obligations:

(a) Corporate guarantees and loans taken for its former subsidiaries, Semua International Sdn Bhd group of companies. These creditors include Malayan Banking Berhad, Bank Pembangunan Malaysia Berhad, NFC Labuan Ship Leasing I Limited and collatarised loan obligation bondholders with an estimated exposure of USD40 million;

(b) Amount owing to MELL under the JIA estimated at USD22.0 million; and

(c) Wells repairs, maintenance and new wells expenditure incurred by the Markmore group on behalf of Sumatec estimated at USD41.0 million.

Summary

SUMATEC is in turnaround position and poised to register strong earnings from this year and onwards.

Its financial results has started to turnaround in 3QFY17.

Given favourable oil price in 4Q17, its 4QFY17 earnings would be surely register even higher.

Not just that, its oil production would also improve in 4Q17 to average 1,000 barrel daily against average 500 barrel daily in 1H17 as guided by the Management in its recent quarters results.

Recall that SUMATEC has commenced an oil production enhancement program back in April 2017, which encompasses the improvement / repairing of existing wells that include rehabilitation and rejunevation works, drilling of new wells for appraisal and production, construction of oilfield surface facilities and upgrading of the central processing facilities.

The flow results of the initial wells have been encouraging and they expect total oil production to improve further.

As oil price stablising at and above USD60/b, SUMATEC is on track to meet my estimated valuation of 56sen.

In fact, SUMATEC has been trading huge discount of PBV of only 0.36x. Its NTA is about 16.5sen.

This year is the year for SUMATEC.

If you want to compare SUMATEC, its direct peer is HIBISCUS and PETRONAS based on pure and fully upstream O&G business. Or else can compare with Sapura Energy but on partial upstream O&G business.

Some O&G experts in town recognised SUMATEC as PETRONAS in Khazakhstan. It is just a matter of time.

I know some might not agree with me, but by the time SUMATEC shows you its right direction of its financial results, you may miss the opportunity to ride the boat at earlier stage.

That time, some institutional investors and big non-GLC funds like CIMB, Public Mutual and could be even Koon Yew Yin will start to recognise potential value in SUMATEC and will go in.

And, I will prove once again what I have discovered.

For short-term, the share price of SUMATEC would reflect the rally in oil prices. It would rally to 20sen-25sen.

The last time Brent oil price hit USD67/b was in May 2015, which share price of SUMATEC had been trading around 20-25sen.

http://klse.i3investor.com/blogs/themagicofmerlin/143497.jsp