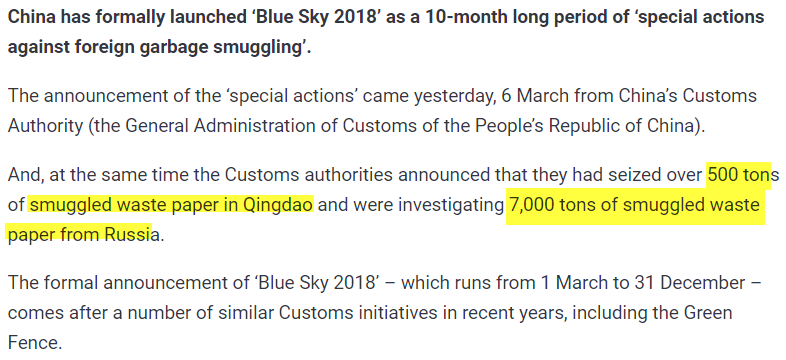

Before we discuss Muda in more details, let us go through what China Blue Sky policy is. China has launched a new blue sky policy in 2018 which they called “Blue Sky 2018”. Let see related news of China blue sky (refer to a Mandarin Blue Sky news at the end of the article) policy as below:

https://www.letsrecycle.com/news/latest-news/china-customs-launches-blue-sky-2018/

Let go through another two news as below:

-

http://www.scmp.com/business/china-business/article/2134963/chinas-paper-product-makers-raise-prices-higher-raw-material

-

https://www.reuters.com/article/us-china-hongkong-paperrecycling/china-ban-on-waste-imports-leads-to-piles-of-paper-abroad-surging-prices-in-china-idUSKCN1C30GR

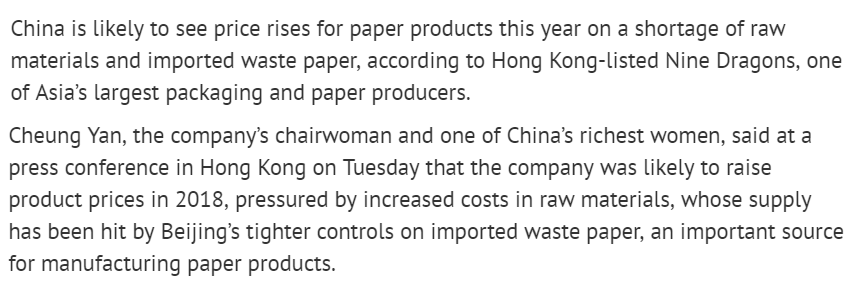

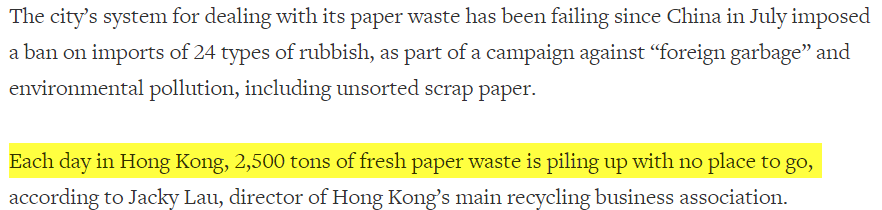

- China has stopped imports of several grades of waste paper since second half of 2017 as a part of campaign against foreign garbage, which has created shortage of raw material and impacted the paper production. As a result, the price of finished paper in China had doubled to 6,000 yuan (Sept 2017) per ton from 3,000 yuan as supplies of the raw material shrink. China price still increasing from Feb to March 2018 (1. http://www.chinapaper.net/news/show-26356.html),(Refer to possible price in May at 2. http://www.chinapaper.net/news/show-26502.html)

- Margin for manufacturing processed recycled papers are expected to improve on the time of falling waste paper prices (China ban creates oversupply of waste paper/rubbish in Asia) and higher finished products selling price. Muda is the only listed company has sizable recycled paper processing capacity in Malaysia (Orna and PPHB are downstream players which does Not benefited much due their raw material price hike. Downstream players need to buy raw material from upstream player) (refer http://www.chinapaper.net/news/show-26388.html)

1. Paper milling (recycled paper processing, upstream): engaged in the manufacture of various types of industrial paper.

2. Paper packaging: engaged in the manufacture of corrugated cartons, honeycomb paper products.

3. Paper bags and laminated paper trading: engaged in trading in paper and paper related products, machinery and machinery components,

4. Investments and management, engaged in investment holding, property holding, management and insurance agency services.

Muda operates two paper mills, seven corrugating plants and another plant producing paper based food packaging and stationery products. Except for a corrugating plant in Guangzhou China, the rest of the plants are located in West Malaysia. To provide raw material to the paper mills, the Group has seven waste paper collection centres for the procurement of waste paper.

Its industrial grade papers are used for the making of corrugated carton boxes, corrugated board sheets and lightweight dice system packaging materials, which is used in the making of pallets and as inner layer of doors, partitions and the furniture industry. Its factories are located in Peninsular Malaysia.

The main product of paper mills manufacturing corrugating medium, test Liner, core board and laminated chip board. The paper mill in Tasek (Penang) started production of as the Group broadens its revenue stream into paper based food packaging products, raising the installed capacity of the paper mills to 490,000m/ton (biggest in Malaysia) per year from 475,000m/ton.

There are about 30% of corrugating medium and test liner produced by the paper mills plant is for the consumption of the Group’s corrugating plants. Paper board and boxes produced by the corrugating plants are used by converters and manufacturers in the food, beverage, electronic, electrical, furniture and other industries.

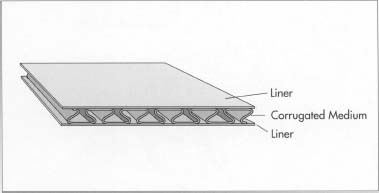

A cardboard box is basically made up of a flute (made up of recycled paper), sandwiched between two liners. It is now very common for these liners to also be made up of a considerable proportion of recycled content, sourced from old cardboard or other sources of second hand paper. Figure below show the diagram of liner and corrugated medium.

Source : http://www.madehow.com/Volume-1/Corrugated-Cardboard.html

Fundamental Data

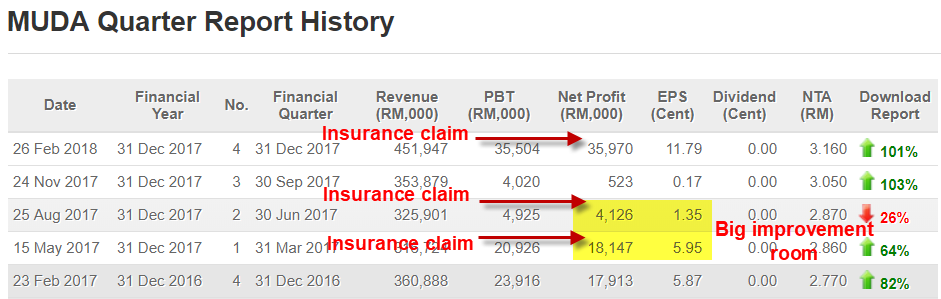

Currently Muda is trading at PE Ratio of 10.7 (based on current price of RM2.07) with EPS of 19.26 sen. However, there is exceptional item from insurance claim (23mil for whole year, 7mil for qtr 4) and deferred tax credit (2.3m) for FY2017 result, but there is also some impairment. Gross profit margin in whole 2017 was flattish but net profit is higher than 2016 mainly due to higher revenue in 2017 vs 2016 (1.45 billion vs 1.21 billion). Let see the past 5 quarters results of Muda as below:

Source: http://www.malaysiastock.biz

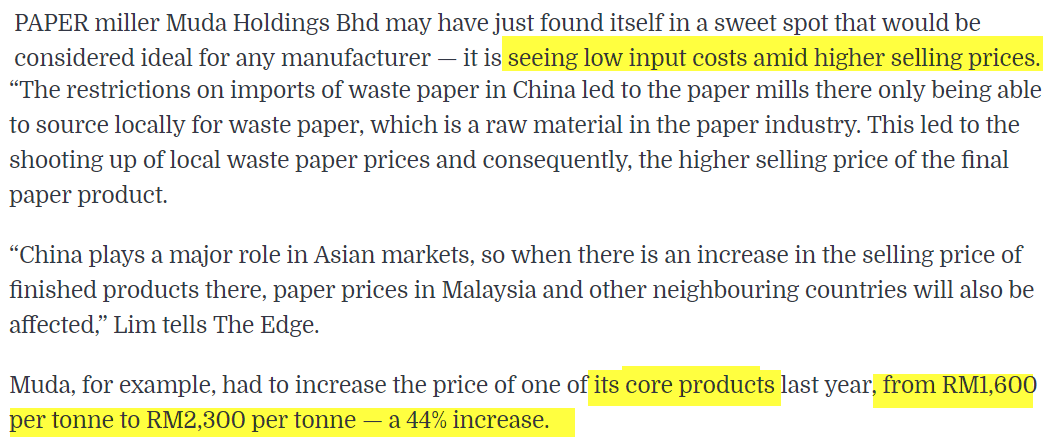

We can observe that the net profit of Q1’17, Q2’17 and Q4’17 included insurance claims payment (RM23 mil). If we exclude insurance claim, the EPS for Muda is about 11.7 sen for FY2017. This is mediocre performance actually and the surprise is the revenue in Q4 jump significantly to RM451 mil. Again, this is the past performance and the more important for me is the future profit and revenue. Let see Theedge news for an interview with Muda deputy managing director Datuk Lim Chiun Cheong as below:

http://www.theedgemarkets.com/article/muda-may-have-just-found-its-sweet-spot

Source: http://www.theedgemarkets.com/article/muda-may-have-just-found-its-sweet-spot

Let have a look on international price of 3 of Muda products (Kraft, liner, medium) as table below:

Source: https://klse.i3investor.com/blogs/Opportunityinvesting/150524.jsp

China price increment even higher than international price. Asia price may be affected by China as they might import from other countries due to insufficient supply. Let see some of the news for China paper and corrugated prices as below:

http://www.chinapaper.net/news/show-26316.html

http://www.chinapaper.net/news/show-25525.html

Muda 2017 and 2018 Expansion

Let us have a look on the prospect of the latest Muda Q4’17 report as below:

Source: q4'17 report

Muda has planned capital expenditure of RM110 million in 2017. These investments are mainly for upgrading, modernizing and replacement of existing plants and machineries to raise productivity.

Corrugating Plants of Muda is strategically located and have a total capacity of 200,000m/ton per year. With the completion of a RM48 million investments in a new corrugating production line in Kajang, Selangor in 2017, total capacity will be raised to 240,000m/ton per year. Besides, Muda’s installed capacity of the paper mills to 490,000m/ton per year from 475,000m/ton.

Currently demands for Paper boards and boxes in Malaysia are higher than total supply. The shortage is import from China but now china short of paper board products.

The strong growth of E-commerce (online shopping) in Malaysia and SEA countries will further boost the demands for paper boards and boxes. The higher their capacity run for paper mill and corrugated products, their cost per unit should be lower which may increase the future profit margin.

Conclusion: The timely expansion of Muda in 2017 and 2018 for its paper mill and corrugated plants coincident with the surge of its product selling price and not to mention that Q4'18 is their peak season conventionally (like double 11 sales worldwide).

Coming Quarters Profit Forecast for Q1’18 (Jan-Mar 2018)

The impact from the higher selling price of Muda products lagged behind the higher raw material price for 2017. The impact of higher selling prices may only seen in 2018 where china and international price lead to Malaysia corrugated products price hike.

Let me have a forecast analysis for their coming profit for its Q1’18 (to be released in May) based on recent paper mill and corrugated product price movement.

Calculation of profit (using previous quarter profit margin data Q4’17):

1) Gross Profit margin (GPM) = (Gross Profit / Revenue) X 100%

GPM = 81.2 / 451.9 X 100% = 18% (Q4’17)

GPM = 16% (Q1’17)

Let assume gross profit margin expansion of 7% (I assumme 2% from lower material cost and 5% from higher selling price) in Q1’18 vs Q4’17 (higher selling price and lower raw material cost), the total estimated gross profit margin in Q1’18 is 25% (from 18% in Q4). Let assume revenue growth of 10% in Q1’18 vs Q1’17 as per table below (Excluded insurance claim and tax credit):

2017

|

2018 (estimated)

|

|

| Q1 (mil) |

316 mil

|

347.6 (10% increase over 2017)

|

| GPM (%) |

16% (Q1)

|

25%

|

| Other income |

2.4

|

2.4

|

| Distribution expenses (Fig from Q1 and Q4 report) |

19.5

|

21.45 (10% increase over 2017)

|

| Administration expenses (Fig from Q1 and Q4 report) |

17.9

|

19.5 (use Q4 fig)

|

| Other expenses |

1.35

|

2.78 (use Q4 fig)

|

| Finance costs |

6.1

|

7.4

|

| Profit before tax |

8.11

|

38.17

|

| Tax expense |

2.4

|

9.16

|

| Profit after tax (mil) |

5.71 mil

|

29.01 mil

|

| EPS (sen) |

1.87

|

9.51

|

| Annualize EPS (9.51x4) (sen) |

38.04

|

|

| Fair value at PE10x |

3.80

|

|

| Fair value at PE11x |

4.18

|

|

| Fair value at PE12x |

4.56

|

The estimated EPS for FY2018 is about 38.04 sen which is base on conventional season low quarter of Q1 revenue. Conventionally, Q3 and Q4 of 2018 are peak season of Muda which their expansion of capacity is expected to complete in these periods.

Personally I would expect the high selling corrugated carton box products price to be remained high in in 2018 in view China ban of waste paper import and of growing of E-commerce (like Lazada, taobao, aliexpress) in SEA countries and China.

For forward 12-month PEx of 10x, the fair value of Muda is estimated to be around RM3.8. Even with the 30% discount of the RM3.8, the fair value of Muda still worth RM2.66.

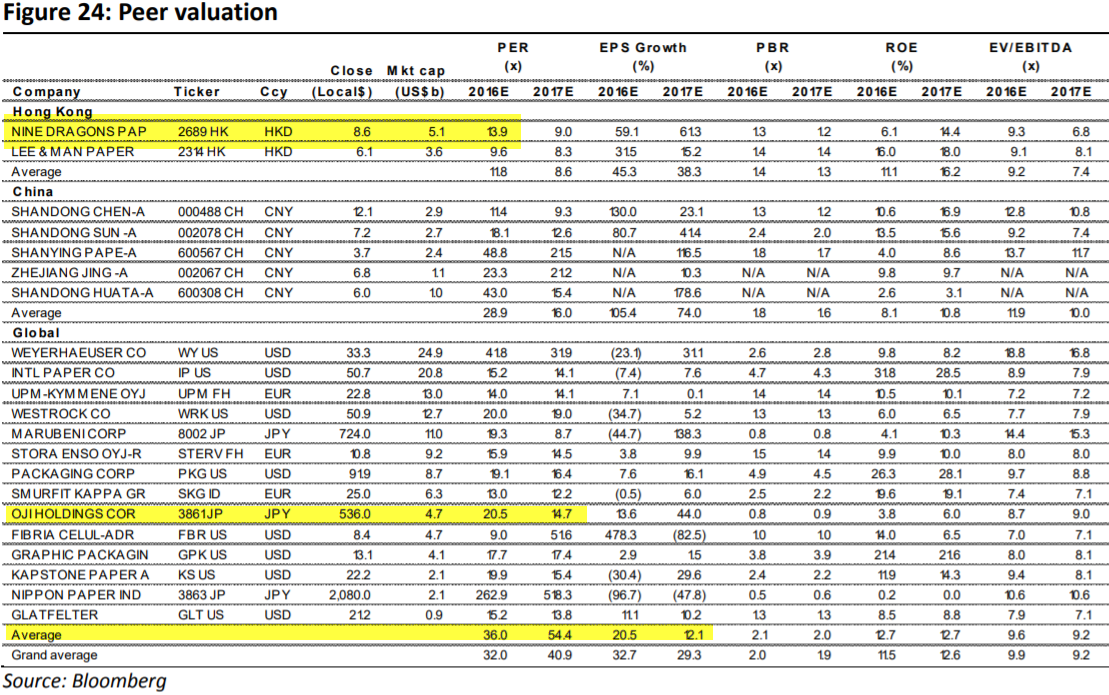

Let see an International comparative valuations of paper packaging segment as table below:

Source: http://securities.csci.hk/wp-content/uploads/2017/03/CSCI-Paper-Chinapackagingpapersector_20170316.pdf

Inventory and Debt

When your company products selling price are on uptrend, what will happen if your company has high level of inventory? Logically your profit margin should increase. Let see the inventory level of Muda in the past three quarters as table below:

Q2

|

Q3

|

Q4

|

|

| Inventory (mil) |

215

|

252

|

258

|

| Revenue (mil) |

325

|

353

|

451

|

We can observe that revenue increment is still higher than inventory. In fact, their inventory level in Q4’17 is still lower than 3 months (1 quarters) sales (451 mil). I think their current inventory level is still healthy base on their current revenue.

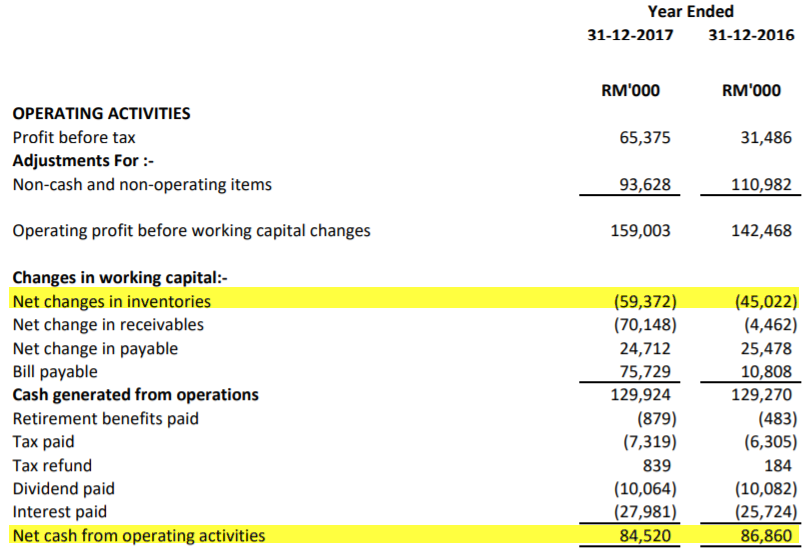

Due to high capex requirement for expansion in 2017 and 2018, Muda debt is increasing in recent two years. However, to evaluate their repayment capability, we need to see from their cash flow from operation as table below:

Source: Q4’17 report

Muda has generated RM84mil and 86 mil cash flow from operation even they increased their inventory level by 59 mil and 45 mil in 2017 and 2016 respectively. The future cash flow from operation should be even higher in the event of higher profit margin and increasing demands of their products.

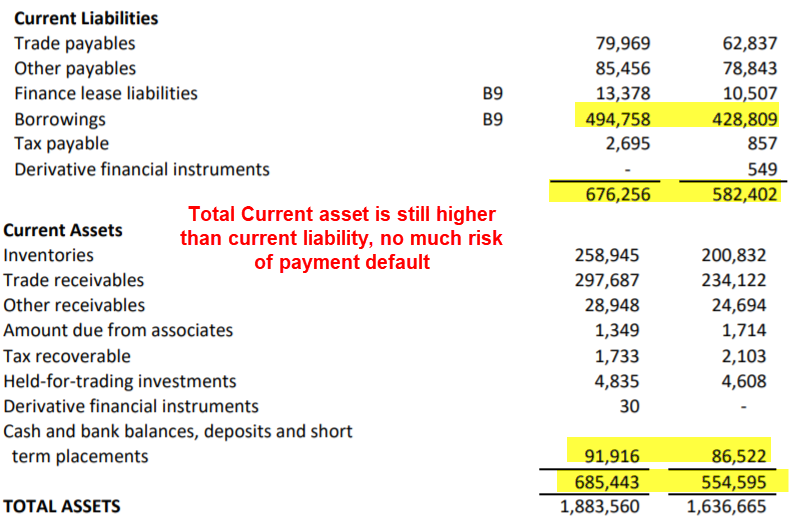

Let see the debt of Muda as below:

Source: Q4’17 report

The total current asset is still higher than total current liability. Maybe due to some trading business, their payable is relatively low and their high level of receivable and inventory. Their borrowings are increasing mainly due to high capex requirement which mainly used for expansion in their plants in 2017 and 2018 which is timely for the higher demands and higher selling price. With the anticipated e-commerce (Taobao, Lazada etc) growth in SEA countries, the demands and high selling prices for paper mill and corrugated products should be sustainable.

Risk

- Higher energy cost (hike in natural gas in Jan 18) may increase the production cost.

- Fluctuation of their raw material price which may affect their production cost.

- Increase in interest rate may increase their finance cost as the Muda debt is high due to big capital expenditure in 2017 and 2018.

- Muda has the highest capacity of paper mill (upstream) in Malaysia. It benefited from China Blue Sky policy (ban of waste paper import) which the selling price of their products have increased consistently from Q4’17 to Q1’18 while the raw material (waste paper) price has dropped.

- The timely expansion of Muda in 2017 and 2018 (to be completed in Q3 and Q4) for its paper mill and corrugated plants coincident with the price surge of its product. This will further drive its profit growth especially in Q4’18 due to peak season of online retail shopping in Nov and Dec.

- Since 2nd half of 2017, paper price in China has been rising, and remain elevated until now. This was caused by shutting down of plants to improve environment. As China is a huge consumer of paper packaging products, the price increase spilled over to international market

- The demands in Malaysia for corrugated products will continue to grow especially Malaysia now serve as Alibaba’s regional e-commerce and logistics hub in South East Asia.

- Based on the higher demands and selling price of paper mill products, profit margin of Muda should be expanded in 2018 and it may has some export opportunity.

- Based on estimated EPS of 38 sen, with forward 12-month PEx of 10x, the fair value of Muda is estimated to be around RM3.8.

- Muda2018 = (Upstream+downstream+trading) X (Expansion+price hike) = High_Profit_Growth

http://society.people.com.cn/n1/2018/0205/c1008-29805764.html

Let read a latest news on Alibaba doubles Lazada, which operates in Malaysia, investment to US$4bil in regional expansion as per link below:

https://www.thestar.com.my/business/business-news/2018/03/20/alibaba-doubles-lazada-which-operates-in-malaysia-investment-to-us$4bil-in-regional-expansion/#zmQIrDF3PV4YE08X.99

You can view the video below to see how Corrugated Boxes Are Made

https://www.youtube.com/watch?v=C5nNUPNvWAw

If you interested on my future analysis reports, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/david_masteel/151327.jsp