Ever since GE14, BURSA is fuelled with speculative news and stocks are dancing abruptly to its tune, and our IB's are smart enough to capitalize on this. Very few care to investigate the real implications of these projects, namely HSR and ECRL cancellation to the STEEL INDUSTRY.

In i3, as the very word suggest one should emphasize on having intelligent information to make prudent investment decision.

As usual let me present the hard facts:

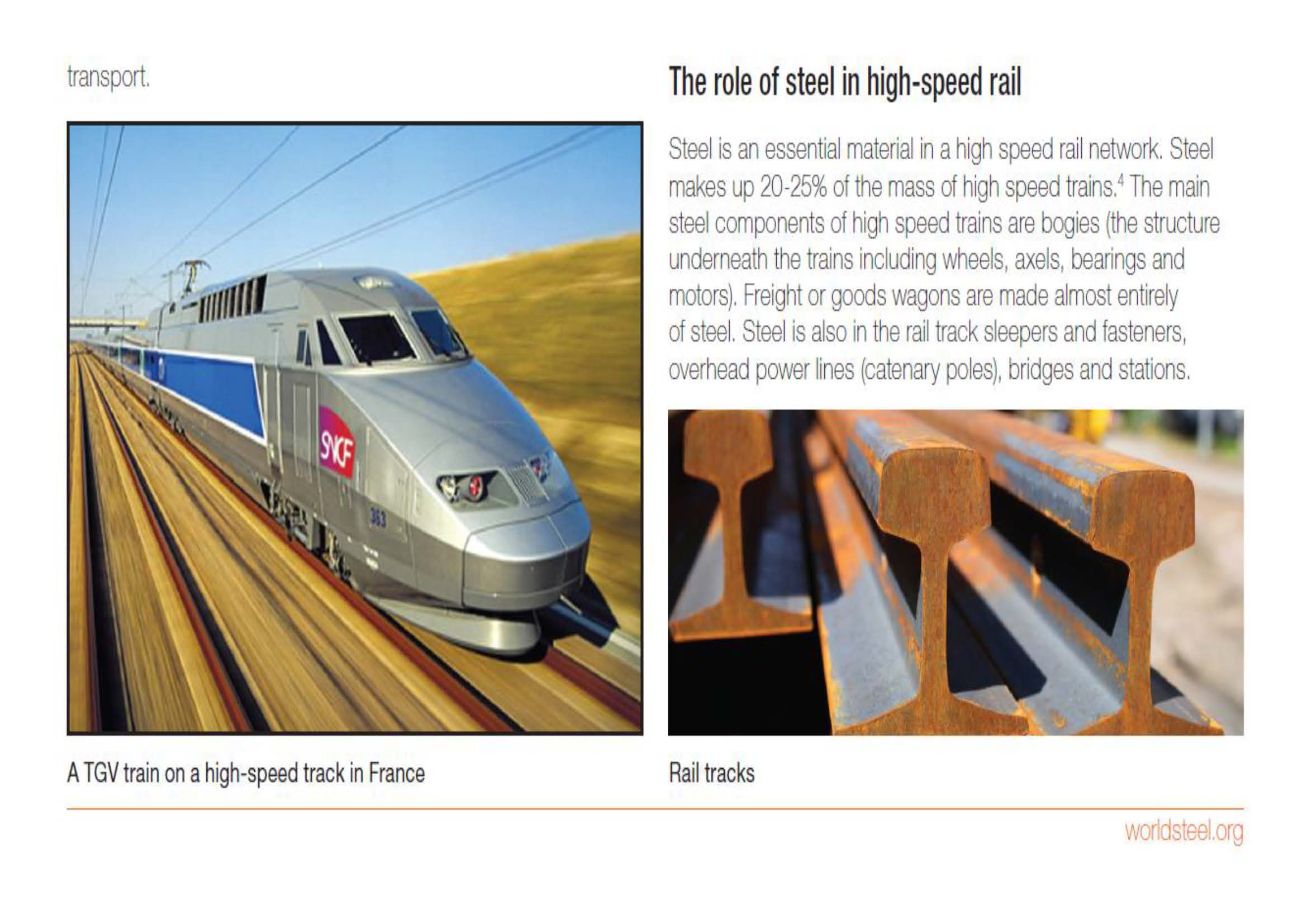

(PART 1) What is the steel consumption per KM High Speed Railway (HSR)?

......................................................................................................................................................

Every KM of HSR track only needs about 670 to 780 tons total steel per KM of HSR.

First article:

https://www.worldsteel.org/en/dam/jcr:3ecb07b6-ca04-469e-8f77-b3d27cbb8f7d/Rail+case+study_2015_vfinal.pdf

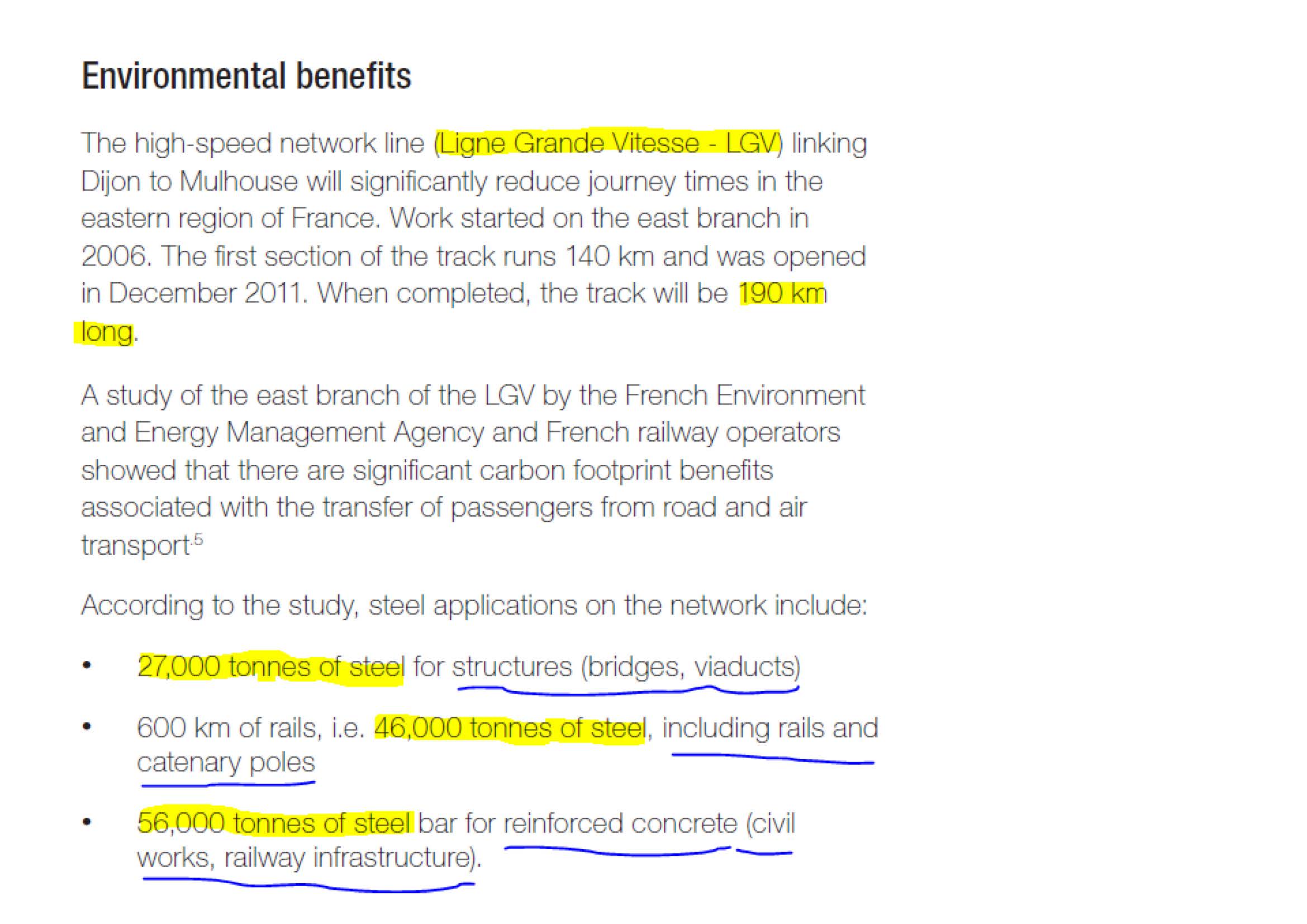

The above adds up to:

= 27,000 + 46,000 + 56,000

= 129,000 for 190 km HSR (Ligne Grande Vitesse)

= 678 tonnes per km

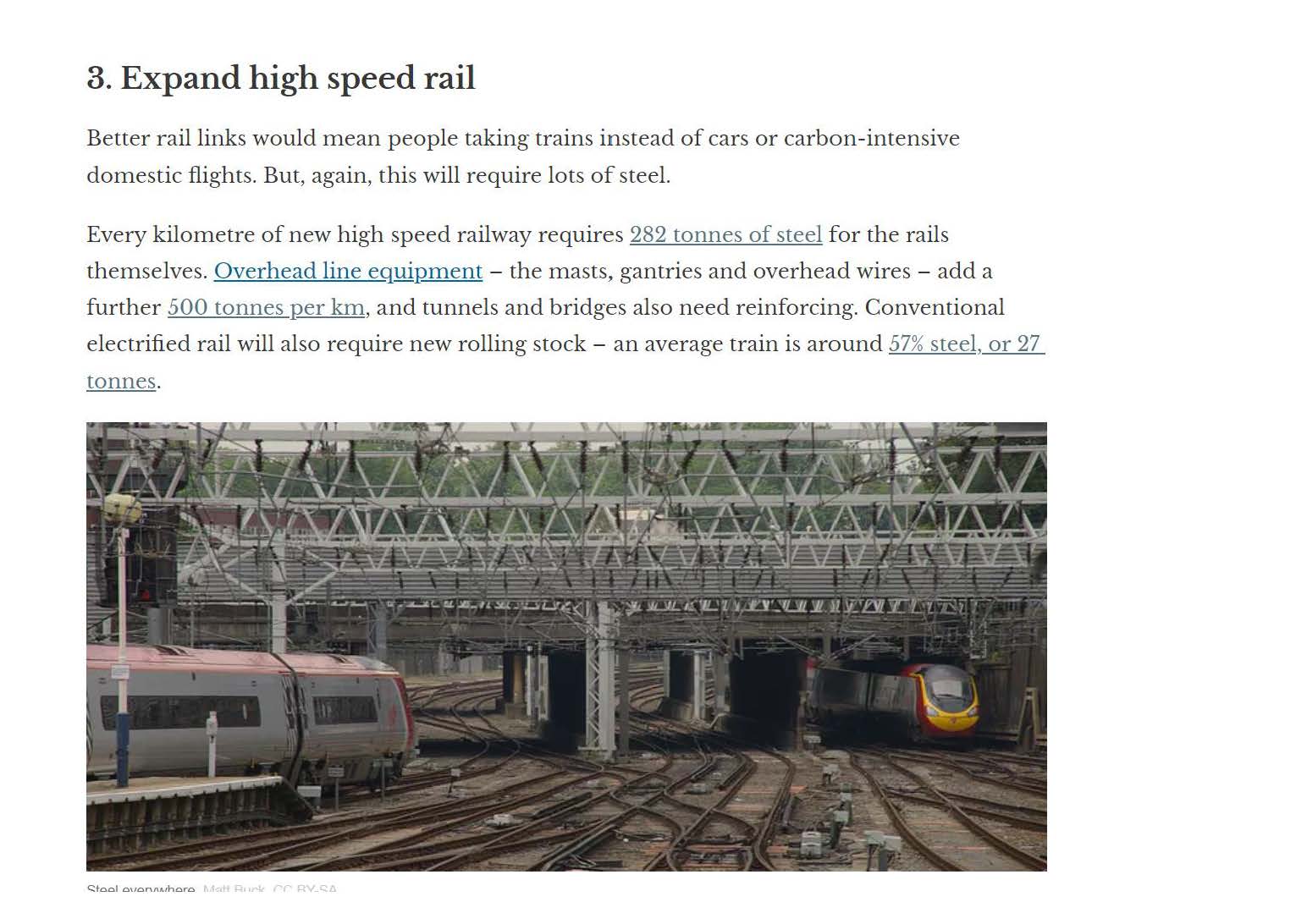

Second article:

https://theconversation.com/nine-ways-steel-could-build-a-greener-economy-57506

From above we can see that its approximately 282 + 500 = 782 tonnes per km

Now we know the total length of the HSR track is only 350 km and the ECRL at 688 km (including phase 1 and phase 2 from below links:

https://en.wikipedia.org/wiki/MRL_East_Coast_Rail_Link

https://en.wikipedia.org/wiki/Kuala_Lumpur%E2%80%93Singapore_high-speed_rail

Using the first article data, the Total Steel required for both the projects would be:

= 678 (ton/km) x 1033 km

= 700,000 tonnes

The project duration is estimated around 6 years.

This means on average, the steel consumption per year due to both HSR and ECRL is only:

= 116,000 tonnes/annum

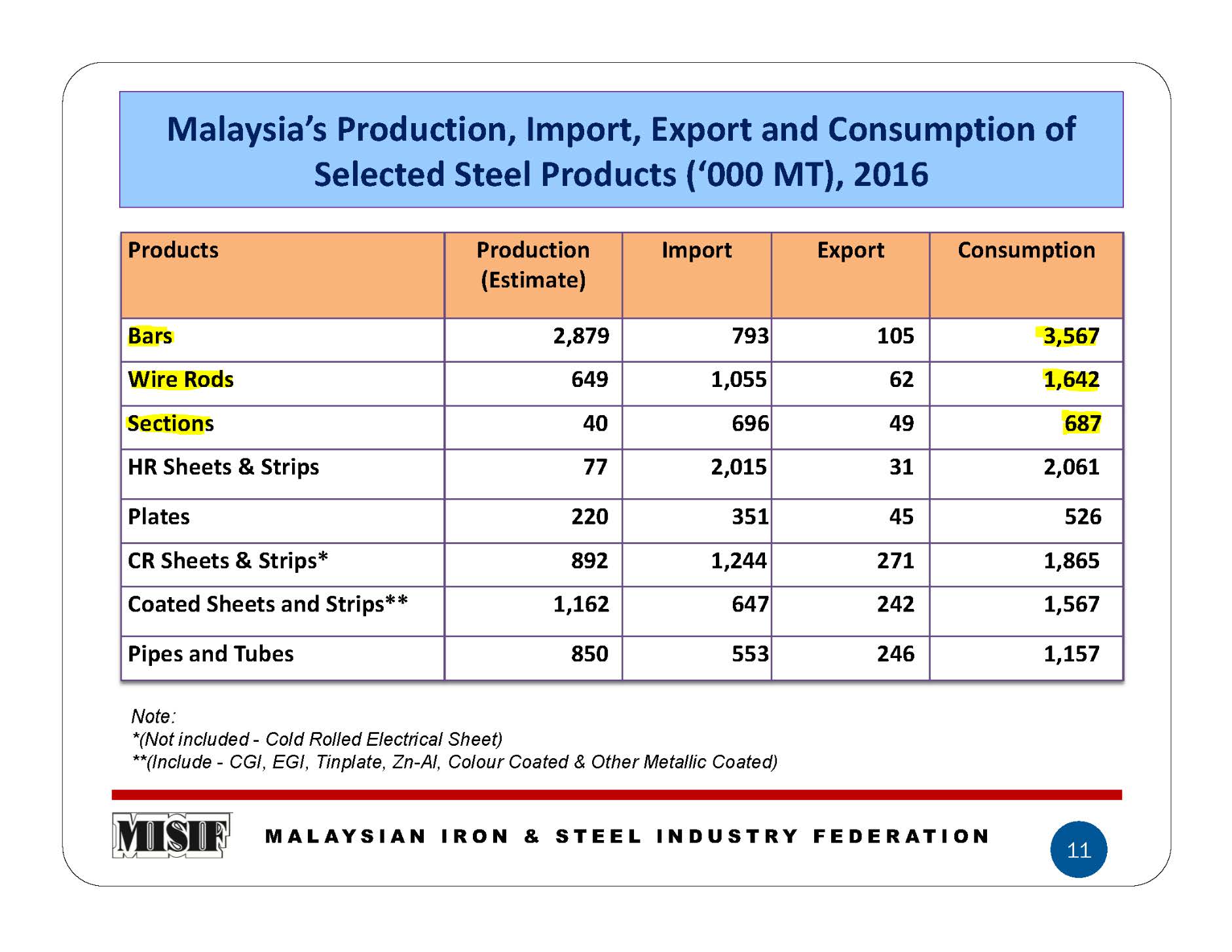

(PART 2) What is Malaysian Long steel consumption per annum?

..................................................................................................................................

Malaysian long steel consumption is already at 5.8 Million tonnes per annum in 2016 based on MISIF data. The total steel consumption per annum is at 13 Million per annum. Refer Bars and Wire Rods , Sections Consumption below:

http://seaisi.org/seaisi2017/file/file/full-paper/Malaysia%20Country%20Report.pdf

(PART 3) What is the impact to Local Steel Demand if both the HSR and ECRL projects are cancelled?

........................................................................................................................................................................

So then, what is the contribution of these project in terms of % impact after cancellation? That is simply part 1 HSR and ECRL demand divided by the total Malaysian consumption.

= 116,000 tonnes/annum divided by 5,800,000 tonnes/annum

= 2 % (yes, just two percent!)

Note that the above estimation was done assuming the HSR is ‘elevated’ with supports and much bridges, tunnels etc, similar to the ‘state of the art’ HSR build in Europe. However, the China made HSR are known to be 1/3 cheaper than Europe as per below:

http://www.worldbank.org/en/news/press-release/2014/07/10/cost-of-high-speed-rail-in-china-one-third-lower-than-in-other-countries

Reason being the tracks are made on flat track (unelevated) for long distances without extra structures (very similar to Malaysia).

One can see from below link and corresponding snapshot that China only consumed 300,000 tonnes of steel for a 1,318 km HSR project. That translates to 230 tonnes/km, i.e one third (1/3) lesser than France LGV steel material requirements.

https://books.google.se/books?id=Iyo-FeoIeH0C&pg=PA195&lpg=PA195&dq=total+steel+consumption+per+km+railway&source=bl&ots=mL3P71-uxB&sig=dbcTwXnSQusj3ydSXzFgSakzTPU&hl=en&sa=X&ved=0ahUKEwjHsJruvarbAhVFEywKHa94BZ4Q6AEIdTAJ#v=onepage&q=total%20steel%20consumption%20per%20km%20railway&f=false

That means, the actual effects to the local Steel industry could be very well below 1% in terms of total reduction in Demand. This negative effects should be negligible in comparison to the positice effects of steel capacity cuts taking place in China.

This then comes to the question whether the recent sell down on steel stocks justified? They had survived so long without these projects, what has changed so much now?

It is unbelievable to see that IB from Kenanga and UOB chose to capitalize on this news to give a derating on the local steel stocks while both Lionind and Annjoo had clearly expressed optimism on their business going forward in their recent quarterly financial reports.

NOTE: the above article was made assuming the ECRL project is cancelled but this is not the case currently.

http://klse.i3investor.com/blogs/Insight1/158617.jsp