What has been said about INSAS that has not been said?

Well, that’s what I’m here to try and provide.

A very brief background since I’m sure most will be very familiar with the Company. This is a investment holding company that does not give much dividends. The goal of this company is to basically reinvest its cash into new investments and better businesses.

Here are some of the questions which you may have, that i feel i may have a different answer compared to most.

Conclusion

Personally, I owned some Insas shares before this, and in a fit of europhia, i doubled my exposure by buying some warrants today.

For some reason, I feel like I should have probably bought the shares, but oh well, live a little. It’s still pretty cheap.

Well, that’s what I’m here to try and provide.

A very brief background since I’m sure most will be very familiar with the Company. This is a investment holding company that does not give much dividends. The goal of this company is to basically reinvest its cash into new investments and better businesses.

Here are some of the questions which you may have, that i feel i may have a different answer compared to most.

- Is the management right to keep dividend so low?

One of the thing about this management is that they are keeping the dividend very low. Is that acceptable?

Well,

that depends on the company’s ability to reinvest the money at a good

return. If they can make a decent return on every ringgit retained, it

could very well be a good idea.

For

the sake of this exercise, we will use the NTA as a proxy for intrinsic

value since most of its value is in its shareholdings anyway.

NTA in 2009: RM1.16

NTA in 2018: RM2.533 (as they gave 6.3 sen in dividend over the years, lets add that in as well)

Just

based on CAGR of NTA, it has grown by 9.07% per annum. Pretty decent.

What if one were to revalue its holdings to revalued net asset?

Its main assets consist of its investment in associates, and these have 3 components

-

Roughly 19% share in Inari Amertron Bhd

-

Roughly 12.1% Share in Ho Hup Construction Company Berhad

-

Various shares in Sdn Bhd Companies which have positive equity.

Here is a brief valuation of each component.

-

The

share of Inari Amertron is currently worth roughly RM1.463 billion in

the market. I personally think it is somewhat overvalued at that price

(mainly due to the high dividend pushing the price up). Therefore I

would put a 50% discount, valuing it at 15 P/E and RM731.5 mil

-

The

shares in Ho Hup, personally it’s probably fairly close-ish to fair

value. Deleveraged ROA is pretty bad at 4.3% or 4.5%, which is less than

FD. To be fair, might just be temporary. But still, I’ll cut 20% just

to be safe. Therefore valuing it at RM19.2 million.

-

The

stakes in Melium, Winfields etc. They are held at RM41.6mil. Earnings

is about RM6.5mil. At roughly 6 P/E. Lazy to do a deeper valuation, but

they don’t look good in terms of the capital structure. So, I’ll just

whack a 35% discount to be safe. It’s now valued at RM27 mil.

All in, they are held in book at RM301 mil, but based on my calculation, it should be actually around RM777.7. This adds RM476.1m to the NTA.

NTA in 2009: RM1.16

Revalued NTA in 2018: RM3.123 (as they gave 6.3 sen in dividend over the years, lets add that in as well)

CAGR is now 11.63%. This is pretty good considering how conservative i was in my estimates.

I personally have no major qualms in the company deciding to keep the capital for future deployment for now.

Having

said that, there is clearly no better use for their capital now than

buying back their stock. I don’t think there is a high value activity

right now for shareholders considering how low the price is.

-

Diluted intrinsic value of the share.

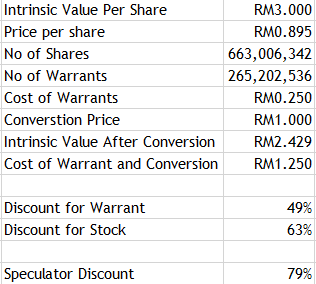

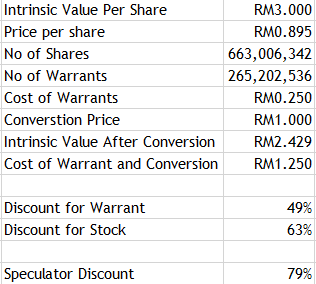

For now, let’s say that the intrinsic value of the share is about RM3, using RNAV.

So which should you buy? Well, let me know what you think.

For

those unfaimiliar with the speculator discount (which i my own

invention, may not be useful after all), it is the price of the warrant,

over the discount between the instrinsic value of the share after

conversion and the conversion price.

Personally, I owned some Insas shares before this, and in a fit of europhia, i doubled my exposure by buying some warrants today.

For some reason, I feel like I should have probably bought the shares, but oh well, live a little. It’s still pretty cheap.

http://klse.i3investor.com/blogs/PilosopoCapital/167252.jsp