Last

night, many Lion Industries ("Lion Ind") shareholders could not sleep

well (not me, I have zero exposure). Lion Ind just announced in the

evening that it is paying RM537 mil to acquire the assets of Megasteel.

Many panicked this morning and ran for the exit. Is the deal really that

bad ?

Due to lack of industry information, it is difficult for me to ascertain the prospects of Megasteel and its impact on the Lion Ind group post acquisition. However, I picked up some interesting points from the announcement :

(a) the entire purchase consideration will be used to settle debts owing by Megasteel to its creditors. Not a single sen will go to William Cheng. It is obvious that this is not a bail out exercise. It is more like a forced selling by Creditors (meaning Lion Ind is there to pick up the assets at a bargain). In this regard, I give a PASS for corporate governance.

(b) The net book value ("NBV") of the assets is RM1.84 billion. Lion Ind is buying them for RM537 mil. A huge discount of RM1.3 billion. From P&L point of view, the reduction in NBV should lead to lower depreciation charges (Accountants please chip in here, as I am not an expert in this field). The following is extracted from Lion Corp's FY2016 annual report :

Its annual depreciation charges was approximately RM142 mil.

Based on RM2.1 bil and RM142 mil, it seemed that the assets had expected remaining lifespan of 14 years (being 2,100 / 142).

Now that Lion Ind's NBV of the assets is RM537 mil, annual depreciation charges would be RM38 mil only. A reduction of RM104 mil per annum compared to the original Megasteel.

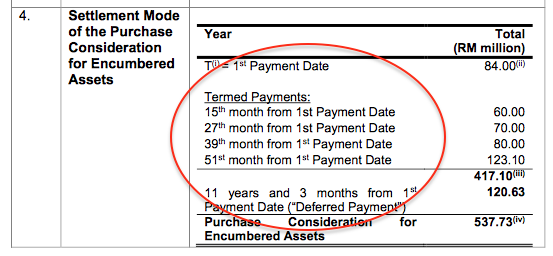

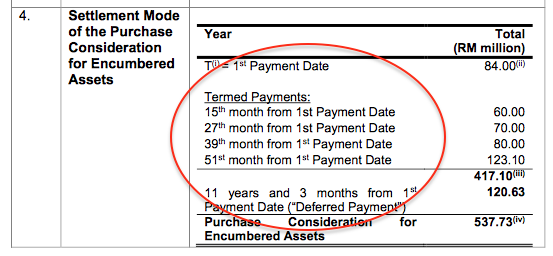

(c) Lion Ind is not paying the RM537 mil in one lump sum. The purchase consideration will be settled via several tranches as follows :-

Plesse note that the immediate payment would be RM84 mil + RM60 mil = RM144 mil only, to be paid within 15 months after acquisition. The rest will be paid over the next several years, with one dragging as far as 11 years.

In other words, Lion Ind is gaining access to RM1.84 billion assets by coming up with upfront payment of RM144 mil only (post 15 months, the Megasteel assets if profitable, should be able to stand on own feet and service the rest of the payment). Not a bad deal !!!

The payment structure is favorable to P&L as Lion Ind does not need to incur huge interest expenses.

(d) As Lion Ind is acquiring the assets only, it will not have Lion Corp's burden of sevicing huge interest expenses amounted to more than RM250 mil per annum.

Concluding Remarks

In my opinion, the deal is structured quite favorably for Lion Ind. Compared to Lion Corp, Lion Ind will enjoy annual cost saving amounting to as much as RM354 mil (due to depreciation charges lowered by RM104 mil (my estimate / assumption) as well as absence of interest charges amounting to RM250 mil).

Notwithstanding

the lower cost structure, there is another hurdle to cross - whether

Lion Ind can make use of the assets to generate profit. That will depend

on the prospects of the Malaysian flat steel industry. We can only find

out when Megasteel started contributing (either positively or

negatively) to Lion Ind bottomline in the future.

I am am not asking you to bet big big. But buy a bit to keep is no harm lah. No risk no gain.

http://klse.i3investor.com/blogs/icon8888/163933.jsp

Due to lack of industry information, it is difficult for me to ascertain the prospects of Megasteel and its impact on the Lion Ind group post acquisition. However, I picked up some interesting points from the announcement :

(a) the entire purchase consideration will be used to settle debts owing by Megasteel to its creditors. Not a single sen will go to William Cheng. It is obvious that this is not a bail out exercise. It is more like a forced selling by Creditors (meaning Lion Ind is there to pick up the assets at a bargain). In this regard, I give a PASS for corporate governance.

(b) The net book value ("NBV") of the assets is RM1.84 billion. Lion Ind is buying them for RM537 mil. A huge discount of RM1.3 billion. From P&L point of view, the reduction in NBV should lead to lower depreciation charges (Accountants please chip in here, as I am not an expert in this field). The following is extracted from Lion Corp's FY2016 annual report :

Its annual depreciation charges was approximately RM142 mil.

Based on RM2.1 bil and RM142 mil, it seemed that the assets had expected remaining lifespan of 14 years (being 2,100 / 142).

Now that Lion Ind's NBV of the assets is RM537 mil, annual depreciation charges would be RM38 mil only. A reduction of RM104 mil per annum compared to the original Megasteel.

(c) Lion Ind is not paying the RM537 mil in one lump sum. The purchase consideration will be settled via several tranches as follows :-

Plesse note that the immediate payment would be RM84 mil + RM60 mil = RM144 mil only, to be paid within 15 months after acquisition. The rest will be paid over the next several years, with one dragging as far as 11 years.

In other words, Lion Ind is gaining access to RM1.84 billion assets by coming up with upfront payment of RM144 mil only (post 15 months, the Megasteel assets if profitable, should be able to stand on own feet and service the rest of the payment). Not a bad deal !!!

The payment structure is favorable to P&L as Lion Ind does not need to incur huge interest expenses.

(d) As Lion Ind is acquiring the assets only, it will not have Lion Corp's burden of sevicing huge interest expenses amounted to more than RM250 mil per annum.

Concluding Remarks

In my opinion, the deal is structured quite favorably for Lion Ind. Compared to Lion Corp, Lion Ind will enjoy annual cost saving amounting to as much as RM354 mil (due to depreciation charges lowered by RM104 mil (my estimate / assumption) as well as absence of interest charges amounting to RM250 mil).

I am am not asking you to bet big big. But buy a bit to keep is no harm lah. No risk no gain.

http://klse.i3investor.com/blogs/icon8888/163933.jsp