Some of the

investors will be panic tomorrow to click the sell button, which is why

we are writing this to tell you our views on Mmode.

Today, Mmode announced its Q4 2018 results. From headline, it looks like a disastrous results of -RM7.3m! There is a RM8.8m impairment losses that the company has taken this opportunity to write off for this last quarter of FY2018, and prepare its wings to transform into a full fledge construction stock.

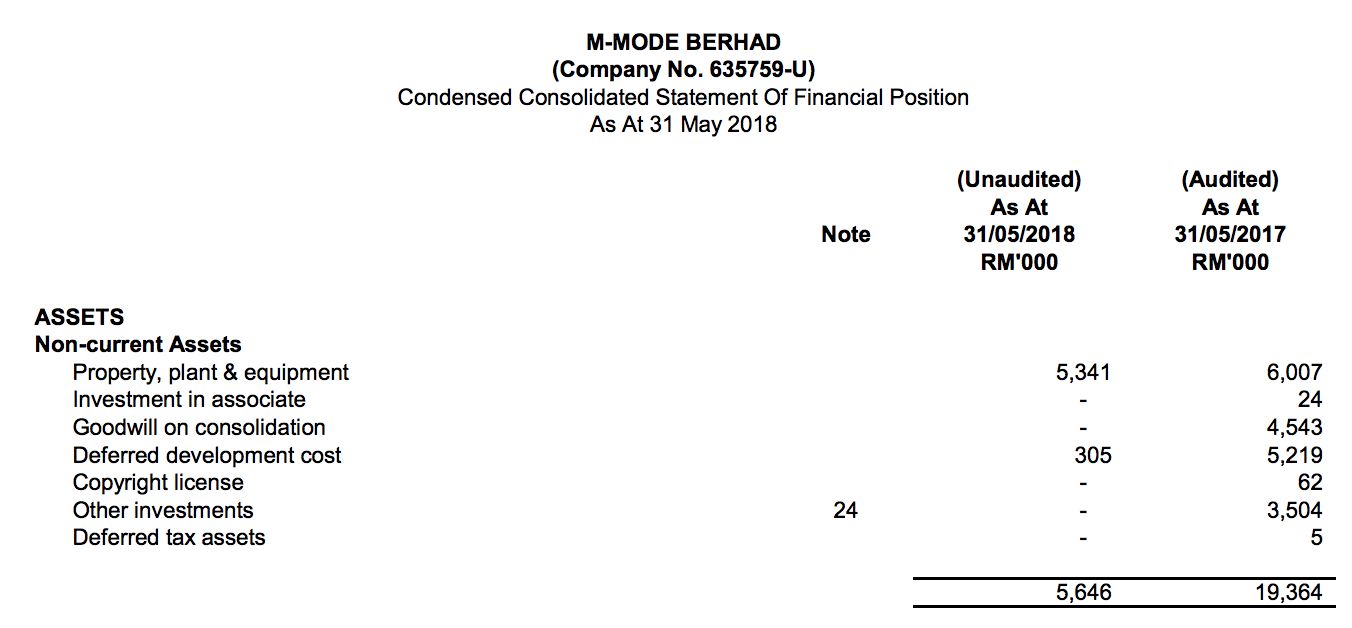

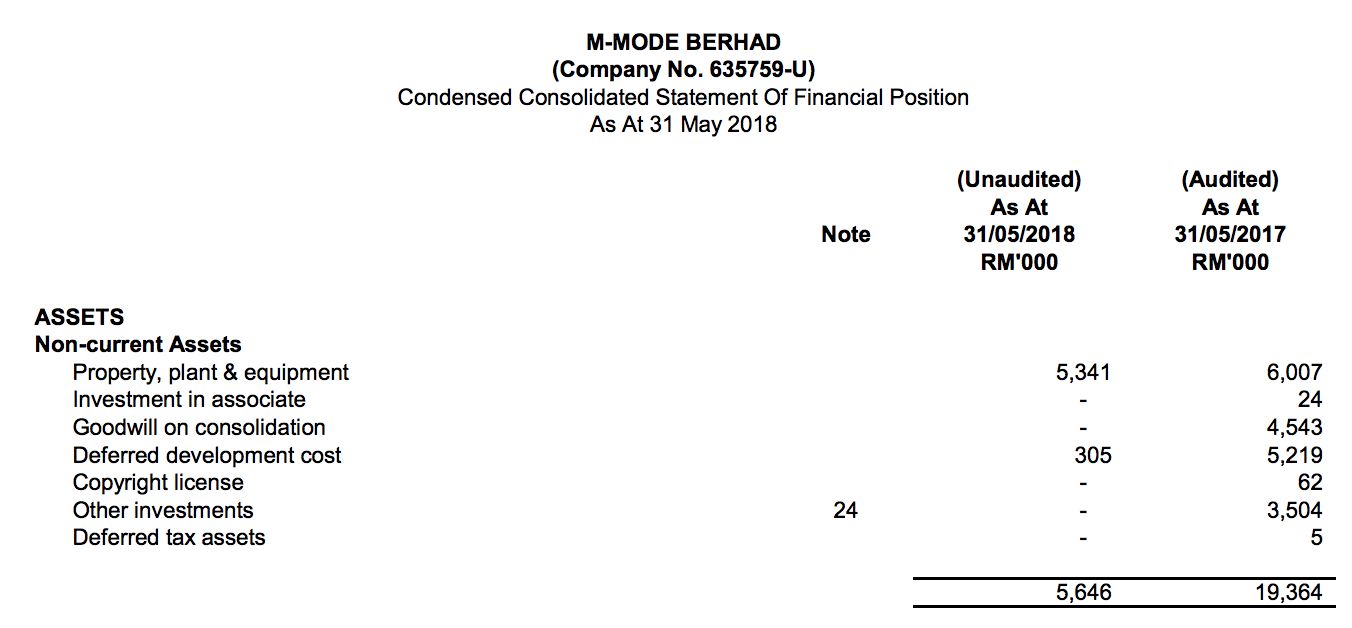

As you can see, the balance sheet is now clean, after writing off RM4.54m from goodwill on consolidation and RM5.2m deferred development cost to RM0.3m. The nett write off for this quarter is actually RM4.54m + RM4.27m = RM8.8m. Hence, the actual PBT for the company is RM0.9m not -RM7.9m.

How will this change our forecast again? Remember there is still about RM300m construction order book for the company. At 6% PAT margin, RM18m profits will be in the bag. Lets write off tech division. And finally, the cash of the company has fallen to RM44m. Do not panic, as the company has just paid off its creditors, as we can see its payables has fallen from RM16m last quarter to RM6m. This cash payment difference actually made up the balance. The base net value for this company should be RM70m which translate into RM0.43 if we assume zero value for its technology division.

Every RM100m contract wins will translate into RM0.04 to the company. If Mmode wins another RM300-500m contract, the value of the company would be at least RM0.55-RM0.63, which is why Mr Ong and his vehicle had paid RM0.57 per share to Dato Lim to take control of the company. To Mr Ong, Mmode is his new baby, and surely RM300-500m contracts has already been in the bag. Dont accuse us of insider info if Mmode announces a few contracts soon. We shall not disclose why we think so..

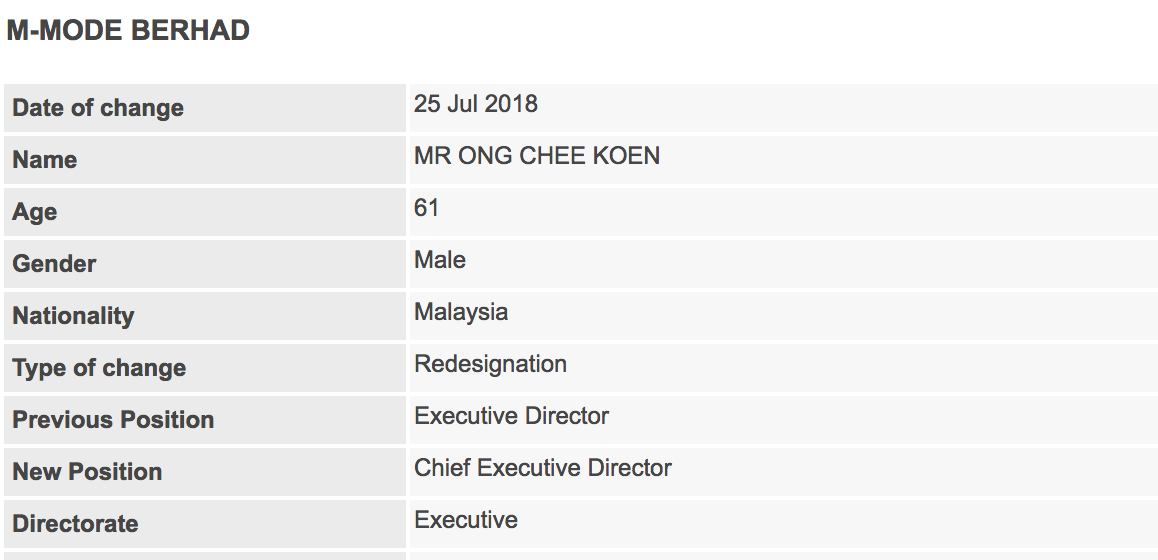

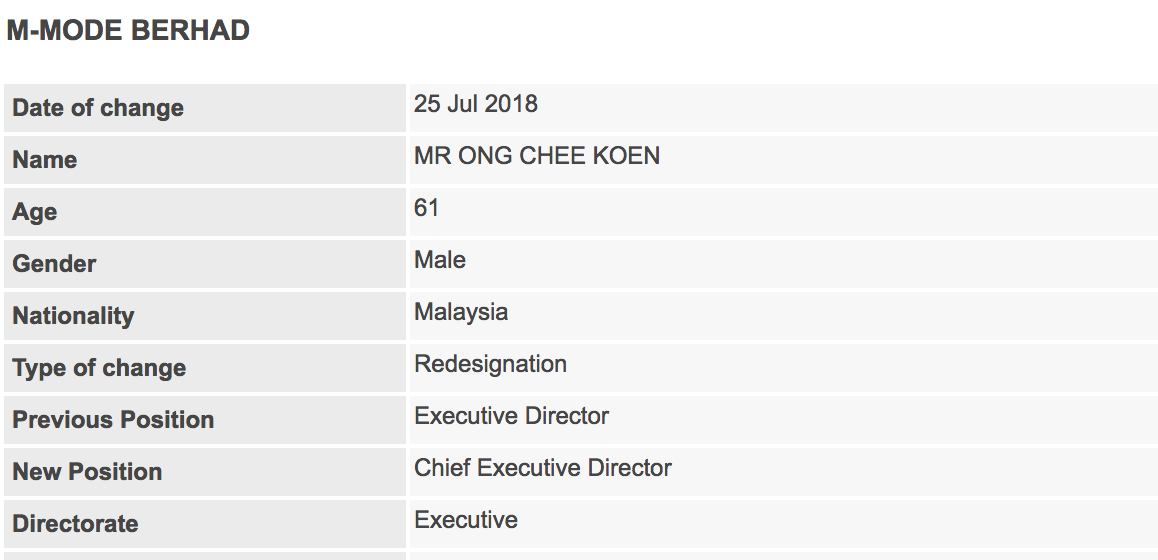

Change of directorship

We could see the depart of Dato Lim officially and the appointment of Mr Ong Chee Koen as the Group CEO now. Dato Lim under the vehicle, Corvina has disposed its stake last month on 22 June 2018 at RM0.57 per share to Mr Ong and Ecobuilt Sdn Bhd. The company is silently reverse take overing a company now and our next guess will be that, they will start to dispose this IT business off and refocus their business in construction, and from now on, contract announcements will start to flow in.

Today, Mmode announced its Q4 2018 results. From headline, it looks like a disastrous results of -RM7.3m! There is a RM8.8m impairment losses that the company has taken this opportunity to write off for this last quarter of FY2018, and prepare its wings to transform into a full fledge construction stock.

As you can see, the balance sheet is now clean, after writing off RM4.54m from goodwill on consolidation and RM5.2m deferred development cost to RM0.3m. The nett write off for this quarter is actually RM4.54m + RM4.27m = RM8.8m. Hence, the actual PBT for the company is RM0.9m not -RM7.9m.

How will this change our forecast again? Remember there is still about RM300m construction order book for the company. At 6% PAT margin, RM18m profits will be in the bag. Lets write off tech division. And finally, the cash of the company has fallen to RM44m. Do not panic, as the company has just paid off its creditors, as we can see its payables has fallen from RM16m last quarter to RM6m. This cash payment difference actually made up the balance. The base net value for this company should be RM70m which translate into RM0.43 if we assume zero value for its technology division.

Every RM100m contract wins will translate into RM0.04 to the company. If Mmode wins another RM300-500m contract, the value of the company would be at least RM0.55-RM0.63, which is why Mr Ong and his vehicle had paid RM0.57 per share to Dato Lim to take control of the company. To Mr Ong, Mmode is his new baby, and surely RM300-500m contracts has already been in the bag. Dont accuse us of insider info if Mmode announces a few contracts soon. We shall not disclose why we think so..

Change of directorship

We could see the depart of Dato Lim officially and the appointment of Mr Ong Chee Koen as the Group CEO now. Dato Lim under the vehicle, Corvina has disposed its stake last month on 22 June 2018 at RM0.57 per share to Mr Ong and Ecobuilt Sdn Bhd. The company is silently reverse take overing a company now and our next guess will be that, they will start to dispose this IT business off and refocus their business in construction, and from now on, contract announcements will start to flow in.

Technical analysis

From chart, it

looks like there was a selling pressure above RM0.40 for the past 2

months, and tomorrow definitely will see a retracement, but question is

what price could we re enter? If you are a season investor, you should

take this opportunity to buy near at support as much as possible as

going forward, more contracts will be flowing into M-mode soon. Good

luck!

Immediate resistance: RM0.40

Immediate support at RM0.36 and RM0.335.

Reiterate to see you at RM0.50 in this year

By Bagger Hunter

http://klse.i3investor.com/blogs/baggerhunterseries/166941.jsp